Imply reversion is a monetary principle suggesting that asset costs and historic returns ultimately revert to their long-term imply. This weblog explores how imply reversion works in buying and selling, its significance, and numerous methods for its implementation. We are going to talk about frequent indicators, danger administration methods, and real-life examples of imply reversion buying and selling methods.

Whether or not you’re a novice or an skilled dealer, this complete information on imply reversion methods presents invaluable insights and sources.

This weblog covers:

Introduction to imply reversion

The speculation of imply reversion implies that markets are inclined to overreact to information and occasions, inflicting costs to maneuver away from their historic imply. Over time, nevertheless, costs right themselves and transfer again towards the common imply. This phenomenon is usually noticed in time sequence knowledge through which the long run path of the sequence is influenced by its deviation from the historic imply. This idea of buying and selling is popularly often called the monetary time sequence evaluation through which the evaluation of the time sequence knowledge may help with seasonal buying and selling (event-driven) and volatility buying and selling.

In sensible functions, imply reversion is a well-liked technique in algorithmic buying and selling. Merchants could purchase undervalued belongings, anticipating they may revert as much as the imply, and promote overvalued belongings, anticipating a reversion all the way down to the imply. Imply reversion can support in danger administration by serving to establish when an asset is probably going overbought or oversold. This may inform higher decision-making in buying and selling and funding methods.

Allow us to now see the significance of imply reversion in buying and selling for a greater understanding.

Significance of imply reversion in buying and selling

Imply reversion is a major idea in buying and selling for a number of causes as talked about under:

- Exploiting Market Inefficiencies: Markets usually overreact to information and occasions, inflicting costs to deviate from their intrinsic values. Imply reversion methods goal to use these inefficiencies by shopping for undervalued belongings and promoting overvalued ones, thus capitalising on momentary mispricings.

- Danger Administration: Imply reversion helps in managing danger by figuring out excessive worth actions. By recognising overbought or oversold circumstances, merchants can keep away from coming into positions at unsustainable ranges and may set simpler stop-loss orders to restrict potential losses.

- Versatility Throughout Belongings: Imply reversion methods could be utilized to varied asset lessons, together with shares, commodities, currencies, and bonds. This versatility permits merchants to make use of a constant method throughout completely different markets, enhancing their total buying and selling technique.

- Basis for Quantitative Methods: Many quantitative buying and selling methods are constructed on the precept of imply reversion. It serves as a basis for extra complicated fashions, reminiscent of statistical arbitrage and pairs buying and selling, which depend on the idea that associated belongings will revert to their historic common costs or spreads.

- Extra Buying and selling Alternatives: Imply reversion methods usually contain making the most of short-term worth fluctuations, which might result in extra frequent buying and selling alternatives and incremental features.

- Diversification Advantages: Imply reversion methods can complement different buying and selling approaches, reminiscent of pattern following or momentum buying and selling. This diversification helps in balancing the portfolio, as imply reversion methods sometimes carry out effectively in range-bound markets, whereas trend-following methods excel in trending markets.

- Improved Choice-Making: Imply reversion supplies clear standards for commerce entries and exits. This structured method may help merchants make extra goal selections, lowering the affect of cognitive biases and emotional reactions to market actions.

- Adaptability to Totally different Timeframes: Imply reversion could be utilized to varied timeframes, from intraday buying and selling to long-term investments. This adaptability makes it a invaluable device for merchants and buyers with completely different time horizons and targets.

Allow us to now transfer to the working of imply reversion in buying and selling.

How does imply reversion work in buying and selling?

Imply reversion in buying and selling works on the precept that asset costs fluctuate round their historic common, and when costs deviate considerably from this common, they’re prone to revert.

This is a breakdown of how imply reversion operates in buying and selling:

Step 1 – Figuring out the Imply

Step one in imply reversion buying and selling is figuring out the historic common or imply worth of an asset. This may be executed utilizing numerous statistical measures Exponential Shifting Common (EMA), Weighted Shifting Common (WMA), and Easy Shifting Common (SMA).

Step 2 – Detecting Deviations

As soon as the imply is established, merchants search for vital deviations from this imply. These deviations point out potential buying and selling alternatives reminiscent of overbought and oversold circumstances.

