![]()

The home fairness markets started the week on a cautious observe however quickly gained momentum, ending the session with modest good points. After a subdued opening, each the Nifty 50 and the Sensex recovered sharply, supported by sturdy shopping for curiosity throughout key sectors. The benchmarks managed to shut in optimistic territory, sustaining their place above essential transferring averages, an indication of sustained underlying power. Technical indicators additionally mirrored a wholesome market setup, with momentum remaining regular and comfortably beneath the overbought zone.

Broader market sentiment was buoyed by sturdy performances in realty, PSU banking, and pharmaceutical shares, which offset gentle weak point in shopper durables, IT, and CPSE indices. Realty and PSU financial institution shares led the rally, pushed by strong shopping for in choose large- and mid-cap names, whereas the pharma house noticed renewed investor curiosity. In distinction, profit-booking in consumer-oriented and expertise counters saved good points in test. Constructive cues from different Asian markets additional supported home sentiment, with main regional indices buying and selling greater and U.S. futures additionally indicating a agency begin to international commerce.

On this overview, we’ll analyse the important thing technical ranges and development instructions for Nifty and BSE Sensex to watch within the upcoming buying and selling periods. All of the charts talked about beneath are primarily based on the 5-minute timeframe.

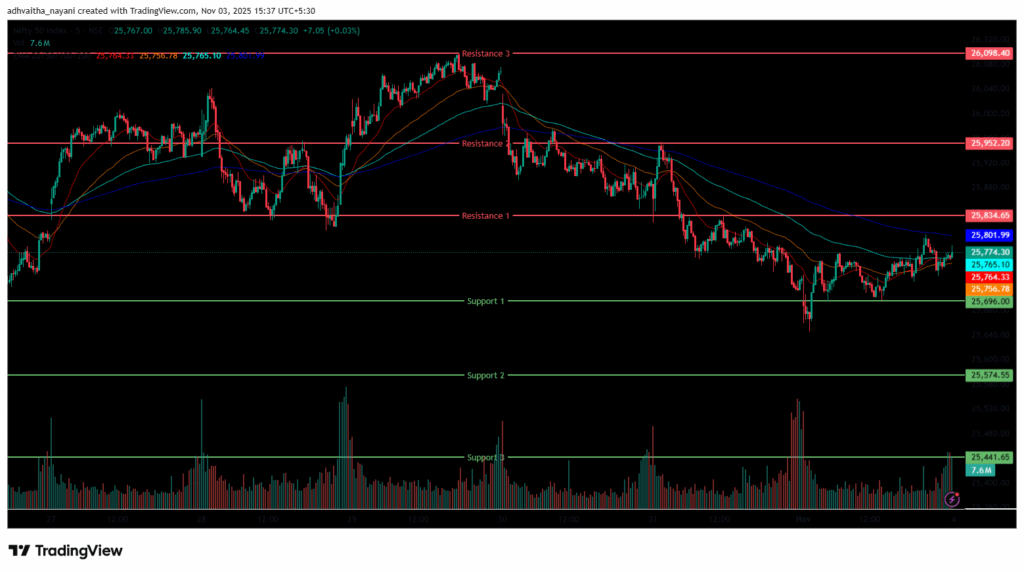

NIFTY 50 Chart & Worth Motion Evaluation

(On this evaluation, we have now used 20/50/100/200 EMAs, the place 20 EMA (Purple), 50 EMA (Orange), 100 EMA (Gentle Blue), 200 EMA (Darkish Blue)).

To view different technical reviews, click on right here

The Nifty 50 Index opened on a muted observe at 25,696.85 on Monday, down by 25.15 factors from Friday’s closing of 25,722.10. The index opened on a bearish observe and traded inside the 25,700-25,750 vary in the course of the morning session, and traded beneath all 4 EMAs of 20/50/100/200 within the 15-minute chart.

