Every week, Benzinga’s Inventory Whisper Index makes use of a mixture of proprietary information and sample recognition to showcase 5 shares which might be slightly below the floor and deserve consideration.

Traders are continually on the hunt for undervalued, under-followed and rising shares. With numerous strategies accessible to retail merchants, the problem typically lies in sifting by the abundance of knowledge to uncover new alternatives and perceive why sure shares ought to be of curiosity.

Learn Additionally: EXCLUSIVE: Prime 20 Most-Searched Tickers On Benzinga Professional In 2024 — The place Do Tesla, Nvidia, GameStop, Trump Media Shares Rank?

Right here’s a have a look at the Benzinga Inventory Whisper Index for the week ending Feb. 7:

The Commerce Desk TTD: The digital promoting firm noticed sturdy curiosity from readers in the course of the week, which comes forward of fourth-quarter monetary outcomes on Feb. 12. Analysts count on the corporate to report quarterly income of $758.9 million, up from $605.8 million in final yr’s fourth quarter.

Analysts count on the corporate to report earnings per share of 56 cents for the fourth quarter, up from 41 cents per share in final yr’s fourth quarter. The corporate has overwhelmed analyst estimates for income in additional than 10 straight quarters and overwhelmed estimates for earnings per share in three straight quarters and eight of the final 10 quarters general.

The inventory has acquired favorable protection from analysts in current weeks with a number of worth goal upgrades. Commerce Desk shares have additionally been risky after an analyst prompt that the corporate might merge with Roku.

Commerce Desk shares traded up barely over the previous 5 days as seen on the Benzinga Professional chart under and are up 68% over the previous yr.

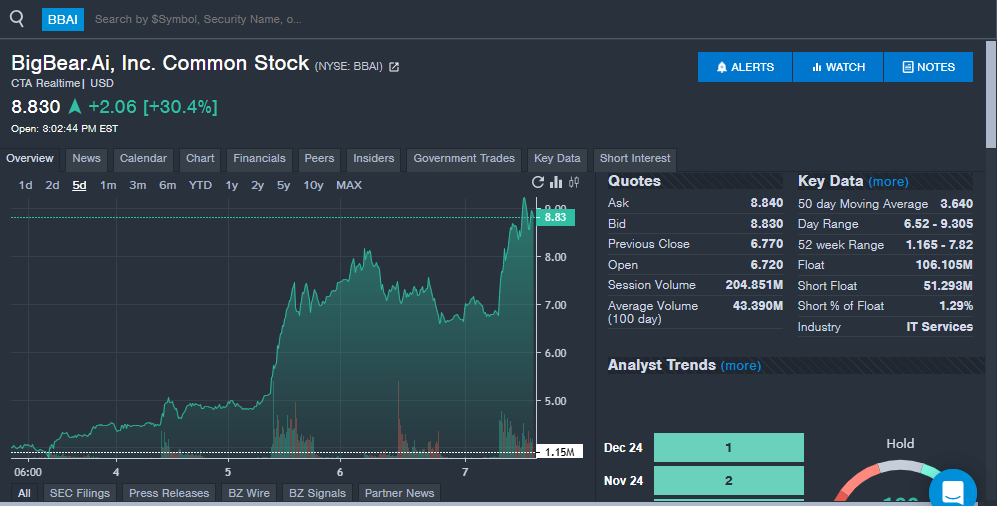

BigBear.ai Holdings Inc BBAI: The digital intelligence options supplier noticed curiosity soar together with its inventory worth in the course of the week. BigBear.ai landed a Division of Protection contract to advance AI-powered risk detection techniques. The information of the DoD deal is welcomed by traders who noticed shares fall after third-quarter monetary leads to November.

The corporate’s quarterly income of $41.5 million missed Avenue consensus estimates. The corporate ended the third quarter with a backlog of $437 million, saying it was constructing a “long-term sustainable enterprise.”

BigBear.ai shares additionally traded increased in January with the announcement that Kevin McAleenan could be the brand new CEO. McAleenan beforehand served because the Performing Secretary of the U.S. Division of Homeland Safety throughout President Donald Trump‘s first White Home time period.

