Be a part of Our Telegram channel to remain updated on breaking information protection

Coinbase has urged the US Treasury Division to stay to Congress’s imaginative and prescient for the GENIUS Act, suggesting that caving in to strain from conventional monetary establishments might stifle stablecoin innovation.

In its response to the Treasury’s request for feedback, Coinbase stated regulators should keep away from “imposing any necessities that transcend what the statute instructions.”

It argued that Congress “fastidiously drafted” the GENIUS Act to advertise accountable progress in stablecoins, strengthen US crypto management, and modernize funds infrastructure.

Banking teams have referred to as on regulators to shut what they view as a “yield loophole” that enables companies like Coinbase to supply returns on Circle’s USDC holdings by way of third events.

Coinbase says that increasing the ban on stablecoin yields would “rewrite Congress’s carefully-drawn strains,” hurting shoppers and curbing innovation by eradicating market incentives that decrease prices and drive adoption.

The change additionally urged Treasury to coordinate with different regulators to keep away from overlapping guidelines that might fragment the market.

“GENIUS is amongst a handful of federal efforts to offer readability in digital asset markets, so Treasury have to be aware to not battle with ongoing efforts of Congress or different federal regulators,” Coinbase wrote.

We submitted @coinbase‘s response to @USTreasury‘s request for feedback on the implementation of the GENIUS Act. Our message is easy: GENIUS is landmark laws designed to make the US the undisputed international chief in crypto and stablecoins. To make that occur, the… pic.twitter.com/XLyq15u0Ov

— Faryar Shirzad 🛡️ (@faryarshirzad) November 5, 2025

Banking Foyer Teams Sad Stablecoin Companies Are Circumventing Yield Ban

The GENIUS Act offered the digital asset market with some long-awaited regulatory readability. It establishes a regulatory framework for stablecoin companies seeking to situation their tokens within the US, and focuses on classifying “fee stablecoins,” how they might be regulated, and who could situation them.

One of many important necessities listed within the GENIUS Act is that permitted issuers preserve a 100% reserve backing of excellent stablecoins with extremely liquid belongings reminiscent of US {dollars} or short-term US Treasuries. The companies additionally want to offer month-to-month disclosures of reserve composition, in addition to annual audited monetary statements.

There may be additionally a ban on stablecoin companies providing their token holders yield instantly, however this prohibition has not been expanded to 3rd events or associates.

That, in accordance with banking foyer teams, paves the best way for stablecoin companies to get across the ban, as has been the case with Coinbase providing a yield on USDC.

Coinbase USDC yield providing (Supply: Coinbase)

Regulators In Different Elements Of The World Working On Stablecoin Regulation

Because the US Treasury Division seems to be to implement the GENIUS Act, regulators from different elements of the world have signalled that they’re engaged on their very own regulatory frameworks for stablecoins.

Canada just lately unveiled plans for a stablecoin regulatory framework in its 2025 federal price range. Much like the GENIUS Act, Canada’s framework would require stablecoin companies to keep up ample reserves.

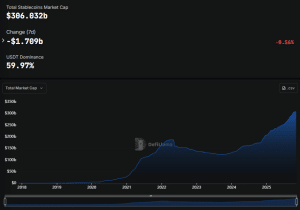

In the meantime, Financial institution of England Deputy Governor Sarah Breeden just lately stated she expects the UK to maintain tempo with the US with regards to regulating the $306 billion stablecoin market.

Stablecoin market cap (Supply: DefiLlama)

She additionally harassed the significance of the US and UK synchronizing with regards to regulating the rapidly-growing sector. The Financial institution of England is reportedly anticipated to situation its stablecoin session paper on Nov. 10 as properly after talking with US authorities and companies.

Associated Articles:

Greatest Pockets – Diversify Your Crypto Portfolio

- Simple to Use, Function-Pushed Crypto Pockets

- Get Early Entry to Upcoming Token ICOs

- Multi-Chain, Multi-Pockets, Non-Custodial

- Now On App Retailer, Google Play

- Stake To Earn Native Token $BEST

- 250,000+ Month-to-month Lively Customers

Be a part of Our Telegram channel to remain updated on breaking information protection