Within the afternoon session, the index, nonetheless, moved upwards and hit an intraday excessive of 25,803, briefly touching the 25,800 stage. Total, the Index traded inside a 25,750-25,800 vary all through the afternoon session. In the course of the afternoon session, the Nifty 50 closed beneath 50/100/200 EMAs however above the 20-day EMA within the 15-minute time-frame.

The Nifty’s speedy resistance ranges are R1 (25,835), R2 (25,952), and R3 (26,098), whereas speedy assist ranges are S1 (25,696), S2 (25,575) and S3 (25,442). The Nifty index had reached a day’s excessive at 25,803 and noticed a day’s low at 25,646. Lastly, it had closed at 25,763.35, within the inexperienced however beneath the 25,800 stage, up 41.25 factors, or 0.16%. The Nifty 50 closed above all 4 EMAs of 20/50/100/200 within the day by day time-frame.

NIFTY 50 Momentum Indicators Evaluation

RSI (Each day): The Nifty 50’s RSI stood at 58.99, which is beneath the overbought zone of 70, indicating a bullish sentiment.

Bollinger Bands (Each day): The index is buying and selling within the higher band of the Bollinger Band vary, barely above the center band (Easy Shifting Common). Its place within the higher vary signifies a bullish sentiment, however the Index is nearing the center band within the day by day time-frame. The index took assist close to 25,696, and 25,835 acted as a resistance stage. A sustained transfer above the center band alerts a bullish sentiment, whereas a drop again towards the decrease band could reinforce bearish sentiment.

Quantity Evaluation: Monday’s buying and selling session had a median quantity of 275.86 Mn.

Derivatives Knowledge: Choices OI signifies sturdy Put writing at 25,700, adopted by 25,600, establishing it as a agency assist zone. On the upside, a big Name OI buildup at 25,800 and 25,900 suggests a possible resistance provide. PCR (Put/Name Ratio) stands at 0.66 (<1), leaning in direction of bullish sentiment, and the Lengthy Buildup signifies a Sturdy Bullish outlook, with an general bullish outlook for the subsequent buying and selling session.

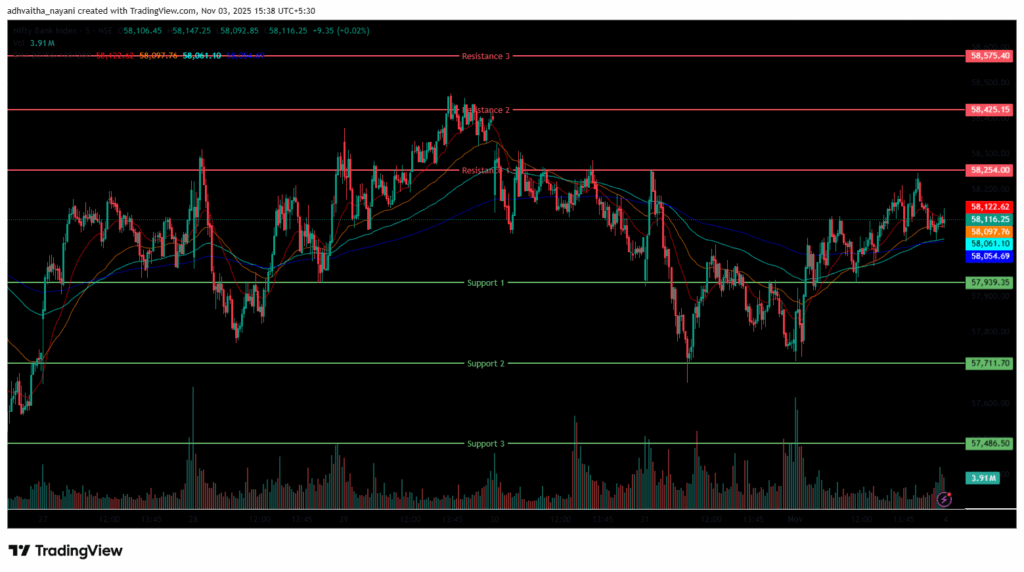

Financial institution Nifty Chart & Worth Motion Evaluation

(On this evaluation, we have now used 20/50/100/200 EMAs, the place 20 EMA (Purple), 50 EMA (Orange), 100 EMA (Gentle Blue), 200 EMA (Darkish Blue)).

