Synopsis: These shares with RSI beneath 30 point out weak short-term momentum, typically reflecting latest value declines or market pessimism. For affected person buyers, such shares would possibly current a shopping for alternative.

The Relative Power Index (RSI) is a well-liked technical indicator utilized by merchants to measure a inventory’s momentum. It helps determine whether or not a inventory is overbought or oversold. An RSI worth beneath 30 sometimes means that the inventory has been offered closely and could also be oversold, which means it may very well be undervalued or nearing a possible rebound if market situations enhance.

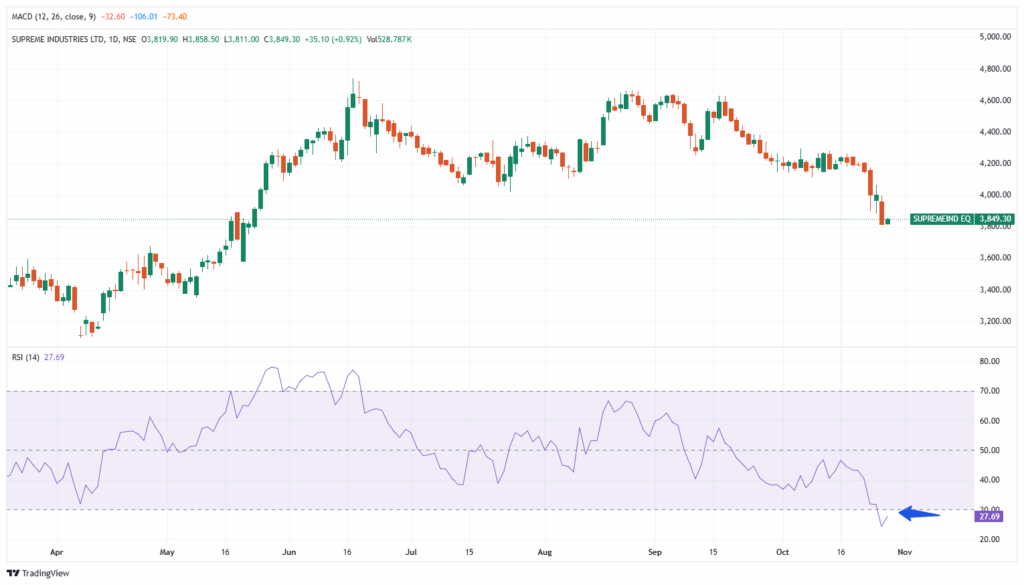

Supreme Industries Ltd is considered one of India’s largest plastic processing firms, manufacturing a variety of plastic merchandise together with pipes, packaging, client items, and industrial elements. With sturdy model recognition and a pan-India distribution community, the corporate serves building, agriculture, and industrial sectors. Its constant innovation, diversified product portfolio, and give attention to value-added merchandise have helped it preserve management within the home plastic trade.

With market capitalization of Rs. 48,818 cr, the shares of Supreme Industries Ltd are closed at Rs. 3,849.30 per share, from its earlier shut of Rs. 3,814.20 per share. With an RSI of 27.69, the inventory is at the moment in oversold territory and will draw investor curiosity for a possible rebound if shopping for momentum picks up.

