BLS Worldwide Companies Ltd – Past Boundaries

Based in 1983 and headquartered in New Delhi, BLS Worldwide Companies Ltd. is a worldwide chief in outsourcing and know-how options. It gives visa, passport, consular, biometric, attestation, and citizen companies to governments and diplomatic missions worldwide. With operations in 66+ international locations, serving 46+ consumer governments, it’s the world’s second-largest participant. The corporate additionally presents digital companies like Enterprise Correspondent (BC) options, e-governance, and assisted e-services in India.

Merchandise and Companies

BLS Worldwide presents a variety of companies, together with:

- Visa Processing: e-visas, visa functions, and biometrics.

- Citizen Companies: Passport functions, nationwide identification playing cards, and journey paperwork.

- Digital Companies: E-governance, enterprise correspondent companies, and banking-related companies for account holders.

- Verification and Attestation: Doc verification, notarial playing cards, and attestation companies.

- Worth-Added Companies: Courier companies, home cash transfers, Aadhaar card companies, and IT options.

Subsidiaries – As of FY24, the corporate has 27 subsidiaries.

Development Methods

- Established Market Chief: BLS Worldwide is a high world participant in visa and consular (VC) companies, e-governance, and digital options, serving governments and consulates in international locations like Slovakia, Hungary, Italy, Poland, and Portugal, with over 121,000 digital service touchpoints throughout city and rural areas.

- Numerous Choices: The corporate delivers G2C companies in sectors like meals, well being, income, schooling, and social justice, alongside B2C companies, enhancing entry in underserved areas.

- Strategic Acquisitions: Current acquisitions embrace iDATA (Turkey), Citizenship Make investments (Dubai), and SLW Media (sports activities administration), increasing its world attain, bettering margins, and creating distinctive synergies like combining sports activities occasions with visa companies.

- Scaling Operations: Transitioning from partner-managed to self-managed facilities has improved margins, whereas its definitive settlement to amass Aadifidelis Options strengthens its place in India’s mortgage processing sector.

- Spectacular Financials: iDATA, with operations in 15+ international locations, reported Q2FY25 income of ₹60 crore and a 37% EBITDA margin, whereas Citizenship Make investments enhances companies for high-net-worth people in residency and citizenship packages.

Operational Efficiency

Q2FY25

- Income Development: Achieved ₹495 crore in income, a 21% enhance from ₹408 crore in Q2FY24.

- EBITDA Surge: EBITDA grew 89% YoY to ₹164 crore, with margins bettering by 1,186 bps to 33%.

- Internet Revenue: Internet revenue rose 78% YoY to ₹146 crore, with margins bettering by 933 bps to 29%.

- Sturdy Stability Sheet: Maintained a strong web money stability of ₹902 crore.

- Growth: Opened new visa software facilities in Colombia and Peru, strengthening world presence.

FY24

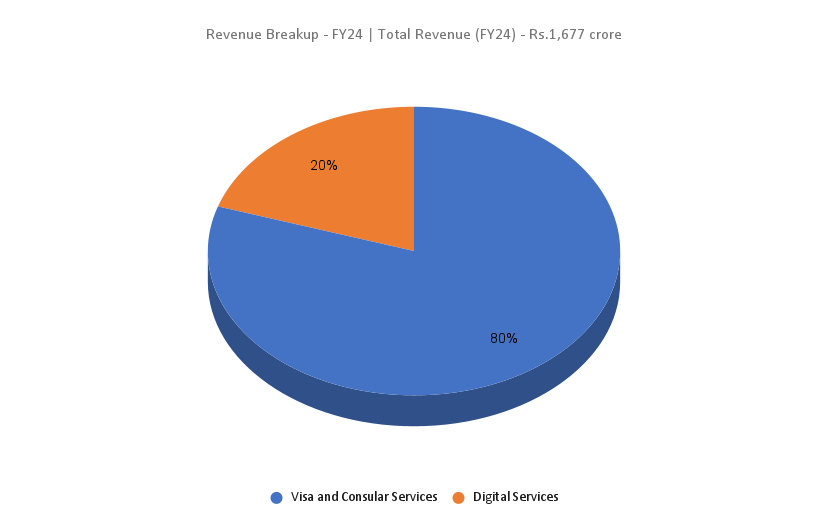

- Income Development: Recorded ₹1,677 crore in income, up 11% YoY.

- Working Revenue: Achieved ₹346 crore, a 57% YoY enhance.

- Internet Revenue: Posted ₹326 crore, a big 60% YoY progress.