BigBear.ai inventory was up over 100% within the final week and shares are up over 400% previously yr.

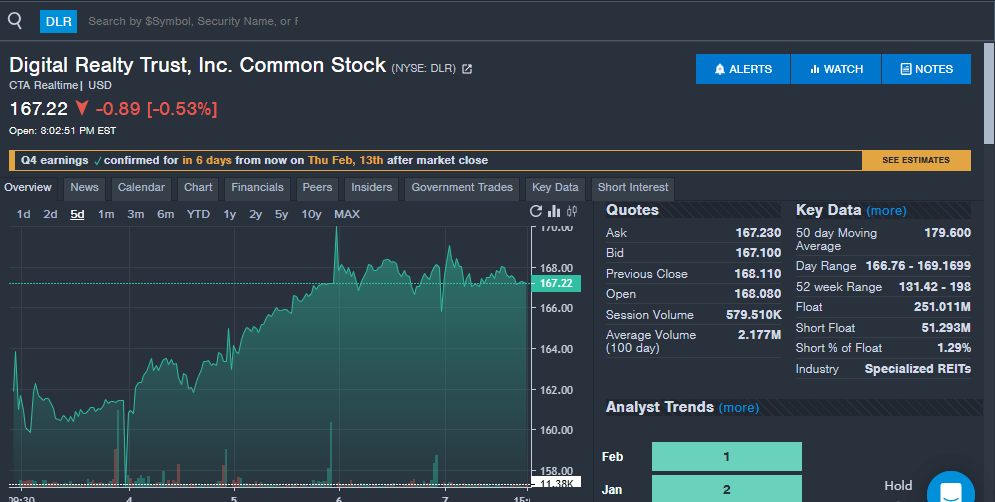

Digital Realty Belief DLR: The info heart firm noticed a surge in curiosity from Benzinga readers, resulting in its second look on the Inventory Whisper Index in three weeks. The rise in curiosity comes with Digital Realty’s fourth-quarter monetary outcomes approaching Feb. 13.

Analysts count on the corporate to report earnings per share of $1.69 and income of $1.46 billion, each enhancements to final yr’s fourth quarter. The corporate has missed analyst income estimates in 4 straight quarters, whereas beating earnings per share estimates in three straight quarters. Traders can be hoping the corporate beats each estimates.

Digital Realty noticed a surge of curiosity in January with the announcement of The Stargate Undertaking resulting in extra consideration on AI infrastructure. There stays considerations that the brand new venture might really harm Digital Realty, which might be one thing the corporate is requested about by analysts after its quarterly outcomes.

Digital Realty shares are up 3.5% over the previous week and up round 15% within the final yr.

