The market sentiment on Monday mirrored a broadly optimistic and bullish tone, supported by robust shopping for curiosity throughout main indices. Each the Nifty 50 and the Sensex managed to maintain positive factors by means of the session, recovering from minor intraday dips and shutting above key shifting averages, a sign of underlying power within the ongoing uptrend.

Investor confidence appeared regular because the indices held above essential technical assist zones, and momentum indicators comparable to RSI remained within the impartial vary, suggesting that there’s nonetheless room for additional upside earlier than reaching overbought circumstances. The general setup pointed to a continuation of short-term bullish momentum pushed by renewed optimism and selective sectoral power.

Sectorally, the IT and Defence areas led the rally, pushed by renewed shopping for curiosity in large-cap expertise corporations and defence producers, indicating market desire for development and export-oriented themes. Alternatively, the Media and Realty indices skilled delicate revenue reserving after latest positive factors, which did little to dampen the broader market sentiment. The upbeat tone throughout main Asian markets additional boosted home investor morale, reflecting international risk-on sentiment and inspiring inflows into equities. Total, the market temper remained constructive, with merchants exhibiting confidence in sustained near-term upside amid supportive international cues and agency home momentum.

On this overview, we are going to analyse the important thing technical ranges and pattern instructions for Nifty and BSE Sensex to watch within the upcoming buying and selling periods. All of the charts talked about beneath are based mostly on the 5-minute timeframe.

NIFTY 50 Chart & Value Motion Evaluation

(On this evaluation, we now have used 20/50/100/200 EMAs, the place 20 EMA (Purple), 50 EMA (Orange), 100 EMA (Gentle Blue), and 200 EMA (Darkish Blue)).

To view different technical reviews, click on right here

The Nifty 50 Index opened on a optimistic notice at 25,503.50 on Monday, up by 11.2 factors from Friday’s closing of 25,492.30. The index opened on a bullish notice, surged and sustained above the 25,650 degree. Within the morning session, the Index traded inside the 25,500-25,650 vary. It traded above the EMAs of 20/50/100 however beneath the 200-day EMA within the 15-minute chart.

Within the afternoon session, the index made its intraday excessive of 25,653.45 and later misplaced its momentum and settled above the 25,550 degree. Total, the Index traded inside a 25,550-25,650 vary all through the afternoon session. Through the afternoon session, the Nifty 50 closed beneath all 4 EMAs of 20/50/100/200 within the 15-minute time-frame.

The Nifty’s quick resistance ranges are R1 (25,653), R2 (25,758), and R3 (25,836), whereas quick assist ranges are S1 (25,555), S2 (25,474) and S3 (25,367). The Nifty index had reached a day’s excessive at 25,653.45 and noticed a day’s low at 25,503.50. Lastly, it had closed at 25,574.35, within the inexperienced and above the 25,550 degree, up 82.05 factors, or 0.32%. The Nifty 50 closed above the EMAs of fifty/100/200 however beneath the 20-day EMA within the each day time-frame.

NIFTY 50 Momentum Indicators Evaluation

RSI (Each day): The Nifty 50’s RSI stood at 52.08, which is beneath the overbought zone of 70, indicating bullish sentiment.

Bollinger Bands (Each day): The index is buying and selling within the decrease band of the Bollinger Band vary (Easy Shifting Common). Its place within the decrease vary suggests a bearish sentiment, however within the each day time-frame on Monday session, the Index led to a bullish notice. The index took assist close to 25,653, and 25,503 acted as a resistance degree. A sustained transfer above the center band indicators a bullish sentiment, whereas a drop again towards the decrease band might reinforce bearish sentiment.

Quantity Evaluation: Monday’s buying and selling session had a mean quantity of 243.59 Mn.

Derivatives Information: Choices OI signifies robust Put writing at 25,500, adopted by 25,400, establishing it as a agency assist zone. On the upside, a major Name OI buildup at 25,600 and 25,700 suggests a possible resistance provide. PCR (Put/Name Ratio) stands at 0.95 (<1), leaning in direction of bullish sentiment, however the lengthy Buildup signifies a Sturdy Bullish outlook, thus indicating a bullish outlook for the subsequent buying and selling session.

