On Monday, the market opened decrease and remained beneath strain all through the session, with key benchmarks closing in unfavourable territory. Regardless of the decline, the general technical setup remained intact because the indices held above essential shifting averages. Sector-wise, vitality shares stood out as high performers, buoyed by a robust rally in choose firms following favorable company actions and regulatory readability. Media and steel sectors additionally posted modest features, whereas IT and pharma sectors confronted vital promoting strain, weighed down by issues over rising prices and regulatory challenges.

Globally, Asian markets principally confirmed energy, with notable features in Japan, China, and South Korea, although Hong Kong bucked the pattern with losses. US futures traded decrease, reflecting cautious sentiment amid broader uncertainty. A significant component dampening investor temper was the latest announcement of a pointy enhance in H1-B visa charges by the US authorities, which sparked issues amongst expert employees and corporations reliant on overseas expertise, notably impacting banking and expertise sectors. General, the market outlook remained cautious, balancing pockets of sectoral energy towards lingering headwinds.

On this overview, we are going to analyze the important thing technical ranges and pattern instructions for Nifty and BSE Sensex to observe within the upcoming buying and selling classes. All of the charts talked about under are primarily based on the 5-minute timeframe.

NIFTY 50

(On this evaluation, we have now used 20/50/100/200 EMAs, the place 20 EMA (Crimson), 50 EMA (Orange), 100 EMA (Gentle Blue), 200 EMA (Darkish Blue)).

To view different technical studies, click on right here

The Nifty 50 Index opened on a unfavourable word at 25,238.1 on Monday, down by 88.95 factors from Friday’s closing of 25,327.05. With a bearish begin to the day, the index had a unstable morning session, buying and selling between 25,270 and 25,320 vary. Moreover, the Index stood above the EMAs of 100/200 however remained under the 20/50 EMA within the 15-minute timeframe in the course of the morning session.

The index fell as little as the 25,151.05 mark, reaching its day low within the afternoon session and traded under its opening degree, between the vary of 25,270 and 25,170. In the course of the afternoon session, the Nifty 50 traded under the three EMAs of 20/50/100 and above the 200 EMA within the 15-minute timeframe. Nifty’s rapid resistance ranges are R1 (25,324), R2 (25,451), and R3 (25,585), whereas rapid assist ranges are S1 (25,149), S2 (25,061), and S3 (24,958).

