Picture supply: Getty photographs

The FTSE 100‘s fixed see-sawing means many high quality blue-chip shares nonetheless commerce at rock-bottom costs. Listed here are two I feel buyers looking for shares to purchase in Could ought to critically contemplate.

Regardless of the specter of additional turbulence within the weeks and months forward, I feel they may ship terrific returns over the long term.

Babcock Worldwide

Demand for defence shares continues surging regardless of the specter of provide chain and value points as commerce tariffs go up. In response to WisdomTree, its devoted European defence exchange-traded fund (ETF) launched in March has already surpassed $1bn in property underneath administration (AUMs). Its constituents like BAE Techniques, Rolls-Royce and Rheinmetall have important scope to develop earnings as continental arms spending ramps up.

Likewise, FTSE 100 trade large Babcock Worldwide (LSE:BAB) has substantial development potential. However I don’t suppose that is mirrored within the cheapness of its shares.

At 782p, its shares commerce on a ahead price-to-earnings (P/E) ratio of 14.8 instances. This makes it one of many least expensive blue-chip defence firms on the market.

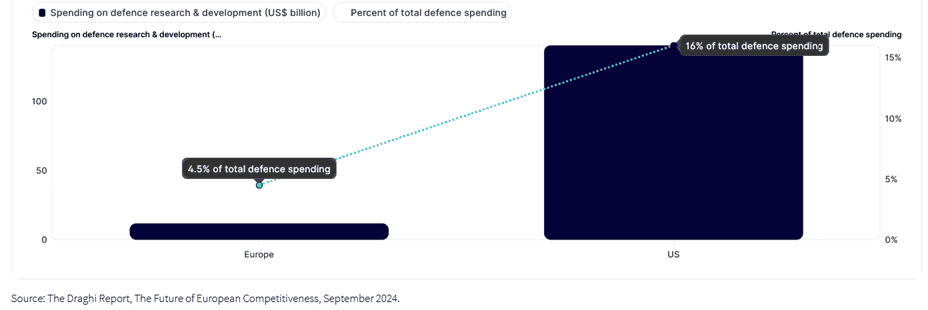

The engineer faces stiff competitors from these sector giants I discussed above. Nevertheless it nonetheless has a once-in-a-generation alternative improve earnings as European nations vow to slim the hole between their very own spending and that of the US.

Because the chart beneath exhibits, the hole between these historic allies is huge:

Babcock — which generates round three-quarters of revenues from the UK and in addition sells to continental neighbours together with France and Eire — is already thriving on this beneficial local weather. Income and underlying revenue leapt 11% and 17% respectively within the 12 months to March. I count on it to proceed performing strongly.

Scottish Mortgage Funding Belief

Tech shares have had a tough trip extra lately, pushing Scottish Mortgage Funding Belief‘s (LSE:SMT) share value sharply decrease.

At 871p per share lately, the tech belief has fallen sharply from its 2025 highs of £11.43 punched in February. As a consequence, it trades at an 8.9% low cost to its estimated web asset worth (NAV) per share.

Now I’m not saying the storm’s handed for trusts with publicity to US tech like this. This 12 months’s troubles haven’t all been about tariffs. The rising risk of Chinese language firms has additionally been on full show (suppose Deepseek’s disruptive risk in synthetic intelligence (AI), as an example, and electrical carmaker BYD‘s gross sales outstripping these of Tesla).

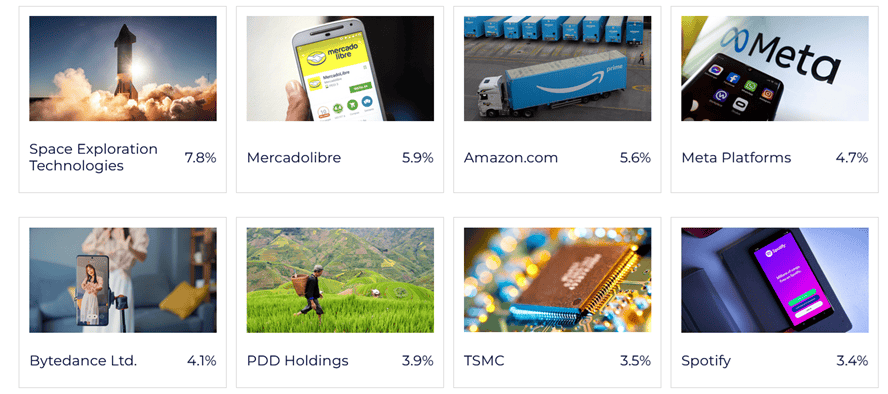

But regardless of these risks, I feel Scottish Mortgage nonetheless has huge long-term potential. The 96 firms it holds, together with Amazon, Meta and Cloudflare, present myriad methods for buyers to capitalise on the booming digital economic system. And it’s not overly reliant on anybody inventory or sector to carry out.

I additionally like Scottish Mortgage as a result of it holds many non-public firms that I wouldn’t ordinarily have the ability to spend money on. These embody Elon Musk’s SpaceX and fintech large Stripe. In concept, these smaller companies might have larger development potential than these better-known tech names.