Final Up to date on Jun 5, 2025 by Aishika Banerjee

Shopping for low and promoting excessive is taken into account the final word mantra for fulfillment in inventory market investments. Everybody needs to catch a inventory when it’s bottoming out and promote it after it has scaled lofty heights. However how does one determine shares which might be undervalued? Or how do you choose if a inventory is reasonable or costly? On this article, let’s perceive methods to determine undervalued shares utilizing Tickertape.

What are Undervalued Shares?

Fairness shares with a decrease market worth than their intrinsic or true worth are referred to as undervalued shares. There may be many causes behind this, starting from sector-specific to market slowdown. The method of investing in undervalued shares is named worth investing. This methodology is a key element of famed investor Warren Buffet’s funding technique.

The best way to Analyse a Inventory?

The inventory market values corporations based mostly on their fundamentals, previous monetary efficiency, future earnings development potential, and different metrics. The intrinsic worth of a inventory is calculated by taking a look at all these elements. A mixture of quantitative and qualitative evaluation is used to find out the intrinsic worth of a inventory.

The best way to Discover Undervalued Shares?

Listed here are some methods you should utilize to find out if a inventory is undervalued.

Analyse monetary statements

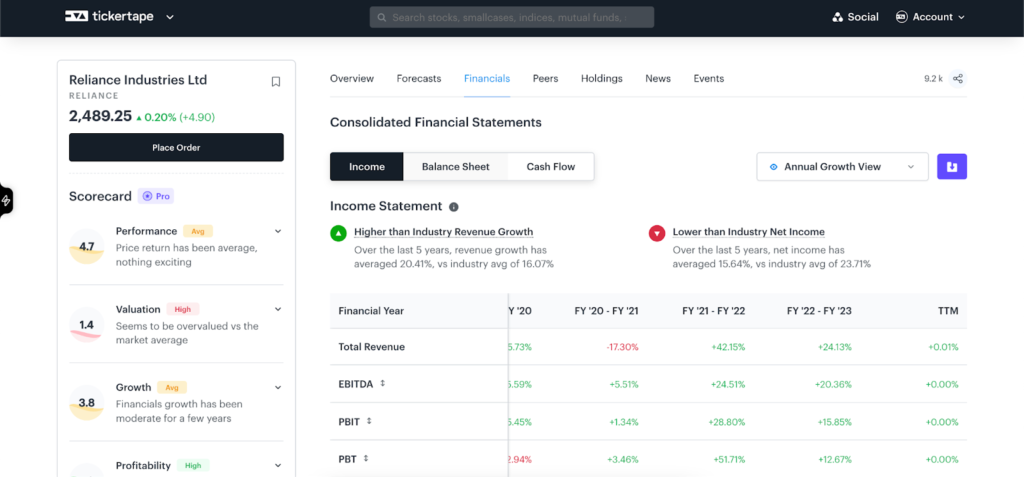

There are three essential statements that each investor ought to concentrate on when deciding on undervalued shares india. The excellent news is you possibly can examine all of them underneath one part on Tickertape. Extra on that later; let’s first perceive the three essential statements.

The steadiness sheet of an organization lists its property and liabilities. This strategy helps an investor decide whether or not a inventory is undervalued by taking into consideration the scale and exercise of the asset and legal responsibility aspect of the steadiness sheet.

A look at an organization’s money stream will let you know precisely how a lot income a enterprise generates from operations in comparison with the expenditure. By taking into consideration the money stream from operations and investing actions, an investor can decide whether or not a inventory is undervalued or not.

An organization’s revenue and loss assertion supplies perception into its monetary efficiency over a given interval. By taking into consideration income, working bills, and web revenue margin, an investor can decide whether or not a inventory is undervalued or not. If the working margin and the online revenue margin are wholesome and the inventory valuation just isn’t in accordance, then it may be thought-about undervalued.

You’ll be able to assess an organization’s profitability, liquidity, debt ranges, and total monetary stability. This evaluation helps determine undervalued large-cap shares and undervalued small-cap shares by evaluating the corporate’s monetary metrics to its market worth. By figuring out discrepancies between an organization’s intrinsic worth and its present market value, traders can uncover alternatives to put money into shares that could be undervalued and have the potential for future development.

