All of us wish to obtain monetary independence in our life!

- That day, once we may have sufficient cash!!

- That day, once we will now not have to fret about our future bills!

- That day, once we are out of the rat race lastly!

For the final couple of years, we’re listening to an acronym FIRE for this!

Monetary Independence Retire Early (FIRE)

FIRE, or Monetary Independence Retire Early, refers to reaching a degree in life the place you come up with the money for to cowl your bills and monetary targets with out having to work for a residing.

Ideally, this occurs nicely earlier than the standard retirement age of 58-60 years. Attaining FIRE means having monetary safety on your future, in addition to the power to journey nicely, spend on big-ticket bills and in addition depart a legacy for future generations.

At this level, you now not have a compulsion to actively work to “earn cash”

FIRE is a good achievement

Attaining FIRE is an excellent accomplishment, however there are a lot of myths which are nonetheless there in buyers’ minds who haven’t explored or learn a lot about this subject.

This text will bust some myths across the subject of FIRE for you immediately.

Let’s begin!

Delusion 1: FIRE is all a few massive quantity!

Most individuals really feel that FIRE is all about simply reaching a goal quantity. Like 5 cr or 10 cr

For these people who find themselves completely new to this idea of FIRE, you shall know that one can name themselves financially free when you might have

- 30X of your yearly bills – at age 60

- 35-40X of your yearly bills – at age 50

- 45-50X of your yearly bills – at age 40

* Be aware that each one these are high-level thumb guidelines solely!

For instance, in case you are at age 50 and your yearly bills (contemplating every thing on this) are Rs 20 lacs, then you definitely would wish 7-8 cr to name your self financially free (FIRE’d) assuming you’ll reside for one more 40 yrs

NO, it’s not about reaching a quantity, however extra about creating X occasions your bills, when X can vary from 30-50 relying in your age and your skill to speculate the cash correctly.

- For somebody with a Rs 50,000 monthly requirement in life, they want roughly 2-3 cr immediately

- For somebody with a 3 lacs monthly requirement and desirous to FIRE at age 40, it will imply a 16-18 cr corpus immediately!

As you progress in life, your bills will change and therefore your FIRE corpus goalpost may also shift!

Delusion 2 : Life is all set after FIRE

Opposite to what most individuals think about, life isn’t hunky-dory after you obtain FIRE.

Sure, life could be very snug and you’ll certainly be much less apprehensive than somebody who doesn’t come up with the money for. However nonetheless, you must always take into consideration how your cash is invested and the way it’s going general and if it would actually final your lifetime or not.

That is very true if you happen to dont have sufficient margin of security in your FIRE corpus. So if you happen to do your calculations and Excel tells you that you just want 10 cr for all of your life, then if you happen to truly FIRE with 10-12 cr, then you’re on the sting!

You could have little or no margin of security. The inflation could be completely completely different in future, it’s possible you’ll not make precisely the identical return in your portfolio, and you will have some completely sudden life occasion

All these will nonetheless maintain your ideas occupied to some degree.

Don’t anticipate your self to be chilling on the Goa seashores with Pina Colada after FIRE. Life might be virtually be the identical for you minus some huge cash worries

That is in fact not true for somebody who has a number of occasions what they honestly require for monetary freedom.

To study extra about FIRE, you can too watch my video under on varied sorts of FIRE

Delusion 3: So many individuals in India are reaching FIRE, and I’m a looser

There’s quite a lot of buzz round FIRE as of late. You always see folks on social media, youtube, telegram channels, and podcasts the place the dialog is alive about FIRE.

There are numerous individuals who have already achieved FIRE or they’re someplace halfway.

This has began placing quite a lot of “stress” on tens of millions of others that aside from them, everyone seems to be getting financially free as of late!

Let me inform you one thing!

Me and my group have already interacted with greater than 5000+ households within the final 10+ yrs in India + NRI and now we have not seen greater than 5-6 individuals who have achieved FIRE by the age of 40-45 yrs. I’m speaking about people who find themselves into common jobs and must create their wealth from scratch.

Aside from these 5-6 folks, there are dozens of different households who will obtain FIRE by the age 50 yrs, however not of their early 40s.

Relaxation all others, will at finest retire at their common 58-60 yrs age bracket. In truth, a lot of them might not even retire correctly and should face monetary crunch. I’m contemplating the entire inhabitants right here and never a particular class of individuals.

Solely a tiny minority of individuals in India obtain monetary freedom early in life in our statement now.

In absolute numbers, you’ll typically see many individuals speaking about reaching FIRE however keep in mind that hundreds of others usually are not near it. In a bunch of 1000 folks, if 2 folks discuss reaching FIRE, the remaining 998 folks begins feeling that it’s a standard factor as of late

Having just a few crores means FIRE?

