Indus Towers Ltd – Connecting Lives Throughout the Nation

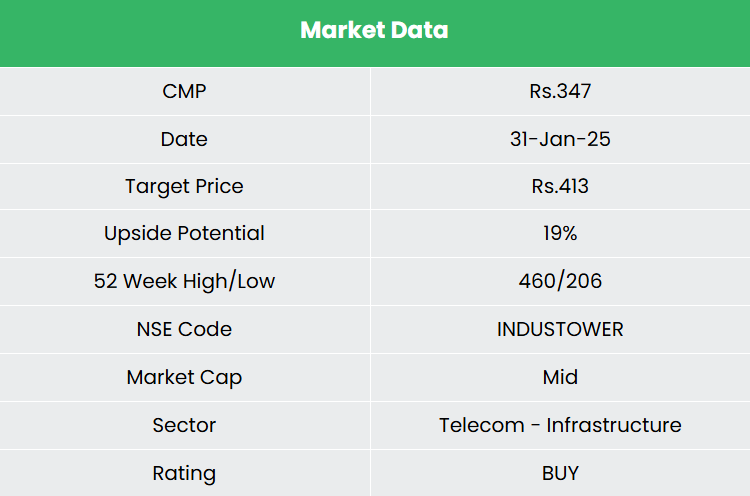

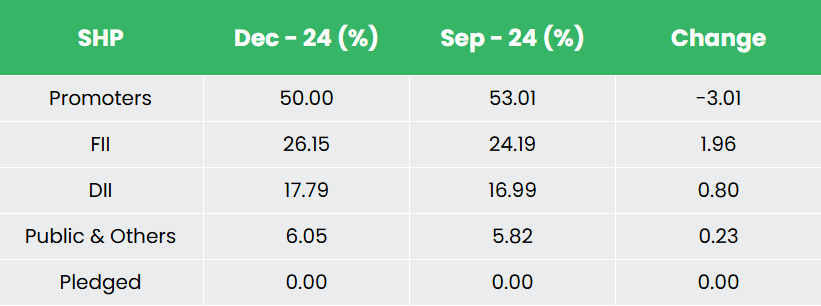

Indus Towers Ltd., shaped by means of the merger of Indus Towers and Bharti Infratel, is among the largest telecom tower firms globally. Established in 2006 and headquartered in Gurugram, the corporate gives tower and associated infrastructure-sharing companies, managing the deployment, possession, and operation of passive infrastructure for telecom networks. As of December 31, 2024, Indus Towers operates over 234,643 macro towers and 386,819 macro co-locations, with a presence throughout all 22 telecom circles in India. Its consumer base consists of {industry} giants reminiscent of Bharti Airtel (together with Bharti Hexacom), Vodafone Thought Restricted (VIL), and Reliance Jio Infocomm Restricted.

Merchandise and Providers

The corporate’s services and products are centered round 3 core components:

- Tower – For mounting the operator antennae at an acceptable top, encompassing a variety of designs from ground-based towers and rooftop towers to hybrid poles and monopoles.

- Energy – For offering uninterrupted power provide to telecom gear together with greener power options.

- Area – Collaboration with residential and industrial property homeowners for housing telecom and energy gear.

Subsidiaries: As of FY24, the corporate has 1 subsidiary and no associates/joint ventures.

Funding Rationale

- Market chief – Indus Towers is the main supplier of tower infrastructure within the nation, serving high Telecom Providers Suppliers (TSPs). It primarily provides shared entry to its towers for wi-fi telecommunications suppliers by means of long-term contracts. The corporate is steadily growing its market share, fuelled by the fast rollout of 5G companies by TSPs, which has considerably boosted its income. Moreover, the continued enlargement into rural areas by main shoppers is predicted to create additional progress alternatives. The corporate presently serves all telecom suppliers throughout India and has a presence in all 22 telecom circles nationwide. With an industry-leading tenancy ratio of 1.65x, Indus stays a dominant drive within the sector. The corporate can also be constantly reaching secure monetary efficiency underpinned by strong tower and co-location additions. Throughout Q3FY25, it added 4,985 macro towers and seven,583 macro co-locations.

