Picture supply: Getty Photos

Passive earnings is why I maintain Authorized & Normal (LSE: LGEN) shares. The FTSE 100 insurer yields over 9%, backed by long-term money flows. With a flat share worth however regular capital era, may this be a inventory to develop your passive earnings over time?

Endurance is essential

I’ve all the time seen investing as a recreation of endurance. Chasing the subsequent AI development inventory could be thrilling, however it gained’t assist me sleep at night time.

My rule is easy: stack the chances in my favour, then let compounding do the heavy lifting.

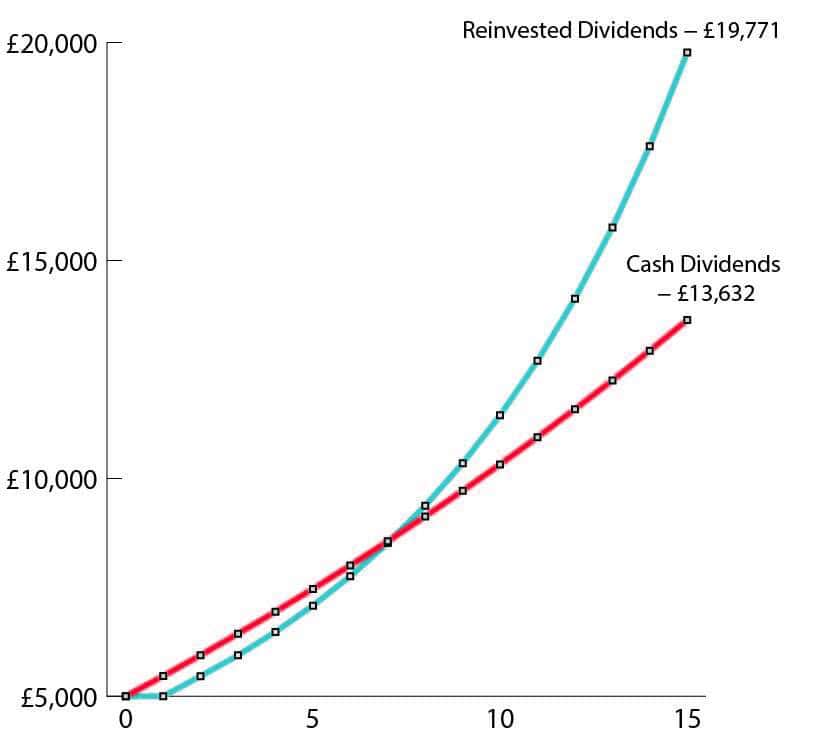

The chart beneath reveals why. Even with zero share worth development, the inventory’s robust yield may practically quadruple my preliminary funding in 15 years, based mostly on a conservative, but real looking, 3% annual development in dividends per share (DPS).

Chart generated by creator

Dividend sustainability

It’s no good choosing shares based mostly on headline yields, solely to see the dividend lower later. I stay assured within the medium-term outlook for this dividend.

Solvency II operational surplus era (OSG) is the important thing metric. This measures the excess capital generated by the enterprise to fund each future development and shareholder payouts.

OSG in 2025 is anticipated to develop 5%, comfortably larger than the two% development in DPS. As well as, following the sale of its US safety enterprise, the corporate will purchase again £1bn of its personal shares subsequent yr. It will scale back the money price of the dividend by £100m, additional supporting future OSG development.

Dangers

Even robust dividend shares carry dangers. A slowdown in financial development or rising inflation may restrict demand, placing stress on income and money era.

These similar macro pressures may additionally have an effect on the worth of the corporate’s £86bn bond portfolio, significantly if a recession hits subsequent yr.

A recession may push up borrowing prices for lots of the companies it invests in. With rising credit score danger, traders would demand larger bond yields. When yields rise, the market worth of present bonds falls.

Taken collectively, these components may impression the corporate’s capability to maintain its dividend.

Future development

The insurer’s money cow is pension danger switch (PRT). Pension trustees depend on the corporate to assist derisk their remaining wage pension schemes. This can be a extremely profitable and increasing market. Over the subsequent decade, the overall addressable market is predicted to succeed in £1trn.

Final yr, the enterprise wrote £10bn of PRT offers globally. Within the UK alone, it has visibility on or is actively pricing £42bn of recent offers over the subsequent 12 months, 9 of which exceed £1bn.

Between 2024 and 2028, it forecasts writing £50bn-£65bn of PRT offers within the UK alone.

Backside line

A protracted-term share worth chart of Authorized & Normal doesn’t precisely encourage confidence at first look. Nonetheless, I’ve owned the inventory for years not just for the headline yield however due to dividend reliability and rising money era.

Over the previous decade, whole shareholder returns have reached a good 83%. Wanting forward, the dividend seems nicely supported by robust money era, underpinned by the insurer’s high-quality, rising companies.

For affected person traders, this mixture of regular development and dependable earnings may supply a pathway to a sustainable passive earnings stream.