- Subsidiary IPO: Efficiently raised ₹300 crore via the IPO of BLS E-Companies Restricted, boosting progress and growth plans.

Monetary Efficiency (FY21-24)

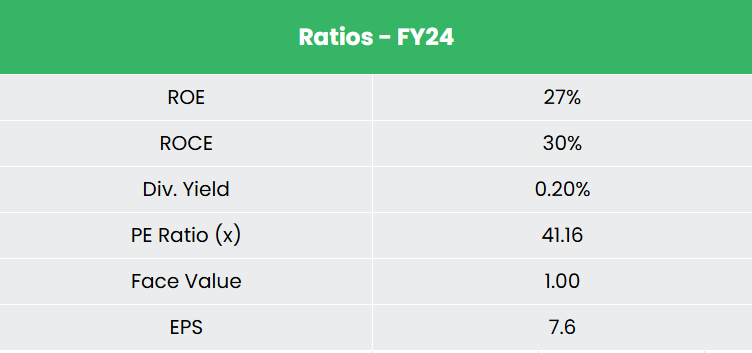

- 3-Yr CAGR (FY21-24): Income grew at 52%, whereas web revenue grew at 84%.

- Profitability Metrics: Common 3-year ROE and ROCE stood at 28% every.

- Sturdy Capital Construction: The corporate maintains a wholesome debt-to-equity ratio of 0.27.

Trade outlook

- Key Function: Visa and consular outsourcing simplifies functions for numerous visa sorts, together with enterprise, work, research, and tourism visas.

- Effectivity: Third-party firms improve effectivity and enhance buyer expertise via streamlined processes.

- Market Development: The worldwide visa outsourcing market is anticipated to develop at a 14% CAGR, increasing from USD 3.7 billion in 2023 to USD 8.3 billion by 2028.

- Driving Components: Development is fueled by rising visa demand and developments in service choices.

Development Drivers

- E-Governance Growth: Initiatives like Digital India, Aadhaar, on-line tax submitting, and digital land administration programs are driving demand for digital companies and e-governance options.

- Give attention to Monetary Inclusion: Authorities and banking sector emphasis on monetary inclusion is creating alternatives in digital and assisted companies throughout city and rural areas.

- Tourism Development: Rising curiosity in numerous types of tourism—cultural, wellness, journey, and coastal—is fueling demand for environment friendly visa processing and consular companies globally.

Aggressive Benefit

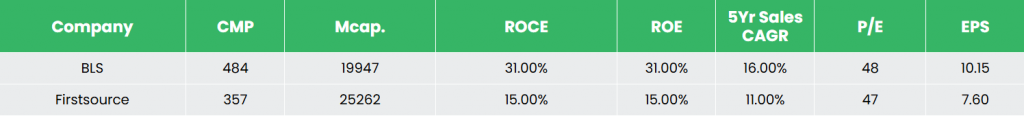

BLS is the one listed participant in India within the visa and consular house. Being a monopoly in its phase, we’ve got in contrast the corporate with different listed IT-Software program firms. BLS is producing larger returns from the invested capital indicating the corporate’s prudent capital allocation methods.

Outlook

- Enhanced Margins: Transitioning from partner-run to self-run facilities and synergies from strategic acquisitions are anticipated to spice up margin profiles considerably.

- Income Development Steerage: The corporate anticipates consolidated income progress of 22-23% and iDATA income progress of 10-15% for FY25, supported by larger service costs from key acquisitions.

- Contract Wins and Renewals: Success in profitable new contracts and renewing present ones, with elevated service charges in some instances, is anticipated to drive sustained profitability.