- Development methods – The corporate has collected vital overdue from VIL. It has additionally secured a major share of the roll out by VIL. The corporate can also be specializing in optimising its energy and gas price (which is a serious contributor of the corporate’s working expense) by means of reducing diesel price and growing using photo voltaic power. The corporate’s photo voltaic websites presently stand at 28,000 which was 25,000 throughout the earlier quarter. It has additionally entered into an influence buy settlement with a strategic companion for procurement of renewable power of 130 MW photo voltaic plant by way of a 26% acquisition of stake at a consideration of Rs.38 crore. It is usually transitioning its battery portfolio to lithium-ion batteries which has decrease charging time and an extended life. The corporate is pivoting in direction of an elevated share of lighter tower variant. These strategic initiatives are anticipated to enhance working and value efficiencies. The corporate plans to foray into the EV charging infrastructure sector and has launched its pilot companies within the enterprise hub of Gurugram and the southern metropolis of Bengaluru.

- Q3FY25 – Throughout the quarter, the corporate generated income of Rs.7,547 crore, a rise of 5% in comparison with the Rs.7,199 crore of Q3FY24. Working revenue elevated from Rs.3,622 crore of Q3FY24 to Rs.6,997 crore of Q3FY25, a progress of 93%. The corporate reported internet revenue of Rs.4,003 crore, a rise by 160% YoY. The income had been influenced by the gathering of overdues and assortment of Rs.19.1 billion from monetization of the secondary pledge on shares by VIL within the firm. Adjusting to this, EBITDA and internet revenue has improved by 8% every throughout the quarter.

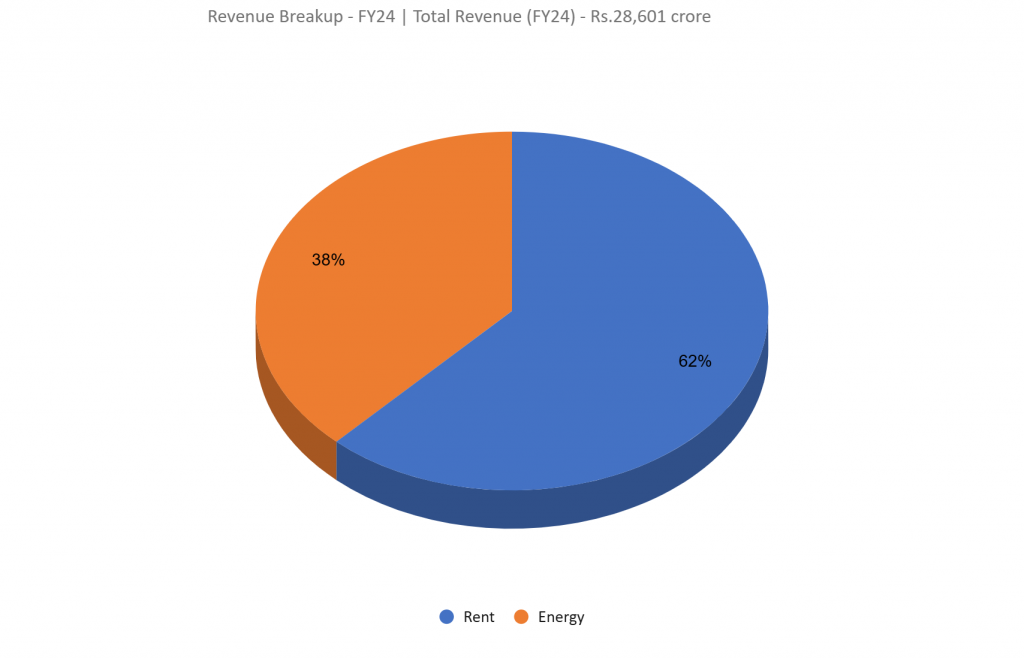

- FY24 – Throughout the FY, the corporate’s income was flat at Rs.28,601 crore. Working revenue was at Rs.14,694 crore, up by 50% YoY. The corporate reported internet revenue of Rs.6,036 crore, a rise of 196% YoY. Throughout the monetary yr, the corporate crossed 2 lakh towers in its portfolio.