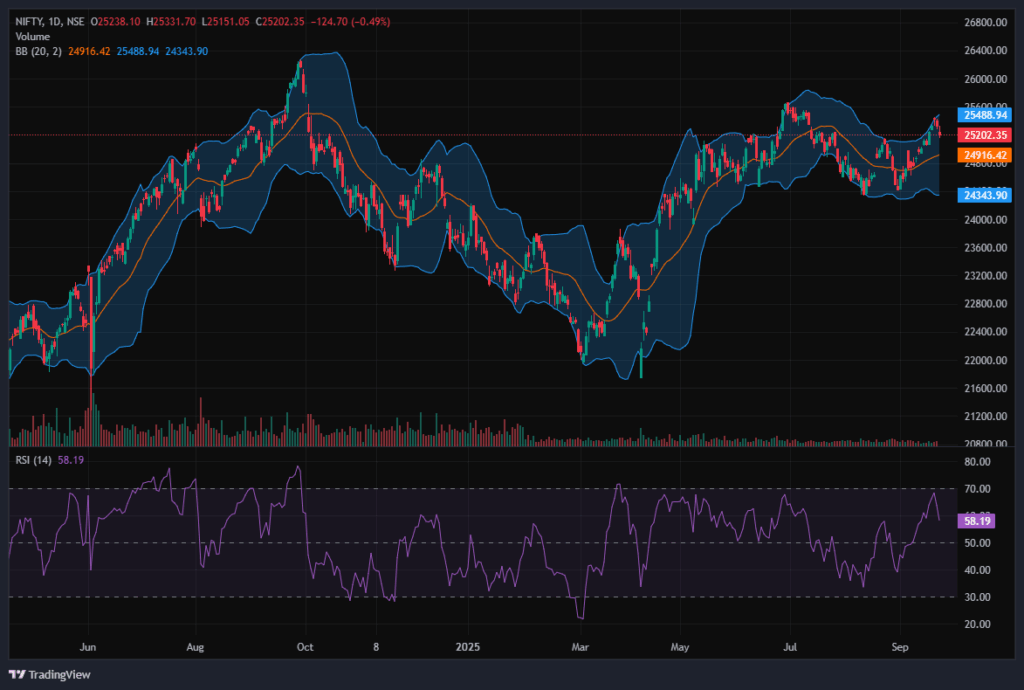

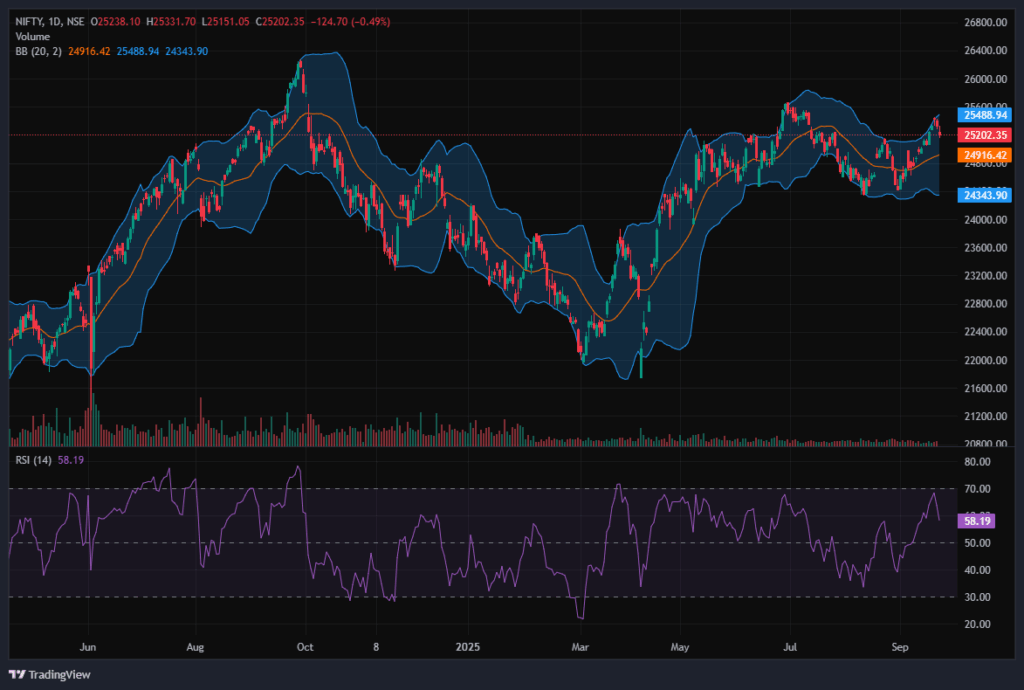

The Nifty index had reached a day’s excessive at 25,331.7 and noticed a day’s low at 25,151.1. Lastly, it had closed at 25,202.4, in crimson under the 25,250 degree, shedding 124.7 factors, or 0.49%. The Nifty 50 closed above all 4 EMAs of 20/50/100/200 EMAs within the every day timeframe.

Momentum Indicators

RSI (Every day): The Nifty 50’s RSI stood at 58.18, which is properly under the overbought zone of 70, indicating a bullish but cautious sentiment.

Bollinger Bands (Every day): The index is buying and selling within the higher band of its Bollinger Band vary above the center band (Easy Shifting Common). Its place within the higher vary, together with stable assist across the 25,150 degree in Monday’s session. A sustained transfer above the center band alerts a bullish sentiment, whereas a drop again towards the decrease band might reinforce bearish sentiment.

Quantity Evaluation: Monday’s buying and selling session had common volumes, which stood at 254.51 Mn.

Derivatives Knowledge: Choices OI signifies sturdy Put writing at 25,200, following 25,000, establishing it as a agency assist zone. On the upside, a big Name OI buildup at 25,300 and 25,500 suggests a possible resistance provide. PCR (Put/Name Ratio) stands at 0.5717 (<1), leaning in the direction of bullish sentiment.

Financial institution Nifty

(On this evaluation, we have now used 20/50/100/200 EMAs, the place 20 EMA (Crimson), 50 EMA (Orange), 100 EMA (Gentle Blue), 200 EMA (Darkish Blue)).