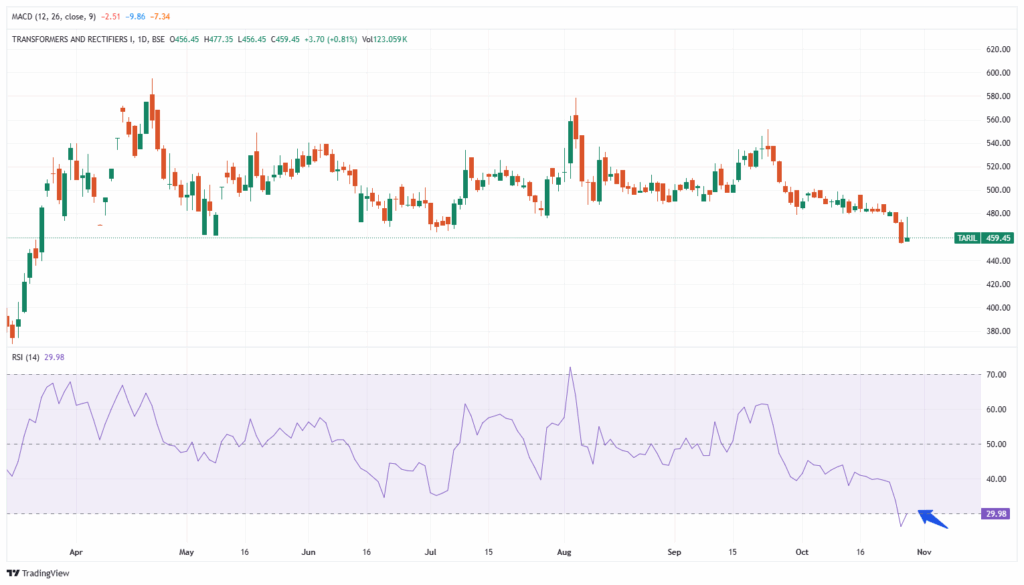

Transformers and Rectifiers (India) Ltd is a key participant within the energy tools trade, specializing within the design, manufacture, and provide of transformers for utilities, industrial, and infrastructure functions. The corporate produces a variety of transformers together with energy, distribution, furnace, and rectifier varieties. With rising demand from renewable vitality and transmission initiatives, it continues to profit from India’s growing energy sector investments.

With market capitalization of Rs. 13,791 cr, the shares of Transformers and Rectifiers (India) Ltd are closed at Rs. 459.45 per share, from its earlier shut of Rs. 455.75 per share. With an RSI of 29.98, the inventory is at the moment in oversold territory and will draw investor curiosity for a possible rebound if shopping for momentum picks up.

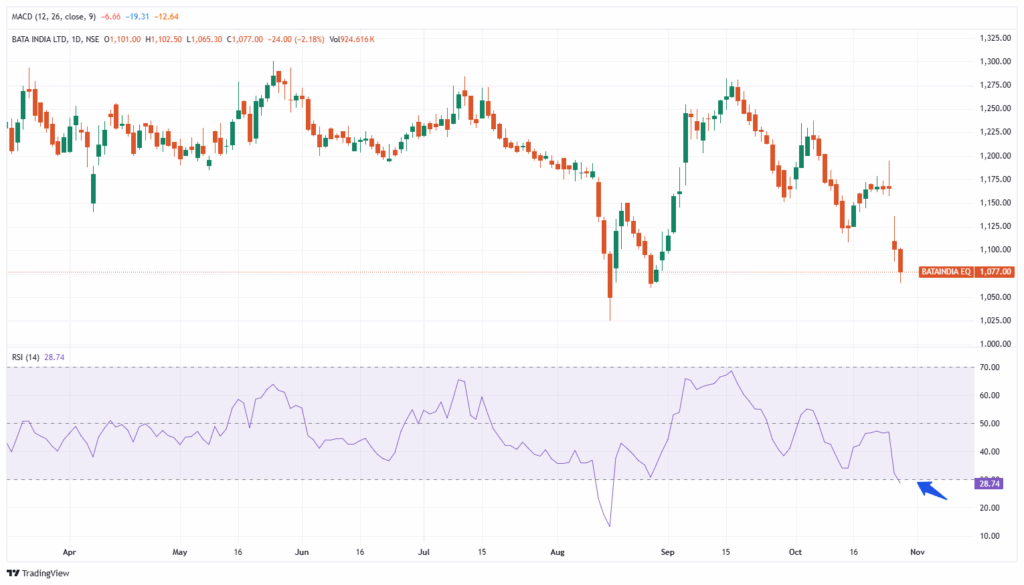

Bata India Ltd is likely one of the nation’s main footwear producers and retailers, identified for its big selection of trendy and reasonably priced sneakers throughout formal, informal, and sports activities classes. With an unlimited retail presence and powerful model legacy, Bata caters to each city and semi-urban markets. The corporate has been specializing in premiumization, digital gross sales channels, and youth-oriented product traces to drive progress amid rising competitors within the footwear section.

