Home fairness markets ended the week on a subdued notice, extending losses for the second straight session as traders booked income amidst cautious world sentiment. Each benchmark indices opened marginally decrease and moved inside a slender vary earlier than closing within the crimson, reflecting a consolidation section after latest good points. Regardless of the decline, key indices remained above their main shifting averages, suggesting underlying technical assist and resilience within the broader development.

Sectoral efficiency was blended, with most indices closing decrease whereas choose pockets like PSU banks and defence shares outperformed. Positive factors in these segments had been supported by regulatory developments and renewed shopping for curiosity. Then again, media, metallic, companies, and healthcare shares dragged the markets decrease. Globally, Asian markets confirmed a blended development as traders reacted to developments in U.S.-China commerce relations and financial coverage cues. Total, sentiment remained cautious amid considerations over international capital outflows and uncertainty about future U.S. price selections.

On this overview, we’ll analyse the important thing technical ranges and development instructions for Nifty and BSE Sensex to watch within the upcoming buying and selling classes. All of the charts talked about under are based mostly on the 5-minute timeframe.

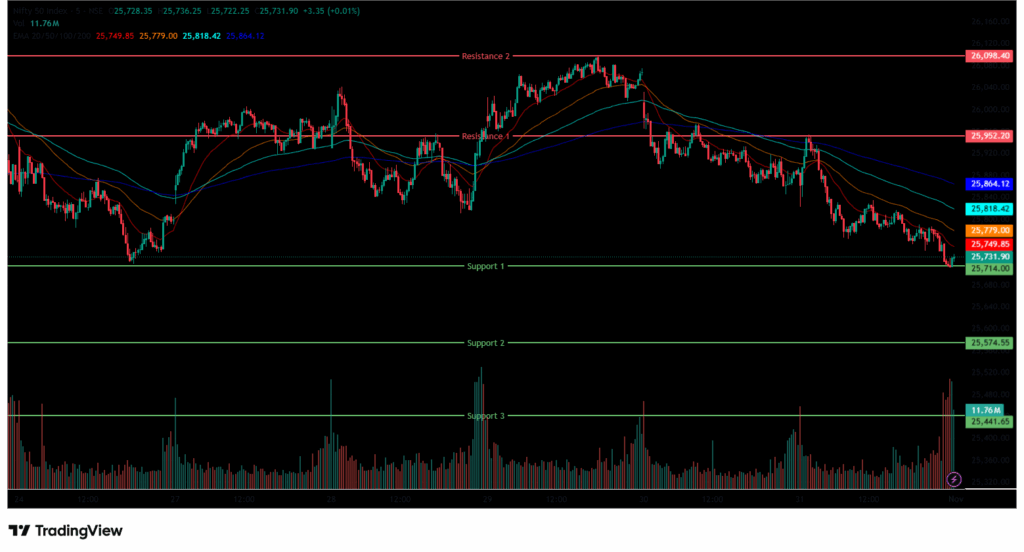

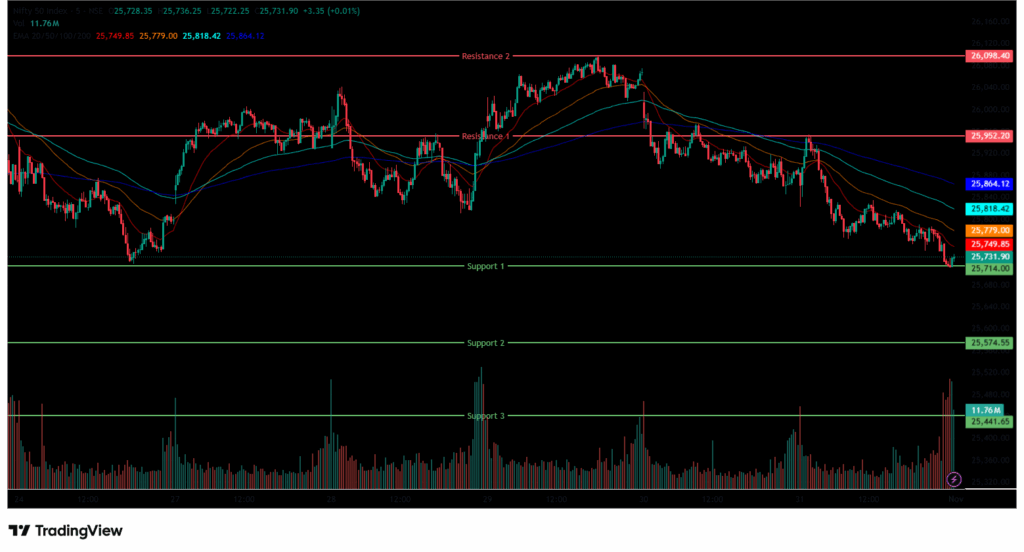

Nifty 50

(On this evaluation, now we have used 20/50/100/200 EMAs, the place 20 EMA (Crimson), 50 EMA (Orange), 100 EMA (Mild Blue), and 200 EMA (Darkish Blue)).

To view different technical experiences, click on right here

The Nifty 50 Index opened on a destructive notice at 25,863.80 on Friday, down by 14.05 factors from Thursday’s closing of 25,877.85. The index opened on a bearish notice; nonetheless, the Index made its day at 25,954 and was dragged down under the 25,800 degree within the morning session. Throughout the morning session, the index traded inside the 25,750-26,000 vary and traded under all 4 EMAs of 20/50/100/200 within the 15-minute chart.