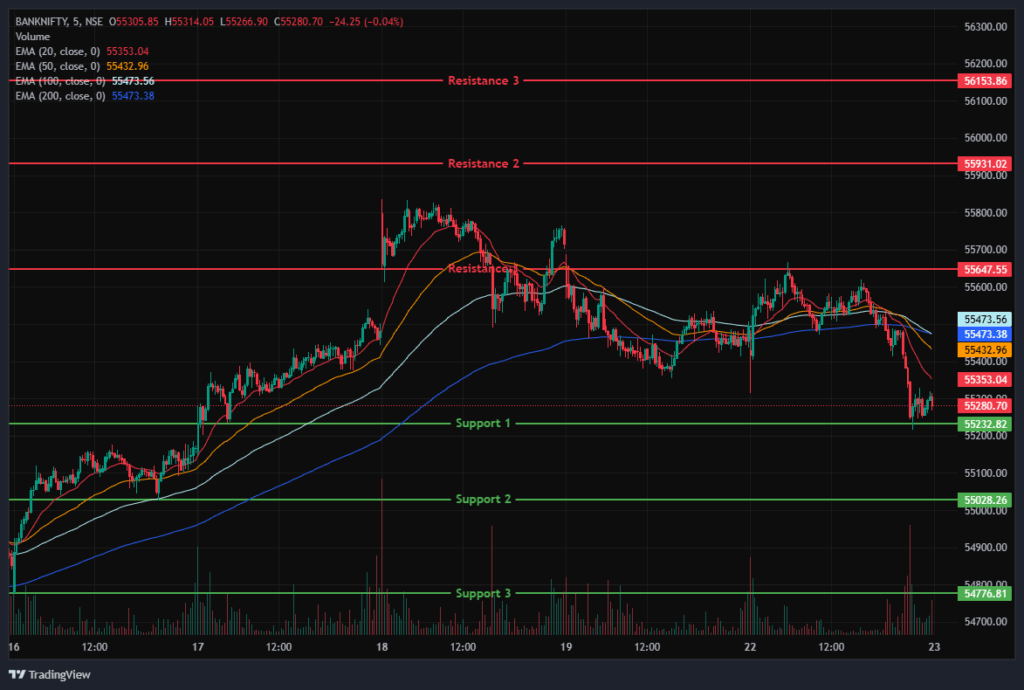

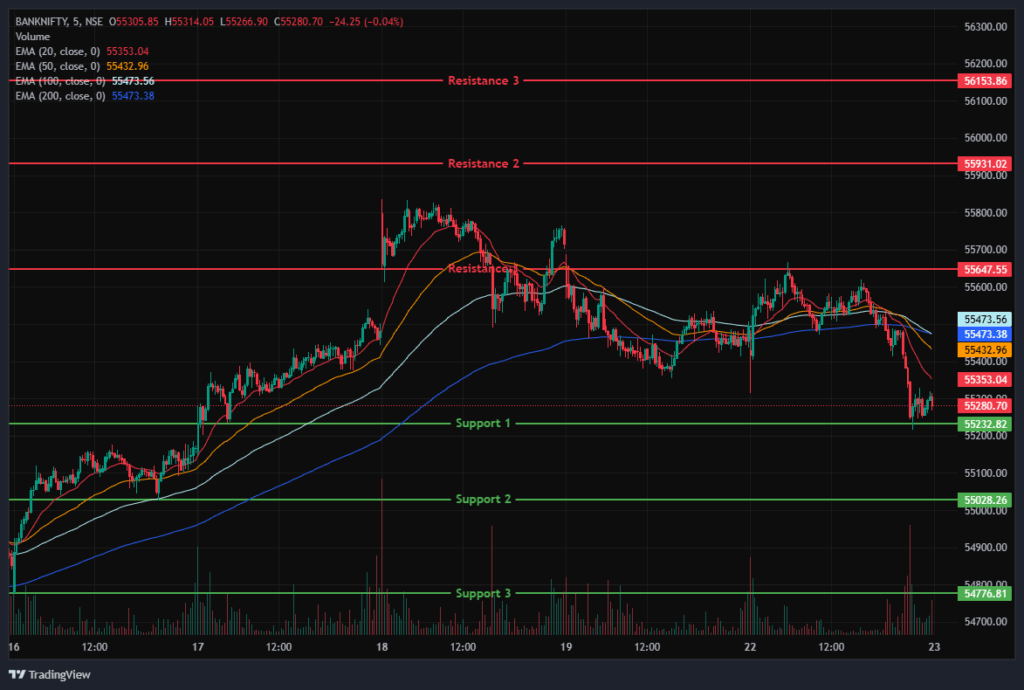

The Financial institution Nifty Index additionally began the session on a unfavourable word at 55,429.3 on Monday, down by 29.55 factors from Friday’s closing of 55,458.85. The index was buying and selling between the vary of 55,600 and 55,500 within the morning session, indicating volatility. As well as, the index was buying and selling above the EMAs of 100/200 however remained under the 20/50 EMAs within the 15-minute timeframe.

