On Wednesday, Indian fairness markets noticed a optimistic session, with main indices opening increased and sustaining upward momentum all through the day. Each the Nifty 50 and BSE Sensex traded above key technical assist ranges, reflecting sturdy investor confidence. Broad market sentiment was bolstered by optimism surrounding a possible commerce settlement between India and america, in addition to cautious anticipation forward of the U.S. Federal Reserve’s coverage announcement. Technical indicators instructed that the markets had been in an overbought zone, highlighting sturdy shopping for curiosity.

Sectoral efficiency was blended, with vitality and oil & fuel segments main the positive aspects, pushed by main company developments and strategic partnerships within the sector. In distinction, the auto sector confronted promoting strain, leading to a modest decline. Asian markets largely mirrored the optimistic pattern seen in India, with choose indices posting stable positive aspects, whereas U.S. futures indicated the next opening, suggesting a continued optimistic bias in international markets.

On this overview, we are going to analyse the important thing technical ranges and pattern instructions for Nifty and BSE Sensex to observe within the upcoming buying and selling classes. All of the charts talked about beneath are based mostly on the 5-minute timeframe.

Nifty 50

(On this evaluation, we now have used 20/50/100/200 EMAs, the place 20 EMA (Crimson), 50 EMA (Orange), 100 EMA (Gentle Blue), and 200 EMA (Darkish Blue)).

