Picture supply: Getty Photographs

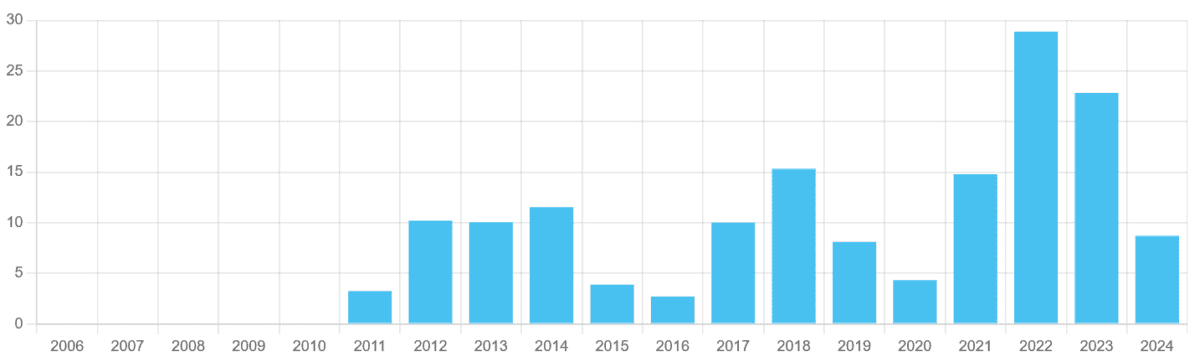

Mining shares are among the many most cyclical on the market. Annual income can swing wildly relying on financial circumstances, as can shareholder dividends. This has been the case with Glencore (LSE:GLEN) shares for greater than a decade.

Since itemizing on the London Inventory Alternate in 2011, shareholder payouts have been up and down like a see-saw. Extra not too long ago, they’ve sank as China’s spluttering financial system and better world rates of interest hit commodities demand. Within the years earlier than that, they rose strongly as a post-pandemic restoration drove metals and power values.

Encouragingly, nonetheless, Metropolis analysts are tipping Glencore shares to rebound strongly over the subsequent few years.

9.6% dividend yield

| Yr | Dividend per share | Dividend development | Dividend yield |

|---|---|---|---|

| 2025 | 14 US cents | 40% | 3.8% |

| 2026 | 22 US cents | 57% | 6.2% |

| 2027 | 34 US cents | 55% | 9.6% |

You’ll maybe be unsurprised that this gorgeous anticipated dividend development coincides with expectations that income will bounce again signficantly.

At the moment, the quantity crunchers count on Glencore:

- To swing from losses per share of 13 US cents final yr to earnings of 20 cents in 2025.

- To report earnings of 33 US cents in 2026, up 65% yr on yr.

- To print earnings of 44 US cents the next yr, a 33% enhance.

Such development far outstrips anticipated dividend development of 1.5%-2% for the broader FTSE 100 over the close to time period. It additionally means dividend yields on Glencore shares shoot previous the FTSE’s long-term common of between 3% and 4%.

Shaky cowl

However dividends are by no means assured, in fact. So I want to contemplate how practical these forecasts are.

On the plus aspect, Glencore’s strong steadiness sheet might go away it in higher form to pay dividends throughout a contemporary downturn than many different miners. As of December 2024, its net-debt-to-EBITDA (earnings earlier than curiosity, tax, depreciation, and amortisation) ratio was a modest 0.78.

However as we’ve seen repeatedly, this in all probability gained’t be sufficient to cease money rewards collapsing if income sink. Glencore already appears to be like uncovered on this entrance, with predicted dividends lined between 1.3 occasions and 1.5 occasions by anticipated earnings by way of to 2027.

These figures sit far under the safety benchmark of two occasions.

Ought to traders purchase Glencore shares?

On steadiness, then, predicting the dimensions of Glencore’s dividends to 2027 stays a troublesome ask given present macroeconomic uncertainty.

Encouragingly, the US-China commerce deal introduced immediately (12 Might) bodes effectively for the corporate’s income, as does a gentle fall in worldwide inflation. Nonetheless, substantial dangers stay to the worldwide financial system (and by extension) to commodity costs, together with the potential for contemporary dust-ups between the US and different main buying and selling companions.

It’s useful, subsequently, to contemplate the returns Glencore shares might ship over the long run reasonably than simply the subsequent few years. And from this attitude, I’m much more upbeat in relation to assessing the corporate’s dividend and share value potential.

As each commodities producer and dealer, the FTSE agency has important alternatives to use the subsequent ‘commodities supercycle’. I feel earnings and dividends may soar as themes just like the rising digital financial system, fast urbanisation, and decarbonisation initiatives drive metals demand.

I purchase shares primarily based on their funding potential over a minimum of a decade. And on this timescale, I feel Glencore’s are price severe consideration.