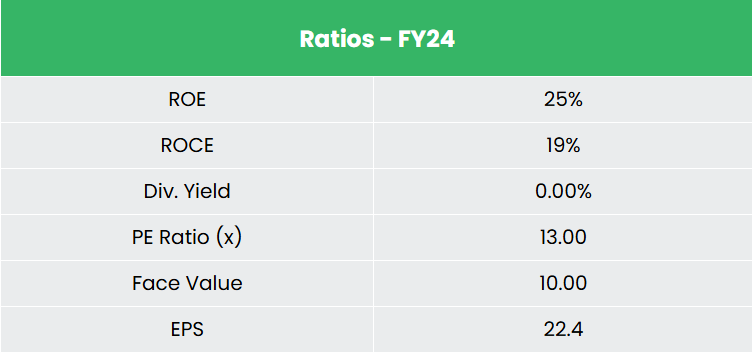

- Monetary efficiency – The corporate has generated income and internet revenue CAGR of 27% and 17% over the interval of three years (FY21-24). Common 3-year ROE & ROCE is round 22% and 19% for FY21-24 interval. The corporate has a strong capital construction with a debt-to-equity ratio of 0.75.

Business

The telecommunications {industry} in India is among the fastest-growing sectors and a serious contributor to employment, rating among the many high 5 job turbines within the nation. Inexpensive tariffs, roll-out of Cellular Quantity Portability (MNP), evolving consumption patterns of subscribers, authorities’s initiatives in direction of digitization are bolstering India’s home telecom manufacturing capability, and a conducive regulatory atmosphere lays robust basis for exponential progress within the {industry}. As of Could 2024, India is the second-largest telecommunications market globally, with a complete of 1,203.69 million phone subscribers. Nevertheless, rural tele-density stands at simply 59.59%, presenting a major progress alternative on this underserved space. Moreover, India is already laying the groundwork for 6G by investing within the know-how’s growth.

Development Drivers

- In Union Funds 2024-25, the Division of Telecommunications and IT was allotted Rs.116,342 crore (US$ 13.98 billion).

- Authorities initiatives reminiscent of 100% FDI allowed beneath the automated route, PLI for Telecom and Networking gear, Digital Bharat Nidhi Fund, lowered license charges, and spectrum liberalization.

- Rising inhabitants and a quickly growing web penetration price with is predicted to drive the demand for telecom companies.

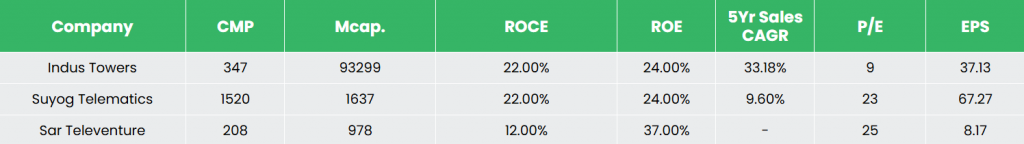

Peer Evaluation

Opponents: Suyog Telematics Ltd, Sar Televenture Ltd and many others.

In comparison with the above rivals, Indus Towers stands out as probably the most undervalued inventory on this section. The corporate is constantly translating its regular progress in gross sales into increasing margins and earnings.

Outlook

The corporate’s 4 strategic priorities are: a) growing market share, b) bettering price effectivity by optimizing diesel utilization, c) guaranteeing community uptime, and d) selling sustainability. Throughout the previous yr, the widespread rollout of 5G companies by operators has pushed greater income streams and fuelled robust progress for the corporate. Components that would drive progress embrace large-scale nationwide operations in an {industry} with vital entry boundaries, the growing potential for information consumption and the rise in information customers/gadgets, a powerful presence throughout all telecommunications circles, and long-term contracts with shoppers.