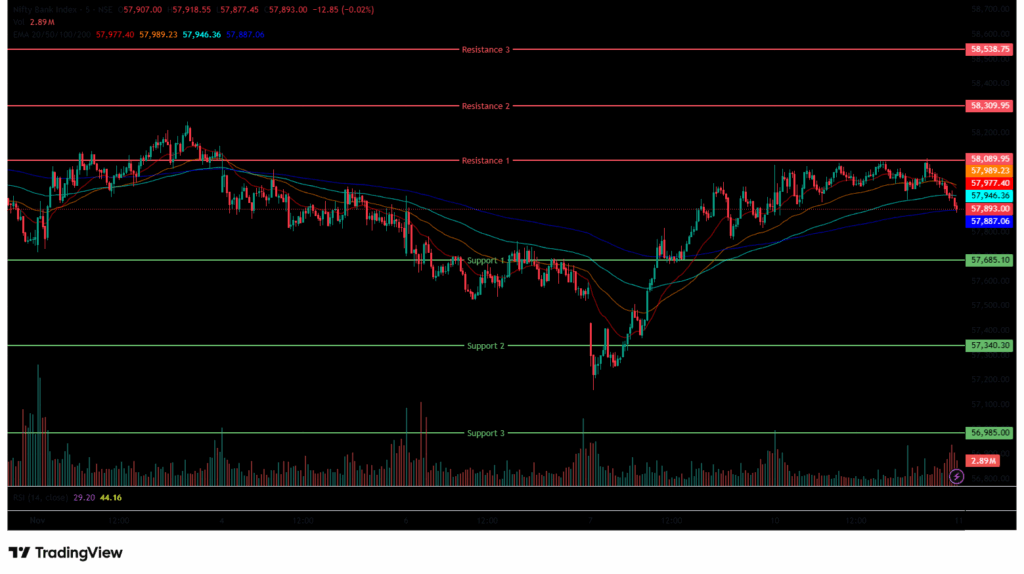

Financial institution Nifty Chart & Value Motion Evaluation

(On this evaluation, we now have used 20/50/100/200 EMAs, the place 20 EMA (Purple), 50 EMA (Orange), 100 EMA (Gentle Blue), and 200 EMA (Darkish Blue)).

The Financial institution Nifty Index began the session on a destructive notice at 57,846.20 on Monday, down by 30.6 factors from Friday’s closing of 57,876.80. The index began on a Bearish notice, however later, it moved upwards and was buying and selling throughout the 57,800-58,100 vary and was buying and selling above all 4 EMAs of 20/50/100/200 within the 15-minute time-frame within the morning session.

Within the afternoon session, the Index hit an intraday excessive at 58,097.20 and settled close to the 57,900 degree. Additional, the Index was buying and selling within the vary of 57,850-58,100, and ended with positive factors in inexperienced. Through the afternoon session, Financial institution Nifty closed beneath the EMAs of 20/50/200 however above the 100-day EMA within the 15-minute time-frame.

The Financial institution Nifty’s quick resistance ranges are R1 (58,090), R2 (58,310) and R3 (58,539), whereas quick assist ranges are S1 (57,685), S2 (57,340), and S3 (56,985). The Financial institution Nifty index had peaked at 58,097.20 and made a day’s low at 57,846.20. Lastly, it had closed in inexperienced at 57,937.55, rising above the 57,900 degree, gaining 60.75 factors or 0.10%. The Relative Power Index (RSI) stood at 60.71, beneath the overbought zone of 70 within the each day time-frame, and Financial institution Nifty closed above all 4 EMAs of 20/50/100/200 within the each day time-frame.

