Indian fairness markets started the week on a cautious observe, opening increased however failing to carry early positive factors because of persistent promoting stress and weak investor sentiment. Each the Nifty 50 and BSE Sensex noticed intraday volatility, finally closing marginally decrease, regardless of a optimistic begin. Technically, the indices confirmed weak spot, slipping under key short-term transferring averages, although they remained above their long-term development traces. Market breadth continued to deteriorate, marking the seventh consecutive session of decline, as international institutional outflows and subdued momentum indicators signalled rising warning amongst merchants.

Amidst the general market weak spot, choose sectors confirmed resilience. Public sector banks led the positive factors, adopted by energy in oil & fuel and actual property shares, pushed by renewed curiosity in defensives and cyclical performs. On the flip facet, media, non-public banks, and small-cap shares noticed notable declines, weighed down by profit-booking and weak broader sentiment. International cues had been combined, with most Asian markets ending increased, whereas weak spot in Japanese equities and a dip in US futures pointed to lingering international uncertainty.

On this overview, we are going to analyse the important thing technical ranges and development instructions for Nifty and BSE Sensex to watch within the upcoming buying and selling periods. All of the charts talked about under are based mostly on the 5-minute timeframe.

Nifty 50

(On this evaluation, we have now used 20/50/100/200 EMAs, the place 20 EMA (Crimson), 50 EMA (Orange), 100 EMA (Mild Blue), and 200 EMA (Darkish Blue)).

To view different technical reviews, click on right here

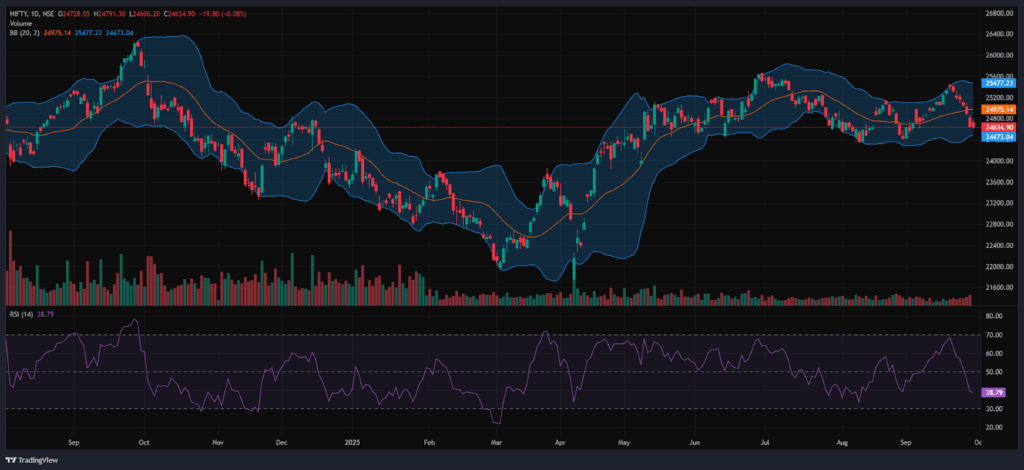

The Nifty 50 Index opened on a optimistic observe at 24,728.55 on Monday, up by 73.85 factors from Friday’s closing of 24,654.70. With a bullish begin to the day, the index had a risky morning session, buying and selling within the 24,600 to 24,800 vary. Moreover, the Index stood under all 4 EMAs of 20/50/100/200 within the 15-minute timeframe in the course of the morning session.

Additional, the index fell as little as the 24,606 mark, the day’s low within the afternoon session, and was traded under its opening stage, between the vary of 24,600 and 24,750. Through the afternoon session, the Nifty 50 traded under all 4 EMAs of 20/50/100/200 within the 15-minute timeframe. Nifty’s rapid resistance ranges are R1 (24,794), R2 (24,958), and R3 (25,082), whereas rapid help ranges are S1 (24,611), S2 (24,521), and S3 (24,402).

The Nifty index had reached a day’s excessive at 24,791.30 and noticed a day’s low at 24,606.20. Lastly, it had closed at 24,634.90, in purple under the 24,650 stage, dropping 19.8 factors, or 0.08%. The Nifty 50 closed above the EMA of 200 however under the 20/50/100 EMAs within the every day timeframe.

