Be part of Our Telegram channel to remain updated on breaking information protection

Crypto asset supervisor 21Shares has filed for a spot Sei (SEI) ETF (exchange-traded fund), becoming a member of a wave of 92 corporations that Bloomberg says are dashing to launch crypto ETFs.

In keeping with an S-1 registration assertion filed with the Securities and Trade Fee (SEC), the proposed SEI ETF will faucet crypto value index supplier CF Benchmarks to trace the altcoin’s value utilizing knowledge from numerous crypto exchanges.

Coinbase Custody Belief Firm would act because the proposed fund’s custodian. 21Shares additionally floated the thought of staking SEI to generate further returns for buyers. Nevertheless, this addition remains to be being investigated to see if it will current “undue authorized, regulatory or tax danger.”

The 21 Shares submitting comes amid a surge in crypto ETF functions. Of a minimum of 92 crypto ETFs which can be at the moment awaiting SEC approval, Bloomberg Intelligence analyst James Seyffart mentioned there are quite a few filings for Solana (SOL) and XRP particularly.

NEW: Here’s a checklist of all of the filings and/or functions I am monitoring for Crypto ETPs right here within the US. There are 92 line gadgets on this spreadsheet. You’ll virtually definitely need to squint and zoom to see however greatest I can do on right here pic.twitter.com/lDhRGEQBoW

— James Seyffart (@JSeyff) August 28, 2025

VanEck, Bitwise, and Grayscale are amongst fund administration titans which have submitted functions for ETFs linked to Cardano (ADA) and even meme cash resembling Dogecoin (DOGE).

Bloomberg analysts Eric Balchunas says that 20 new crypto ETF filings have been added in simply the previous 4 months, on prime of 72 beforehand reported.

“Fairly quickly there can be extra crypto ETF filings than shares,” he joked.

Fairly quickly there can be extra crypto ETF filings than shares 😝 https://t.co/txPR7S7iFu

— Eric Balchunas (@EricBalchunas) August 28, 2025

21Shares will not be alone in its pursuit of a spot SEI ETF. US digital asset funding agency Canary Capital utilized for an ETF targeted on SEI again in April. In keeping with an April 30 assertion from the SEI community, Canary’s ETF would supply each institutional and retail buyers “direct publicity to staked SEI.”

Canary’s product can even present buyers with “passive earnings by way of staking rewards.”

Solely Spot Bitcoin And Ethereum ETFs Authorised So Far

Presently, the US SEC has solely permitted spot ETFs for crypto market leaders Bitcoin (BTC) and Ethereum (ETH).

21Shares was among the many issuers whose spot Bitcoin and spot Ethereum ETF merchandise acquired the regulatory nod from the SEC final yr.

21Shares is in a partnership with Cathie Wooden’s ARK Make investments for the BTC product, referred to as the ARK 21Shares Bitcoin ETF (ARKB). Below the settlement, 21Shares is the ETF’s sponsor, and primarily brings crypto infrastructure and product improvement expertise to the desk.

The 2 corporations additionally had a partnership to problem the ARK 21Shares Ethereum ETF, however this partnership was ended and 21Shares subsequently rebranded the ETF to the 21Shares Ethereum ETF (TETH).

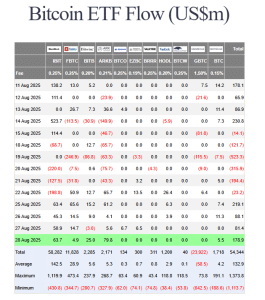

In keeping with knowledge from Farside Buyers, ARKB has skilled over $2.17 billion in cumulative inflows for the reason that SEC permitted spot Bitcoin ETFs in January 2024.

Spot Bitcoin ETF inflows (Supply: Farside Buyers)

In the meantime, TETH has seen a lot decrease cumulative inflows of $35 million for the reason that ETH merchandise launched in July of final yr.

The spot Bitcoin ETFs have seen the vast majority of the inflows for the reason that BTC and ETH funds’ launches. Nevertheless, this development shifted within the final week, when spot Ethereum ETFs skilled ten occasions extra inflows than their BTC counterparts. The ETH ETFs additionally prolonged their inflows streak to 6 days yesterday.

With each Bitcoin and Ethereum pulling in billions of {dollars} in such a brief time frame by way of ETFs, corporations are actually racing to file for comparable merchandise for smaller-cap tokens within the hope of repeating this success.

Associated Articles:

Finest Pockets – Diversify Your Crypto Portfolio

- Straightforward to Use, Function-Pushed Crypto Pockets

- Get Early Entry to Upcoming Token ICOs

- Multi-Chain, Multi-Pockets, Non-Custodial

- Now On App Retailer, Google Play

- Stake To Earn Native Token $BEST

- 250,000+ Month-to-month Energetic Customers

Be part of Our Telegram channel to remain updated on breaking information protection