Congrats! – Well being Insurance coverage simply acquired quite a bit higher

IRDA has just lately provide you with some main adjustments in medical insurance tips that are extraordinarily buyer pleasant. These adjustments will cut back lots of confusion that prospects used to face whereas shopping for medical insurance and also will assist in clean declare expertise.

These adjustments are actually good and it’s recommended that you have to be conscious of all of the adjustments you probably have a medical insurance coverage. It’s going to take a while to know these adjustments, however please learn this text totally.

In case you wish to pay attention, slightly than learn – here’s a 35 min video dialogue I did with Mahavir Chopra of Beshak.org who’s an knowledgeable on this topic and a very good buddy too. Whereas there are various large and small adjustments within the tips, the video talks in regards to the prime 10 adjustments which issues to you.

Change #1 – Customary definition of 18 exclusion

There are numerous exclusions in a medical insurance coverage and wordings for them differ from coverage to coverage. This confuses the policyholders whereas their decision-making course of. Now IRDA has standardized the definitions and wordings for all form of exclusions

One of many examples of that is the wordings for a pre-existing sickness, 30 day ready interval, maternity, weight problems, and plenty of extra. In varied insurance policies, the definition is completely different for these phrases and it leaves a gray space many occasions.

Now with the brand new rule, each coverage can have the identical wordings and definition of the exclusions together with a CODE for every exclusion.

Change #2 – No ambiguous wordings or definitions

Aside from this, IRDA has additionally stated that there shouldn’t be any ambiguity within the wordings which might create confusion sooner or later. For instance – “Weight problems just isn’t coated, and every other sickness which is derived out of weight problems can be not coated”.

Should you take a look at the instance above, how will an insurer and the coverage come to an settlement is one thing was due to weight problems or not? There could also be a disagreement sooner or later and corporations can deny the declare citing some unreasonable factor.

Now, this apply ends…

Change #3 – Many Exclusions are disallowed

Now many exclusions which had been a part of insurance policies earlier are disallowed, which implies that corporations must cowl them. A few of the examples are as follows.

- Therapy of psychological sickness

- Behavioral and Neurodevelopmental Issues

- Genetic illnesses or problems

- Puberty and Menopause Associated Issues

- Harm or sickness related to hazardous actions

So the protection of the medical insurance coverage widens now and it is possible for you to to get protection for a lot of extra issues. That is fantastic information as a result of psychological sickness or psychological associated hospitalization will now get coated which was an enormous requirement.

Try our youtube video on these 10 adjustments if you wish to take heed to the entire dialog

Try this video

Change #4 – The definition of “Pre-existing” illnesses is standardized

That is one space that was fairly complicated for patrons.

Until now, it was not very clear what precisely is a pre-existing sickness? So the onus was fully on the shopper to recollect his signs and return in previous to dig out all that had occurred. If he had forgotten something and it got here up later sooner or later which was not disclosed within the coverage, there was a very good probability of rejection of claims.

Now, the IRDA has made it clear {that a} pre-existing sickness is an sickness for which,

- A health care provider has suggested you a remedy

- Or Physician has identified a illness

Solely in these two circumstances, it will likely be handled as a pre-existing sickness, else not. Therefore, it has now change into a much-focused definition now which can take away all of the confusion.

So now simply because you’ve got some delicate signs or a sign of an sickness, doesn’t routinely change into a pre-existing sickness going ahead.

One other instance is let’s say you might be overweight and have had unhealthy consuming habits and you aren’t positive if you’re diabetic or not… On this case, lots of people surprise if the insurer can reject the claims sooner or later due to hospitalization as a consequence of diabetes.. however with new guidelines, until it was identified by the physician formally, it won’t be handled only a pre-existing sickness.

Change #5 – No declare rejection after 8 yrs. of premium cost

This can be a large aid to policyholders.

Now medical insurance corporations must settle all of the claims as soon as a coverage has been energetic for steady 8 yrs. In case you improve your sum assured in the identical coverage, one other 8 yrs. of moratorium interval will likely be relevant on the elevated restrict. Aside from this, the everlasting exclusions will at all times be excluded.

