Picture supply: Getty Photographs

Whereas looking for high-yield alternatives on the FTSE All-Share, I not too long ago recognized two low cost shares that look undervalued. For income-focused buyers, discovering corporations providing each sturdy dividends and modest valuations generally is a highly effective mixture.

I are likely to search for companies with low price-to-earnings (P/E) ratios, excessive dividend yields and stable free money move. These are sometimes indicators the market has ignored potential worth.

After some digging, two shares caught my consideration: MAN Group (LSE: EMG) and Worldwide Private Finance (LSE: IPF).

MAN Group

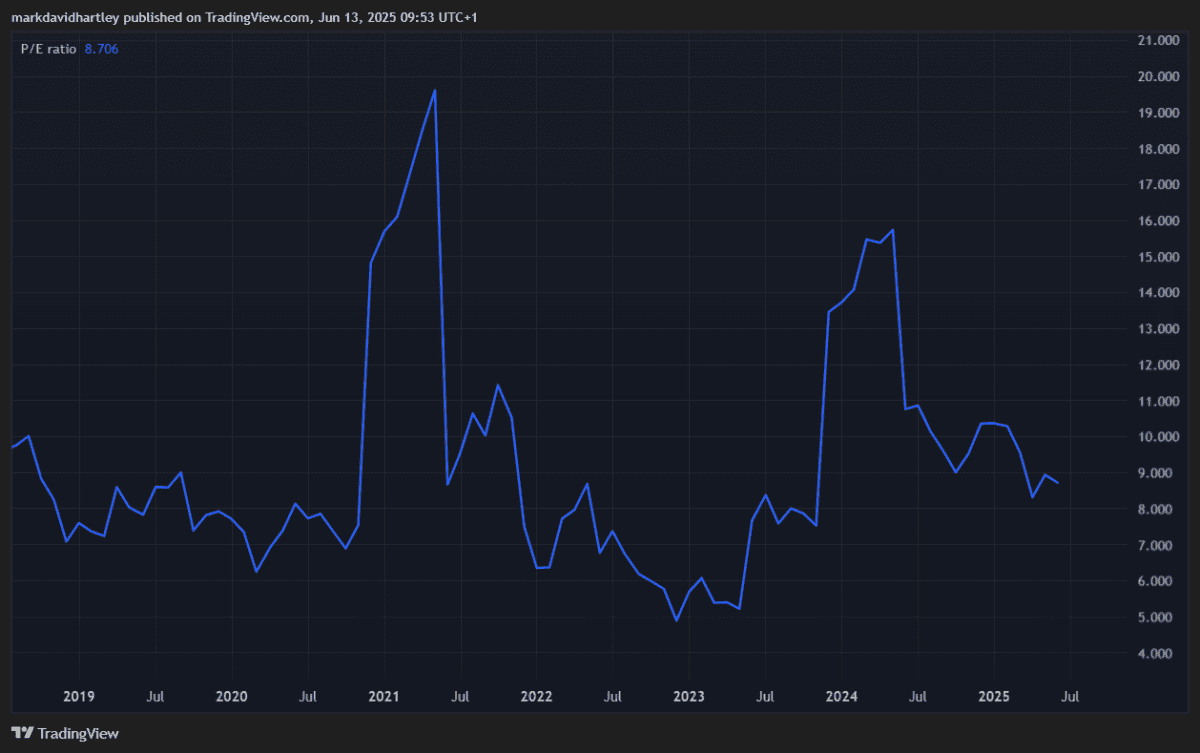

MAN Group’s one of many world’s largest publicly-listed hedge fund corporations with a £1.97bn market-cap and a protracted observe report in quantitative and different methods. The shares at present commerce for round £1.70 and have a P/E ratio of solely 8.7, which is low in comparison with the monetary sector common.

One of many main benefits right here is MAN’s capital-light enterprise mannequin. With comparatively low mounted prices and scalable operations, the corporate can preserve sturdy margins even throughout risky market situations. In reality, market volatility usually advantages the agency, because it drives increased efficiency and administration charges.