To view different technical reviews, click on right here

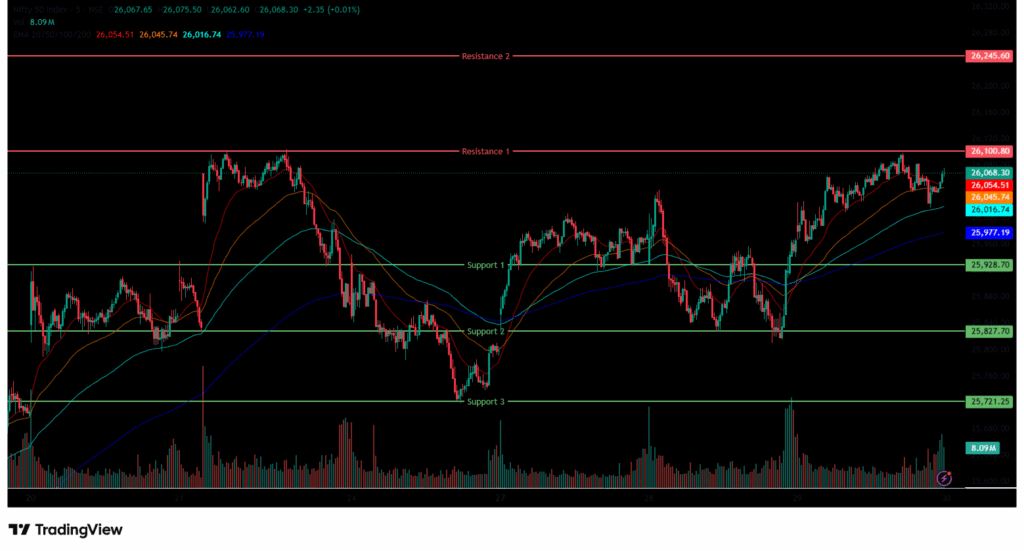

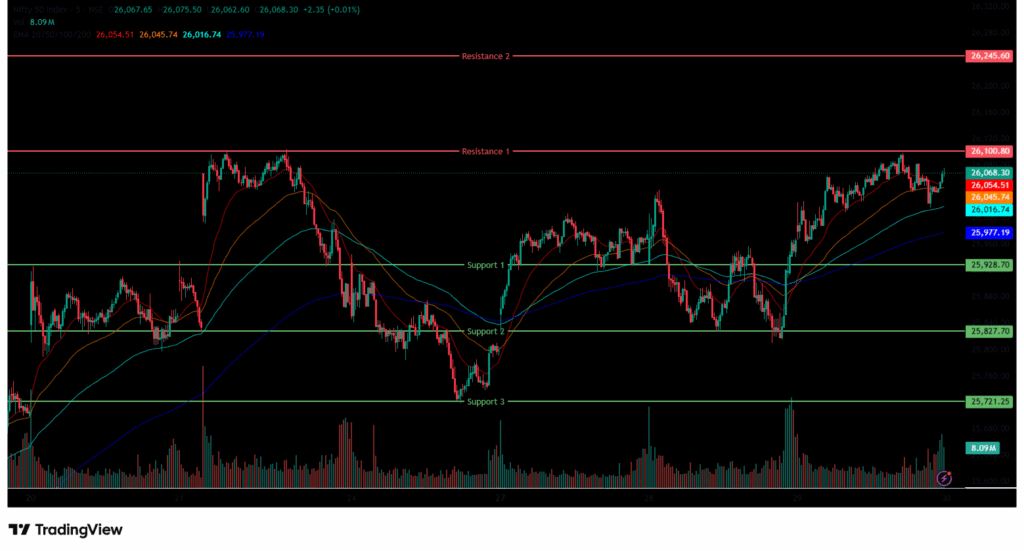

The Nifty 50 Index opened on a optimistic observe at 25,982.00 on Wednesday, up by 45.8 factors from Tuesday’s closing of 25,936.20. The index opened on a bullish observe and surged above the 26,000 stage within the morning session. Through the morning session, the index traded inside the 25,950-26,100 vary, staying above all 4 EMAs (20/50/100/200) on the 15-minute chart.

Within the afternoon, the index continued its optimistic momentum and surged as excessive as 26,098, marking its day excessive. General, the Index traded inside a 26,000-26,100 vary all through the session. Through the afternoon session, the Nifty 50 closed above all 4 EMAs of 20/50/100/200 within the 15-minute time-frame. The Nifty’s instant resistance ranges are R1 (26,101) and R2 (26,246), whereas instant assist ranges are S1 (25,929), S2 (25,828) and S3 (25,721).

