Picture supply: Getty Photographs

Low-yielding financial savings accounts, property, or fashionable enterprise schemes? To my thoughts, one of the best ways to focus on a long-term passive revenue is to purchase dividend-paying FTSE 100 shares as a substitute.

Blips can occur, as we noticed through the Covid-19 disaster when even dependable dividend shares lower or suspended payouts. However largely talking, the UK’s blue-chip share index stays an ideal place to focus on a good second revenue, supported by:

- Dozens of market-leading firms that take pleasure in sturdy obstacles to entry.

- Corporations in mature industries that return extra earnings by means of dividends.

- The presence of many defensive (ie non-cyclical) shares.

- Companies with sturdy money flows and manageable debt ranges.

Elevate-off

Contemplating defence shares like BAE Techniques (LSE:BA.) could be nice methods to focus on a rising second revenue. Their operations aren’t considerably influenced by broader financial situations, giving them the energy and confidence to lift dividends regardless of the climate.

This Footsie operator continued rising money rewards through the pandemic, underlining this resilience. Defending one’s borders from exterior threats is any nation’s prime precedence, which means BAE Techniques merchandise take pleasure in persistently sturdy demand. In reality, the outlook right here is stronger than it’s been for many years as key European shoppers quickly re-arm.

After all tech failures may very well be extremely damaging for future earnings, impacting income and the corporate’s popularity. Nonetheless, the blue-chip’s sturdy monitor document helps soothe any fears I’ve on this entrance.

Right this moment the ahead dividend yield on BAE Techniques shares is 2%.

Excessive yielder

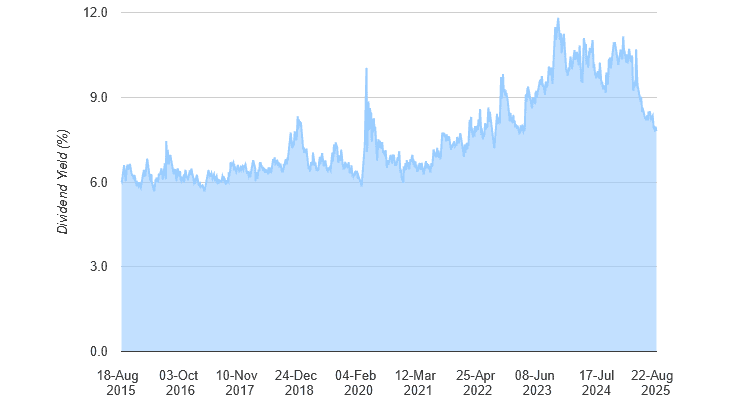

Phoenix Group (LSE:PHNX) has an extended document of providing above-average dividend yields, because the chart under exhibits. They’ve grown for round a decade on the spin, and Metropolis analysts count on this to proceed over the medium time period.

As a consequence, the dividend yield on Phoenix shares for 2025 stays monumental, at 8%.

Put merely, the monetary companies large is a formidable money generator. Its share worth might disappoint when financial situations worsen and demand for its monetary companies may decline. However a robust stability sheet means this doesn’t come to the detriment of its beneficiant dividend coverage.

Its Shareholder Capital Protection Ratio was 172% as of December. I’m anticipating the agency’s half-year buying and selling replace (on 8 September) to reaffirm its strong monetary foundations.

Prime belief

Unite Group (LSE:UTG) is ready as much as present a big and dependable passive revenue to its shareholders. As an actual property funding belief (REIT), it should distribute a minimal of 90% of rental income within the type of dividends. That is in alternate for juicy tax benefits.

Please observe that tax therapy is dependent upon the person circumstances of every consumer and could also be topic to alter in future. The content material on this article is supplied for info functions solely. It’s not meant to be, neither does it represent, any type of tax recommendation.

Such a stipulation doesn’t by itself imply REITs are no-brainer dividend buys. Nonetheless, Unite’s give attention to the extremely secure pupil lodging market makes it much more resilient than different property trusts (like warehouse operators or homeowners of purchasing centres).

There are dangers right here, similar to rate of interest pressures that may depress asset values. But I believe the alternatives right here outweigh the risks, supported by rising numbers of abroad college students and a permanent property scarcity.

The ahead dividend yield right here is 5.3%. Like BAE Techniques and Phoenix, I believe the belief is value critical consideration.