Be a part of Our Telegram channel to remain updated on breaking information protection

The Ethereum value fell a fraction of a % within the final 24 hours to commerce at $3,858.54 as of 4 a.m. EST on a 36% enhance in buying and selling quantity to $49.69 billion.

That got here amid controversy inside the ETH ecosystem because the Ethereum Basis moved over $654 million value of ETH right into a pockets sometimes used for large-scale gross sales, sparking considerations of a dump that might affect the market.

THE ETHEREUM FOUNDATION JUST TRANSFERRED $650M $ETH

The Ethereum Basis simply transferred $654M of ETH to a pockets used for promoting prior to now.

This pockets has solely made important transfers to:

Kraken Deposit

SharpLink Gaming

A Multisig that sells ETH pic.twitter.com/hqdQINzx0P— Arkham (@arkham) October 21, 2025

The sudden switch was considerably bigger than prior basis strikes and comes at a time when buyers are already anxious

A a lot smaller ETH sale final month barely moved the market, however this time merchants are bracing for a possible larger affect. The concern is that if a whole lot of ETH is offered shortly, the worth may break by way of main assist ranges, encouraging extra promoting and inflicting losses in different cash linked to Ethereum’s efficiency.

The newest actions have additionally reignited discussions about the way forward for Ethereum’s management and who controls main selections.

Ethereum Value: On-Chain Indicators Present Crimson Flags

On-chain information for ETH in October factors to decrease confidence amongst large holders and whales. Key holders within the 1,000–10,000 ETH bracket trimmed their positions by 8.38% this week. These with 10,000–100,000 ETH did add a bit extra, however general, whales appear to be cautious.

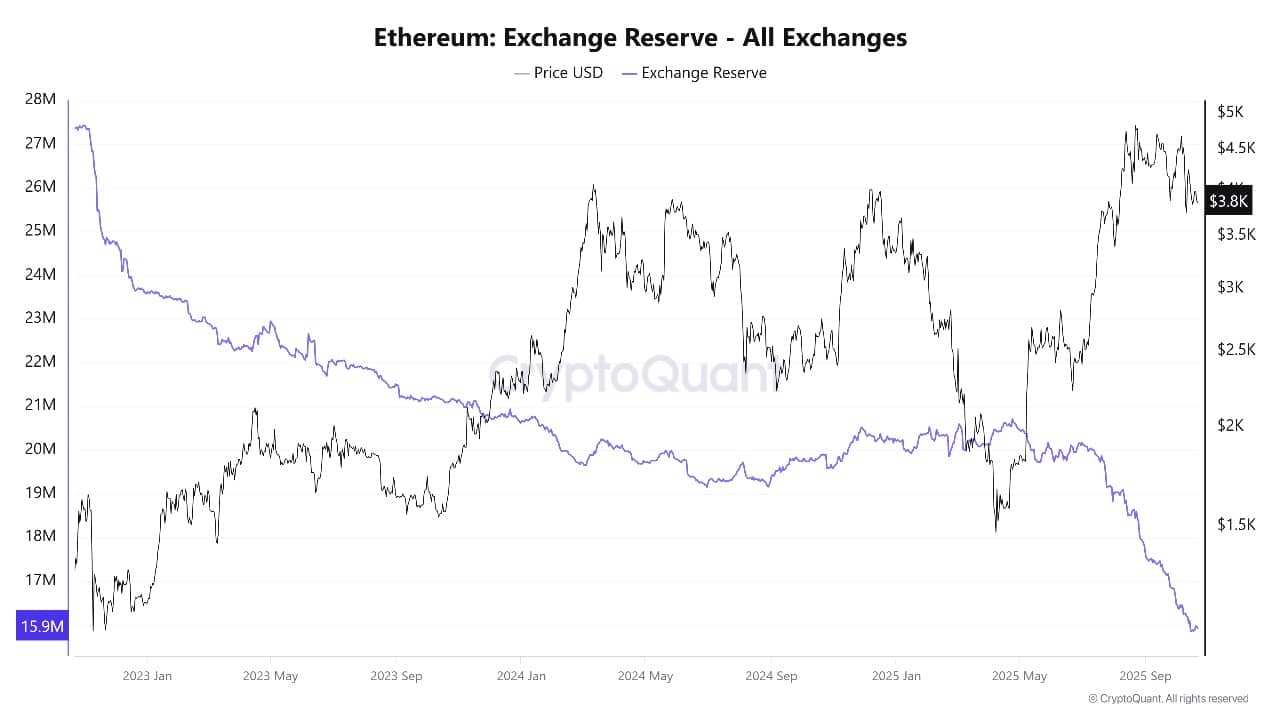

Alternate reserves dropped by greater than 2%, signalling that holders are transferring cash off exchanges, maybe to keep away from panic promoting or to carry for the long run.

ETH Alternate Reserve Supply: CyptoQuant

ETH staking inflows additionally fell off a cliff, with new staked cash dropping by over 95% in comparison with final week. This reveals fewer buyers are locking up cash for additional rewards, an indication that religion in short-term value progress is weak.

Regardless that the community noticed a bounce in day by day transactions and extra cash moved between wallets, most exercise regarded sell-driven moderately than new shopping for.

Liquidations have been excessive, with over $1.77 billion in lengthy positions and $824 million in shorts worn out after the Basis’s announcement. This reveals merchants bought spooked and rushed to shut positions earlier than ETH may fall any additional.

Ethereum Value Prediction

Based mostly on the weekly chart, the ETH value is now at $3,861, seeing a drop this session after failing to carry earlier highs near $4,957. The value misplaced steam after a steep rally, and now patrons are defending the 50-week SMA round $3,123.

If ETH falls additional, the 200-week SMA at $2,446 is the following large assist the place dip-buyers would seemingly step in.

Resistance sits up close to $4,937, simply above the final swing excessive earlier than the sell-off began. The market is now beneath this level and struggling close to earlier assist zones.

ETHUSD Evaluation Supply: Tradingview

The RSI is at 53.21, barely above the midpoint, which reveals there is no such thing as a robust shopping for vitality, but in addition no deep oversold stage simply but. The MACD has turned bearish, with the MACD line crossing beneath the sign line and transferring into destructive territory. This alerts that sellers have taken management for now.

ETH has began to kind decrease highs, which is an indication that the rally is cooling off and patrons are shedding grip. So long as the worth stays above the $3,123 assist, there’s an opportunity of a rebound in the direction of $4,000 within the coming weeks.

If the worth dips beneath the 200-week SMA at $2,446, Ethereum may retest decrease ranges close to $883, the place earlier patrons appeared.

A bullish reversal is feasible if optimistic updates arrive or if main patrons present up at key assist zones.

For now, the ETH value is caught in a fragile spot, with downward strain coming from market uncertainty and Ethereum Basis-driven concern.

Associated Articles:

Greatest Pockets – Diversify Your Crypto Portfolio

- Straightforward to Use, Function-Pushed Crypto Pockets

- Get Early Entry to Upcoming Token ICOs

- Multi-Chain, Multi-Pockets, Non-Custodial

- Now On App Retailer, Google Play

- Stake To Earn Native Token $BEST

- 250,000+ Month-to-month Lively Customers

Be a part of Our Telegram channel to remain updated on breaking information protection