Picture supply: Getty Photographs

The variety of individuals utilizing Particular person Financial savings Accounts (ISAs) to purchase shares is rising. However not everybody saving or investing in these tax-efficient merchandise is assured to make a pleasant pile of money over time.

Listed below are three steps that ISA customers can take to assist considerably develop their wealth.

1. Set clear objectives

Earlier than filling up a Shares and Shares ISA, it’s crucial to contemplate what you’re making an attempt to attain. It will affect each side of an investing technique.

Somebody seeking to construct a retirement fund is more likely to have time on their facet. As a consequence, they may wish to contemplate prioritising development shares, which, whereas risky, can ship distinctive long-term returns.

Conversely, a person who’s searching for to fund their youngster’s training could have lower than a decade to construct their ISA. On this occasion, they could wish to steadiness riskier, high-growth shares with extra defensive shares like utilities. They might additionally wish to maintain some a refund in a Money ISA.

Please notice that tax therapy will depend on the person circumstances of every shopper and could also be topic to vary in future. The content material on this article is supplied for info functions solely. It’s not supposed to be, neither does it represent, any type of tax recommendation. Readers are accountable for finishing up their very own due diligence and for acquiring skilled recommendation earlier than making any funding choices.

2. Be affected person

All of us love the concept of getting wealthy in a single day. However taking a ‘Hail Mary’ method with high-risk belongings not often works. In actual fact, it will possibly depart people nursing a big gap of their pockets.

In actuality, self-discipline, endurance, and a measured risk-reward technique are typically probably the most highly effective weapons for focusing on life-changing returns.

Charlie Munger, who was right-hand man to Warren Buffett for 45 years, mentioned, “the large cash will not be within the shopping for or the promoting, however within the ready“. With this method, traders can let the facility of time and compound returns do the heavy lifting for them.

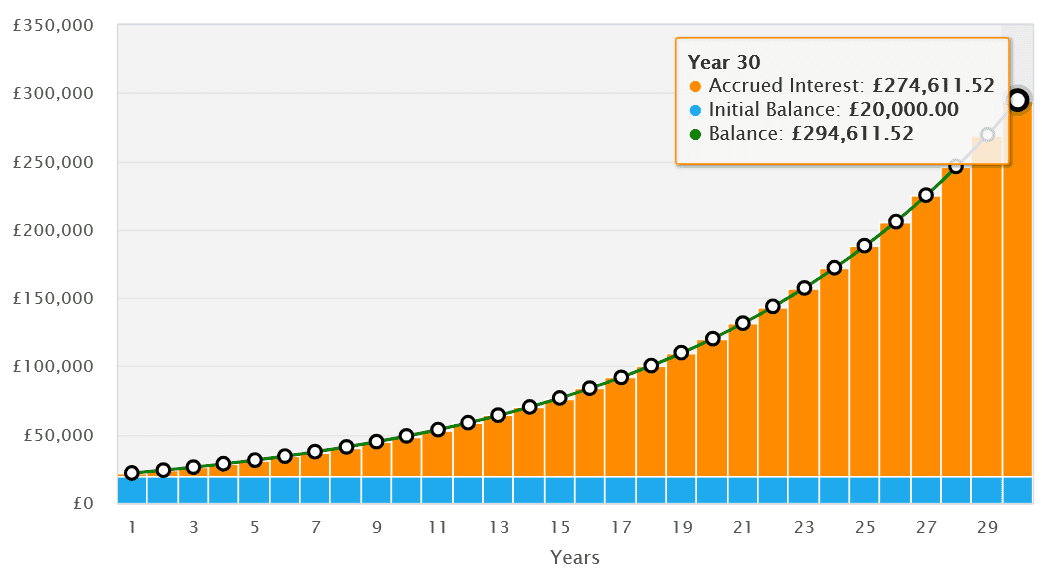

A £20,000 lump sum funding may not appear a lot. However left to compound at an annual charge of 9%, a modest nest egg like this might ultimately flip into nearly £300,000 after 30 years.

3. Construct a diversified ISA

ISA traders have 1000’s of shares, funding trusts, and funds from throughout the globe they will purchase to focus on robust returns. It may well pay to take full benefit of this.

Having a diversified portfolio gives publicity to a variety of development and earnings alternatives. It additionally helps people cut back danger. I personally like the concept of getting an ISA of a minimum of 20-25 shares whose operations span industries and areas.

This may be executed by shopping for particular person shares, although trusts like Alliance Witan (LSE:ALW) will also be used to successfully diversify.

This FTSE 100-listed funding belief depends on a staff of 11 fund managers to pick out a most of 20 shares. This gives a variety of views that pulls on many years of investing experience.

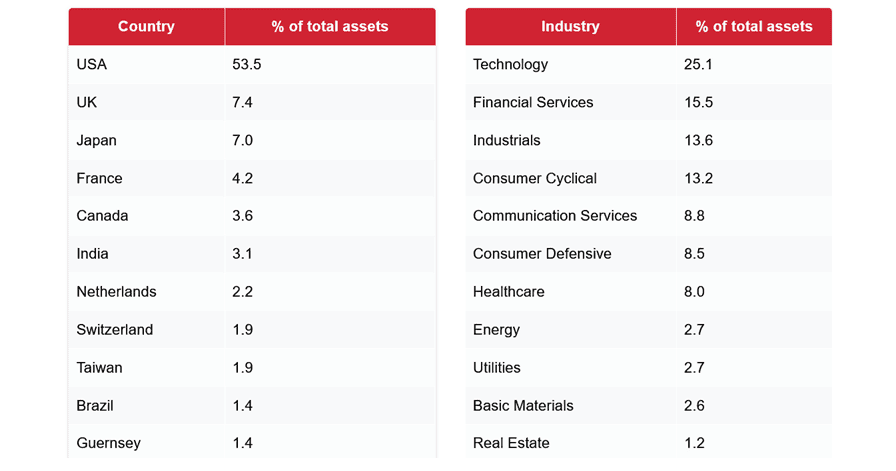

At the moment, Alliance Witan holds shares in 223 completely different firms spanning a variety of sectors and protecting all 4 corners of the globe:

Its portfolio is filled with multinational firms, providing additional power. And plenty of of those are tech giants like Microsoft and Nvidia, which — though leaving the belief weak to financial slowdowns — opens the door to important long-term returns because the digital financial system explodes.

Alliance Witan has delivered a median annual return of 11.6% since 2015. If this continues, which after all will not be assured, it might go a protracted option to serving to an ISA investor generate substantial wealth.