Be part of Our Telegram channel to remain updated on breaking information protection

Arthur Hayes says the four-year Bitcoin cycle is lifeless and the present bull run can proceed, powered by plentiful liquidity.

Because the four-year anniversary of the present cycle approaches, merchants have been questioning whether or not this bull run is ending, however BitMEX co-founder Hayes says previous cycles ended due to financial tightening, not the cycle.

Hayes sees Fed fee cuts and easing in China and different nations as elements that may proceed supporting Bitcoin’s bull market.

“Hearken to our financial masters in Washington and Beijing,’’ he stated in a weblog put up. ‘’They clearly state that cash shall be cheaper and extra plentiful. Due to this fact, Bitcoin continues to rise in anticipation of this extremely possible future. The king is lifeless, lengthy stay the king!”

Bitcoin Cycles Don’t Revolve Round Halving Occasions, Says Hayes

Previously, analysts have used the Bitcoin halvings as a landmark to find out BTC’s cycle phases. It’s because the occasion, which occurs kind of each 4 years, slashes the quantity of latest BTC that’s launched into circulation by miners by half.

This provide crunch is then usually adopted by a worth surge as demand picks up.

Nevertheless, Hayes says that Bitcoin’s previous cycles have been pushed by the provision and amount of cash, primarily the USD and the Chinese language yuan, relatively than arbitrary four-year patterns tied to BTC’s halvings.

In keeping with Hayes, Bitcoin’s first cycle occurred across the similar time the US Federal Reserve (Fed) initiated quantitative easing and Chinese language credit score expanded. The cycle then ended when each the Fed and the Chinese language central financial institution slowed cash printing in 2013.

The second crypto market bull run was the “ICO cycle,” and was pushed by the yuan credit score explosion and forex devaluation in 2015. This bull market additionally collapsed as Chinese language credit score progress decelerated and greenback circumstances tightened.

A few years later, through the Covid-19 Pandemic, Bitcoin went on to surge on USD liquidity alone whereas China took a extra restrained strategy. This rally then ended when the Fed began tightening financial coverage in late 2021, Hayes stated.

Present Bitcoin Cycle Is Completely different

Hayes additionally wrote in his put up that the present cycle is completely different from these up to now.

He highlighted the US Treasury draining $2.5 trillion from the Fed’s Reverse Repo program and injecting it into the market by issuing extra Treasury payments, in addition to US President Donald Trump desirous to ease financial coverage to develop out debt, as differentiating elements for this cycle.

Along with that, the US central financial institution has resumed fee cuts despite the fact that inflation is larger than its goal. There are additionally two extra cuts predicted this 12 months.

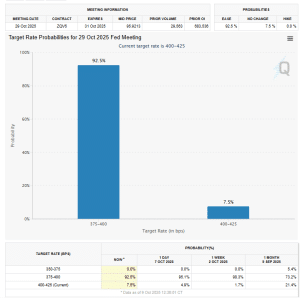

In keeping with knowledge from the CME Futures markets, analysts see a 92.5% probability of an October lower and 80% odds that there will probably be one other one in December.

Odds of an October fee lower (Supply: CME FedWatch instrument)

Hayes went on to foretell that this cycle gained’t be influenced by China as a lot as previous situations as a result of policymakers are shifting to “finish deflation” as a substitute of continuous to empty liquidity from the market.

That shift removes a significant impediment that will have introduced an finish to this cycle’s Bitcoin rally, in accordance with Hayes.

There Are Nonetheless Analysts That Imagine The 4-12 months Cycle Is Alive

Whereas Hayes says the four-year cycle is lifeless, different analysts consider Bitcoin worth actions stay cyclical.

Glassnode, an on-chain analytics and intelligence platform, stated in August that Bitcoin’s worth motion nonetheless echoes prior patterns.

Relative to prior cycles, #Bitcoin’s all-time highs in 2017 and 2021 had been reached simply 2–3 months forward of at the moment’s level within the cycle. Whereas historical past is a restricted information, it’s a noteworthy context given current profit-taking and elevated speculative exercise. pic.twitter.com/HvgM7RFHwq

— glassnode (@glassnode) August 25, 2025

In the meantime, Gemini’s head of APAC area, Saad Ahmed, stated earlier this month that the market will possible proceed to see “some type of a cycle.”

Not too long ago, famend dealer and analyst Peter Brandt stated that Bitcoin’s excessive may come “any day now” if the four-year cycle is certainly nonetheless alive.

“These cycles from low-to-halving-to-high haven’t at all times been the identical size, however the post-halving distance of every has at all times been equal to the pre-halving distance,” stated Brandt.

The analyst defined that Bitcoin hit its low for the present cycle on Nov. 9, 2022. This was 533 days earlier than the Bitcoin halving in April 2024.

“Add 533 days to April 20, 2024, and bingo, it’s this week,” he stated. The precise date was this previous Sunday, which was at some point earlier than Bitcoin set a brand new all-time excessive (ATH).

Associated Articles:

Finest Pockets – Diversify Your Crypto Portfolio

- Simple to Use, Characteristic-Pushed Crypto Pockets

- Get Early Entry to Upcoming Token ICOs

- Multi-Chain, Multi-Pockets, Non-Custodial

- Now On App Retailer, Google Play

- Stake To Earn Native Token $BEST

- 250,000+ Month-to-month Lively Customers

Be part of Our Telegram channel to remain updated on breaking information protection