Within the afternoon, the index continued its downward momentum and fell as little as 25,711, marking its day low. Total, the Index traded inside a 25,700-25,850 vary all through the session. Throughout the afternoon session, the Nifty 50 closed under all 4 EMAs of 20/50/100/200 within the 15-minute timeframe. The Nifty’s fast resistance ranges are R1 (25,952) and R2 (26,098), whereas fast assist ranges are S1 (25,714), S2 (25,575) and S3 (25,442).

The Nifty index had reached a day’s excessive at 25,953.75 and noticed a day’s low at 25,711.20. Lastly, it had closed at 25,722.10, within the crimson under the 25,750 degree, shedding 155.75 factors, or 0.60%. The Nifty 50 closed above all 4 EMAs of 20/50/100/200 within the day by day timeframe.

Momentum Indicators

RSI (Day by day): The Nifty 50’s RSI stood at 57.84, which is under the overbought zone of 70, indicating a bullish sentiment.

Bollinger Bands (Day by day): The index is buying and selling within the higher band of the Bollinger Band vary above the center band (Easy Shifting Common). Its place within the higher vary signifies a bullish sentiment, however the Index fashioned a powerful bearish candle within the day by day timeframe and took assist close to 25,711 and 25,954 acted as a resistance degree. A sustained transfer above the center band alerts a bullish sentiment, whereas a drop again towards the decrease band might reinforce bearish sentiment.

Quantity Evaluation: Friday’s buying and selling session had an above-average quantity of 334.38 Mn.

Derivatives Information: Choices OI signifies sturdy Put writing at 25,700, adopted by 25,600, establishing it as a agency assist zone. On the upside, a big Name OI buildup at 25,800 and 25,900 suggests a possible resistance provide. PCR (Put/Name Ratio) stands at 0.5 (<1), leaning in the direction of bullish sentiment, and the Lengthy Buildup signifies a Robust Bullish outlook, with an total bullish outlook for the following buying and selling session.