Step 3 – Buying and selling Indicators

Imply reversion methods generate buying and selling alerts based mostly on these deviations:

- Purchase Sign: Generated when the value falls under the imply (oversold situation). The expectation is that the value will rise again to the imply.

- Promote Sign: Generated when the value rises above the imply (overbought situation). The expectation is that the value will fall again to the imply.

Step 4 – Execution of Trades

After figuring out buying and selling alerts, merchants execute their trades:

- Entry Level: A commerce is entered when the asset’s worth deviates considerably from the imply. For instance, shopping for when the value is under the imply and promoting when it’s above.

- Exit Level: The commerce is exited when the value reverts to the imply or reaches a predetermined stage that signifies the reversion has occurred.

Subsequent, we are going to talk about the frequent indicators utilized in imply reversion buying and selling.

Frequent indicators utilized in imply reversion

Merchants use numerous instruments and indicators to implement imply reversion methods successfully:

- Bollinger Bands: Bands plotted round a shifting common that expands and contracts based mostly on volatility. When costs transfer outdoors these bands, it alerts overbought or oversold circumstances.

- Relative Power Index (RSI): Measures the velocity and alter of worth actions. RSI values above 70 point out overbought circumstances, whereas values under 30 point out oversold circumstances.

- Shifting Common Convergence Divergence (MACD): Exhibits the connection between two shifting averages of costs, indicating potential purchase and promote alerts when the strains cross.

Subsequent, we are going to talk about the methods for imply reversion and the implementation of the identical within the buying and selling area.

Methods for imply reversion in buying and selling

By understanding and implementing imply reversion methods in quantitative buying and selling, merchants can doubtlessly exploit momentary worth deviations and improve their buying and selling efficiency.

Listed here are a number of frequent methods for imply reversion utilized by merchants:

- Shifting Common (SMA) Crossover Technique: This technique entails evaluating short-term and long-term SMAs. When the short-term SMA crosses above the long-term SMA, it alerts a possible shopping for alternative, anticipating that the value will revert upwards. Conversely, when the short-term SMA crosses under the long-term SMA, it alerts a promoting alternative.

- Bollinger Bands: Bollinger Bands include a shifting common and two customary deviation strains. When the value strikes outdoors the bands, it signifies an overbought or oversold situation. Merchants should purchase when the value falls under the decrease band and promote when it rises above the higher band, anticipating a reversion to the imply.

- Relative Power Index (RSI): The RSI measures the velocity and alter of worth actions. An RSI above 70 signifies an overbought situation, whereas an RSI under 30 signifies an oversold situation. Merchants use these alerts to anticipate imply reversion by promoting overbought belongings and shopping for oversold belongings.

- Pairs Buying and selling: This entails buying and selling two correlated belongings. When the value of 1 asset deviates considerably from its pair, merchants can quick the overperforming asset and purchase the underperforming asset, anticipating their costs to converge once more.

- Statistical Arbitrage: This technique entails utilizing statistical fashions to establish worth deviations between associated belongings. Merchants exploit these deviations by taking lengthy and quick positions, anticipating the costs to revert to their historic relationship. It is likely one of the fashionable varieties of buying and selling methods in quantitative buying and selling.

Going forward, we are going to see an instance of the imply reversion technique with Python.

Instance of a imply reversion buying and selling technique with Python

Right here, we are going to use Cointegrated Portfolio Buying and selling for instance, which is part of statistical arbitrage. In this kind of buying and selling technique, buying and selling alerts rely upon two or extra cointegrated devices. Pairs buying and selling is likely one of the most well-known examples of a cointegrated buying and selling fashion. Since we’re utilizing two cointegrated devices to make a commerce, subsequently the title pairs buying and selling!

However it’s not all the time a pair, it is also triplets or may very well be greater than that. For those who discover 5 cointegrated shares, you can also make a portfolio of that and do the buying and selling. The cointegration check could be performed with the Augmented Dickey Fuller Check. This part of the instance will deal with the ideas of pairs buying and selling and a buying and selling technique based mostly on that.

