Picture supply: Getty Photos

Are you nervous about the way forward for the State Pension and your way of life in retirement? If that’s the case, you’re not alone. The concern of not having sufficient cash in a while is driving me, like hundreds of thousands of different traders, to lean closely into share investing.

My view is that everybody ought to contemplate taking motion to safeguard their monetary well being for in a while. Right here’s why.

Pension stress

Britain’s advantages system is underneath stain because the nation struggles with its huge and rising public debt. With the nation’s aged inhabitants rising sharply too, the way forward for the State Pension is more and more unsure.

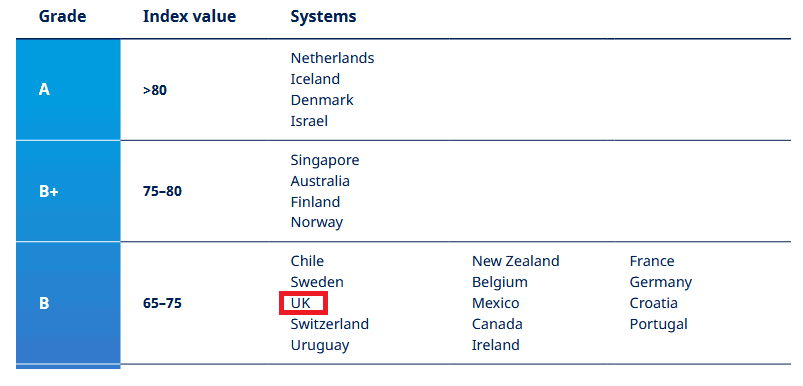

Analysis from consultancy Mercer underlines the stress of those challenges. Its newest World Pension Index confirmed the State Pension rating decline to 71.6 out of 100. That is down from 73 final 12 months.

The State Pension declined on all three classes that make up its rating: Adequacy, Sustainability and Integrity).

I’m not suggesting now’s the time for panic. Mercer additionally says the UK’s ‘B’ ranking signifies “a system that has a sound construction, with many good options however has some areas for enchancment“.

Nevertheless, a declining rating within the UK counsel Britons have to take motion to guard their future. In my view, investing in world shares is a wonderful technique to contemplate given the long-term efficiency of the inventory market.

A FTSE 100 portfolio

Shopping for and holding FTSE 100 shares is a technique I’ve sought to focus on long-term wealth. These blue-chip shares are famed for his or her capability to pay a dependable and wholesome passive earnings, which will be compounded by means of reinvestment to create long-term wealth.

The Footsie additionally options a big number of high-performing development shares, offering traders the chance to realize substantial capital positive factors.

Take Scottish Mortgage Funding Belief (LSE:SMT). This tech-focused funding belief has successfully capitalised on the digital revolution of the twenty first century, delivering a median 10% annual share worth achieve since 2000

There have been some bumps alongside the way in which, and it’s prone to expertise future turbulence in step with financial volatility. However I’m assured it could actually proceed delivering long-term highly effective outcomes, with development over the subsequent decade pushed by phenomena like synthetic intelligence (AI), robotics and quantum computing.

I like how Scottish Mortgage’s portfolio blends main listed tech shares like Nvidia — the world’s Most worthy firm — with smaller (generally personal) companies. This implies traders get pleasure from publicity to sturdy, market-leading firms alongside smaller gamers which have higher development potential.

Investing £500 a month

I believe a powerful seven-stock portfolio for retirement earnings might comprise Scottish Mortgage, Video games Workshop and BAE Programs for development, and HSBC, Unilever, Nationwide Grid and Authorized & Normal for dividends.

In whole, this mini-portfolio to contemplate gives publicity to 107 totally different UK and worldwide shares, spreading threat and offering publicity to a myriad of funding alternatives. I believe a 9% common return is a sensible goal which might assist safeguard retirees from an inadequate State Pension.

Attaining this high-single-digit return would flip a £500 month-to-month funding into greater than £560,000 over 25 years.