Valuation

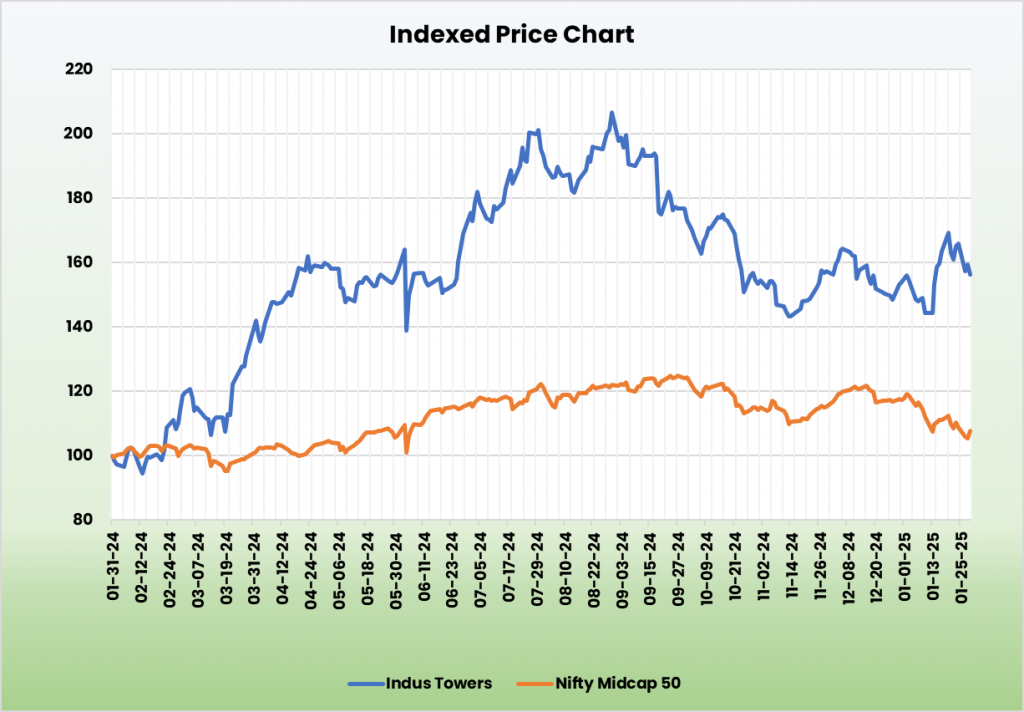

The demand for telecom infrastructure is predicted to remain robust, pushed by excessive information consumption, fast 5G rollouts, and the present community hole in 4G companies. We imagine Indus Towers Ltd. is well-positioned to make the most of these tendencies. We advocate a BUY score within the inventory with the goal value (TP) of Rs. 413, 16x FY26E EPS.

Danger

- Monetary stability of TSPs – The rising investments in 5G rollout, together with different companies and spectrum acquisitions, are placing strain on TSPs’ financials. This might probably have an effect on their skill to make funds to Indus Towers, which could, in flip, impression the corporate’s monetary efficiency.

- Unfavourable phrases for contract renewal – Any unfavourable modifications to the contract phrases with the consumer, reminiscent of decrease pricing or annual value escalations when renewing leasing agreements, pose a danger to the corporate.

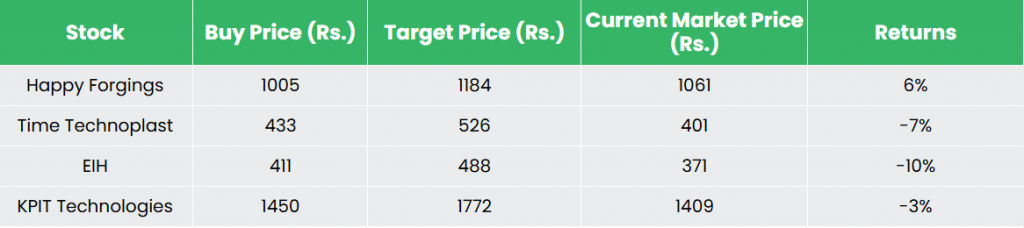

Recap of our earlier suggestions (As on 31 January 2025)

Comfortable Forgings Ltd

Time Technoplast Ltd

EIH Ltd

KPIT Applied sciences Ltd

Disclaimer: Investments within the securities market are topic to market dangers, learn all associated paperwork rigorously earlier than investing. Securities quoted listed here are exemplary, not recommendatory. Please seek the advice of your monetary advisor earlier than investing. Please be aware that we don’t assure any assured returns for the securities quoted right here.

Analysis disclaimer: Funding within the securities market is topic to market dangers. Learn all of the associated paperwork rigorously earlier than investing. Registration granted by SEBI, and certification from NISM under no circumstances assure the efficiency of the middleman or present any assurance of returns to traders.

For extra particulars, please learn the disclaimer.

Different articles you might like

Put up Views:

61