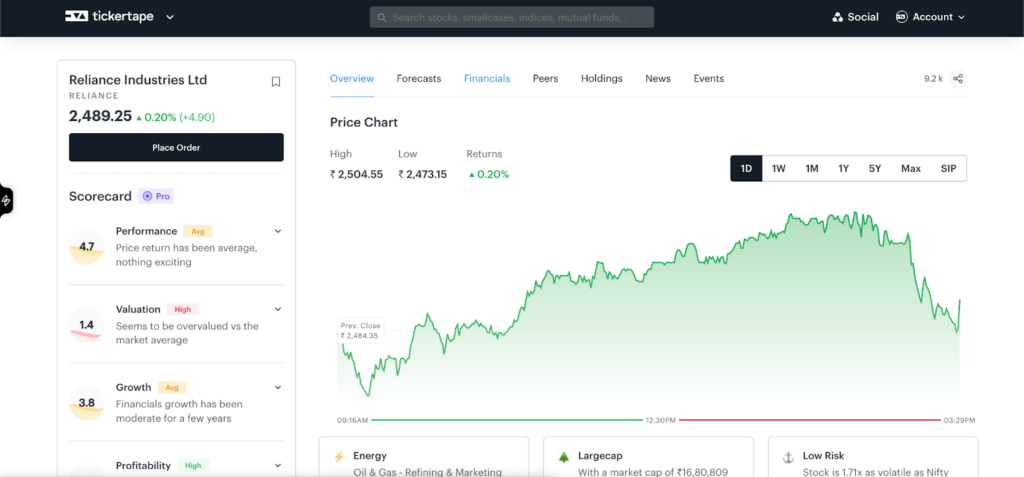

To get all these statements on Tickertape, comply with the below-mentioned steps.Step 1: Seek for any firm on Tickertape.

For this instance, let’s seek for Reliance Industries Ltd.

Step 2: From the inventory ‘Overview’ web page, click on on ‘Financials’.

Step 3: There you go! You get all three essential statements underneath one umbrella.