Momentum Indicators

RSI (Each day): The Nifty 50’s RSI stood at 38.79, which is effectively under the overbought zone of 70 however close to to the oversold zone, indicating a bearish sentiment.

Bollinger Bands (Each day): The index is buying and selling within the decrease band of its Bollinger Band vary under the center band (Easy Transferring Common). Its place within the decrease vary signifies a bearish sentiment, together with sturdy resistance across the 24,700 stage in Monday’s session. A sustained transfer above the center band alerts a bullish sentiment, whereas a drop again towards the decrease band might reinforce bearish sentiment.

Quantity Evaluation: Monday’s buying and selling session had above-average volumes, which stood at 394.39 Mn.

Derivatives Information: Choices OI signifies sturdy Put writing at 24,600, following 24,500, establishing it as a agency help zone. On the upside, a big Name OI buildup at 24,700 and 24,800 suggests a possible resistance provide. PCR (Put/Name Ratio) stands at 0.66 (<1), leaning in the direction of bullish sentiment and the Quick masking alerts a brief short-term bullish transfer, with an general impartial to optimistic outlook for the subsequent buying and selling session.

Financial institution Nifty

(On this evaluation, we have now used 20/50/100/200 EMAs, the place 20 EMA (Crimson), 50 EMA (Orange), 100 EMA (Mild Blue), and 200 EMA (Darkish Blue)).

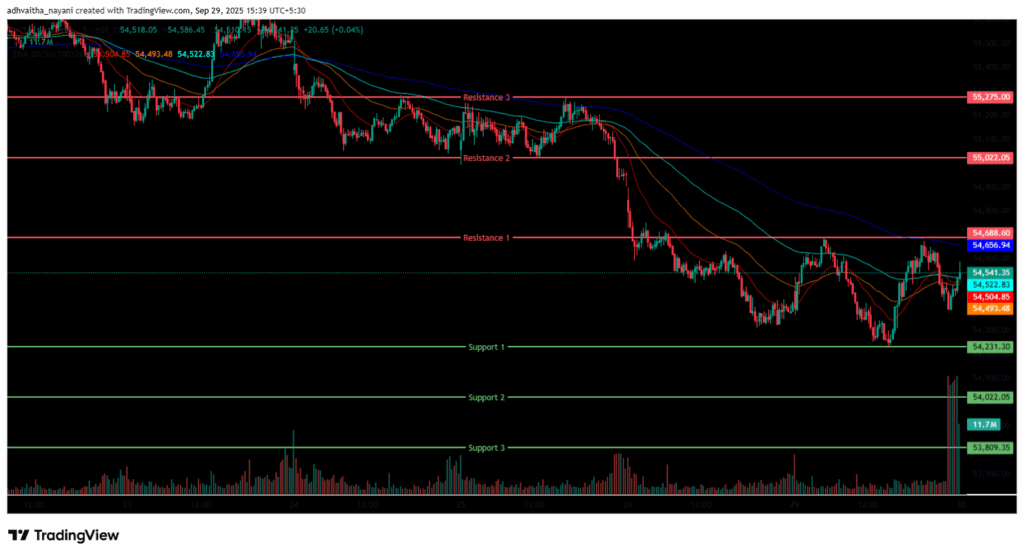

The Financial institution Nifty Index additionally began the session on a optimistic observe at 54,460.40 on Monday, up by 71.05 factors from Friday’s closing of 54,976.20. The index was buying and selling between the vary of 54,200 and 54,700 within the morning session, indicating volatility. As well as, the index was buying and selling under all 4 EMAs of 20/50/100/200 within the 15-minute timeframe.

Within the afternoon session, the Index additional fell as little as the 54,227 stage, marking its day’s low and was traded across the vary of 54,200 and 54,700, ending in inexperienced. Through the afternoon session, Financial institution Nifty closed under the EMAs of fifty/100/200 however above the 20-period EMA within the 15-minute timeframe. Financial institution Nifty rapid resistance ranges are R1 (54,689), R2 (55,022), and R3 (55,275), whereas rapid help ranges are S1 (54,231), S2 (54,022), and S3 (53,809).

The Financial institution Nifty index had peaked at 54,686.05 and made a day’s low at 54,226.60. Lastly, it had closed in inexperienced at 54,461.00, closing above the 54,400 stage, gaining 71.65 factors or 0.13%. The Relative Power Index (RSI) stood at 42.15 effectively under the overbought zone of 70 however close to to the oversold zone within the every day timeframe, and Financial institution Nifty closed above the EMA of 200 however under the 20/50/100 EMAs within the every day timeframe.