Within the afternoon session, the Index fell farther from the day’s excessive and traded across the vary of 55,250 and 55,500, ending in crimson. In the course of the afternoon session, Financial institution Nifty closed under all of the EMAs of 20/50/100 and above the 200 EMA within the 15-minute timeframe. Financial institution Nifty rapid resistance ranges are R1 (55,648), R2 (55,931), and R3 (56,154), whereas rapid assist ranges are S1 (55,233), S2 (55,028), and S3 (54,777).

The Financial institution Nifty index had peaked at 55,666.35 and made a day’s low at 55,215.6. Lastly, it had closed in crimson at 55,284.75, closed under the 55,300 degree, shedding 174.1 factors or 0.31%. The Relative Energy Index (RSI) stood at 54.47 properly under the overbought zone of 70 within the every day timeframe, and Financial institution Nifty closed above all 4 EMAs of 20/50/100/200 within the every day timeframe.

Sensex

(On this evaluation, we have now used 20/50/100/200 EMAs, the place 20 EMA (Crimson), 50 EMA (Orange), 100 EMA (Gentle Blue), 200 EMA (Darkish Blue)).

To view different technical studies, click on right here

The BSE Sensex Index additionally opened on a unfavourable word at 82,151.07 on Monday, down by 475.22 factors from Friday’s closing of 82,626.23. The index traded in the same sample because the Nifty 50, and was buying and selling between 82,400 and 82,500 vary all through the morning session’s 15-minute timeframe, above the 200 EMA however under the 20/50/100 EMAs.

Within the afternoon session, the Index declined additional, marking a day’s low at 81,997.29 and was buying and selling between the 82,100 and 82,400 degree, sustaining its general bearish pattern and shutting under all 4 EMAs of 20/50/100/200 within the 15-minute timeframe. BSE Sensex rapid resistance ranges are R1 (82,506), R2 (82,803), and R3 (83,030), whereas rapid assist ranges are S1 (81,993), S2 (81,751), and S3 (81,506).

The BSE Sensex index had peaked at 82,583.16 and made a day’s low at 81,997.3. Lastly, it closed at 82,159.97 in crimson, shedding 466.26 factors or 0.56%. The Relative Energy Index (RSI) stood at 56.4 (under the overbought zone of 70) within the every day timeframe, and the BSE Sensex closed above all 4 EMAs of 20/50/100/200 within the every day timeframe.

India VIX

The India VIX elevated by 0.59 factors or 5.92%, from 9.97 to 10.56 throughout Monday’s session. A rise within the India VIX sometimes signifies larger value volatility within the inventory market, suggesting a much less steady market atmosphere. Nevertheless, a steady market atmosphere and minimal volatility are anticipated when the India vix is under 15.

Market Recap on twenty second of September 2025

On Monday, the Nifty 50 opened on a bearish word at 25,238.10, falling 88.95 factors from its earlier shut of 25,327.05. It touched an intraday low of 25,151.05 earlier than settling at 25,202.35, down 124.70 factors or 0.49%. Technically, the index remained above all 4 key exponential shifting averages (20, 50, 100, and 200-day) on the every day chart. The BSE Sensex adopted the same pattern, opening at 82,151.07, decrease by 475.16 factors from its earlier shut of 82,626.23. It ended the session at 82,159.97, registering a lack of 466.26 factors or 0.56%.

Momentum indicators confirmed reasonable energy, with the RSI for Nifty 50 at 58.19 and for Sensex at 56.37, each staying under the overbought mark of 70. The Financial institution Nifty Index additionally closed in unfavourable territory, declining 174.10 factors or 0.31% to complete at 55,284.75. The drop adopted the US authorities’s announcement on 20 September 2025 of a rise within the H1-B visa value to USD 100,000, sparking confusion and concern amongst expert employees.

