Be part of Our Telegram channel to remain updated on breaking information protection

Michael Saylor’s Technique meets all the factors for inclusion within the S&P 500 index, which might result in $16 billion in inflows for the corporate’s inventory, Bloomberg reported.

That’s after the corporate achieved a $14 billion unrealized achieve the final quarter, delivering the profitability wanted to be included within the index underneath present guidelines.

Along with assembly the profitability necessities, Technique’s shares are probably the most actively and effectively traded of all the 26 doable candidates for inclusion within the index on the subsequent quarterly rebalancing, the story mentioned. Different candidates embody AppLovin Corp, Robinhood Markets, and Carvana Co.

If Technique (MSTR) have been to be included within the S&P 500, passive funds that monitor the index can be compelled to purchase up almost 50 million shares, which is value round $16 billion, in line with evaluation by Stephens Inc that was referenced within the report.

Based on Bloomberg, Technique Inc. (previously MicroStrategy) has theoretically met the S&P 500’s profitability standards with a $14 billion unrealized achieve final quarter. Inclusion would set off passive index funds to purchase round 50 million shares, value roughly $16 billion at…

— Wu Blockchain (@WuBlockchain) September 4, 2025

Institutional Validation

The inclusion would additionally deliver institutional validation for Saylor’s daring Bitcoin accumulation plan, which has been pilloried by critics over time for being too reckless, the report mentioned. It could additionally flip pension funds into oblique holders of the king of cryptos.

Whereas Technique has already been added to the Nasdaq 100 in December, inclusion within the S&P 500 will likely be a a lot greater milestone given it’s almost double the dimensions of the Nasdaq 100 with near $10 trillion in passive capital monitoring it.

Bloomberg’s report mentioned Technique’s inclusion within the S&P 500 should still be “a protracted shot for now,” however added that MSTR becoming a member of the index is now inside the realm of chance, noting that it was unthinkable even a 12 months in the past.

Volatility could also be one downside for its inclusion, with Bloomberg highlighting that Technique’s 30-day value swings run at round 96%, considerably greater than Nvidia’s 77% and Tesla’s 74%.

The S&P committee perhaps reluctant to incorporate MSTR on that foundation, in line with the report.

The S&P committee has the ultimate say in terms of which corporations are added to the index, which might imply candidates that meet liquidity necessities are nonetheless ignored.

Expertise shares at present dominate the index, however the committee’s latest inclusion of US crypto trade Coinbase International Inc and Jack Dorsey’s fintech agency Block Inc suggests the committee is beginning to acknowledge the rising footprint of the crypto area, the report mentioned.

Doubts Over Sustainability Of Technique’s Company Treasury Mannequin

Regardless of the opportunity of S&P 500 inclusion, there was rising skepticism across the sustainability of Technique’s company treasury mannequin.

The corporate depends on debt financing to build up BTC, a technique that comes with dangers, particularly if the corporate’s inventory value, or Bitcoin, fall steeply.

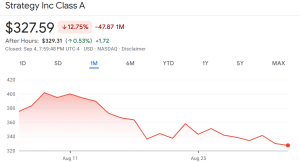

MSTR share value (Supply: Google Finance)

Over the previous month, MSTR’s value has plummeted over 12%. Throughout this similar interval, BTC has slipped 1%, and trades at $112,710.44 as of three:20 a.m. EST, knowledge from CoinMarketCap reveals.

Nonetheless, Technique’s share value remains to be up over 6% on the 6-month timeframe, and MSTR stays greater than 13% within the inexperienced YTD.

Technique BTC holdings (Supply: SaylorTracker)

Technique Is Largest Bitcoin Treasury Agency

Technique is the main Bitcoin treasury firm and is usually seen as a proxy for the value of BTC given the corporate’s excessive focus within the digital asset.

Based on knowledge from Bitcoin Treasuries, Technique holds 636,505 BTC on its stability sheet. The firm is sitting on an unrealized achieve of greater than $25.98 billion, or round 57%, because the agency kicked off its BTC accumulation again in 2020. At present costs, Technique’s Bitcoin stash is valued at $71.45 billion.

The corporate’s most up-to-date Bitcoin buy was on Sept. 2, when it purchased one other 4,084 BTC value round $449.3 million at a mean value of $110,81, in line with an X put up by Saylor.

Technique has acquired 4,048 BTC for ~$449.3 million at ~$110,981 per bitcoin and has achieved BTC Yield of 25.7% YTD 2025. As of 9/1/2025, we hodl 636,505 $BTC acquired for ~$46.95 billion at ~$73,765 per bitcoin. $MSTR $STRC $STRK $STRF $STRD https://t.co/dxXWygUijS

— Michael Saylor (@saylor) September 2, 2025

Associated Articles:

Finest Pockets – Diversify Your Crypto Portfolio

- Simple to Use, Characteristic-Pushed Crypto Pockets

- Get Early Entry to Upcoming Token ICOs

- Multi-Chain, Multi-Pockets, Non-Custodial

- Now On App Retailer, Google Play

- Stake To Earn Native Token $BEST

- 250,000+ Month-to-month Energetic Customers

Be part of Our Telegram channel to remain updated on breaking information protection