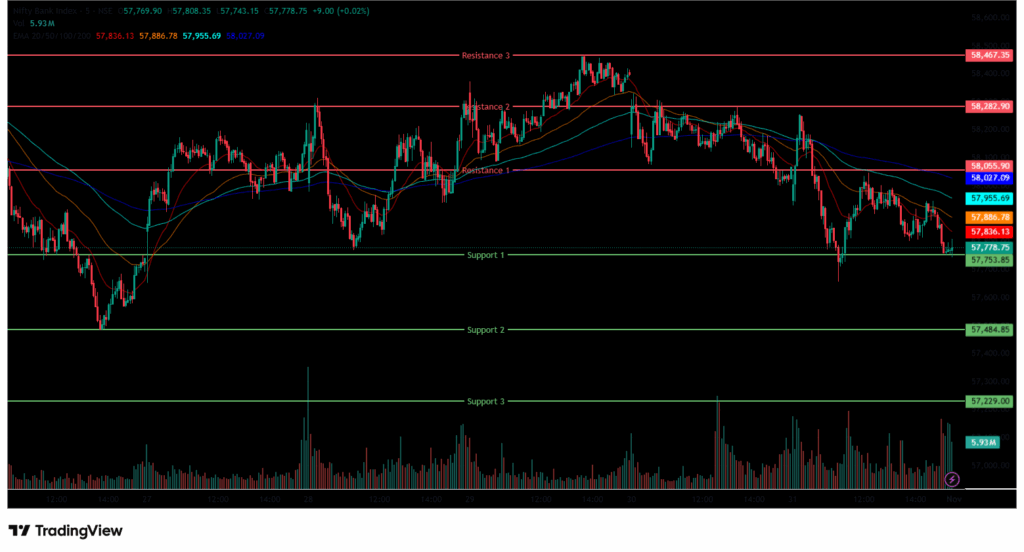

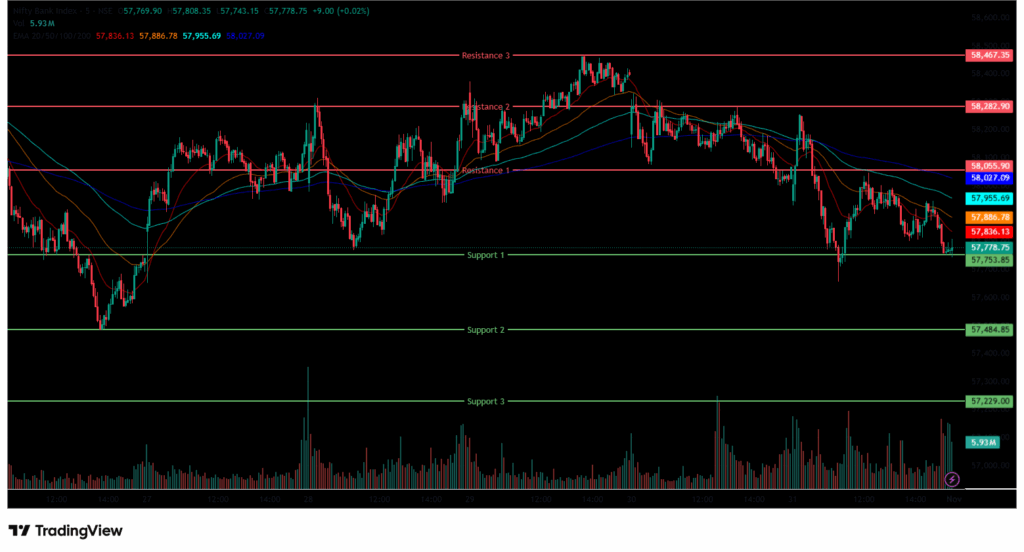

Financial institution Nifty

(On this evaluation, now we have used 20/50/100/200 EMAs, the place 20 EMA (Crimson), 50 EMA (Orange), 100 EMA (Mild Blue), and 200 EMA (Darkish Blue)).

The Financial institution Nifty Index began the session on a destructive notice at 57,942.45 on Friday, down by 88.65 factors from Thursday’s closing of 58,031.10. The index began on a Bearish notice, however made its day excessive at 58,255 and made its day low on the 57,657 degree within the morning session and was buying and selling within the vary of 57,650-58,300. As well as, the index was buying and selling above the EMA of 200 and under the 20/50/100 EMAs within the 15-minute timeframe within the morning session.

Within the afternoon session, the Index recovered from its day low and settled above the 57,750 degree. Additional, the Index was buying and selling within the vary of 57,700-58,000, resulted in crimson. Throughout the afternoon session, Financial institution Nifty closed under all 4 EMAs of 20/50/100/200 within the 15-minute timeframe. The Financial institution Nifty’s fast resistance ranges are R1 (58,056), R2 (58,283) and R3 (58,467), whereas fast assist ranges are S1 (57,754), S2 (57,485), and S3 (57,229).

