Picture supply: Getty Pictures

The US inventory market has been all around the store just lately. In reality, the S&P 500‘s 4.6% drop within the first quarter of 2025 was the index’s largest quarterly loss since 2022.

Given this, I’ve been weighing up a couple of choices for my Shares and Shares ISA. Listed below are two shares I’ve obtained my eye on.

Out-of-favour AI inventory

The primary — Nvidia (NASDAQ: NVDA) — wants no introductions. The chipmaker is the world’s third-largest agency and stays central to developments in synthetic intelligence (AI). Demand for its newest Blackwell AI chips may be very robust, in keeping with administration.

But Nvidia’s share value has fallen 27% in lower than three months. This places the inventory on a ahead price-to-earnings (P/E) ratio of 24, which is an undemanding a number of for a top-notch development firm.

Traders appear to be apprehensive about a couple of issues right here. First, there’s uncertainty round tariffs, which admittedly could affect Nvidia’s operations. And the possibility of a US recession has risen significantly, in keeping with most economists. An financial downturn can be unhealthy all spherical.

In the meantime, some doubts have crept in about Nvidia’s place within the inference stage of generative AI. Whereas its chips reign supreme within the coaching part, the competitors could also be far stronger in inference (i.e., when a skilled mannequin spits out a Shakespearean sonnet on the fly).

Whereas these considerations are warranted, I at present see no proof that Nvidia gained’t maintain benefitting from rising AI infrastructure spending. The market nonetheless expects Nvidia to put up robust double-digit development over the subsequent three years.

Certainly, the AI chip king’s income is forecast to prime $300bn by 2028, up from $130bn final 12 months. Internet revenue is tipped to exceed $155bn by then!

After all, these forecasts may change. However because the inventory strikes nearer to $100, I believe the chance/reward setup is beginning to look extra beneficial. As such, I’m very tempted to put money into some shares.

Transport disruptor

The second inventory I’ve obtained my eye on is Joby Aviation (NYSE: JOBY). It’s fallen 41% to $6 in lower than three months.

Joby Aviation is aiming to commercialise electrical vertical take-off and touchdown plane (eVTOLs). In lay phrases, flying electrical taxis that take off vertically and journey with out emissions in close to silence.

Joby’s plane can at present do a 100-mile journey at speeds of as much as 200mph. But it surely’s nonetheless working in the direction of full certification, which implies there’s quite a lot of regulatory and operational danger right here.

Nonetheless, the corporate is making speedy progress and expects to begin a business service in Dubai in late 2025 or early 2026. The primary of 4 ‘vertiports’ is at present being constructed at Dubai Worldwide Airport. It goals to zip 4 passengers to Palm Jumeirah island in simply 12 minutes relatively than 45 minutes by automobile.

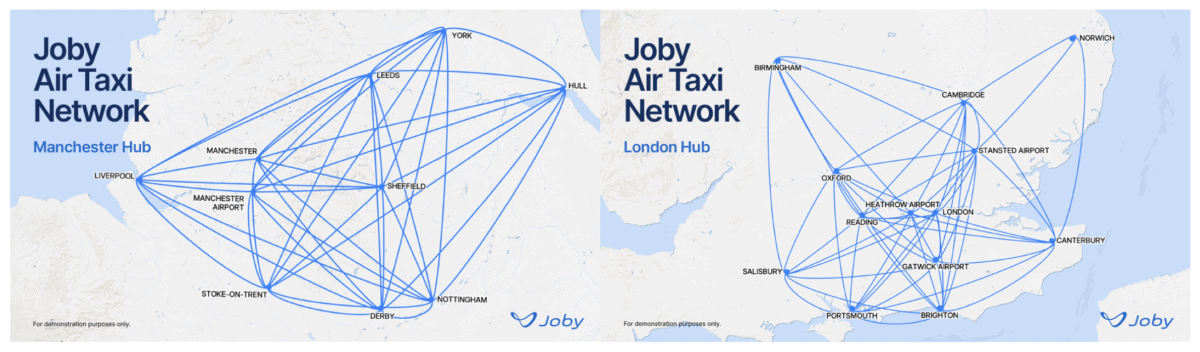

Within the UK, Joby has partnered with Virgin Atlantic to roll out air taxis, beginning with regional and metropolis connections from the airline’s hubs at Heathrow and Manchester Airport.

Yesterday (31 March), China turned the primary nation to approve business air taxis. So relatively than being merely science fiction, it is a large new rising market.

Joby has over $1bn in money to fund its business launch, however the inventory remains to be very a lot within the high-risk, high-reward class.