Picture supply: Getty Pictures

UK shares have been struggling this month after the early April announcement of contemporary US commerce tariffs. The stunning information wiped as a lot as 30% off sure shares and nearly 1,000 factors off the FTSE 100.

However because of the chaos, there may very well be some profitable alternatives for traders. Many dividend shares have seen their yields soar as costs fall. I’ve uncovered two specifically that look enticing proper now – MAN Group (LSE: EMG) and Greencoat UK Wind (LSE: UKW).

For traders looking for dependable dividends, these two may very well be value contemplating.

MAN Group

MAN Group is down 27% this 12 months, regardless of an honest set of 2024 outcomes. They included a share buyback announcement and dividend enhance. Nevertheless, regardless that income and earnings elevated by 23% and 27%, respectively, earnings per share (EPS) missed expectations. Worst of all, the asset supervisor reduce its steering for the approaching 12 months.

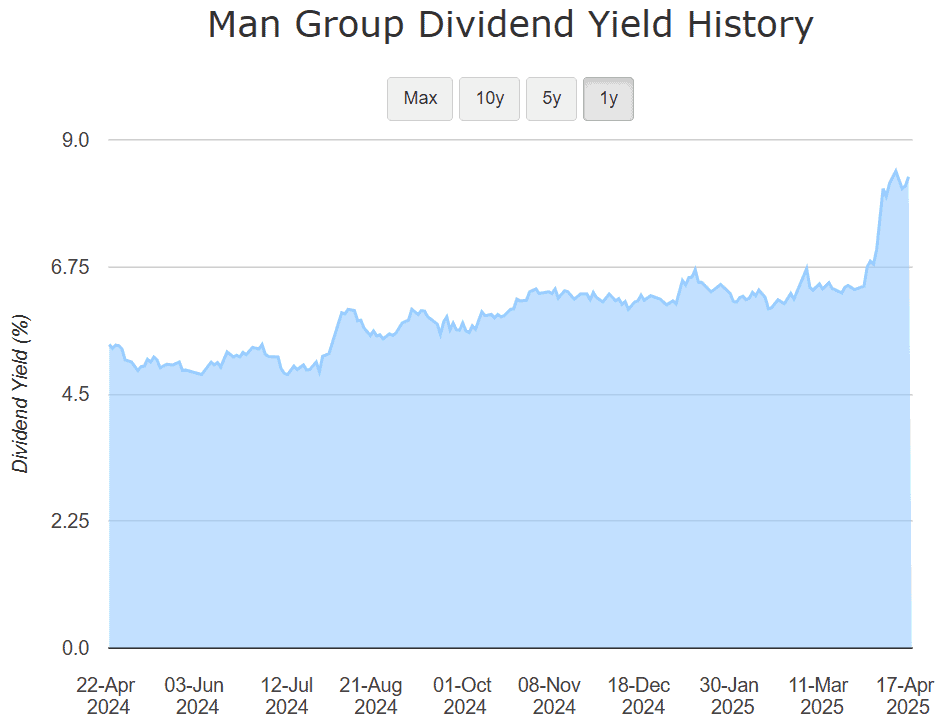

The outcomes didn’t initially have a big adverse impact on the inventory. However after the announcement of a ten% commerce tariff on UK items, it took a tumble. Now down 27% 12 months thus far, the inventory’s dividend yield has soared from 6% to eight.3%. At this stage, it appears to be like like a sexy choice for revenue traders.

The corporate has a protracted monitor document of returning money to shareholders by each dividends and buybacks. Actually, it has returned over $2bn to shareholders since 2018. Plus, the dividend is properly coated by earnings and supported by a stable stability sheet, with internet money of $700m on the finish of 2024. That gives a cushion towards any short-term volatility in earnings.

That stated, there are dangers. The agency’s future efficiency is carefully tied to market sentiment and world fund flows, each of which might be hit laborious throughout unsure occasions. If volatility spikes or investor urge for food fades, property below administration (AUM) might fall, placing stress on earnings and distributions.