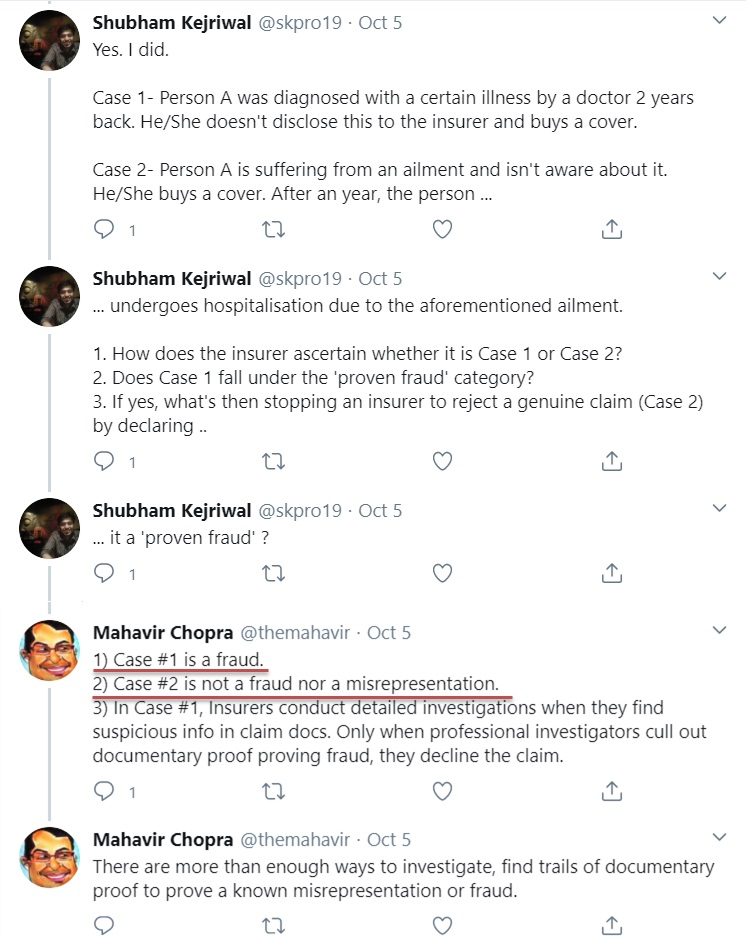

Solely in case of a Confirmed fraud, the rejection can occur after 8 yrs. Nonetheless, in case of a real declare, the policyholder doesn’t want to fret. Try the reply by Mahavir Chopra on twitter timeline to one of many individuals who requested a query on what’s a fraud and what’s not.

Change #6 – Folks with critical sicknesses to get cowl with everlasting exclusions

Lots of people who had some critical sicknesses like most cancers, epilepsy, Power Kidney illness, Alzheimer’s Illness had been denied any form of medical insurance. They weren’t even supplied cowl for different issues with this stuff put as everlasting exclusions.

Nonetheless, this has modified now.

IRDA has stated that now individuals with these sorts of sicknesses even have a proper for getting medical insurance for at the least different sicknesses. So medical insurance corporations will now have to offer them medical insurance for at the least the opposite illnesses with their pre-existing sicknesses as everlasting exclusions.

That is essential as a result of if somebody had Power Kidney illness, they will nonetheless be hospitalized as a consequence of a very completely different sickness like a mind sickness, psychological sickness, accident, or most cancers .. You’ll be able to’t simply fully reject them and deprive them of medical insurance.

This clause just isn’t relevant to way of life illnesses like diabetes, hypertension, and so forth. as a result of insurers can’t put everlasting exclusions on this stuff as they’ve virtually change into a part of our life as of late, and other people like their entire life with this stuff. Extra on this within the subsequent factors.

Change #7 – Trendy remedies to be coated in medical insurance

One other welcoming change is that some superior and fashionable remedies will now be compulsorily coated in medical insurance insurance policies. Here’s a full checklist of recent remedies which IRDA has specified

- Uterine Artery Embolization and HIFU

- Balloon Sinuplast

- Deep Mind stimulation

- Oral chemotherapy

- Immunotherapy- Monoclonal Antibody to be given as an injection

- Intra vitreal injections

- Robotic surgical procedures

- Stereotactic radio surgical procedures

- Bronchial Thermoplasty

- Vaporisation of the prostrate (Inexperienced laser remedy or holmium laser remedy)

- IONM – (Intra Operative Neuro Monitoring)

- Stem cell remedy

Lots of occasions, these superior remedies are suggested by medical doctors however these had been by no means coated by medical insurance insurance policies. Nonetheless, with this, you get entry to extra superior remedies going ahead.

Change #8 – Ready interval for specified sicknesses can’t be greater than 4 yrs.

So earlier there was readability on how a lot may be the ready interval for varied sicknesses like cataract, knee surgical procedure, and plenty of other forms of sicknesses. More often than not it was within the vary of 2-4 yrs. and a few older insurance policies might have greater than 4 yrs of ready interval.

However IRDA has now made it clear that in no case, it may be greater than 4 yrs. of ready interval.

Change #9 – Ready interval for way of life illnesses solely as much as 90 days

So the ready interval for way of life sicknesses like diabetes, hypertension, and Cardiac situations may be solely as much as 90 days and never past that. Until now the insurer used to maintain ready interval for these way of life illnesses as much as 2-4 yrs. These days these sicknesses are quite common and have change into a part of life in a approach.

That is good from the shopper’s perspective.

Nonetheless, notice that the ready interval of 90 days is just in case you don’t have these on the time of taking the coverage. In case you have already got them, then it’s labeled as “pre-existing sickness” in your case.

Additionally notice that you probably have just lately taken a medical insurance coverage, then on the time of subsequent renewal this 90 days ready interval will apply in your case and can get coated for you.

Change #10 – Pre and Publish hospitalization bills to be coated for domiciliary hospitalization

One other change is that now in case of domiciliary hospitalization (whenever you do the remedy at dwelling due to unavailability of hospital beds) the pre and post-hospitalization bills will even be coated which was not the case earlier.

To learn every part intimately, examine our IRDA round right here

Enhance in Premiums as a consequence of these adjustments

When one thing improves by an enormous margin, it’s virtually assured that its value will even rise in the identical style. The identical is the case right here. Due to all these new adjustments, the medical insurance insurance policies have gotten extra superior and significantly better & gives extra worth now.

So you may certainly anticipate that the premiums will rise sooner or later for these insurance policies

If you have already got the medical insurance coverage, you may anticipate the premiums to rise in your subsequent renewal. Nonetheless, it’s best to take it positively and never really feel unhealthy about it.

These adjustments have occurred on your profit and it’s you who will profit from it sooner or later. Well being Insurance coverage corporations are additionally certain to include these adjustments as an order from IRDA.

What’s your view about these adjustments? Do you are feeling it is going to assist prospects?

Do share your views within the feedback part!