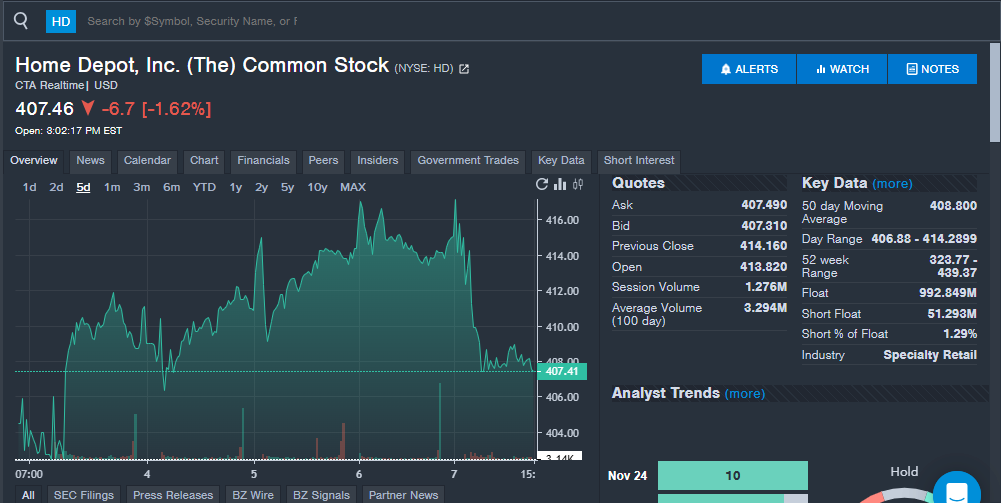

Residence Depot Inc HD: The house enchancment inventory noticed a surge in curiosity from readers in the course of the week, together with greater than regular searches for a inventory of its dimension. The curiosity might be associated to stress on shares within the homebuilder sector on account of tariff and financial considerations. Residence Depot may be risky with winter storms impacting areas of the nation.

Residence Depot is ready to report fourth-quarter monetary outcomes on Feb. 25, with analysts anticipating the corporate to have earnings per share of $2.97 and income of $38.7 billion. The corporate has overwhelmed analyst estimates for earnings per share in additional than 10 straight quarters. Whereas Residence Depot has solely overwhelmed analyst income estimates in a single straight quarter, the corporate has overwhelmed the consensus determine in six of the final 10 quarters.

JPMorgan analyst Christopher Horvers not too long ago gave the nod to Residence Depot within the battle with rival Lowe’s Corporations for quarterly monetary outcomes. The analyst mentioned Residence Depot is more likely to outcomp Lowe’s with stabilizing shopper tendencies, cutting-edge know-how, and its acquisition of SRS Distribution.

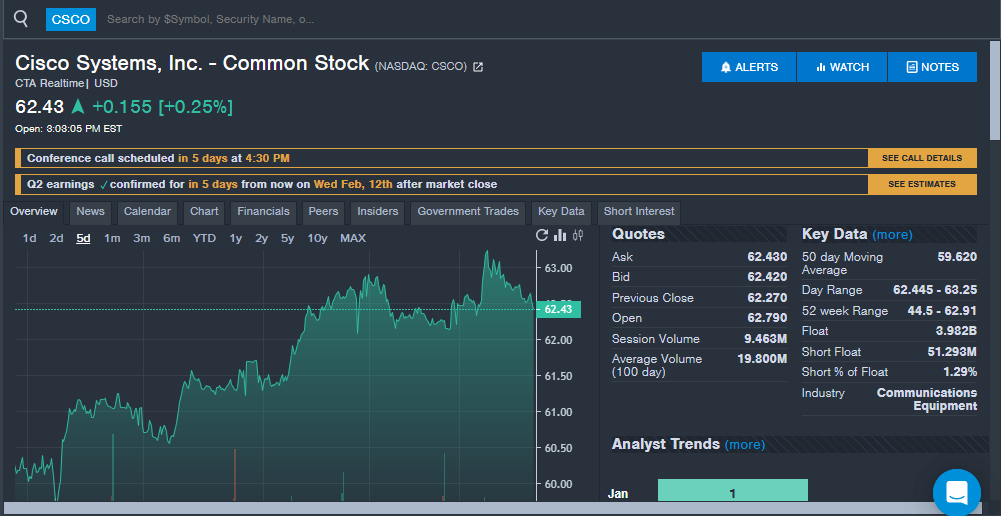

Cisco Techniques CSCO: The networking and software program large noticed elevated curiosity from Benzinga readers forward of quarterly monetary outcomes. Cisco reviews second-quarter monetary outcomes on Feb. 12.

Analysts count on the corporate to report earnings per share of 91 cents and income of $13.87 billion. The corporate has overwhelmed analyst estimates for earnings per share in additional than 10 straight quarters and overwhelmed income estimates in 10 straight quarters.

The surge in curiosity for Cisco comes with shares hitting new 52-week highs on Friday and shares buying and selling at their highest worth since December 2021, nearing five-year highs.

Keep tuned for subsequent week’s report, and comply with Benzinga Professional for all the newest headlines and prime market-moving tales right here.

Learn the newest Inventory Whisper Index reviews right here:

Learn Subsequent:

Picture: Benzinga

© 2025 Benzinga.com. Benzinga doesn’t present funding recommendation. All rights reserved.