Nonetheless, with the shares buying and selling at simply eight occasions forecast earnings and yielding over 8%, the risk-reward stability may very well be compelling for long-term revenue seekers to think about.

Greencoat UK Wind

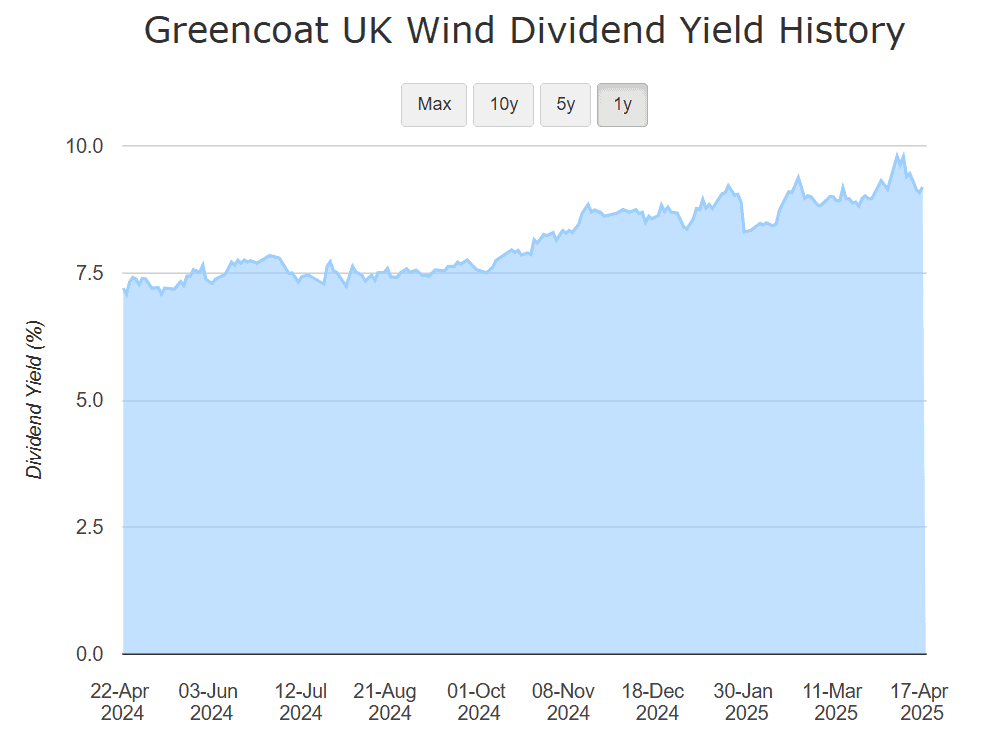

Greencoat UK Wind is a inexperienced power inventory that has seen its share worth drop considerably (down 15% up to now 12 months) pushing its dividend yield to an attractive 9.2%. As a renewable infrastructure funding belief, Greencoat owns a diversified portfolio of operational UK wind farms.

Its revenues are largely inflation-linked, and its money flows are supported by long-term energy buy agreements. This makes it a comparatively defensive revenue play.

The belief has delivered constant dividend development since itemizing in 2013 and stays dedicated to growing its payout consistent with inflation. Its 2024 annual outcomes confirmed stable efficiency, with internet asset worth (NAV) per share secure and money move technology sturdy sufficient to help its goal dividend for 2025.

Nevertheless, the current sell-off has been pushed by a wider de-rating throughout the renewables sector, partly attributable to rising rates of interest. As charges have climbed, income-focused traders have shifted in the direction of gilts and different fixed-income property, placing stress on listed infrastructure trusts.

That stated, with rates of interest anticipated to fall later this 12 months, it may very well be well-positioned for a re-rating. Within the meantime, traders are being paid a wholesome yield to attend so it may very well be value additional analysis.