Valuation

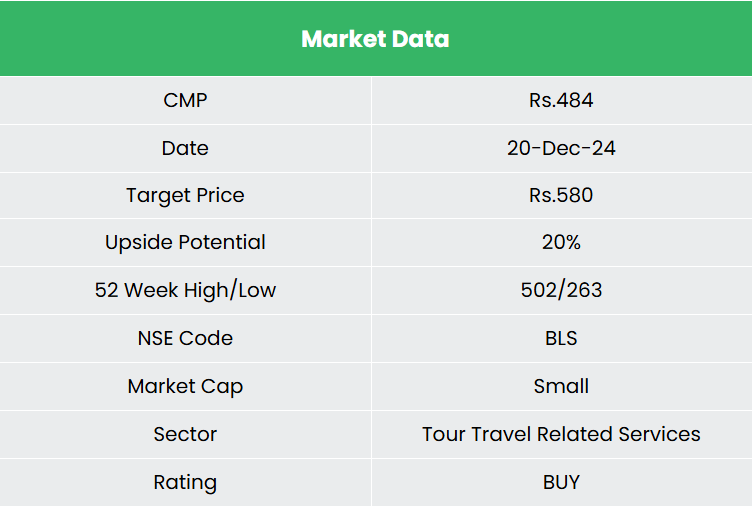

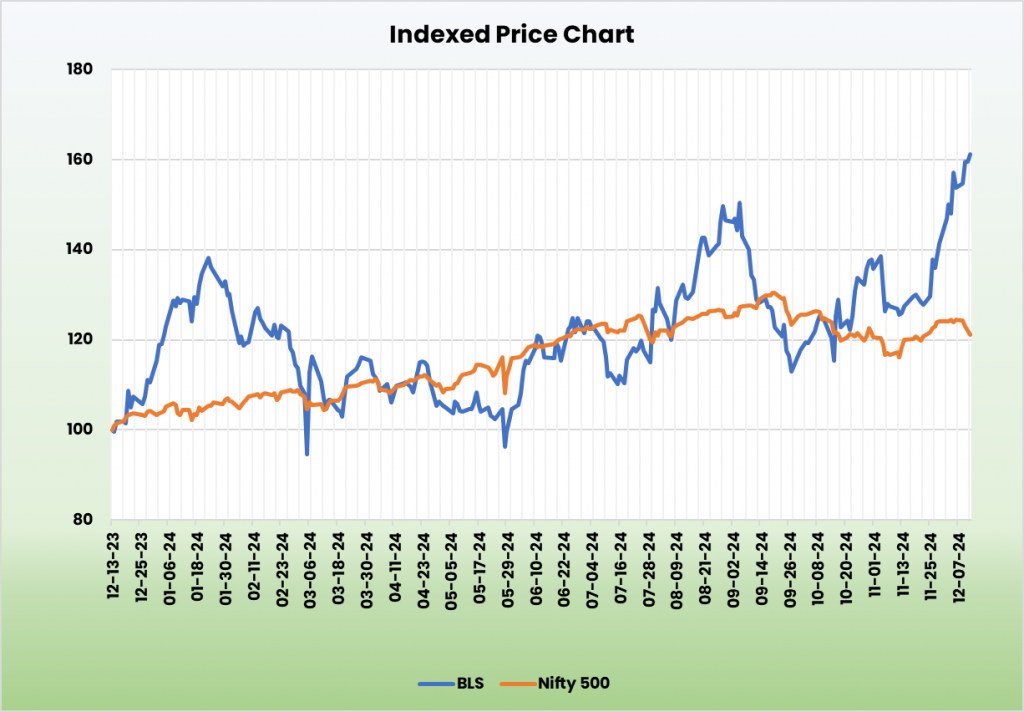

We anticipate that BLS Worldwide will maintain its progress momentum as a longtime world chief in an oligopolistic market. We suggest a BUY score with a goal value (TP) of ₹580, based mostly on a 40x FY26E EPS.

Dangers

- Foreign exchange Danger: With vital operations in international markets, BLS is uncovered to foreign exchange danger. Unexpected fluctuations in forex trade charges may negatively impression the corporate.

- Geopolitical Danger: Geopolitical tensions, diplomatic disputes, or modifications in immigration insurance policies might limit cross-border motion, affecting the corporate’s operations.

Be aware: Please word that this isn’t a advice and is meant just for academic functions. So, kindly seek the advice of your monetary advisor earlier than investing.

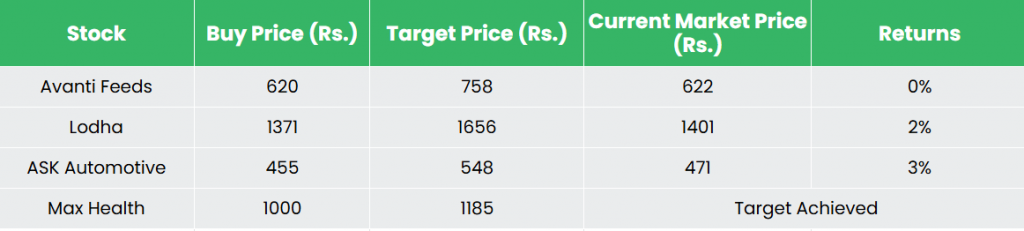

Recap of our earlier suggestions (As on 20 December 2024)

Avanti Feeds Ltd

Macrotech Builders Ltd

ASK Automotive Ltd

Max Healthcare Institute Ltd

Different articles chances are you’ll like

Put up Views:

177