Additionally, having just a few crores doesn’t imply an individual has achieved FIRE.

An individual having a pleasant loan-free home plus Rs 3-4 crores might not have even reached halfway of FIRE. They appear RICH (and they’re) however they aren’t Financially FREE within the true sense. They’ve their very own share of monetary worries and insecurities.

FIRE earlier than 50 yrs of age is a wild achievement, however it’s statistically very uncommon. Perceive that it’s fairly TOUGH to attain and it’s regular to not obtain FIRE. You’re certainly not lacking the FIRE bus, nevertheless, you shall give an sincere try to attain monetary independence as early as attainable

Delusion 4: Attaining FIRE means by no means working once more

FIRE is “Monetary Independence Retire Early”

Nevertheless, most individuals give attention to retiring early half which is commonly unreal. It’s very powerful to not do something all day and simply retire out of your job. People are designed for staying busy and be lively, to pursue one thing. Individuals who FIRE truly maintain working and dont sit at residence.

One in every of our readers as soon as shared with us that to expertise the way it feels after retirement, he took a really lengthy break from job (round 2 months) and tried to see what life appears like and shortly realised that it’s very powerful to spend the day and in addition withdraw out of your corpus on your daily bills. He needed to return again to the job in 2 weeks as he couldn’t take it.

Now that’s not the most effective instance I may give however it merely offers you a touch that “I’m not working once more” after FIRE is generally wishful pondering and principally involves thoughts in case you are right into a aggravating job and dont take sufficient time to take pleasure in your life.

Higher not purpose for FIRE with that mindset.

At finest, what is going to occur is as under

You’ll obtain FIRE, take a really very lengthy break after which get again into some low-stress job/work which supplies you quite a lot of flexibility and make it easier to discover your hobbies/what you take pleasure in.

Additionally, its a good suggestion to speak to your partner as soon as about your plans of staying at residence all day after FIRE, principally you can be directed to maintain working for just a few extra years as they received’t be capable to tolerate you all day lengthy at residence 😉

Delusion 5: FIRE requires excessive frugality and deprivation

This is likely one of the greatest myths for my part about FIRE.

Lots of people really feel that slicing down on bills and depriving themselves of the preliminary years will assist them transfer in the direction of FIRE. In any case, what you save will get added to your wealth kitty.

This isn’t TRUE!

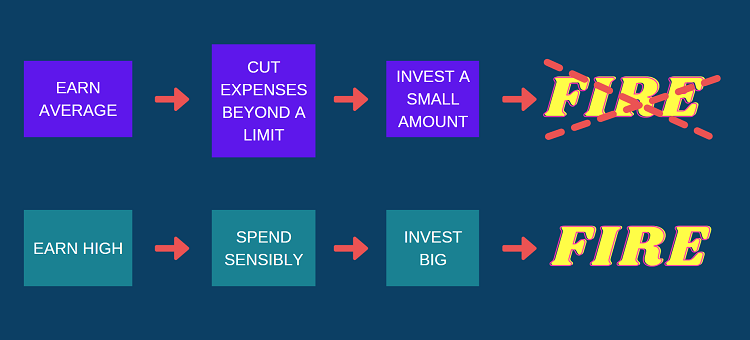

The general public who truly attain FIRE early in life are these whose focus is on rising their INCOME and never those that minimize down on their EXPENSES.

Reducing down on bills has a restrict, and actually talking depriving your self isn’t a wholesome strategy to obtain monetary freedom.

There are individuals who earn 5 lacs a month, keep their life in an honest method in Rs 1 lac and save Rs 4 lacs a month in the proper method with self-discipline for years. These are the individuals who principally FIRE younger and never the one who earns a smaller earnings and is making an attempt to squeeze the bills a “bit extra”

Dont do this!

Reducing bills past a restrict will principally take away all of the FUN out of your life and add up some extra cash in your kitty which ultimately you’ll spend on one thing silly once more. It won’t result in monetary independence.

In case you are naturally a frugal particular person and reside with a really small sum of money, then it’s advantageous. However simply ensure you dont idiot your self with making an attempt to chop bills the place you actually dont need it.

Intention for Monetary Freedom

The mail of this text was to easily current some info about retirement and clear some myths in order that one can pursue monetary freedom with the proper mindset. Do focus in your earnings and attempt to enhance it and save an enormous chunk of that to speculate neatly in inflation-beating monetary merchandise to create wealth within the true sense!

I’ve tried to share my private ideas and what I really feel concerning the subject primarily based on my expertise.

Do share your ideas about this subject. Have you ever seen some extra myths within the minds of your pals/household about monetary independence? Do share within the feedback part!