To study extra about Imply Reversion Buying and selling Methods utilizing market knowledge and statistical ideas, under is a quick video.

Listed here are the ideas we are going to cowl on this instance:

- Precept of Pairs Buying and selling

- Correlation vs Cointegration

- Collection of Pairs

- Pairs Buying and selling in Python

Precept of Pairs Buying and selling

Let’s say you might have a pair of devices with comparable fundamentals, belonging to the identical sectors and comparable financial hyperlinks. For instance, shares like Google and Microsoft or Fb and Twitter. Since they’ve comparable fundamentals, you anticipate each shares to behave equally. You additionally anticipate the ratio or unfold of such shares to stay fixed with time. Nonetheless, resulting from a brief change within the demand and provide and different elements, there is likely to be a divergence within the unfold between the pairs.

In such situations, one safety outperforms the opposite. In accordance with the imply reversion precept, you anticipate this divergence to revert to regular with time. In such situations, when there’s a temporal divergence, you possibly can carry out the pairs commerce. That’s shopping for the underperforming safety and promoting the outperforming safety.

Under is a brief, instructional video that explains the basics of pairs buying and selling technique in about 3 minutes.

Correlation vs Cointegration

The general public are confused between correlation and cointegration, they usually usually assume they’re the identical. However that’s not the case. When two worth sequence transfer in the identical or wrong way, then there’s some correlation between the value sequence. If one worth sequence strikes in both up or down route and different worth sequence additionally transfer in the identical route, there’s a optimistic correlation between them.

Whereas one worth sequence strikes within the upward or downward route, the opposite strikes reverse to that, then each sequence are negatively correlated.

Cointegration is a statistical property of two or extra worth sequence that signifies if a linear mixture of the sequence is stationary, then each sequence are cointegrated with one another.

In different phrases, cointegration implies attempting to determine whether or not two or extra worth sequence transfer collectively or not in such a approach that their mixed actions stay steady over time. If this mixed sequence is steady, the unique sequence is taken into account cointegrated and can be utilized for pair buying and selling.

For instance, if the linear mixture of two shares is stationary, each shares are cointegrated with one another. A worth sequence is alleged to be stationary if its imply and variance are fixed over time.

Statistical check for cointegration: Augmented dickey fuller or ADF check is likely one of the statistical checks for cointegration. In Python, this may be simply executed via the statsmodels library of Python.

As defined within the precept of pairs buying and selling, the unfold between shares should converge to the imply over time for pairs buying and selling to work. That’s, each shares have to be cointegrated with one another.

Simply trying on the correlation between the shares may offer you spurious outcomes as a result of the costs of the 2 shares could carry on rising with out ever mean-reverting. It’s a false impression that the 2 correlated devices have to be cointegrated and vice versa.

Collection of Pairs

- Find out how to choose inventory pairs?

Suppose you might have a big universe of shares. Step one is to segregate shares based mostly on market capitalisation, sector, day by day traded quantity and so on. After segregating, you possibly can test for a correlation between the securities in every group. The correlation helps to filter the variety of pairs to a extra manageable set. When you get the securities in a small set of teams, you possibly can test for cointegrated pairs inside the group and choose the cointegrated pairs. - Find out how to choose foreign exchange pairs?

The essential thought behind deciding on pairs in foreign exchange is much like that of shares. We have to discover nations which have comparable financial fundamentals.. - Find out how to choose pairs within the futures market?

Within the futures market, there aren’t many good pairs, even with comparable financial publicity. This can be resulting from variations in demand and provide. Subsequently, within the futures, you possibly can’t merely depend on financial publicity for selecting pairs.

Pairs Buying and selling in Python

Steps to implement pairs buying and selling in Python

- Step 1 – Choose foreign exchange pairs

- Step 2 – Calculate the ratio and test for cointegration

- Step 3 – Create function to generate buying and selling alerts

- Step 4 – Outline entry and exit level

- Step 5 – Calculate cumulative returns

Step 1 – Choose foreign exchange pairs

As mentioned above, we choose pairs having comparable financial fundamentals.

