ROE Boosting Technique

You’re the administration of Bharat Industries, an Indian manufacturing agency with a 15% ROE. Modify the sliders to use methods and click on Apply Methods to see how they increase ROE!

ROE Impression

Apply methods to see how Bharat Industries’ ROE modifications!

Introduction

What makes an organization financially profitable? The time period Return on Fairness (ROE) is the important thing. It’s a type of metrics that buyers love to speak about. However ROE can be one thing firm administration obsesses over. Why? As a result of ROE tells you how effectively an organization is utilizing its shareholders’ cash to generate income. I understand how companies from small startups to large conglomerates, chase this quantity.

So, let’s dive into what ROE is and how an organization’s administration can enhance it.

I’ll attempt to declutter the idea of ROE enlargement in easy phrases.

1. What Is ROE, and Why Does It Matter?

Return on Fairness (ROE) measures how a lot revenue (like Rs.20) an organization generates for each Rs.100 of the shareholders’ cash (fairness) invested within the firm.

ROE exhibits how effectively an organization makes use of the cash invested by its house owners.

The system is easy: ROE = Internet Revenue ÷ Shareholders’ Fairness.

A better ROE means the corporate is doing a fantastic job of turning funding into revenue. For instance, if an organization has an ROE of 20%, it’s incomes Rs.20 for each Rs.100 of fairness.

Let me let you know, a ROE variety of 20% represents a reasonably sturdy enterprise. However there are some companies who ROE’s are inherently low. One such instance is corporations of the Cement sector. Ultratech is likely one of the greatest corporations on this sector however its ROE is about 12%. Dalmia Bharat has an ROE of about 7%. Equally, ROE of Metal sector companies additionally hover round 12%.

A excessive ROE indicators to buyers that the corporate is value their cash. How? For an investor, a excessive ROE means the corporate effectively makes use of their invested cash to generate sturdy income. It’s an oblique however a robust suggestion of potential for larger returns by way of dividends or inventory value progress.

Except and untul an organization’s monetary well being is powerful and it has an efficient administration, it can’t preserve a consistentlt excessive ROEs.

In a aggressive ambiance, bettering ROE could make or break an organization’s popularity. Good managements all the time stay conscious of this truth. Henc, they’re all the time in search of methods to push that quantity larger.

2. The Three Huge Levers to Enhance ROE

To enhance ROE, administration must deal with three key areas. Consider these as levers they will pull to make the corporate extra worthwhile or environment friendly.

These are profitability, asset effectivity, and monetary leverage.

Let’s discover every space, step-by-step, and see how administration can use them for ROE enlargement.

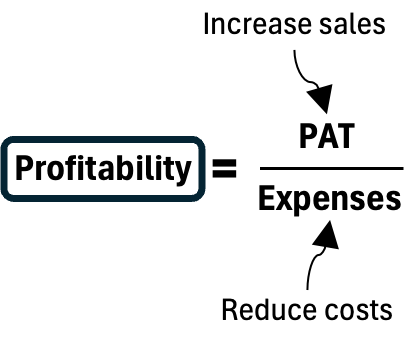

2.1. Rising Profitability

It’s about making extra gross sales or lowering the fee

This sounds apparent, nevertheless it’s not all the time simple. Administration can attempt to develop income or minimize prices, or each.

- The primary approach to increase ROE is to extend internet revenue (PAT). What’s PAT? It’s the revenue left in spite of everything bills are deducted from income. As an example, an organization like an area FMCG model may launch a brand new line of snacks to draw extra prospects. I keep in mind when a preferred Indian biscuit model launched more healthy choices to compete with international gamers. Gross sales went up as a result of they tapped into the rising demand for health-conscious merchandise.

- One other means is to cut back prices. This might imply negotiating higher offers with suppliers or automating elements of the manufacturing course of. I as soon as visited a small sugar manufacturing facility (throughout my faculty days) the place the proprietor switched to energy-efficient machines. His electrical energy payments dropped, and his income received a pleasant increase. However administration needs to be cautious, chopping prices too aggressively can damage product high quality or worker morale, which might backfire.

2.2. Bettering Asset Effectivity

It’s about producing extra income with much less useful resource.

The second lever is about making the corporate’s belongings work tougher.

Property are issues like equipment, stock, and even workplace house.

If an organization can generate extra income from the identical belongings, its ROE improves. That is known as bettering the asset turnover ratio.

For instance, a retail chain like D-Mart is a grasp at this. They hold their shops lean, inventory stock that sells quick, and switch over their inventory rapidly.

This implies they don’t have cash tied up in unsold items.

Administration may dump belongings that aren’t performing effectively. Let’s say an organization owns a manufacturing facility that’s barely used. Promoting it and investing the cash in a high-return mission can enhance ROE.

I’ve seen this occur with some Indian actual property corporations that offered unused land to fund new initiatives.