Sensex

(On this evaluation, we have now used 20/50/100/200 EMAs, the place 20 EMA (Crimson), 50 EMA (Orange), 100 EMA (Mild Blue), and 200 EMA (Darkish Blue)).

To view different technical reviews, click on right here

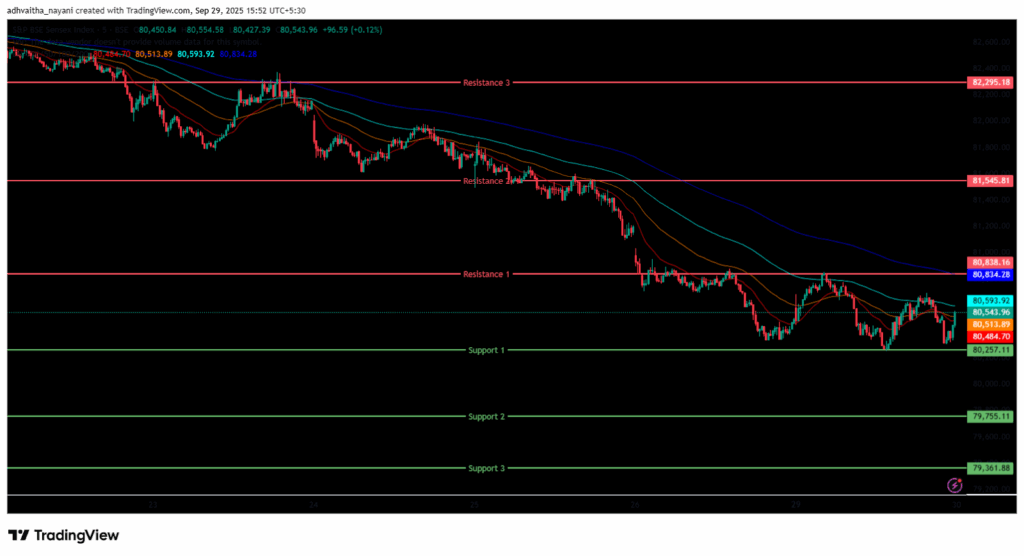

The BSE Sensex Index additionally opened on a optimistic observe at 80,588.77 on Monday, up by 162.31 factors from Friday’s closing of 80,426.46. The index began its session on a bullish observe and was buying and selling within the 80,250 to 80,850 vary all through the morning session’s 15-minute timeframe, under all 4 EMAs of the 20/50/100/200.

Within the afternoon session, the Index was additional dragged down, marking its day low on the 80,249 stage and buying and selling between the 80,200 and 80,700 ranges, sustaining its general bearish development and shutting under the EMAs of fifty/100/200 however above the 20 interval EMA within the 15-minute timeframe. BSE Sensex rapid resistance ranges are R1 (80,838), R2 (81,546), and R3 (82,295), whereas rapid help ranges are S1 (80,257), S2 (79,755), and S3 (79,362).

The BSE Sensex index had peaked at 80,851.38 and made a day’s low at 80,248.84. Lastly, it had closed at 80,364.94 in purple, dropping 61.52 factors or 0.076%. The Relative Power Index (RSI) stood at 38.36 (under the overbought zone of 70 however close to to the oversold zone within the every day timeframe), and the BSE Sensex closed under all 4 EMAs of 20/50/100/200 within the every day timeframe.

India VIX

The India VIX decreased by 0.060 factors or 0.53%, from 11.42 to 11.36 throughout Monday’s session. A lower within the India VIX usually signifies cheaper price volatility within the inventory market, suggesting a extra steady market surroundings. Nonetheless, a steady market surroundings and minimal volatility are anticipated when the India vix is under 15.

Market Recap on the twenty ninth of September 2025

On Monday, the Nifty 50 opened on a optimistic observe above the 24,700 stage at 24,728.55, up 73.85 factors from its earlier shut of 24,654.70. It touched an intraday low of 24,606.2 earlier than closing marginally decrease at 24,634.9, down 19.80 factors or 0.08%. Technically, the index stayed above the 200-day EMA however slipped under the 20-, 50-, and 100-day EMAs on the every day chart. The BSE Sensex mirrored this development, opening increased at 80,588.77 (up 162.31 factors) however ending the session at 80,364.94, down 61.52 factors or 0.08%.