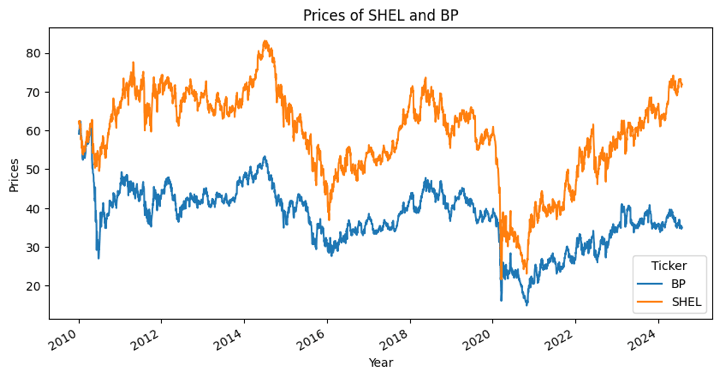

Output:

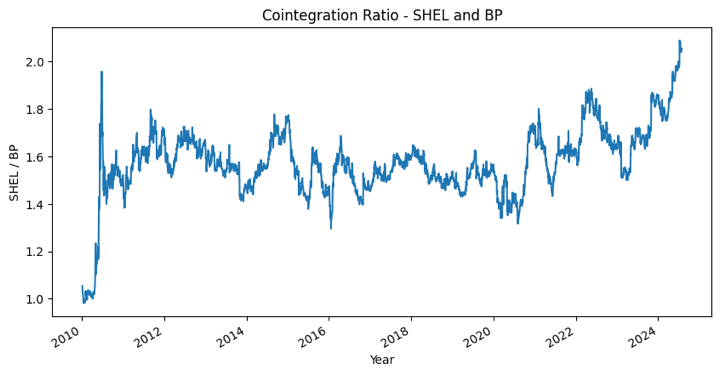

Step 2 – Calculate the ratio and test for cointegration

We calculate the ratio between the foreign money pairs. If the ratio is stationary, then we are able to say that the foreign money pairs are cointegrated. We’re utilizing an ADF check to test whether or not the ratio is stationary or not. One factor to recollect whereas utilizing the ADF check is that the check outcome modifications by altering the order of the ratio.

Output:

The sequence is stationary p-value = 0.0032407953901051174

The p-value from the ADF check for the SHEL/BP ratio is lower than the 0.05 significance stage. Subsequently we are able to say that the ratio is stationary.

Let’s check out the cointegrated ratio to ensure this is sensible with the code under.

Output:

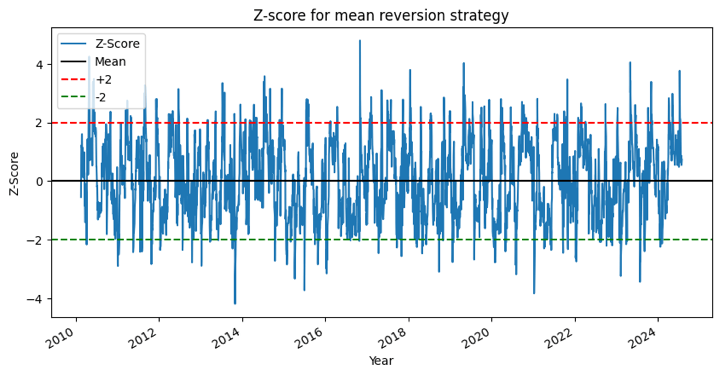

Step 3 – Create function to generate buying and selling alerts

Absolutely the ratio isn’t very helpful in statistical phrases. It may be noticed via the above ratio graph that it doesn’t appear like it strikes round a steady imply. We have to normalise the ratio. That is executed utilizing z-score.

Z rating is outlined as:

Z Rating = (Worth — Imply) / Commonplace

Output:

Now it’s simpler to look at that the ratio strikes across the imply, however generally it diverges from the imply, which we are able to make the most of.

Step 4 – Outline entry and exit factors

If the z rating crosses under the decrease threshold, then we purchase and exit the place when it reaches the imply. If the z rating crosses above the higher threshold, then we promote and exit the place when it reaches the imply.