The bottom line is to deal with initiatives or belongings that give the very best returns in opposition to value for which they have been purchases (for instance, your FD will fetch you about 7% returns).

2.3. Utilizing Monetary Leverage

The third lever is monetary leverage, which is about utilizing debt to spice up income.

This one’s could be a bit tough, because it dosen’t work for everybody. So, let me clarify it extra minutely.

When an organization borrows cash and invests it in worthwhile initiatives, it may well enhance its ROE. Why? As a result of the income from the mission are earned on a smaller fairness base. For instance, an Indian infrastructure firm may take a mortgage to construct a brand new toll highway. If the highway generates sturdy income, the ROE goes up as a result of the corporate didn’t use a lot of its personal cash.

However right here’s the catch, debt is a double-edged sword.

An excessive amount of borrowing can result in excessive curiosity prices.

If the mission doesn’t ship, the corporate may very well be in bother. I’ve seen some Indian startups get burned by taking up an excessive amount of debt too quick.

Administration wants to search out the best steadiness, making certain the return on borrowed cash (Return on Capital) is larger than the price of borrowing. Learn this about what Warren Buffett and Charlie Munger says concerning the ROC (Return on Captal).

3. Challenges Administration Faces To Improve ROE

Boosting ROE is just not a straightforward objective to attain.

In truth, a lot of the corporations that commerce within the inventory market have seen their ROE’s contacted with time. So, corporations who can maintain or broaden their excessive ROE ranges are further particular for buyers.

Each business has its personal hurdles.

- For instance, in retail sector, competitors is brutal. There’s all the time a battle between on-line giants and native kirana shops. Rising costs to spice up income may push prospects away.

- Equally, in manufacturing, upgrading equipment to enhance asset effectivity prices cash upfront. As these prices (CAPEX) are capitalized, it lowers the PAT (in close to time period).

- Then there are exterior components like inflation or authorities rules. These can additional complicate the method of revenue enhancement or value discount.

- Today there are additionally challenges associated to technological developments. The day a brand new product is launched, another person begins constructing a replace.

These components make it actually laborious for corporations to survice, depart apart ROE enlargement.

Because of this, virtually 85% of all corporations by no means expertise cosistent ROE enhancement.

I recall a dialog the CEO of a small pharma firm has on a brand new portal. He needed to enhance ROE by launching a brand new drug, however regulatory approvals took years. By the point the product hit the market, opponents had already grabbed an enormous share.

This exhibits how administration’s plans will be derailed by issues past their management. Endurance and flexibility are key.

4. Actual-World Examples

Let’s take a look at some Indian corporations which have labored on their ROE.

- Reliance Industries.

- They’ve boosted profitability by diversifying into telecom and retail by way of Jio and Reliance Retail. Their asset effectivity is spectacular too, they use their huge community of shops and digital platforms to generate large gross sales.

- On the leverage entrance, they’ve taken on debt however invested it in high-growth areas like 5G. Their ROE has stayed sturdy as a result of they steadiness all three levers rigorously.

- Bajaj Finance.

- They’ve mastered the artwork of utilizing debt to fund lending operations whereas maintaining dangers in verify. Their deal with high-margin merchandise like client loans has saved income wholesome.

These two corporations are examples that present that boosting ROE requires a mixture of daring strikes and cautious planning.

A Few Sensible Ideas for Administration

Listed below are some steps for you, in the event you within the firm’s high administration, to take to enhance ROE:

- Analyze the Numbers: Usually verify your organization’s revenue margins, asset turnover, and debt ranges. Use these to identify weak areas.

- Deal with Excessive-Return Initiatives: Put money into areas with sturdy progress potential, like digital transformation or new markets.

- Interact Workers: A motivated workforce can drive effectivity and innovation, not directly boosting ROE.

- Monitor Dangers: Control market tendencies and rates of interest to keep away from getting caught off guard.

These steps sound easy, however they require self-discipline. It’s like sticking to a food plan, it is advisable keep constant to see outcomes.

Why ROE Isn’t the Solely Factor

A fast phrase of warning.

ROE is essential, nevertheless it’s not all the pieces.

An organization may increase ROE by taking up dangerous debt or chopping corners on high quality. That’s like constructing a home on a shaky basis. It’d look good for some time, nevertheless it received’t final.

Administration ought to goal for sustainable progress. It’s extra essential than ROE enlargement.

Buyers worth corporations that steadiness profitability with stability. In spite of everything, who desires to spend money on an organization that’s all flash and no substance?

Conclusion

Bettering ROE is like fixing a puzzle.

Administration wants to tug the best levers, growing income, utilizing belongings higher, and managing debt correctly.

It’s not simple, particularly in a dynamic market like India. However with the best technique, it’s potential to make shareholders joyful whereas constructing a stronger enterprise.

So, what do you suppose?

If you happen to have been operating an organization, which lever would you pull first? Let me know within the feedback part beneath.

Have a cheerful investing.