Relative valuation

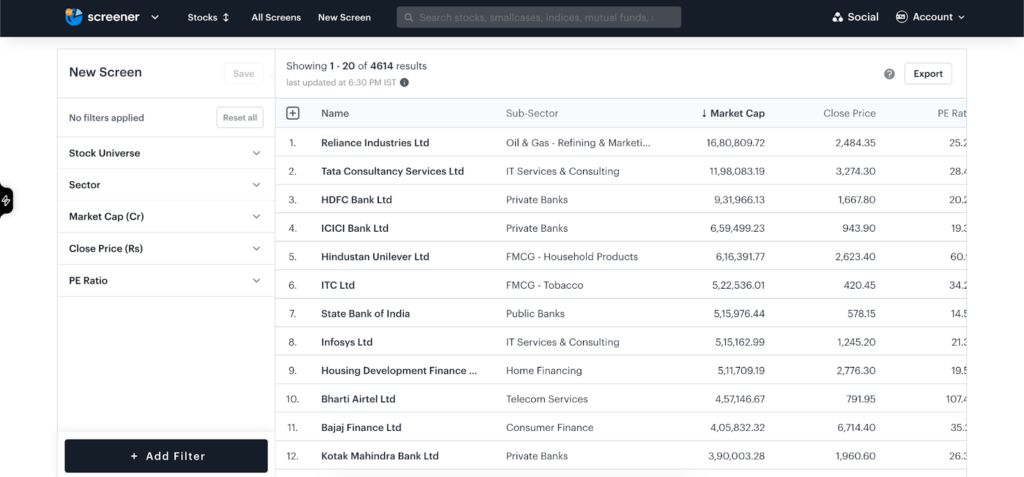

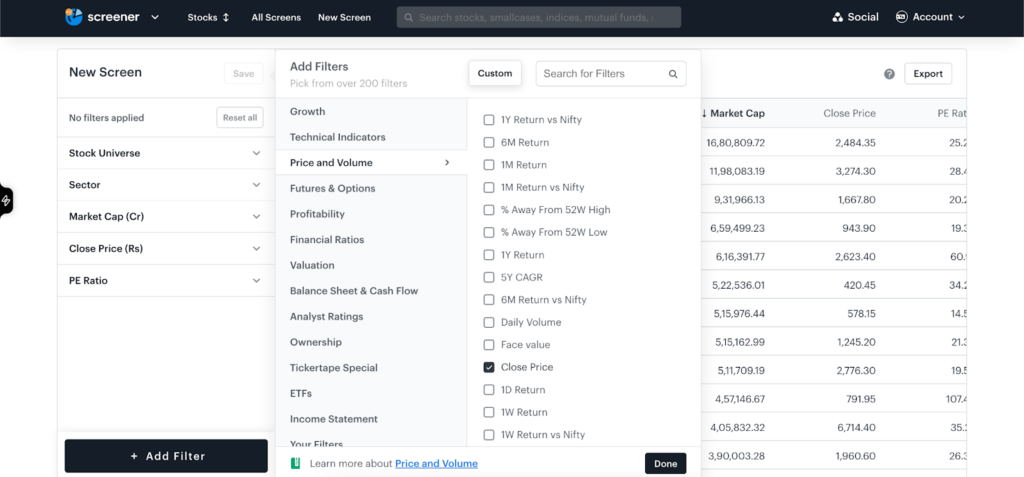

It is a qualitative valuation method the place corporations are in contrast towards their friends. It mainly follows figuring out a peer set after which utilizing applicable ratios and numerals to gauge the relative stand of the corporate out there. You will get all the knowledge you want on Tickertape Inventory Screener. Use over 200+ filters to get the checklist based mostly on metrics as per your choice. In case you possibly can’t discover a filter, you possibly can create one utilizing {custom} filters. For instance, if we want to determine undervalued inventory within the multiplex trade, we are able to use the price-to-sales ratio to see which firm is a greater performer. Observe the below-mentioned steps to create a {custom} filter.

Step 1: Go to Tickertape Inventory Screener.

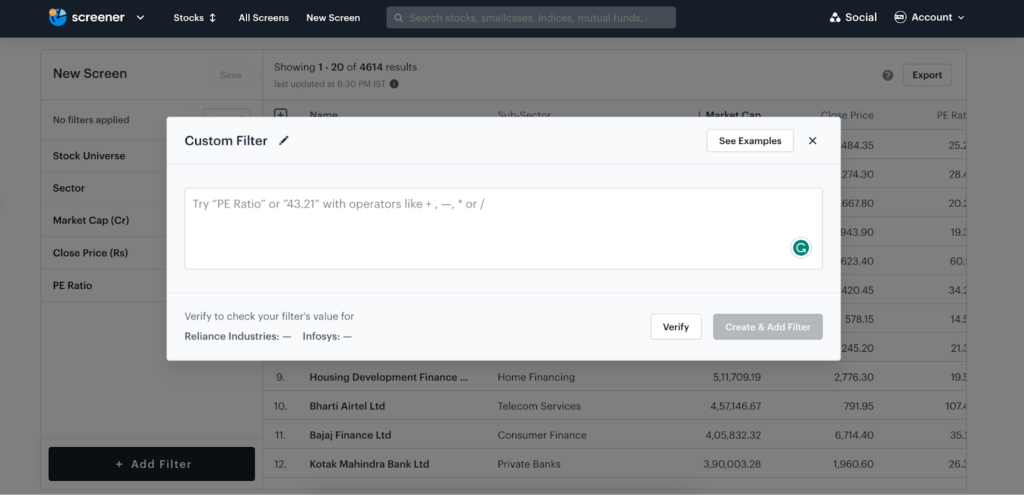

Step 2: Click on on ‘+Add Filter’ after which click on on ‘Customized’ on the high of all filters.

Step 3: A pop-up window will seem the place you possibly can put the method for creating your {custom} filter or use one from examples from ‘See Examples’.

There you go! Your {custom} filter is created and saved for future use. Utilizing the obtainable or custom-built filters, you possibly can checklist the shares under their intrinsic values and analyse them additional.

Analysis through monetary ratios

Monetary ratios are a superb and time-saving methodology of evaluating the worth of a inventory. It helps in firm evaluation, efficiency valuation, and predicting the inventory’s future. Most of those numbers are available and can be utilized to search out the true worth of a inventory. Earlier than we dive into how you should utilize Tickertape to determine shares under their intrinsic worth, let’s take a look at some essential monetary ratios.

- Value-to-Earnings Ratio (P/E)

The P/E ratio arguably is crucial monetary ratio to assist decide if a inventory is undervalued and even overvalued. It provides the value that traders are able to pay for every unit of revenue. It’s given by the method:

P/E ratio = Present Market Value/Earnings Per Share

If the P/E ratio of low P/E shares is lower than 15, then analysts normally contemplate the inventory undervalued. A decrease P/E ratio signifies that traders are keen to just accept a decrease return from the inventory in trade for holding on to it. A low P/E ratio might additionally point out the inventory is unpopular and but to be found by markets.

- Value-to-Guide Ratio (PB Ratio)

Traders look at this ratio to evaluate a agency’s market capitalisation in comparison with its e-book worth. It’s given by the method:

P/B Ratio = Market value per share/Guide worth per share

A decrease P/B ratio in low P/B ratio shares implies that the market is valuing an organization’s e-book worth decrease than its precise price, indicating that it may very well be undervalued. For operating corporations, the P/B ratio ought to by no means be under e-book worth.