Momentum indicators mirrored weak sentiment, with the RSI at 38.79 for Nifty 50 and 38.36 for Sensex, each nearing oversold territory. In distinction, the Financial institution Nifty Index ended within the inexperienced, gaining 71.65 factors or 0.13%, to shut at 54,461. Broader markets declined for the seventh straight session, impacted by sustained FII promoting and elevated volatility.

Sector-wise, the Nifty PSU Financial institution Index outperformed, rising 1.78% to shut at 7,390.75, with main PSU banks like Indian Financial institution, Financial institution of Baroda, Financial institution of India, Canara Financial institution, and Financial institution of Maharashtra gaining as much as 2.6%. The Nifty Oil & Gasoline Index adopted, up 1.35% at 11,282.3, led by HPCL, which surged 4.62%, together with positive factors in Petronet LNG, BPCL, and IOC. The Nifty Realty Index additionally posted modest positive factors of 0.88%, closing at 874.75.

On the draw back, the Nifty Media Index was the worst performer, slipping 0.9% to 1,562, with Nazara Applied sciences dropping 5% and different names like Hathway, Saregama and PVR Inox falling as much as 3.5%. The Nifty Smallcap 50 declined 0.3% to eight,410.15, dragged by names like Firstsource Options, Aditya Birla Actual Property, and Kaynes Expertise, which fell as much as 7.2%. The Nifty Non-public Financial institution Index additionally slipped 0.3% to settle at 26,411.3.

In international markets, Asian indices closed combined. Hong Kong’s Cling Seng led positive factors, rising 1.89% to 26,622.88, adopted by South Korea’s KOSPI up 1.33%, and the Shanghai Composite, up 0.9%. Nonetheless, Japan’s Nikkei 225 declined 0.69% to 45,043.75. As of 4:20 p.m. IST, US Dow Jones Futures had been down 200 factors, or 0.43%, buying and selling at 46,756.

Commerce Setup Abstract

The Nifty 50 opened on a optimistic observe at 24,728.55 on Monday however ended the session within the purple under the 24,650 stage at 24,634.90. A break under 24,611 might set off additional promoting in the direction of 24,521 whereas breaking the subsequent resistance stage of 24,794 might set off bullishness in the direction of the 24,958 stage.

Financial institution Nifty began the session on a optimistic observe at 54,460.40 and ended the session within the inexperienced at 54,461.00, above the 54,400 stage. A break under 54,231 might set off additional promoting in the direction of 54,022, whereas breaking the subsequent resistance stage of 54,689 might set off bullishness in the direction of the 55,022 stage.

Sensex additionally opened on a optimistic observe at 80,588.77 however ended the session within the purple at 80,364.94, under the 80,400 stage. A break under 80,257 might set off additional promoting in the direction of 79,755, whereas breaking the subsequent resistance stage of 80,838 may lead in the direction of the 81,546 stage.

Given the continuing volatility and combined sentiments, it’s advisable to keep away from aggressive positions and look ahead to clear directional strikes above resistance or under help. Merchants ought to take into account these key help and resistance ranges when getting into lengthy or brief positions following the value break from these essential ranges. Moreover, merchants can mix transferring averages to establish extra correct entry and exit factors.

Disclaimer

The views and funding ideas expressed by funding consultants/broking homes/score businesses on tradebrains.in are their very own, and never that of the web site or its administration. Investing in equities poses a danger of monetary losses. Buyers should due to this fact train due warning whereas investing or buying and selling in shares. Commerce Brains Applied sciences Non-public Restricted or the writer usually are not answerable for any losses precipitated on account of the choice based mostly on this text. Please seek the advice of your funding advisor earlier than investing.

About: Commerce Brains Portal is a inventory evaluation platform. Its commerce title is Dailyraven Applied sciences Non-public Restricted, and its SEBI-registered analysis analyst registration quantity is INH000015729.

Investments in securities are topic to market dangers. Learn all of the associated paperwork rigorously earlier than investing.

Registration granted by SEBI and certification from NISM on no account assure efficiency of the middleman or present any assurance of returns to traders.