The Financial institution Nifty index had peaked at 58,254.95 and made a day’s low at 57,656.95. Lastly, it had closed in crimson at 57,776.35, closing under the 57,800 degree, shedding 254.75 factors or 0.44%. The Relative Power Index (RSI) stood at 62.29, under the overbought zone of 70 within the day by day timeframe, and Financial institution Nifty closed above all 4 EMAs of 20/50/100/200 within the day by day timeframe.

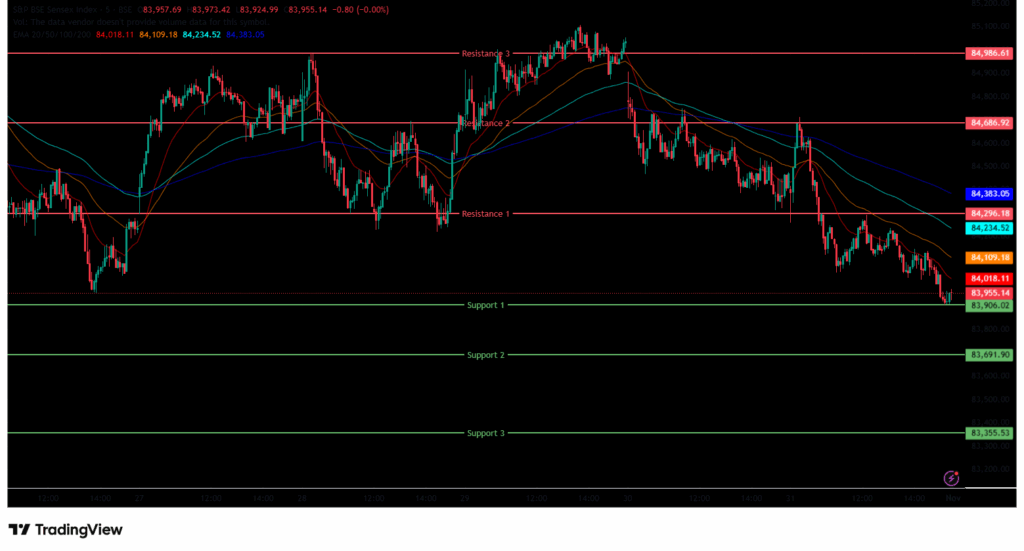

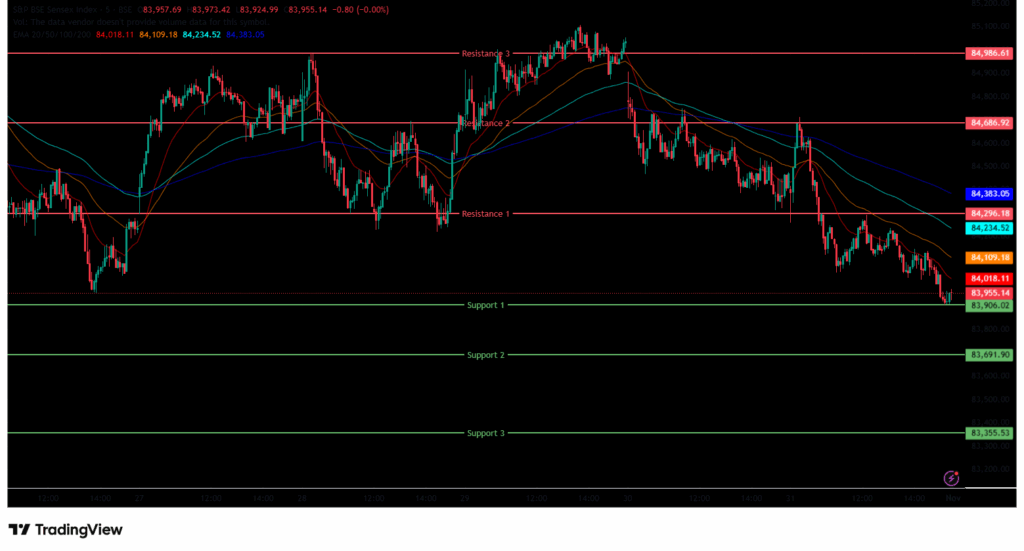

Sensex

(On this evaluation, now we have used 20/50/100/200 EMAs, the place 20 EMA (Crimson), 50 EMA (Orange), 100 EMA (Mild Blue), and 200 EMA (Darkish Blue)).