The Financial institution Nifty Index began the session on a adverse observe at 57,726.85 on Monday, down by 49.5 factors from Friday’s closing of 57,776. The index began on a Bearish observe, however continued to maneuver upwards and was buying and selling within the vary of 57,800-58,100. As well as, the index was buying and selling above the EMA of 200 and close to the 20/50/100 EMAs within the 15-minute time-frame within the morning session. Within the afternoon session, the Index hit an intraday excessive at 58,247.55, nearing the 58,250 stage.

Additional, the Index was buying and selling within the vary of 58,000-58,200, and ended with good points. In the course of the afternoon session, Financial institution Nifty closed above all 4 EMAs of 20/50/100/200 within the 15-minute time-frame. The Financial institution Nifty’s speedy resistance ranges are R1 (58,254), R2 (58,425) and R3 (58,575), whereas speedy assist ranges are S1 (57,939), S2 (57,712), and S3 (57,487).

The Financial institution Nifty index had peaked at 58,247.55 and made a day’s low at 57,718.40. Lastly, it had closed in inexperienced at 58,101.45, closing close to the 58,100 stage, gaining 325.1 factors or 0.56%. The Relative Energy Index (RSI) stood at 65.60, close to the overbought zone of 70 within the day by day time-frame, and Financial institution Nifty closed above all 4 EMAs of 20/50/100/200 within the day by day time-frame.

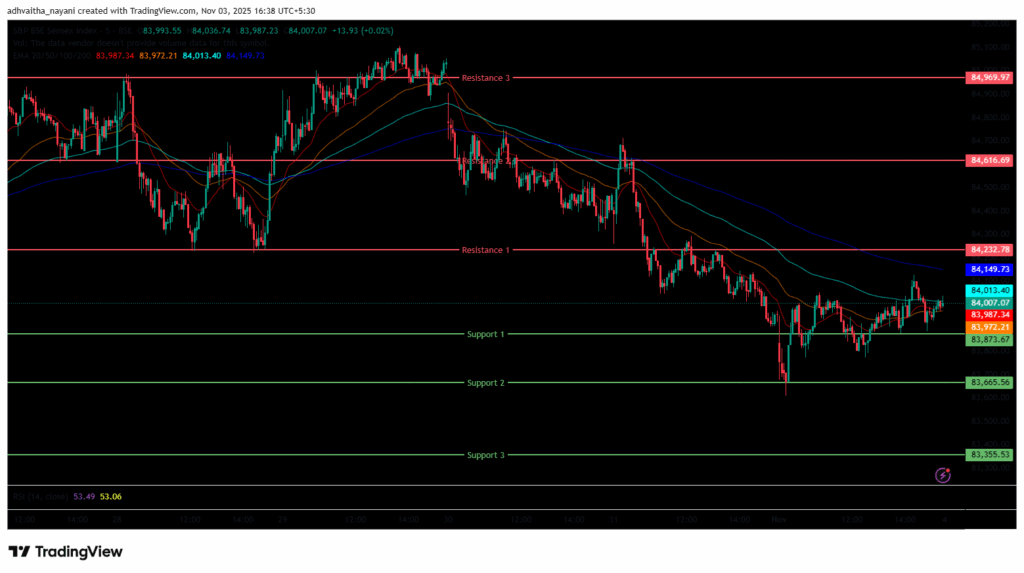

BSE Sensex Chart & Worth Motion Evaluation

(On this evaluation, we have now used 20/50/100/200 EMAs, the place 20 EMA (Purple), 50 EMA (Orange), 100 EMA (Gentle Blue), 200 EMA (Darkish Blue)).

