Picture supply: Getty Pictures

Over the past 12 months or so, Palantir (NASDAQ: PLTR) CEO Alex Karp has developed an Elon Musk-like cult following. It’s simple to see why – Karp may be very optimistic about his firm’s prospects and he’s not afraid to have interaction in a little bit of trash discuss. Now, over the long run, Musk’s firm, Tesla, has been a tremendous long-term funding because of continuous share shopping for exercise from his legion of followers. So, ought to I purchase Palantir inventory for my portfolio on the again of Karp’s following?

Unimaginable development

Palantir immediately, there’s quite a bit to love concerning the firm from an funding perspective, I really feel.

For starters, there’s the unimaginable degree of income development that the enterprise is producing because of the demand for its synthetic intelligence (AI) options. This development is actually unprecedented for an organization of its measurement.

For the second quarter of 2025, Palantir’s revenues got here in at $1.004bn, up 48% 12 months on 12 months (and properly forward of the consensus forecast of $940m). This was pushed by an exceptional efficiency within the US, the place business income soared 93% to $306m and authorities income elevated 53% to $426m.

Smashing the rule of 40

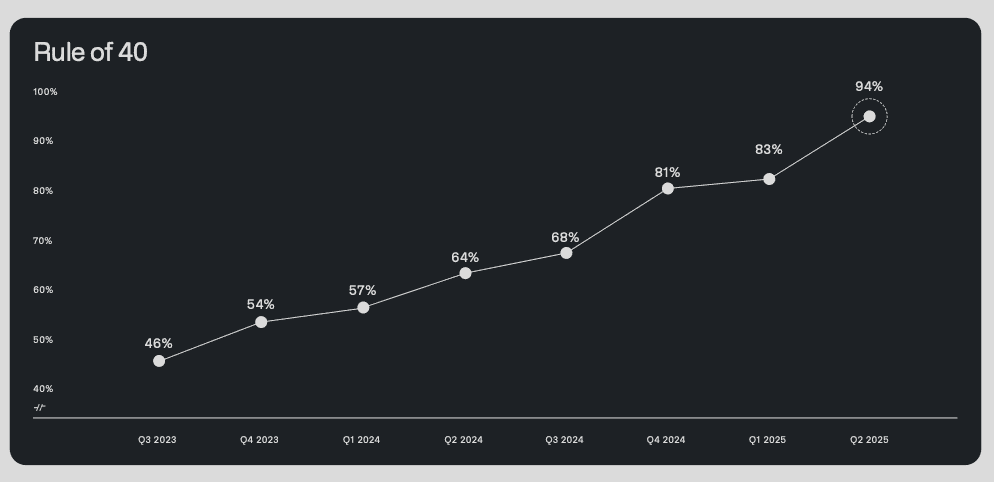

Then there’s the extent of profitability the corporate is producing. Within the software program world, a standard benchmark is the ‘rule of 40’ rating. That is calculated by including an organization’s income development and revenue margin and the concept is {that a} rating of 40 is respectable. Right here, Palantir simply posted a rating of 94 for the most recent quarter, which is de facto spectacular.

Confidence

I additionally like the boldness from Alex Karp. Within the agency’s Q2 letter to shareholders, he wrote: “With continued execution, and a concentrate on what issues and a close to full disinterest in what doesn’t, we imagine that Palantir will develop into the dominant software program firm of the longer term. And the market is now waking as much as this actuality.”

Positive, it’s a bit of tacky. Nevertheless it’s nice to see a pacesetter who’s keen about his firm and its prospects.

Value goal will increase

On his line that the market is waking up this actuality, it appears it’s. Because the Q2 earnings, a variety of brokers have elevated their value targets for Palantir. For instance, Wedbush has raised its goal to $200 from $160. In the meantime, Financial institution of America Securities has elevated its goal to $180 from $150.

“The expansion price of our enterprise has accelerated radically, after years of funding on our half and derision by some. The sceptics are admittedly fewer now, having been defanged and bent right into a form of submission. But we see no purpose to pause, to relent, right here.”

Palantir CEO Alex Karp

A sky-high valuation

Whereas there’s quite a bit to love, nonetheless, the valuation is only a little bit of a stretch for me proper now. Presently, Palantir trades on a price-to-sales ratio of 90 and a price-to-earnings (P/E) ratio of 247.

To my thoughts, shopping for the inventory at these multiples can be fairly dangerous. If earnings miss estimates within the upcoming quarters because of much less spending on AI, the inventory may fall by 20% or extra.

I’ll level out that I’m excited about proudly owning this inventory sooner or later. For now although, I’m going to maintain it on my watchlist and look ahead to a greater entry level.