The Networth method is kind of easy

Networth = Belongings – Liabilities

So, when you have belongings of Rs. 2 crores and your liabilities are 50 lacs, your internet price is Rs 1.5 crores.

Now we have all the time been taught to calculate networth this manner and there’s nothing unsuitable with that, nevertheless, it’s a really simplified model of calculating your internet price, which doesn’t give any sort of insights or info to you.

Loads of occasions, you may additionally get the unsuitable impression about somebody due to this over-simplified method. Loads of buyers on paper are having good networth, however they by no means really feel RICH or happy with what everybody thinks about them.

For instance, think about an individual who lives in a home price 2 crores (no loans) and in addition has one other actual property price 1 crore, plus mutual funds price Rs 50 lacs.

Now, what’s his/her internet price?

- Some will say that the individual’s internet price is Rs 3.5 crores (2 cr+1 cr+ 50 lacs) as per our easy definition?

- Some will say that we will not depend his present home, therefore it’s simply 1.5 crores.

- And a few could remark that as a result of the actual property is just not liquid sufficient, it shall simply be seen as 50 lacs of networth?

- And what if this identical individual may inherit shares price 10 crores sooner or later? Then?

I hope you bought my level. Simply doing belongings minus liabilities, provides you a one-point reply and that misses the main points and offers you very superficial info.

4 classes of Belongings

Lately, I created a framework utilizing which it turns into less complicated to visualise your networth. On this framework, step one is to categorize all of your belongings into one of many 4 classes as beneath.

- Blocked – An asset is marked “blocked” if it’s not liquid and the cash is blocked for a few years. You can’t liquidate, or don’t want to liquidate proper now. Nonetheless, sooner or later, you’ll liquidate it and use it for funding any purpose.

- Free – An asset is marked “Free” if it’s doable to liquidate it in a couple of days/weeks and get the cash in your checking account.

- Usable – An asset is marked “Usable” if it’s used for consumption functions. So the home you reside in shall principally be counted as “Usable”. The gold jewellery at residence shall be marked as “Usable”. Nonetheless when you have a home the place you reside proper now, however you understand that in future, you’ll absolutely transfer to your property city and unload the home or put it on lease, then that home shall be marked as “Blocked” and never “Usable”. A automobile will also be marked as “Usable” if you want, nevertheless, it’s not really helpful.

- Perhaps – One other class is “Perhaps”. An asset shall be marked as “Perhaps” in case you are not sure if it can come to you sooner or later or not. You don’t want to depend on it as of now, however in case you are fortunate, that can come to you. So any inheritance could also be marked as “Perhaps”. Some cash which you gave as a mortgage to a pal could also be marked as “Perhaps”. Nonetheless in case you are very positive that its absolutely going to come back to you, you then shall mark it as “Blocked” and never “Perhaps”

Let me present you a pattern information of the way it appears to be like like

[su_table responsive=”yes”]

Asset Title | Present Price | Kind |

| MF (Fairness) | 15000000 | Free |

| MF (Debt) | 1550000 | Free |

| Flat in Bangalore | 5500000 | Usable |

| Land in Hyderabad | 2000000 | Blocked |

| PPF | 4000000 | Blocked |

| EPF | 2876000 | Blocked |

| Shares | 3000000 | Free |

| Money | 130000 | Free |

| Plot in Residence city | 5000000 | Perhaps |

| NPS | 5000000 | Blocked |

| Mounted Deposits (Inheritance) | 1000000 | Perhaps |

| Mortgage to somebody | 50000 | Perhaps |

| Gold | 1500000 | Usable |

[/su_table]

Observe that if there’s a residence mortgage or automobile mortgage then please alter the mortgage quantity with the market worth of the asset and solely write the distinction. So if a home is price Rs 1 crore and the excellent residence mortgage is 40 lacs, then write worth of home as solely 60 lacs.