To view different technical reviews, click on right here

The BSE Sensex Index additionally opened on a adverse observe at 83,835 on Monday, down by 104 factors from Friday’s closing of 83,939. The index began its session on a bearish observe, however later, it moved barely upwards and was buying and selling inside the 83,800-84,000 vary. It traded beneath all 4 EMAs of 20/50/100/200 EMA within the 15-minute time-frame within the morning session.

Within the afternoon session, the Index additional moved upwards and touched 84,127, marking its day excessive. The Index was buying and selling within the 83,900-84,150 vary, following a risky buying and selling session and closed beneath all 4 EMAs of 20/50/100/200 EMA within the 15-minute time-frame. The BSE Sensex speedy resistance ranges are R1 (84,233), R2 (84,617) and R3 (84,970), whereas speedy assist ranges are S1 (83,874), S2 (83,666), and S3 (83,356).

The BSE Sensex index had peaked at 84,127 and made a day’s low at 83,609. Lastly, it had closed at 83,978.49 in inexperienced, gaining 39.78 factors or 0.05%. The Relative Energy Index (RSI) stood at 58, beneath the overbought zone of 70 within the day by day time-frame, and the BSE Sensex closed above all 4 EMAs of 20/50/100/200 within the day by day time-frame.

India VIX

The India VIX elevated by 0.5125 factors or 4.22%, from 12.15 to 12.67 throughout Monday’s session. A rise within the India VIX sometimes signifies greater worth volatility within the inventory market, suggesting a much less steady market setting. Nevertheless, a steady market setting and minimal volatility are anticipated when the India VIX is beneath 15.

Market Recap on November third, 2025

On Monday, the Nifty 50 began the week on a barely adverse observe at 25,696.85, down -25.25 factors from its earlier shut of 25,722.10. Later, the index moved in direction of an upward trajectory, hitting an intraday excessive of 25,803.10 earlier than closing at 25,763.35, up 41.25 factors (0.16%), close to the 25,800 mark. The Nifty stayed above all main transferring averages (20/50/100/200-day EMAs), reflecting sturdy underlying technical assist.

The BSE Sensex adopted an identical trajectory, opening decrease at 83,835.10 (decrease by -103.61 factors from the earlier shut of 83,938.71), went above the 84,100 mark, and finally settled at 83,978.49, up 39.78 factors (0.05%). Each benchmarks ended the day in optimistic territory, with RSI values beneath the overbought zone (over 70), 58.99 for Nifty 50 and 58.00 for Sensex. The Financial institution Nifty additionally closed with good points of 325.10 factors (0.56%) at 58,101.45.

Amongst sectoral indices, most ended within the inexperienced apart from a number of losers. The Nifty Realty Index was the highest performer, rising 2.23% (21.10 factors) to 968.65, pushed by sturdy good points in Phoenix Mills Ltd, Lodha Builders Ltd, DLF Ltd, and Sobha Ltd, which superior as much as 3.80%.

The Nifty PSU Financial institution Index additionally added 1.92% (157.00 factors) to eight,341.35, led by Financial institution of Baroda, Indian Financial institution, Canara Financial institution, and Punjab & Sind Financial institution, as much as 4.60%. The Nifty Pharma Index additionally ended greater at 22,442.60 (+1.20%), supported by Wockhardt Ltd (+10.32%), together with modest good points in Ipca Laboratories Ltd, Ajanta Pharma Ltd, and Laurus Labs Ltd (as much as 3.01%).

On the draw back, the Nifty Client Durables Index was the largest laggard, falling 0.3% (-112.05 factors) to 38,503.05. Kajaria Ceramics Ltd led the declines with a 1.9% drop, adopted by losses in Whirlpool of India Ltd, Voltas Ltd, and Amber Enterprises India Ltd (-1%). The Nifty IT Index slipped 0.2% (-59.25 factors) to 35,653.1, dragged by TCS Ltd, Oracle Monetary Companies Software program Ltd, and Tech Mahindra Ltd, which fell as a lot as 1.4%. The Nifty CPSE Index additionally closed decrease by 0.1% (-9.05 factors) at 6,606.6.