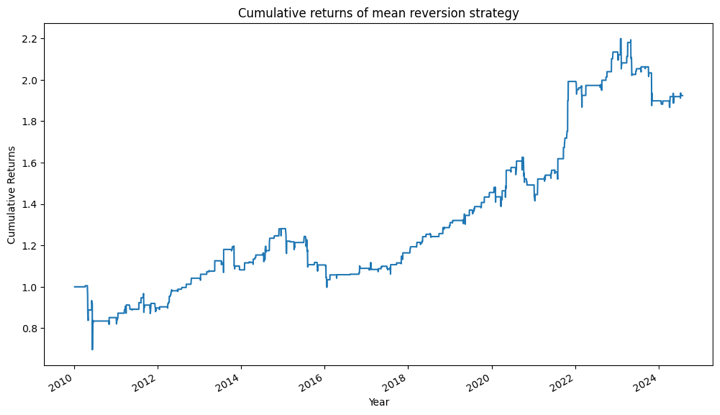

Step 5 – Calculate Cumulative returns

Output:

Additional Enhancements

The technique could be additional optimised utilizing completely different values of the lookback interval of the shifting common and customary deviation.

Options to generate buying and selling alerts

The function that we used to outline the entry and exit place is the z-score. You should utilize a unique variant of the z-score reminiscent of:

z rating: (15-day shifting common — 50-day shifting common) / 50-day customary deviation

One other method is to make use of the Bollinger Band for sign technology.

Cease loss

You possibly can set the cease loss above and under your threshold stage.

For instance, within the above technique, the set threshold was plus/minus 2 customary deviations. You possibly can set the cease loss at plus/minus 3 customary deviations. When the ratio/unfold crosses that threshold, you possibly can exit the place. One other method is to exit the place when a prefixed loss is hit.

Holding Interval

You possibly can maintain the place for a day, week or month and exit after that. How lengthy you possibly can maintain the place could be discovered utilizing an idea often called the half-life. It tells how lengthy it will take the time sequence to revert to the imply. It provides an thought of the anticipated holding interval for a specific commerce.

Whenever you exit the place based mostly on time, you’ll look ahead to the value to revert to imply to provoke new positions.

Under is the video that discusses Imply Reversion and Z-score, imply reversion ideas which means that costs have a tendency to maneuver across the historic imply over time. Additionally, it mentions that the z-scores can be utilized to establish the deviation from the imply and generate the suitable buying and selling alerts.

Conclusion

Imply reversion methods supply invaluable insights and methods for merchants searching for to capitalise on market inefficiencies. By understanding the basics of imply reversion, merchants can develop and implement efficient methods that exploit momentary deviations from the historic imply.

This complete information covers important elements reminiscent of figuring out imply reversion alternatives, utilizing frequent indicators, and making use of numerous methods, together with pairs buying and selling and statistical arbitrage.

Moreover, danger administration practices tailor-made to imply reversion buying and selling, reminiscent of place sizing, stop-loss orders, diversification, and volatility evaluation, are essential for optimising efficiency and mitigating potential losses. Whether or not you are a novice or an skilled dealer, mastering imply reversion methods can improve your buying and selling self-discipline, and enhance decision-making.

The course on Imply Reversion Methods, authored by Dr. Ernest P Chan (Managing member of QTS Capital Administration, LLC.)., covers the subject intimately as it’s devised that will help you establish buying and selling alternatives based mostly on Imply Reversion principle. After studying from this course, you possibly can create completely different imply reversion methods reminiscent of Index Arbitrage and long-short portfolios utilizing market knowledge and superior statistical ideas.

File within the obtain

- Imply reversion methods in buying and selling – Python pocket book

Writer: Chainika Thakar (Initially written by Vibhu Singh)

Be aware: The unique put up has been revamped on 26th August 2024 for recentness, and accuracy.

Disclaimer: All knowledge and knowledge supplied on this article are for informational functions solely. QuantInsti® makes no representations as to accuracy, completeness, currentness, suitability, or validity of any info on this article and won’t be accountable for any errors, omissions, or delays on this info or any losses, accidents, or damages arising from its show or use. All info is supplied on an as-is foundation.