Picture supply: Getty Pictures

For properly over a decade, Authorized & Basic (LSE:LGEN) shares have confirmed a strong inventory to purchase for traders looking for a passive earnings.

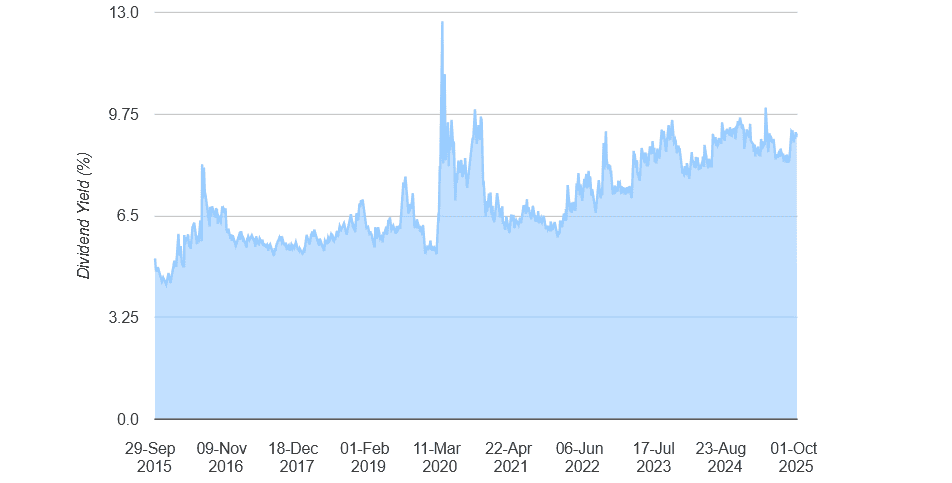

Since 2015, dividends have grown at a median compound annual progress of 6.2%. And because the graphic beneath exhibits, dividend yields on the monetary companies large have additionally been monumental over the interval. To offer them context, the long-term Footsie common yield sits again at 3%-4%.

Authorized & Basic’s spectacular dividend report is supported by its wealthy money flows and powerful dividend tradition. However amid an unsure financial panorama, can the corporate maintain its beneficiant payout coverage alive?

Slower progress, giant yields

Whereas dealer projections aren’t set in stone, it’s after all a good suggestion to see what the Metropolis’s forecasting. Right here, issues are trying promising:

| Yr | Dividend per share | Dividend progress | Dividend yield |

|---|---|---|---|

| 2025 | 21.79p | 2% | 9.2% |

| 2026 | 22.23p | 2% | 9.4% |

| 2027 | 22.71p | 2.2% | 9.6% |

The very first thing you’ll see is dividends are tipped to continue to grow over the medium time period, albeit at a slower tempo than in earlier years.

That is in keeping with the corporate’s present capital distribution coverage. Beneath plans launched in 2024, future dividend progress shall be pegged at a decrease fee of two%, however with share buybacks serving to to complement money returns.

As a consequence, dividend progress might path the speed of inflation, that means the real-world worth of payouts may fall. But with yields nonetheless above 9% and rising over the interval, the inventory should still stay a compelling one for dividend traders.

Money machine

As I say, dividends are by no means assured although. So let’s see how sturdy these forecasts are.

On our first measure — dividend cowl — these estimates are trying a bit of flaky. This metric gauges how properly predicted rewards are lined by anticipated earnings, for which a studying of two occasions and above is fascinating.

With Authorized & Basic shares, this yr’s anticipated dividend per share is definitely increased than predicted earnings per share (20.78p). Issues enhance thereafter, however dividend cowl’s modest at 1.1 and 1.2 for 2026 and 2027 respectively.

That’s clearly not nice. Nevertheless it’s definitely not a motive to panic, in my opinion. Sub-par protection has lengthy been a function of this specific FTSE 100 inventory, but — because of its rock-solid steadiness sheet — this hasn’t prevented the supply of huge and rising dividends over the previous 10 years.

Authorized & Basic’s stays money wealthy in the present day too. So I’m optimistic it may possibly not less than meet these dividends Metropolis brokers predict. The agency’s Solvency II capital ratio was 217% as of June.

Is Authorized & Basic a purchase?

Authorized & Basic, in my opinion, stays one of many hottest passive earnings shares to think about in the present day. There’s motive it’s at the moment the biggest single holding in my very own portfolio.

But traders want to think about the dangers of proudly owning the share. Regardless of nonetheless paying giant dividends, Authorized & Basic’s share worth continues to battle. It’s up simply 2% within the yr to this point, that means traders may have nonetheless obtained higher complete returns elsewhere.

This might stay so if financial situations are robust. However over the long run, I’m assured it can ship spectacular capital features alongside additional market-beating dividends, supported by sturdy progress in its retirement, insurance coverage and asset administration markets.