To view different technical experiences, click on right here

The BSE Sensex Index additionally opened on a destructive notice at 84,379.79 on Friday, down by 24.67 factors from Thursday’s closing of 84,404.46. The index began its session on a bearish notice and made its day excessive at 84,712.79. Later, the Index fell under the 84,050 mark and was buying and selling inside the 84,000-84,750 vary, under all 4 EMAs of 20/50/100/200 EMA within the 15-minute timeframe within the morning session.

Within the afternoon session, the Index additional pulled down and fell as little as 83,905.66, marking its day low. The Index was buying and selling within the 83,900-84,250 vary, sustaining its total bearish development and shutting under all 4 EMAs of 20/50/100/200 EMA within the 15-minute timeframe. The BSE Sensex fast resistance ranges are R1 (84,296), R2 (84,687) and R3 (84,987), whereas fast assist ranges are S1 (83,906), S2 (83,692), and S3 (83,356).

The BSE Sensex index had peaked at 84,712.79 and made a day’s low at 83,905.66. Lastly, it had closed at 83,938.71 in crimson, shedding 465.75 factors or 0.55%. The Relative Power Index (RSI) stood at 57.66, under the overbought zone of 70 within the day by day timeframe, and the BSE Sensex closed above all 4 EMAs of 20/50/100/200 within the day by day timeframe.

India VIX

The India VIX elevated by 0.085 factors or 0.70%, from 12.07 to 12.15 throughout Friday’s session. Total, this week the India VIX noticed a 2.4% or 0.2925 factors soar. A rise within the India VIX usually signifies increased worth volatility within the inventory market, suggesting a much less secure market atmosphere. Nevertheless, a secure market atmosphere and minimal volatility are anticipated when the India VIX is under 15.

Market Recap – thirty first of October 2025

On Friday, the Nifty 50 opened barely decrease at 25,863.8, down -14.05 factors from its earlier shut of 25,877.85. The index hit an intraday excessive of 25,953.75 and closed at 25,722.1, down -155.75 factors, or -0.60%. The index remained above all key shifting averages (20/50/100/200-day EMAs) on the day by day chart, indicating some technical assist. The BSE Sensex mirrored the Nifty’s development, opening at 84,379.79, down -24.67 factors from the earlier shut of 84,404.46.

It adopted an analogous sample, closing at 83,938.71, a fall of -465.75 factors, or -0.55%. Each indices confirmed excessive momentum, with RSI values for Nifty 50 at 57.84 and Sensex at 57.65, under the overbought threshold of 70. The markets ended on a muted notice amidst the worldwide cues, as traders continued to maintain reserving income for the second consecutive day.

The vast majority of indices had been in crimson on Friday, with a number of in inexperienced. The Nifty PSU financial institution index was the most important gainer, rising 1.6% or 125.6 factors, and standing at 8,184.35. Shares equivalent to Union Financial institution of India Ltd jumped 4.5% on Friday. Whereas different PSU financial institution shares like Canara Financial institution Ltd, Punjab Nationwide Financial institution Ltd, and UCO Financial institution additionally gained as much as 3.1%.

Shares rose following SEBI’s announcement of recent guidelines for Financial institution Nifty, which now requires a minimal of 14 constituents as an alternative of 12, beginning in December. The Nifty India Defence index was additionally among the many main gainers, rising 1% or 83.10 factors, and standing at 8,135.2. Shares equivalent to Bharat Electronics Ltd rose 4%, adopted by MTAR Applied sciences Ltd and Dynamatic Applied sciences Ltd, which gained as much as 3.3% on Friday.

The vast majority of the indices resulted in crimson on Friday. The Nifty Media Index was the most important loser, falling -1.3%, or -20.6 factors, to 1,538.35. Media Sector shares like PVR Inox Ltd, Zee Leisure Ltd, Nazara Applied sciences Ltd, and Saregama Ltd noticed declines of as much as -2.8%. The Nifty Metallic Index additionally fell on Friday, shedding -117.05 factors or -1.1%, ending at 10,612.15.