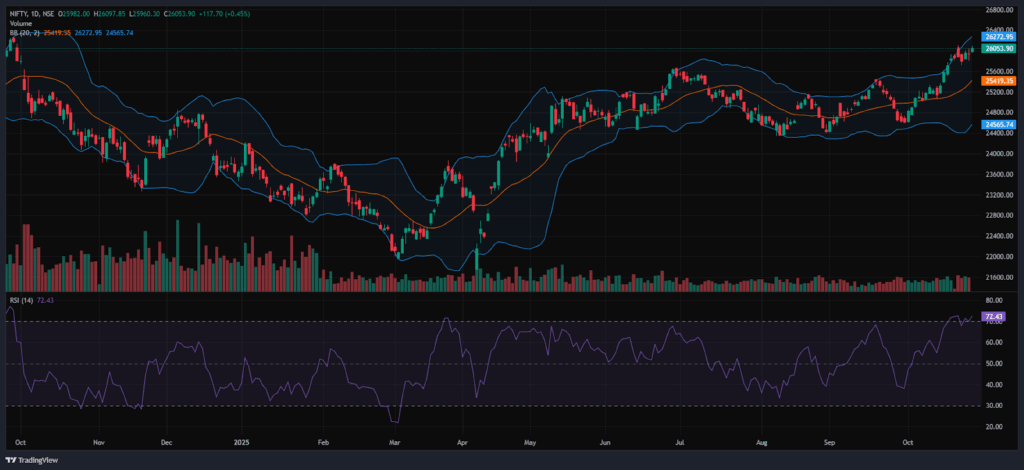

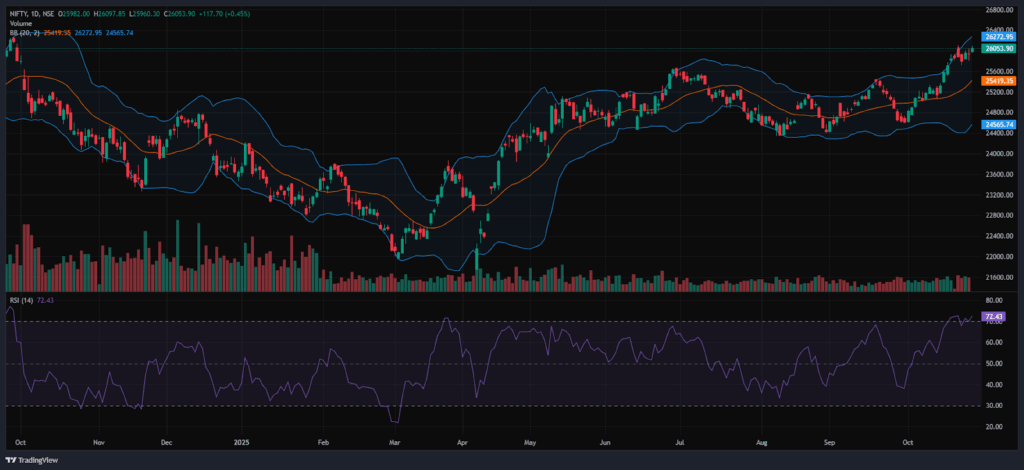

The Nifty index had reached a day’s excessive at 26,097.85 and noticed a day’s low at 25,960.30. Lastly, it had closed at 26,053.90, within the inexperienced above the 26,050 stage, gaining 117.7 factors, or 0.45%. The Nifty 50 closed above all 4 EMAs of 20/50/100/200 within the each day time-frame.

Momentum Indicators

RSI (Each day): The Nifty 50’s RSI stood at 72.43, which is above the overbought zone of 70, indicating potential for a reversal.

Bollinger Bands (Each day): The index is buying and selling within the higher band of the Bollinger Band vary above the center band (Easy Transferring Common). Its place within the higher vary signifies a bullish sentiment, and the Index fashioned a bullish candle within the each day time-frame after an indecision candle fashioned within the earlier session and took assist close to 25,960 and 26,098 acted as a resistance stage. A sustained transfer above the center band indicators a bullish sentiment, whereas a drop again towards the decrease band might reinforce bearish sentiment.

Quantity Evaluation: Wednesday’s buying and selling session had an above-average quantity of 321.88 Mn.

Derivatives Knowledge: Choices OI signifies sturdy Put writing at 26,000, adopted by 25,900, establishing it as a agency assist zone. On the upside, a big Name OI buildup at 26,100 and 26,200 suggests a possible resistance provide. PCR (Put/Name Ratio) stands at 1.06 (>=1), leaning in the direction of impartial sentiment, and the Lengthy Buildup signifies a Robust Bullish outlook, with an total impartial to bullish outlook for the subsequent buying and selling session.

Financial institution Nifty

(On this evaluation, we now have used 20/50/100/200 EMAs, the place 20 EMA (Crimson), 50 EMA (Orange), 100 EMA (Gentle Blue), and 200 EMA (Darkish Blue)).

The Financial institution Nifty Index began the session on a optimistic observe at 58,316.25 on Wednesday, up by 102.15 factors from Tuesday’s closing of 58,214.10. The index began on a Bullish observe, however dragged right down to the 58,087 stage, marking its day low and was buying and selling within the vary of 58,050-58,400. As well as, the index was buying and selling above all 4 EMAs of 20/50/100/200 within the 15-minute time-frame within the morning session.

Within the afternoon session, the Index continued its momentum and surged as excessive as 58,470 marking its day excessive. Additional, the Index was buying and selling within the vary of 58,250-58,500, resulted in inexperienced. Through the afternoon session, Financial institution Nifty closed above all 4 EMAs of 20/50/100/200 within the 15-minute time-frame. The Financial institution Nifty’s instant resistance ranges are R1 (58,438) and R2 (58,582), whereas instant assist ranges are S1 (57,939), S2 (57,676), and S3 (57,350).