Visualizing your Belongings

When you categorize the belongings into 4 varieties, you get clear info on what number of belongings you personal in every class. It helps you a large number to make sense out of it.

Right here you possibly can see that by categorizing the belongings into varieties, it’s so clear now that this individual has a complete of Rs 1.96 crores in these belongings that are in Liquid kind (FREE) and a serious chunk of 1.1 crores (Perhaps) is into belongings which will or could not come to him. So it’s not very prudent to depend on them for his future. If it involves him/her, it’s a bonus.

Additionally, Rs. 88.7 lacs is blocked into varied belongings, so whereas all of the family and buddies contemplate it to be his internet price, it’s not out there to him/her in the meanwhile if want arises. So he’s paper wealthy, however not in actuality.

Additionally, Rs. 70 lacs is into these belongings which is used for consumption goal, which he won’t ever liquidate for his targets (except there’s an emergency or in principle)

4 varieties of Networth

This brings me to the ultimate and conclusive level – “What’s his internet price”?

Right here, we will completely different sorts of networth somewhat than simply taking a look at one single networth.

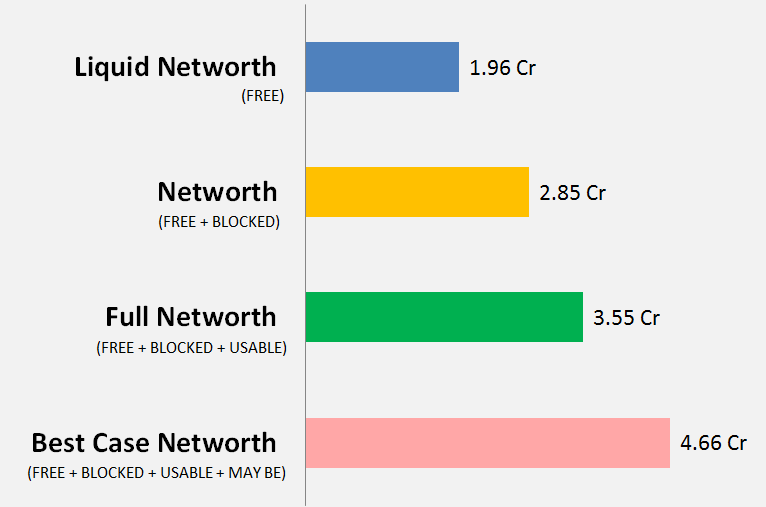

- Liquid Networth – You simply add up all of the FREE sources and name it your Liquid Networth. Within the case above, its Rs 1.96 crores

- Networth – Add up your FREE and Blocked belongings, which I’ll name “Networth” which totals to Rs 2.85 cr right here, which is the standard definition of internet price. I’m not together with the Usable and Perhaps class of belongings into this.

- Full Networth – It will embody all of your belongings besides the “Perhaps” class. Full Networth means all belongings which you personal (both for funding or consumption), and you’ve got full management over it. On this case, its Rs 3.55 cr

- Greatest Case Networth – That is the full of every little thing you personal or can personal sooner or later. This would be the identical as full networth for individuals who don’t have any inheritance or belongings that are possible to come back to them. On this case, it’s Rs. 4.66 Cr

Here’s what you shall do now

Put your belongings in an excel sheet, and mark every certainly one of them into FREE, BLOCKED, USABLE, and MAYBE. I’m positive you’ll get quite a lot of readability on how a lot of your belongings fall in these classes and the varied sorts of networth you could have.

Do give me suggestions should you appreciated this framework and if it helped you? That is only a framework and you’ll customise it as per your approach of taking a look at issues.

![Prime Inventory To Purchase in India [2024] Prime Inventory To Purchase in India [2024]](https://i2.wp.com/getmoneyrich.com/wp-content/uploads/2024/10/Top-Stocks-To-Buy-in-India-For-Long-Term-Thumbnail99.png?w=150&resize=150,150&ssl=1)