Picture supply: Getty Pictures

Many traders draw back from investing within the FTSE 250, believing it to be too dangerous. Definitely, the index does are inclined to exhibit extra volatility than its bigger cousin. Nonetheless, additionally it is full of high-quality companies with confirmed enterprise fashions and paying sizeable dividends.

Dividend champion

One in all my favorite shares is asset administration big, Aberdeen (LSE: ABDN). At this time, the dividend yield is a headline-grabbing 7.3%.

So how a lot might an investor who parked £5,000 within the inventory right now realistically anticipate to get again in 15 years’ time?

The corporate has already made it clear that it’s going to not be climbing dividend per share (DPS) till payouts are lined 1.5 instances by adjusted earnings. That’s unlikely earlier than 2027. So allow us to add that truth to the mannequin.

After 2027, allow us to assume that DPS grows at 2% yearly. A 2% annual share worth development can also be extraordinarily conservative.

Dividend compounding

In fact, no dividends are ever assured. However that stated, if I plough my annual dividend funds into shopping for extra shares, then I create a compound producing machine.

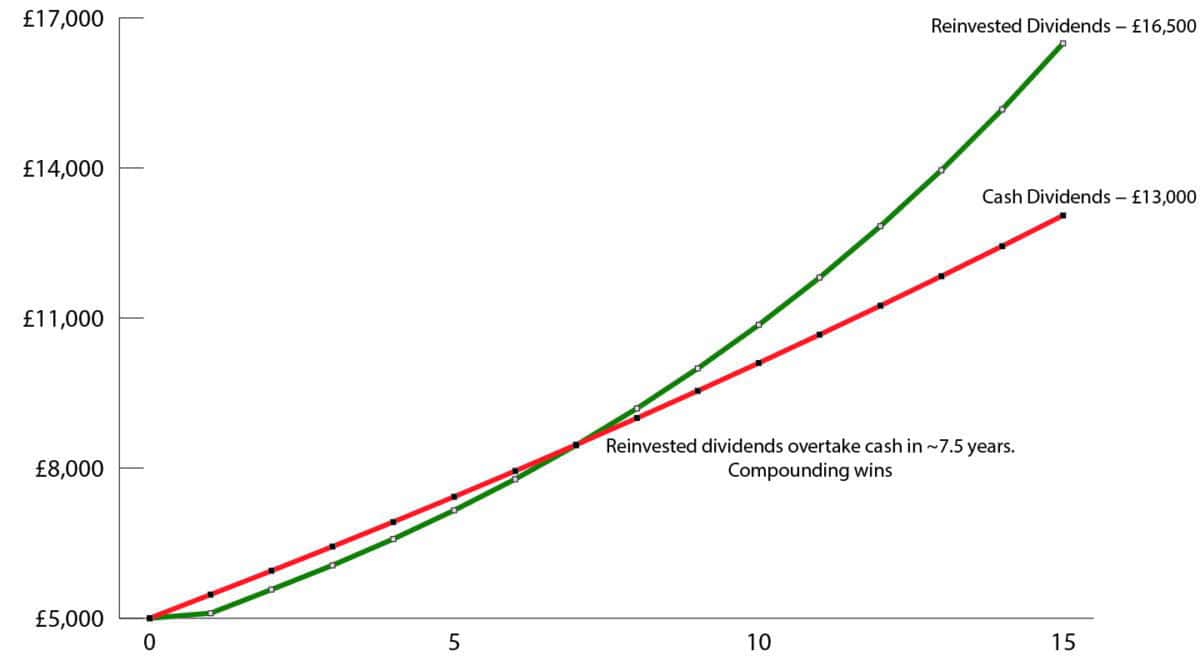

Most traders fail to essentially admire the significance of compounding in constructing long-term wealth. As the next chart highlights, after 15 years £5,000 compounds to over £16,500.

Chart generated by creator

If I take the dividends as money, then the variety of shares I personal stays flat. Because the graph exhibits, the orange line, though rising, at all times stays linear.

Fund outflows

One of many explanation why Aberdeen’s dividend yield is so excessive is as a result of the share worth has been in long-term decline.

Nonetheless, within the final six months the enterprise has begun to point out indicators that it would lastly have turned a nook.

In H1, web outflows from its Adviser enterprise had been £900m. Though disappointing, traders want to take a look at the pattern line not absolutely the quantity.

Over the past 4 quarters, web flows have improved considerably. Certainly, web outflows are actually 50% decrease than they had been in 2024.

A part of the explanation for this bettering image is all the way down to decrease administration charges on its numerous funds. Though this has led to a short-term hit to revenues, I imagine it’s going to possible show to be the precise technique in a extremely aggressive business.

Altering business

The asset administration enterprise is evolving quickly. Buyers right now don’t have a number of persistence. In the event that they see a fund performing badly, they’ll ditch it with out a lot thought.

With so many funds and fund managers to select from, standing out from the pack will be extraordinarily troublesome. However simply because an business is extremely aggressive, doesn’t imply it can’t be profitable.

For my part, Aberdeen’s differentiating issue is that it possesses deep, personalised relationships with impartial monetary advisors (IFAs).

It understands what IFAs require from a fund supervisor. For instance, it not too long ago ramped up capital funding and now has a glossy trendy platform. I imagine such investments will assist entice extra IFAs to enroll.

In my books, the corporate nonetheless has one of many largest model names throughout the business. If it might probably replicate the runaway success of interactive investor throughout its different companies, then that 2% share worth development, modelled earlier on, will look extraordinarily conservative. That’s the reason I not too long ago purchased extra shares – for each development and revenue.

**sugarmute**

sugarmute is a science-guided nutritional supplement created to help maintain balanced blood sugar while supporting steady energy and mental clarity.