The Financial institution Nifty index had peaked at 58,469.90 and made a day’s low at 58,087.05. Lastly, it had closed in inexperienced at 58,385.25, closing above the 58,350 stage, gaining 171.15 factors or 0.29%. The Relative Energy Index (RSI) stood at 74.19, above the overbought zone of 70 within the each day time-frame, and Financial institution Nifty closed above all 4 EMAs of 20/50/100/200 within the each day time-frame.

Sensex

(On this evaluation, we now have used 20/50/100/200 EMAs, the place 20 EMA (Crimson), 50 EMA (Orange), 100 EMA (Gentle Blue), and 200 EMA (Darkish Blue)).

To view different technical reviews, click on right here

The BSE Sensex Index additionally opened on a optimistic observe at 84,663.68 on Wednesday, up by 35.52 factors from Tuesday’s closing of 84,628.16. The index began its session on a bullish observe and surged above the 85,000 mark. The Index was buying and selling inside the 84,600-85,050 vary and was buying and selling above the EMAs of 20/50/100/200 within the 15-minute time-frame within the morning session.

Within the afternoon session, the Index continued its bullish momentum and surged as excessive as 85,105, marking its day excessive. The Index was buying and selling within the 84,850-85,150 vary, sustaining its total bullish pattern and closed above all 4 EMAs of 20/50/100/200 within the 15-minute time-frame. The BSE Sensex instant resistance ranges are R1 (85,109) and R2 (85,283), whereas instant assist ranges are S1 (84,611), S2 (84,241), and S3 (83,956).

The BSE Sensex index had peaked at 85,105.83 and made a day’s low at 84,638.68. Lastly, it had closed at 84,997.13 in inexperienced, gaining 368.98 factors or 0.44%. The Relative Energy Index (RSI) stood at 71.48, above the overbought zone of 70 within the each day time-frame, and the BSE Sensex closed above all 4 EMAs of 20/50/100/200 within the each day time-frame.

India VIX

The India VIX elevated by 0.02 factors or 0.17%, from 11.95 to 11.97 throughout Wednesday’s session. A rise within the India VIX usually signifies increased worth volatility within the inventory market, suggesting a much less secure market setting. Nevertheless, a secure market setting and minimal volatility are anticipated when the India VIX is beneath 15.

Market Recap – twenty ninth October 2025

On Wednesday, the Nifty 50 opened barely increased at 25,939.95, up 21.7 factors from its earlier shut of 25,936.2. The index hit an intraday excessive of 26,097.85, rising above the 26,000 stage, closing at 26,053.9, up 117.7 factors, or 0.45%. The index remained above all key transferring averages (20/50/100/200-day EMAs) on the each day chart, indicating some technical assist.

The BSE Sensex mirrored the Nifty’s pattern, opening at 84,663.68, up 35.52 factors from the earlier shut of 84,628.16. It adopted an identical sample, closing at 84,997.13, a acquire of 368.98 factors, or 0.44%. Each indices confirmed excessive momentum, with RSI values for Nifty 50 at 72.43 and Sensex at 71.48, crossing the overbought threshold of 70. Investor sentiment stayed upbeat forward of the US Federal Reserve’s coverage announcement later tonight, supported by optimism over a potential commerce settlement between India and america.

Nearly all of indices remained optimistic on Wednesday. The Nifty Oil & Fuel index was the most important gainer, rising 2.1% or 249.35 factors, and standing at 11,995.95. The explanation for the index acquire was that Oil India and BPCL entered right into a collaborative framework for constructing the Rs 1 Lakh crore Built-in Ramayapatnam Greenfield Refinery & Petrochemical, the primary in South India.

Shares equivalent to Indian Oil Company Ltd jumped 5.6% on Wednesday. Whereas different oil & fuel shares like Hindustan Petroleum Ltd, GAIL India Ltd, and Bharat Petroleum additionally gained as much as 3.7%. The Nifty Power was additionally among the many main gainers, rising 1.9% or 689.8 factors, and standing at 36,347.95. Shares equivalent to Adani Inexperienced Power Ltd rose 10.8%, adopted by Reliance Energy and Indian Oil Company, which gained as much as 6% on Wednesday.