Within the broader Asian markets, sentiment was largely optimistic. Japan’s Nikkei 225 surged 2.12% (+1,085.73 factors) to 52,411.34, Hong Kong’s Cling Seng superior 0.97% (+251.71) to 26,158.36, China’s Shanghai Composite climbed 0.55% (+21.73) to three,976.52, and South Korea’s KOSPI surged 2.78% (+114.37) to 4,221.87. As of 4:34 p.m. IST, U.S. Dow Jones Futures had been up 0.11% (+52 factors) at 47,774.

Commerce Setup Abstract

The Nifty 50 opened on a adverse observe at 25,697 on Monday however ended the session within the inexperienced above the 25,750 stage at 25,763.3. A break beneath 25,696 might set off additional promoting in direction of 25,575, whereas breaking the subsequent resistance stage of 25,835 might set off bullishness in direction of the 25,952 stage.

The Financial institution Nifty additionally began the session on a adverse observe at 57,727 however ended the session within the inexperienced at 58,101.45, close to the 58,100 stage. A break beneath 57,939 might set off additional promoting in direction of 57,712, whereas breaking the subsequent resistance stage of 58,254 might set off bullishness in direction of the 58,425 stage.

The Sensex additionally opened on a adverse observe at 83,835 however ended the session on a flat observe at 83,978.49, beneath the 84,000 stage. A break beneath 83,874 might set off additional promoting in direction of 83,666, whereas breaking the subsequent resistance stage of 84,233 might set off bullishness in direction of the 84,617 stage.

Given the continued volatility and blended sentiments, it’s advisable to keep away from aggressive positions and look forward to clear directional strikes above resistance or beneath assist. Merchants ought to take into account these key assist and resistance ranges when coming into lengthy or quick positions following the value break from these crucial ranges. Moreover, merchants can mix transferring averages to establish extra correct entry and exit factors.

Disclaimer

The views and funding suggestions expressed by funding specialists/broking homes/score businesses on tradebrains.in are their very own, and never that of the web site or its administration. Investing in equities poses a danger of economic losses. Buyers should due to this fact train due warning whereas investing or buying and selling in shares. Commerce Brains Applied sciences Non-public Restricted or the creator aren’t accountable for any losses brought on because of the choice primarily based on this text. Please seek the advice of your funding advisor earlier than investing.

About: Commerce Brains Portal is a inventory evaluation platform. Its commerce identify is Dailyraven Applied sciences Non-public Restricted, and its SEBI-registered analysis analyst registration quantity is INH000015729.

Investments in securities are topic to market dangers. Learn all of the associated paperwork rigorously earlier than investing.

Registration granted by SEBI and certification from NISM under no circumstances assure efficiency of the middleman or present any assurance of returns to traders.

![Simply launched: the three greatest growth-focused shares to contemplate shopping for in November [PREMIUM PICKS] Simply launched: the three greatest growth-focused shares to contemplate shopping for in November [PREMIUM PICKS]](https://i0.wp.com/www.fool.co.uk/wp-content/uploads/2022/10/Three.jpg?w=150&resize=150,150&ssl=1)

Играть стоит только там, где уважают игрока. В ТОП-10 казино РФ попадают только лицензированные площадки с прозрачными условиями и моментальным выводом. Среди них — онлайн казино, где вы получаете не только фриспины за регистрацию, но и уверенность в каждом рубле.

Website https://portalbook.ru/arenda-avtomobilya-dlya-povsednevnyh-zadach-i-poezdok-po-gorodudlya-povsednevnyh-zadach-i-poezdok-po-gorodu/