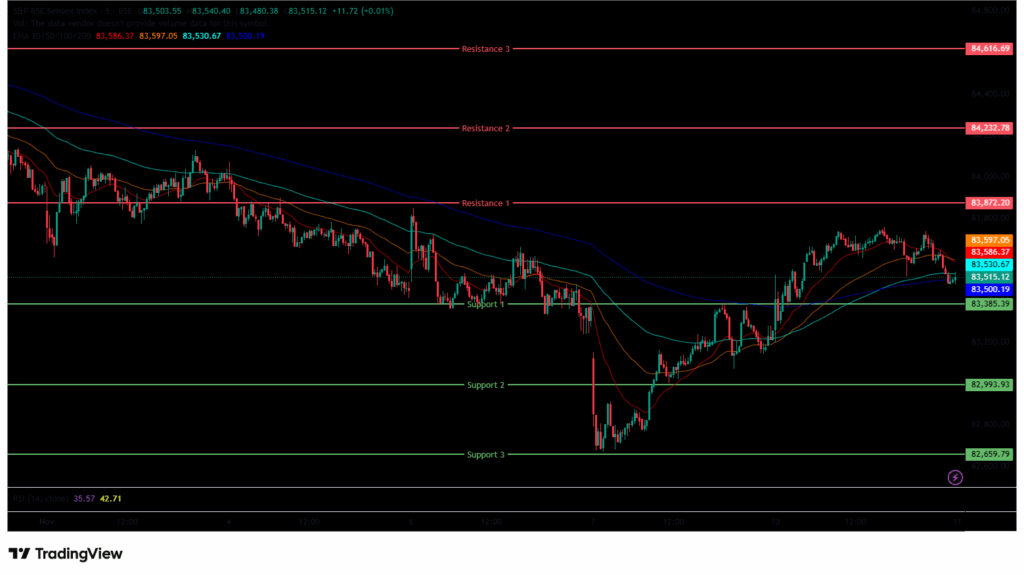

BSE Sensex Chart & Value Motion Evaluation

(On this evaluation, we now have used 20/50/100/200 EMAs, the place 20 EMA (Purple), 50 EMA (Orange), 100 EMA (Gentle Blue), and 200 EMA (Darkish Blue)).

To view different technical reviews, click on right here

The BSE Sensex Index opened on a destructive notice at 83,198.20 on Monday, down by 18.08 factors from Friday’s closing of 83,216.28. The index began its session on a bearish notice, however later, it moved upwards and was buying and selling throughout the 83,150-83,750 vary. It traded above the EMAs of 20/50/100 however beneath the 200-day EMA within the 15-minute time-frame within the morning session.

Within the afternoon session, the Index additional climbed and touched 83,754.49, marking its day’s excessive and settled above 83,500. The Index was buying and selling within the 83,450-83,800 vary, following a bullish pattern and closed beneath the EMAs of 20/100/200 however above the 50-day EMA within the 15-minute time-frame.

The BSE Sensex quick resistance ranges are R1 (83,872), R2 (84,233) and R3 (84,617), whereas quick assist ranges are S1 (83,385), S2 (82,994), and S3 (82,660).The BSE Sensex index had peaked at 83,754.49 and made a day’s low at 83,197.67. Lastly, it had closed at 83,535.35 in inexperienced, gaining 319.07 factors or 0.38%. The Relative Power Index (RSI) stood at 52.96, beneath the overbought zone of 70 within the each day time-frame, and the BSE Sensex closed above all 4 EMAs of 20/50/100/200 within the each day time-frame.

Market Recap on November tenth, 2025

On Monday, the Nifty 50 opened barely larger at 25,503.5, up 11.2 factors from its earlier shut of 25,492.3. The index hit an intraday excessive of 25,653.45 and closed at 25,574.35, up 82.05 factors, or 0.32%. The index went solely beneath the 20-day EMA through the day however closed above key shifting averages (50/100/200-day EMAs) on the each day chart.

The BSE Sensex opened on a destructive pattern, opening at 83,198.20, down -18.08 factors from the earlier shut of 83,216.28. It adopted the same sample to Nifty, closing at 83,535.35, up 319.07 factors, or 0.38%. Each indices confirmed excessive momentum, with RSI values for Nifty 50 at 52.08 and Sensex at 52.96, beneath the overbought threshold of 70.