The Nifty Auto Index was the most important and solely loser on Wednesday, falling -0.73%, or -199.45 factors, to 26,948.90. Auto Shares like Bosch Ltd, TVS Motor Firm Ltd, Mahindra & Mahindra Ltd, and Maruti Suzuki India Ltd noticed declines of as much as -3.01%.

Asian markets had been broadly optimistic on Wednesday. Japan’s Nikkei 225 elevated by 1,110.82 factors or 2.16%, closing at 51,330. Whereas China’s Shanghai Composite additionally rose by 28.11 factors, or 0.70%, to 4,016.33. Conversely, Singapore’s Straits Occasions Index declined by 10.15 factors or 0.23%, ending at 4,440.21, however South Korea’s KOSPI elevated by 70.74 factors or 1.73%, closing at 4,081.15. At 4:44 p.m. IST, U.S. Dow Jones Futures had been increased, up 0.21%, at 47,806.20, gaining 99.83 factors.

Commerce Setup Abstract

The Nifty 50 opened on a optimistic observe at 25,982.00 on Wednesday and ended the session within the inexperienced above the 26,050 stage at 26,053.90. A break beneath 25,929 may set off additional promoting in the direction of 25,828, whereas breaking the subsequent resistance stage of 26,101 may set off bullishness in the direction of the 26,246 stage.

Financial institution Nifty additionally began the session on a optimistic observe at 58,316.25 and ended the session within the inexperienced at 58,385.25, above the 58,350 stage. A break beneath 57,939 may set off additional promoting in the direction of 57,676, whereas breaking the subsequent resistance stage of 58,438 may set off bullishness in the direction of the 58,582 stage.

Sensex additionally opened on a optimistic observe at 84,663.68 and ended the session within the inexperienced at 84,997.13, beneath the 84,950 stage. A break beneath 84,611 may set off additional promoting in the direction of 84,241, whereas breaking the subsequent resistance stage of 85,109 may set off bullishness in the direction of the 85,283 stage.

Given the continued volatility and blended sentiments, it’s advisable to keep away from aggressive positions and look ahead to clear directional strikes above resistance or beneath assist. Merchants ought to take into account these key assist and resistance ranges when coming into lengthy or quick positions following the value break from these crucial ranges. Moreover, merchants can mix transferring averages to determine extra correct entry and exit factors.

Disclaimer

The views and funding suggestions expressed by funding specialists/broking homes/score businesses on tradebrains.in are their very own, and never that of the web site or its administration. Investing in equities poses a threat of monetary losses. Traders should due to this fact train due warning whereas investing or buying and selling in shares. Commerce Brains Applied sciences Non-public Restricted or the writer are usually not responsible for any losses triggered because of the choice based mostly on this text. Please seek the advice of your funding advisor earlier than investing.

About: Commerce Brains Portal is a inventory evaluation platform. Its commerce identify is Dailyraven Applied sciences Non-public Restricted, and its SEBI-registered analysis analyst registration quantity is INH000015729.

Investments in securities are topic to market dangers. Learn all of the associated paperwork fastidiously earlier than investing.

Registration granted by SEBI and certification from NISM under no circumstances assure efficiency of the middleman or present any assurance of returns to traders.

90’lar modas?n? hat?rlayanlar burada m?? Sizlere gecmisin moda ikonu olan donemden ilhamla ipuclar? sundugumuz bu yaz?ya davetlisiniz.

Зацепил раздел про Guzellik ve Kozmetik: 90’lar Modas?ndan Ipuclar?.

Ссылка ниже:

[url=https://aynakirildi.com]https://aynakirildi.com[/url]

Guzellik, gecmisle gunumuz aras?nda bir kopru kurmakt?r. 90’lar?n moda s?rlar?, bu koprunun onemli parcalar?ndan.