The return on fairness ( ROE ) ratio is used to measure an organization’s profitability by revealing how a lot revenue it generates with the cash shareholders have invested in its inventory.

Return on fairness = Internet revenue/Common shareholder’s fairness

If an organization has a low P/B ratio clubbed with a excessive ROE, it normally is indicative of an undervalued inventory.

- Return on Capital Employed (ROCE)

The return on capital employed (ROCE) ratio is used to measure an organization’s efficiency by revealing how a lot revenue it generates from its complete property.

ROCE = EBIT/Capital employed

If ROCE is greater than the price of capital, then it normally is taken into account undervalued.

- Value to Free Money Circulation Ratio (P/FCF)

Free Money stream is the precise money that an organization has generated by its operations, stored as a reserve for future funding functions.

P/FCF = Share Value/Free money stream

Ideally, an organization with a strong money stream generates extra revenue receivable month on month than what it pays out. An upward development on this ratio signifies that an investor is paying a decrease price for an elevated incomes potential. The P/FCF can be utilized to measure undervaluation. If the ratio is lower than 10, it may be thought-about undervalued.

Tickertape inventory pages and Inventory Screener reveals you a deeper view of the inventory and an in depth comparability of its friends. With over 200+ filters, you possibly can improve your seek for undervalued or worth shares under their intrinsic worth. Listed under are steps to use filters to guage undervalued shares utilizing monetary ratios.

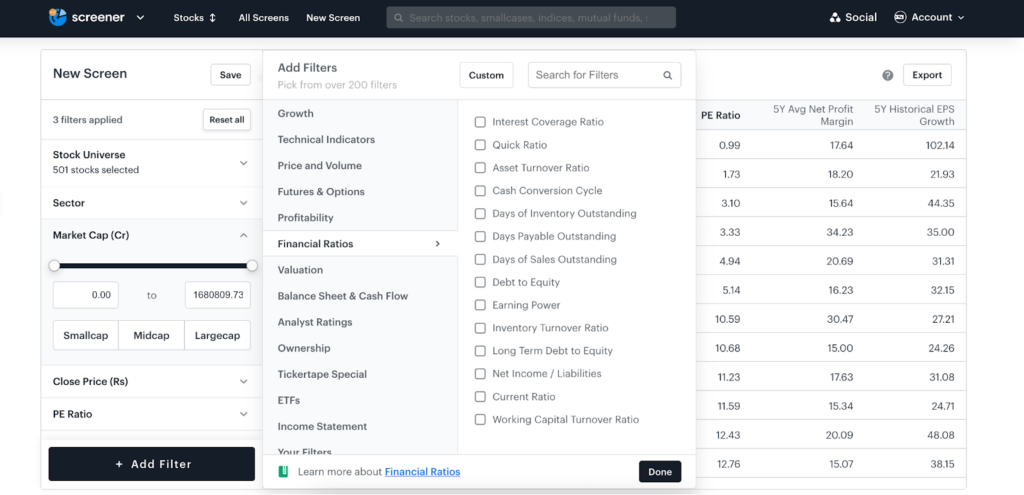

Step 1: Go to Tickertape Inventory Screener.

Step 2: Click on on ‘+ Add Filter’ and search for ‘Monetary Ratios’. You’ll be able to seek for the ratios which you’ll’t discover right here.

That’s it! In 2 easy steps, you will get an inventory of undervalued low-priced shares at Tickertape.

Discover Undervalued Shares Inside Minutes!

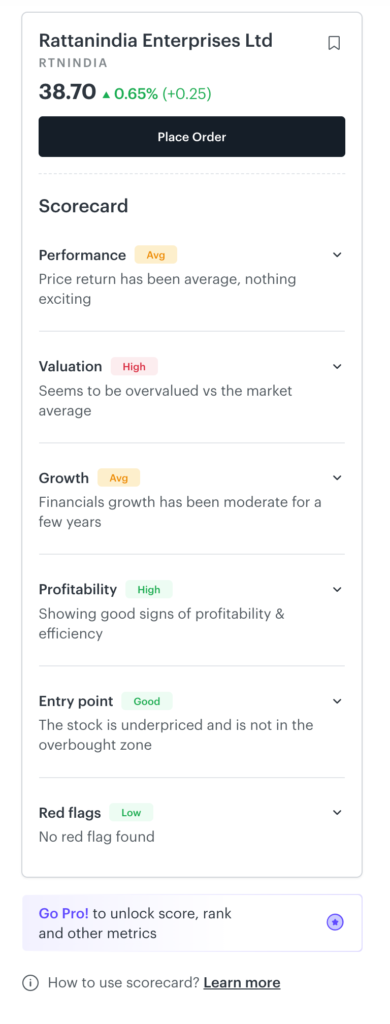

The method of screening and analysing shares buying and selling under intrinsic worth sounds time-consuming. As a substitute, you should utilize Tickertape Scorecard. It’s obtainable on each inventory web page, making your evaluation simple with quantitative scores. The Scorecard assigns scores or ranks to essential parameters you’d take a look at when evaluating a inventory. The scores are as follows:

- Efficiency and monetary rating: First 4 playing cards, particularly, Efficiency, Valuation, Development, and Profitability, summarise the efficiency and financials of the corporate with scores on a scale of 0 to 10.

The efficiency rating is calculated utilizing 1Y return, 5Y CAGR, and 1Y forecast. Whereas the valuation rating is calculated utilizing the PE ratio, PB ratio, and P/CFO. The expansion rating seems at 3-yr income development, 3-yr money stream development, and 3-yr earnings per share development, and the profitability rating considers return on fairness, web revenue margin, and money stream margin.

- Entry level based mostly on fundamentals and technicals: These playing cards assist consider if a inventory is price shopping for on the present value relative to its intrinsic worth and on the present value (based mostly on technical indicators).

- Pink flags: These are divided into 5 separate metrics to present you readability on what precisely the pink flags are. It’s a mixture of 5 gadgets: promoter pledged holding, Further Surveillance Measures (ASM) and Graded Surveillance Measure(GSM)* lists, chance of default, and unsolicited messages.

*ASM and GSM are security measures taken by the SEBI for the protection of the traders.

These scores give actionable data and mean you can make faster, data-backed conclusions on whether or not a inventory is sweet to put money into or not. Furthermore, these take the inventory’s friends into consideration, so you understand how a specific inventory is faring within the trade. So, what are you ready for? Analyse any inventory in underneath a couple of minutes utilizing Scorecard. Analyse now!

Issues to Maintain in Thoughts

Whereas all of the above-mentioned ratios and methods will help you choose undervalued shares, it is very important keep in mind that they aren’t the one criterion to contemplate when figuring out undervalued shares.

Inventory markets usually hold altering their temper and sentiments. If tomorrow the markets crash, you might discover most shares bottoming out. Now, this doesn’t imply that they’re undervalued or make for a great funding possibility. Equally, many undervalued shares for long-term funding might even see their fortunes rising in an upward development. This doesn’t imply that they’re overvalued.

The factor to recollect is that choosing a high quality inventory amidst market turmoils, which is widespread, may be difficult. A behavior of deeply studying annual stories and ratios will help you choose sensible undervalued development shares that are nonetheless not recognized. Additional, when making funding selections, it’s at all times sensible to not contemplate unreliable sources like on-line media and phrase of mouth as the first supply of data.

Inventory markets are all about timing. Multibagger shares may be a superb instance right here. To maintain monitor of market temper, use Tickertape’s Market Temper Index (MMI) to time your investments higher. It tracks the market sentiment – the angle of traders in the direction of the general inventory market or a selected inventory. The MMI displays the market’s temper when it comes to concern and greed. To study extra about it and how you can use it successfully, learn this text.

Conclusion

By utilising the above-mentioned ratios and methods, you possibly can determine undervalued shares with excessive potential and revenue by making strategic investments. There may be yet another fashionable method to determine shares under their intrinsic worth – Discounted Money Circulation (DCF). Right here, a inventory’s valuation is completed by estimating the longer term free money flows of an organization and discounting them again to current worth. If the value at which a share trades (out there) as we speak is decrease than the valuation arrived at, such a inventory may very well be thought-about undervalued. This methodology might fluctuate amongst analysts due to their various assumptions about future development charges, capital construction, and low cost charges.

You will get the information you want from Tickertape inventory pages and Inventory Screener. Nonetheless, take into account that it’s essential to speculate on the proper time. Following herd mentality might not show helpful and may usually be counterproductive. Therefore, do your personal analysis and seek the advice of your monetary advisor earlier than investing in any inventory or scheme.

Often Requested Questions About Undervalued Shares

1. The best way to decide if a inventory is undervalued or overvalued?

There are 4 methods to search out if a inventory is undervalued or overvalued:

Evaluation of the corporate’s monetary statements

Discounted money stream evaluation

Relative valuation

Monetary ratios

2. What are essentially the most undervalued shares in India?