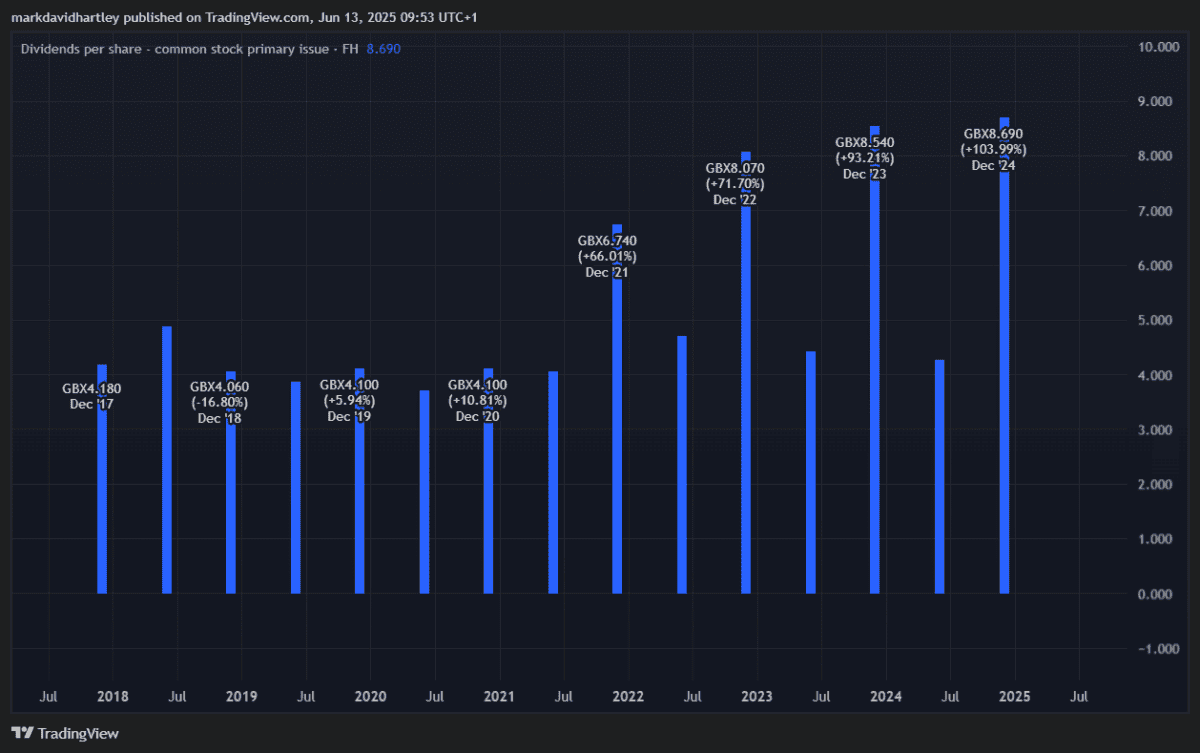

On prime of that, the 7.35% dividend yield seems enticing, particularly given the corporate’s historical past of particular dividends and share buybacks.

Nevertheless, there are dangers. The corporate’s income is intently tied to asset efficiency and investor sentiment. If markets flip bitter, efficiency charges can dry up rapidly. There’s additionally the macroeconomic angle – rising charges and geopolitical shocks may weigh on investor urge for food for hedge fund methods.

Nonetheless, for these in search of an affordable inventory with earnings potential, MAN Group appears price contemplating, for my part.