Amongst sectoral indices, the Nifty Vitality Index was the highest performer, gaining 246.90 factors or 0.69% to shut at 35,992.65. Adani Energy Ltd rallied 20.00% after a 5-for-1 inventory cut up and partial SEBI clearance from allegations of inventory manipulation and accounting fraud. Different Adani group shares, together with Adani Complete Fuel Ltd, Adani Inexperienced Vitality Ltd, and Adani Vitality Options Ltd, additionally surged by as much as 19.85%.

The Nifty Media Index added 7.85 factors or 0.48% to shut at Rs 1,627.30. High gainers included Zee Leisure Enterprises Ltd and Nazara Applied sciences Ltd, which rose as much as 2.97%. The Nifty Steel Index additionally posted modest features, ending at Rs 10,029.10, up 39.20 factors or 0.39%.

On the draw back, the Nifty IT Index was the weakest sector, closing at 35,500.15, down 1,078.10 factors or 2.95%. Mphasis Ltd declined 4.72%, whereas LTIMindtree Ltd and Coforge Ltd fell by as much as 4.53%. The Nifty Pharma Index additionally ended decrease at 22,365.75, down 320.85 factors or 1.41%. Notable laggards included Glenmark Prescription drugs Ltd, Granules India Ltd, Laurus Labs Ltd, and Ipca Laboratories Ltd, which dropped by as much as 3.23%. The Nifty Smallcap 50 Index closed at 8,796.75, shedding 112.95 factors or 1.27%.

Asian markets have been largely optimistic on Monday. Japan’s Nikkei 225 Index superior 487.19 factors or 1.07%, closing at 45,533.00. China’s Shanghai Composite Index gained 8.49 factors or 0.22%, ending at 3,828.58. South Korea’s KOSPI Index ended larger at 3,468.65, up 23.41 factors or 0.67%, whereas Hong Kong’s Cling Seng Index dropped 175.10 factors or 0.66% to shut at 26,370.00. As of 4:48 p.m. IST, US Dow Jones Futures have been buying and selling at 46,171.14, down 141.15 factors or 0.31%.

Commerce Setup Abstract

The Nifty 50 opened on a unfavourable word at 25,238.1 on Monday and ended the session within the crimson under the 25,250 degree at 25,202.35. A break under 25,149 might set off additional promoting in the direction of 25,061, whereas breaking the subsequent resistance degree of 25,324 might set off bullishness in the direction of the 25,451 degree.

Financial institution Nifty additionally began the session on a unfavourable word at 55,429.3 and ended the session within the crimson at 55,284.75, under the 55,300 degree. A break under 55,233 might set off additional promoting in the direction of 55,028, whereas breaking the subsequent resistance degree of 55,648 might set off bullishness in the direction of the 55,931 degree.

Sensex additionally opened on a unfavourable word at 82,151.07 and ended the session within the crimson at 82,159.97, under the 82,200 degree. A break under 81,993 might set off additional promoting in the direction of 81,751, whereas breaking the subsequent resistance degree of 82,506 could lead on in the direction of the 82,803 degree.Given the continuing volatility and combined sentiments, it’s advisable to keep away from aggressive positions and look forward to clear directional strikes above resistance or under assist.

Merchants ought to take into account these key assist and resistance ranges when getting into lengthy or brief positions following the worth break from these crucial ranges. Moreover, merchants can mix shifting averages to establish extra correct entry and exit factors.

Disclaimer

The views and funding suggestions expressed by funding specialists/broking homes/score companies on tradebrains.in are their very own, and never that of the web site or its administration. Investing in equities poses a danger of monetary losses. Buyers should subsequently train due warning whereas investing or buying and selling in shares. Commerce Brains Applied sciences Non-public Restricted or the creator should not answerable for any losses induced because of the choice primarily based on this text. Please seek the advice of your funding advisor earlier than investing.

About: Commerce Brains Portal is a inventory evaluation platform. Its commerce title is Dailyraven Applied sciences Non-public Restricted, and its SEBI-registered analysis analyst registration quantity is INH000015729.

Investments in securities are topic to market dangers. Learn all of the associated paperwork rigorously earlier than investing.

Registration granted by SEBI and certification from NISM on no account assure efficiency of the middleman or present any assurance of returns to buyers.