Be part of Our Telegram channel to remain updated on breaking information protection

Ripple, Coinbase, and different digital asset companies now qualify as crypto custodians after the US Securities and Trade Fee (SEC) issued a no-action letter permitting funding advisers to make use of state-chartered belief firms to carry purchasers’ belongings.

Within the letter, the SEC’s Division of Funding Administration stated it wouldn’t suggest the company take enforcement motion if advisers used state belief firms as a crypto custodian.

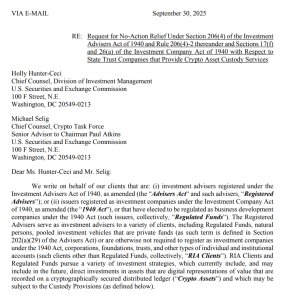

That was in response to a letter despatched by Regulation Agency Simpson Thatcher & Bartlett, which requested for assurances that registered companies wouldn’t be topic to enforcement motion from the SEC in the event that they began holding crypto for purchasers.

Letter despatched to SEC asking for assurances (Supply: SEC)

New Steerage Clarifies The Definition Of A Financial institution, Offers Clear Necessities

The steerage from the SEC employees has offered the crypto business with some extra clarification concerning the definition of a “financial institution” below the Funding Advisers Act of 1940 and the Funding Firm Act of 1940.

Brian Daly, the director of the SEC Division, stated that the extra readability “was wanted as a result of state-chartered belief firms weren’t universally seen as eligible custodians for crypto belongings.”

Ripple, Coinbase, and a number of different crypto companies have operated as state-chartered belief firms, however beforehand confronted questions on their eligibility below custody necessities.

In its response, the SEC’s Division confirmed that state belief firms resembling Ripple and Coinbase can be utilized as custodians, which Daly believes will unlock “a bigger universe of crypto custody choices.”

Nevertheless, these companies might want to have procedures in place which are designed to safeguard purchasers’ crypto.

Advisers and fund managers will even must observe particular standards, which incorporates performing due diligence resembling reviewing audited monetary statements ready below GAAP and inside management reviews from unbiased accountants.

Advisers will even have to find out whether or not it’s in the most effective curiosity of their purchasers for the businesses to custody the crypto.

Custodial agreements must prohibit lending, pledging, or rehypothecating crypto belongings with out the shopper’s consent as properly. One other main requirement is that purchasers’ digital belongings are segregated from the custodian’s stability sheet.

That final requirement addresses a serious purpose for among the greatest collapses in crypto’s historical past over time. Considered one of these collapses was the autumn of crypto alternate FTX, which allowed its sister buying and selling agency Alameda to make use of buyer funds for investments, dangerous trades, and different obligations.

One other instance is the Celsius Community, which had contractual phrases for its “Earn” program that transferred title to the belongings to Celsius. The corporate was then free to lend, re-pledge, or commingle funds.

SEC Steerage Applauded By Some, However Staying Energy And Regulatory Progress Nonetheless Questioned

A number of crypto business figures have stated the brand new steerage from the SEC is a step in the precise course.

SEC Commissioner Hester Peirce, whose advocacy for digital belongings has earned her the nickname “Crypto Mother,” stated that the brand new steerage brings an finish to the “guessing sport” that registered advisers and controlled funds have been caught up in “for too lengthy.”

She went on to say that the no-action letter “is an encouraging growth” for registered advisers and funds that wish to spend money on crypto.

Equally, Wyoming Senator Cynthia Lummis stated she was “inspired” by the event, and identified that the previous Joe Biden Administration condemned her state for making an identical transfer in 2020.

Bloomberg ETF analyst James Seyffart additionally applauded the choice.

“This can be a textbook instance of extra readability for the digital asset house.,” he stated on X.

This can be a textbook instance of extra readability for the digital asset house. Precisely the type of factor the business was asking for over the previous couple of years. And it retains coming. https://t.co/vIA9XQ0XMU

— James Seyffart (@JSeyff) September 30, 2025

“Precisely the type of factor the business was asking for over the previous couple of years. And it retains coming,” he added.

One X consumer commented below Seyffart’s submit and questioned whether or not the brand new steerage “is definitely sticky” or if it can vanish as soon as a brand new SEC Chair is chosen. The Bloomberg analyst replied by saying, “It’s a begin.”

One other X consumer expressed frustration with how gradual new crypto legal guidelines and steerage is being issued by US regulators, and argued that regulators are “failing.”

Seyffart replied by saying the X consumer was “severely underestimating how slowly the federal government can transfer,” likening regulators’ dimension and pace to that of plane carriers. In contrast with the requirements of regular authorities strikes, US regulators are “turning on a dime” with crypto insurance policies, Seyffart stated.

Associated Articles:

Greatest Pockets – Diversify Your Crypto Portfolio

- Simple to Use, Function-Pushed Crypto Pockets

- Get Early Entry to Upcoming Token ICOs

- Multi-Chain, Multi-Pockets, Non-Custodial

- Now On App Retailer, Google Play

- Stake To Earn Native Token $BEST

- 250,000+ Month-to-month Lively Customers

Be part of Our Telegram channel to remain updated on breaking information protection