On Monday, indices present a bullish response. The Nifty IT index was the main gainer, rising 1.6% or 570.6 factors, and standing at 35,688.25. Shares comparable to Infosys Ltd rose 2.5%, adopted by HCL Applied sciences Ltd and Mphasis Ltd, which gained as much as 1.5% on Monday. The Nifty India Defence index was additionally among the many greatest gainers, rising 1.5% or 115.35 factors, and standing at 8,073.7. Shares comparable to Dynamatic Applied sciences Ltd jumped 6.3% on Monday. Whereas different defence shares like Bharat Dynamics Ltd, Backyard Attain Shipbuilders, and Hindustan Aeronautics Ltd additionally gained as much as 4.6%.

On the Sectoral Losers, the Nifty Media Index was the most important loser, falling -1.04%, or -15.50 factors, to 1,474.15. Media shares like Nazara Applied sciences Ltd, Prime Focus Ltd, Ideas Music Ltd, and PVR Inox Ltd noticed declines of as much as -2.51%. The Nifty Realty Index additionally fell on Monday’s commerce, ending at 944.15, down -2.25 or -0.24%.

Asian markets had an general bullish sentiment on Monday. Japan’s Nikkei 225 elevated by 635.39 factors or 1.26%, closing at 50,911.76. Whereas China’s Shanghai Composite rose by 21.04 factors, or 0.53%, to 4,018.60, equally, Hong Kong’s Grasp Seng Index additionally jumped by 407.23 factors, or 1.55%, to shut at 26,649.06. South Korea’s KOSPI rose sharply by 119.48 factors or 3.02%, closing at 4,073.24. At 4:46 p.m. IST, U.S. Dow Jones Futures have been up, growing 0.46%, at 47,201.09, shedding 213.99 factors.

India VIX

The India VIX decreased 0.25 factors or 2.01%, from 12.56 to 12.30 throughout Monday’s session. A lower within the India VIX sometimes signifies cheaper price volatility within the inventory market, suggesting a extra secure market setting. Nonetheless, a secure market setting and minimal volatility are anticipated when the India VIX is beneath 15.

Commerce Setup Abstract

The Nifty 50 opened on a optimistic notice at 25,503.50 on Monday and ended the session within the inexperienced above the 25,550 degree at 25,574.35. A break beneath 25,555 may set off additional promoting in direction of 25,474, whereas breaking the subsequent resistance degree of 25,653 may set off bullishness in direction of the 25,758 degree.

The Financial institution Nifty additionally began the session on a destructive notice at 57,846.20 however ended the session within the inexperienced at 57,937.55, above the 57,900 degree. A break beneath 57,685 may set off additional promoting in direction of 57,340, whereas breaking the subsequent resistance degree of 58,090 may set off bullishness in direction of the 58,310 degree.

The Sensex opened on a destructive notice at 83,198.20 however ended the session within the inexperienced at 83,535.35, above the 83,500 degree. A break beneath 83,385 may set off additional promoting in direction of 82,994, whereas breaking the subsequent resistance degree of 83,872 may set off bullishness in direction of the 84,233 degree.

Given the continued volatility and combined sentiments, it’s advisable to keep away from aggressive positions and await clear directional strikes above resistance or beneath assist. Merchants ought to take into account these key assist and resistance ranges when coming into lengthy or brief positions following the worth break from these vital ranges. Moreover, merchants can mix shifting averages to establish extra correct entry and exit factors.

Disclaimer

The views and funding ideas expressed by funding consultants/broking homes/ranking businesses on tradebrains.in are their very own, and never that of the web site or its administration. Investing in equities poses a danger of economic losses. Traders should due to this fact train due warning whereas investing or buying and selling in shares. Commerce Brains Applied sciences Non-public Restricted or the creator usually are not answerable for any losses precipitated on account of the choice based mostly on this text. Please seek the advice of your funding advisor earlier than investing.

About: Commerce Brains Portal is a inventory evaluation platform. Its commerce title is Dailyraven Applied sciences Non-public Restricted, and its SEBI-registered analysis analyst registration quantity is INH000015729.

Investments in securities are topic to market dangers. Learn all of the associated paperwork rigorously earlier than investing.

Registration granted by SEBI and certification from NISM on no account assure efficiency of the middleman or present any assurance of returns to buyers.