With market capitalization of Rs. 13,847 cr, the shares of Bata India Ltd are closed at Rs. 1,077 per share, from its earlier shut of Rs. 1,101 per share. With an RSI of 28.74, the inventory is at the moment in oversold territory and will draw investor curiosity for a possible rebound if shopping for momentum picks up.

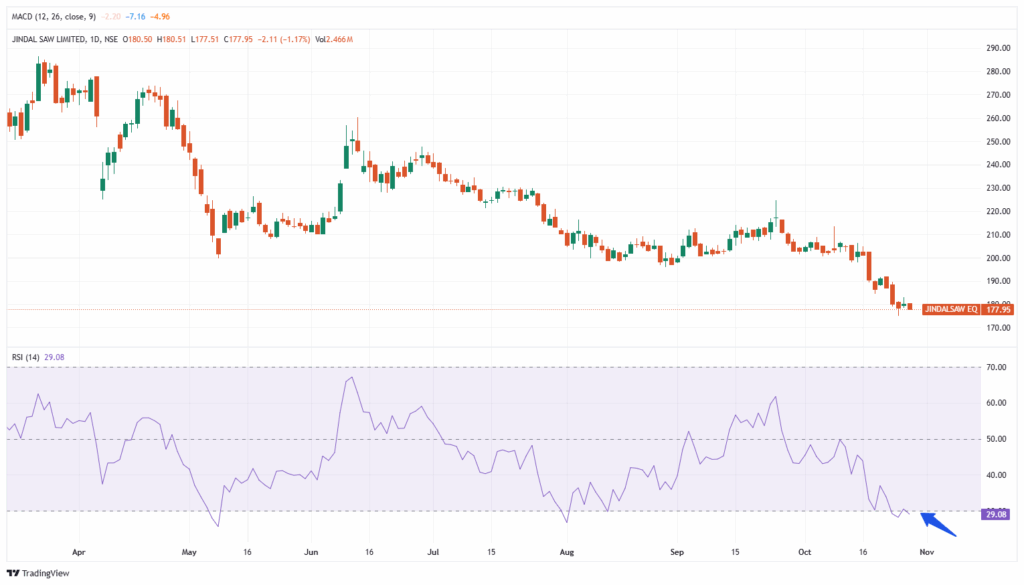

Jindal Noticed Ltd is a number one producer of metal pipes and tubes, supplying merchandise used within the vitality, water, and infrastructure sectors. The corporate produces a various vary, together with massive diameter submerged arc welded (SAW) pipes, ductile iron pipes, and seamless tubes. With a powerful export presence and participation in main pipeline and water distribution initiatives, Jindal Noticed performs an important function in India’s infrastructure and industrial improvement.

With market capitalization of Rs. 11,383 cr, the shares of Jindal Noticed Ltd are closed at Rs. 178 per share, from its earlier shut of Rs. 179.90 per share. With an RSI of 29.34, the inventory is at the moment in oversold territory and will draw investor curiosity for a possible rebound if shopping for momentum picks up.

Written by Manideep Appana

Disclaimer

The views and funding suggestions expressed by funding consultants/broking homes/ranking businesses on tradebrains.in are their very own, and never that of the web site or its administration. Investing in equities poses a danger of monetary losses. Buyers should due to this fact train due warning whereas investing or buying and selling in shares. Commerce Brains Applied sciences Personal Restricted or the creator aren’t accountable for any losses brought on because of the choice primarily based on this text. Please seek the advice of your funding advisor earlier than investing.