Worldwide Private Finance

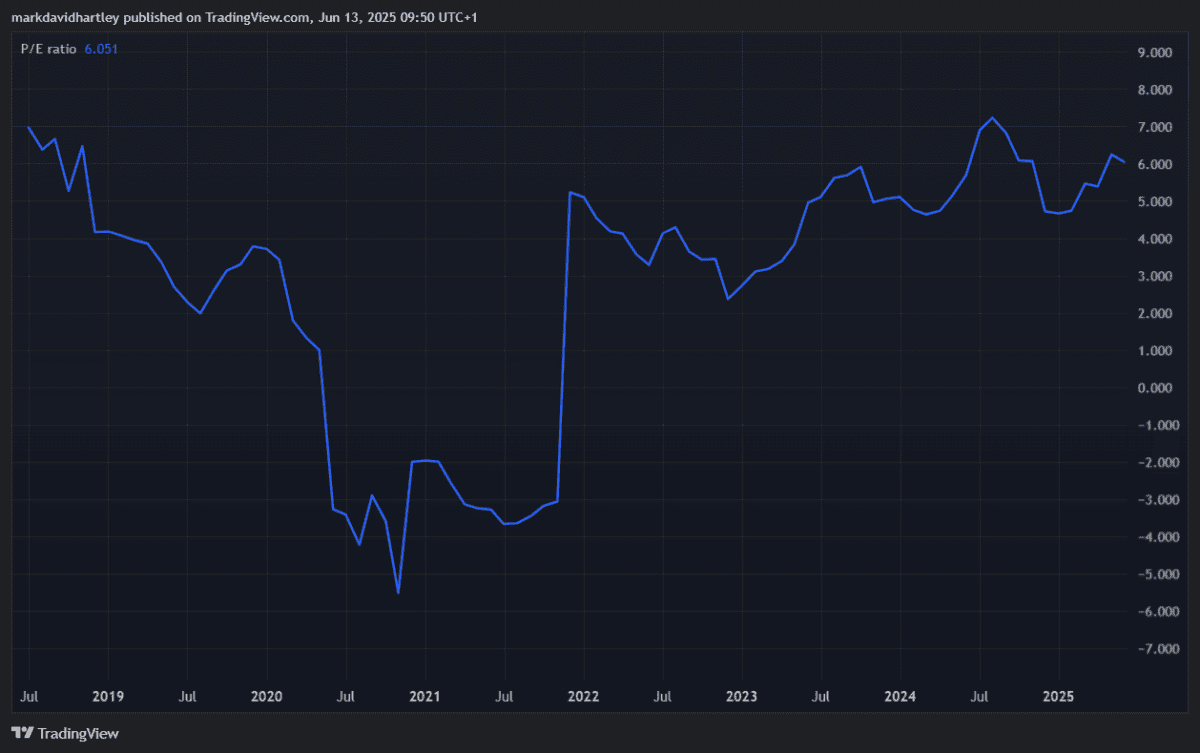

With a P/E ratio of simply 6 and a £1.56 price ticket, this up-and-coming finance inventory seems like one of many most cost-effective shares on the FTSE All-Share.

The £345m firm provides client credit score companies in rising markets, primarily in Jap Europe and Latin America. Whereas the sector carries extra threat than blue-chip financials, the returns could be compelling. Plus, the corporate has a protracted observe report of awarding money to its devoted shareholders, at present sporting a dividend yield of seven.15%.

A key energy is the agency’s native data. The corporate operates with in-country groups who perceive regional lending situations and preserve shut contact with clients. This face-to-face mannequin helps preserve default charges manageable, even in much less steady economies.

On the flip facet, worldwide operations expose it to foreign money fluctuations and political instability, which may threaten earnings. Regulatory adjustments are one other problem, notably if governments impose rate of interest caps or tighten lending standards. Furthermore, funding prices may rise if international rates of interest keep elevated.

Nonetheless, with each a excessive yield and room for development, I feel it’s a inventory price additional analysis.

Last ideas

Each MAN Group and Worldwide Private Finance supply a pretty mixture of low cost shares with excessive dividends. They’re not with out dangers, however the low valuations recommend a lot of the dangerous information could already be priced in.

For buyers snug with a little bit of market volatility, these two shares may present significant passive earnings whereas buying and selling at a reduction.