Jindal Stainless Ltd fell essentially the most, declining by -3.7%, adopted by Vedanta Ltd, Hindustan Copper Ltd, and Adani Enterprises Ltd, falling as much as -2.6%. The Nifty Providers Sector Index adopted the decline, shedding -0.9% or -303.3 factors, to shut at 33,206.35. Providers Sector shares, together with Eternals Ltd, Max Healthcare Institute Ltd, NTPC Ltd, and HDFC Life Insurance coverage Firm Ltd, fell as much as 3.5%. The Nifty Healthcare Index additionally fell on Friday’s commerce, ending at 14,693.3, down -132.6 or -0.9%.

Asian markets adopted a blended sentiment on Friday. Japan’s Nikkei 225 elevated by 1,085.73 factors or 2.12%, hitting a contemporary file, closing at 52,411.34. The Japanese market rallied after Washington and Beijing reached a commerce truce over uncommon earths. Whereas China’s Shanghai Composite fell by -32.11 factors, or -0.04%, to three,954.79, equally, Hong Kong’s Hold Seng Index additionally declined by -376.04 factors, or -1.43%, to shut at 25,906.65.

Singapore’s Straits Occasions Index additionally declined by -5.15 factors or -0.39%, ending at 4,428.62, however South Korea’s KOSPI elevated by 20.61 factors or 0.5%, closing at 4,107.5. At 4:21 p.m. IST, U.S. Dow Jones Futures had been decrease, down 0.061%, at 47,648, shedding -29 factors.

This week, the US Federal Reserve reduce US rates of interest by 0.25% placing it in a spread of three.75% to 4%. The US President lowered tariffs on China and introduced an finish to uncommon earth roadblocks, after assembly the Chinese language president. The MEA shared an replace on India, and the US continued to be engaged in discussions for finalising a commerce deal. This week, the broad indices Nifty 50 and Sensex declined by -0.65% and -0.87% respectively. Ongoing international capital outflows and fading expectations for a U.S. price reduce in December continued to weigh on market sentiment.

Commerce Setup Abstract

The Nifty 50 opened on a destructive notice at 25,863.80 on Friday and ended the session within the crimson under the 25,750 degree at 25,722.10. A break under 25,714 might set off additional promoting in the direction of 25,575, whereas breaking the following resistance degree of 25,952 might set off bullishness in the direction of the 26,098 degree.

Financial institution Nifty additionally began the session on a destructive notice at 57,942.45 and ended the session within the crimson at 57,776.35, under the 57,800 degree. A break under 57,754 might set off additional promoting in the direction of 57,485, whereas breaking the following resistance degree of 58,056 might set off bullishness in the direction of the 58,283 degree.

Sensex additionally opened on a destructive notice at 84,379.79 and ended the session within the crimson at 83,938.71, under the 84,000 degree. A break under 83,906 might set off additional promoting in the direction of 83,692, whereas breaking the following resistance degree of 84,296 might set off bullishness in the direction of the 84,687 degree.

Given the continued volatility and blended sentiments, it’s advisable to keep away from aggressive positions and anticipate clear directional strikes above resistance or under assist. Merchants ought to take into account these key assist and resistance ranges when getting into lengthy or quick positions following the worth break from these vital ranges. Moreover, merchants can mix shifting averages to determine extra correct entry and exit factors.

Disclaimer

The views and funding ideas expressed by funding specialists/broking homes/ranking businesses on tradebrains.in are their very own, and never that of the web site or its administration. Investing in equities poses a threat of economic losses. Buyers should due to this fact train due warning whereas investing or buying and selling in shares. Commerce Brains Applied sciences Personal Restricted or the creator usually are not answerable for any losses brought on on account of the choice based mostly on this text. Please seek the advice of your funding advisor earlier than investing.

About: Commerce Brains Portal is a inventory evaluation platform. Its commerce title is Dailyraven Applied sciences Personal Restricted, and its SEBI-registered analysis analyst registration quantity is INH000015729.

Investments in securities are topic to market dangers. Learn all of the associated paperwork fastidiously earlier than investing.

Registration granted by SEBI and certification from NISM on no account assure efficiency of the middleman or present any assurance of returns to traders.