Every week, Benzinga’s Inventory Whisper Index makes use of a mixture of proprietary information and sample recognition to showcase 5 shares which might be slightly below the floor and deserve consideration.

Buyers are continually on the hunt for undervalued, under-followed and rising shares. With numerous strategies accessible to retail merchants, the problem usually lies in sifting by the abundance of knowledge to uncover new alternatives and perceive why sure shares needs to be of curiosity.

Learn Additionally: EXCLUSIVE: February’s 20 Most-Searched Tickers On Benzinga Professional – The place Do Tesla, Palantir, Alibaba, Nvidia Rank?

Right here’s a take a look at the Benzinga Inventory Whisper Index for the week ending March 21:

Lululemon Athletica LULU: The attire firm noticed sturdy curiosity from readers, which comes earlier than the corporate’s fourth-quarter monetary outcomes on Thursday March 27. Analysts anticipate the corporate to report income of $3.57 billion, up from $3.21 billion in final 12 months’s fourth quarter. Lululemon has crushed income estimates in 9 of the final 10 quarters. Analysts anticipate the corporate to report fourth-quarter earnings per share of $5.84, up from $5.29 in final 12 months’s fourth quarter. The corporate has crushed analyst estimates for earnings per share in 9 of the final 10 quarters total. Analysts have bargain targets forward of the quarter and buyers stay cautious on the Canadian firm with issues about tariffs. Analysts and buyers might be watching the earnings report carefully to see if there are feedback on tariffs and in addition if the corporate’s worldwide gross sales proceed to develop. Worldwide income was up 33% year-over-year within the third quarter.

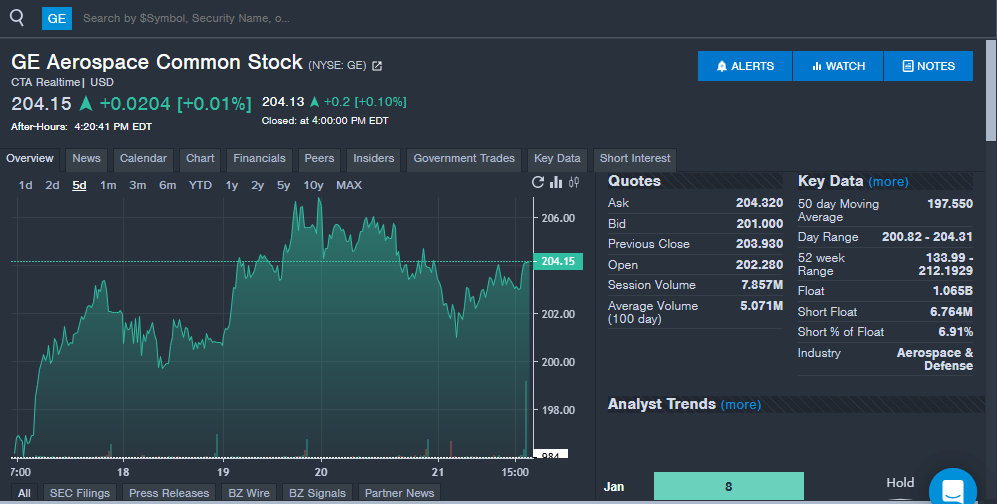

GE Aerospace GE: The aerospace firm noticed shares commerce larger on the week, helped probably by some current contract awards. GE Aerospace just lately introduced a US Air Drive contract price as much as $5 billion for engines used on the F-15 and F-16 fighter jets. The corporate additionally just lately introduced plans to speculate $1 billion in its U.S. manufacturing services to strengthen manufacturing, which might sign elevated orders and development alternatives.

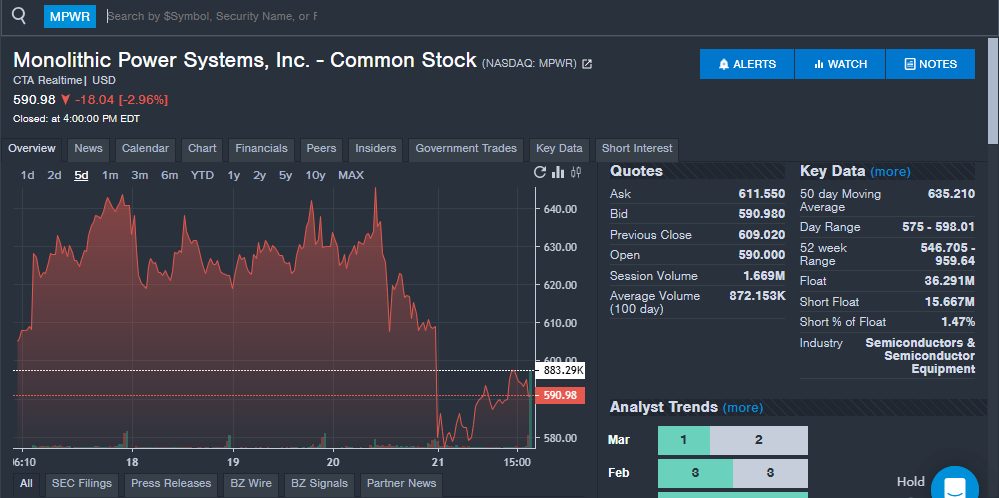

Monolithic Energy Methods MPWR: The chipmaker noticed sturdy curiosity throughout the week, which comes after the corporate hosted its analyst day and up to date its steering on Thursday. The corporate is guiding for first-quarter income to be in a spread of $630 million to $640 million, up from a previous vary of $610 million to $630 million. Analysts anticipate the corporate to publish first-quarter income of $578.1 million. Analysts just lately remained bullish on the corporate with Purchase scores maintained. Shares had been down on the week with a pointy drop throughout the week, earlier than transferring again up on Thursday and Friday.

AppLovin Company APP: The promoting tech firm was one of many top-performing shares in 2024 and shares are up over 300% within the final 12 months. Readers confirmed sturdy curiosity within the inventory, which gained on the week and in current weeks has posted good points after a number of quick stories despatched shares decrease. Robust fourth-quarter outcomes helped the inventory in February earlier than shares dropped from the quick stories. Needham analyst Bernie McTernan reiterated a Maintain score on the inventory just lately. McTernan researched APP’s growth past cellular gaming advertisements into different industries like ecommerce, attire, and furnishings.

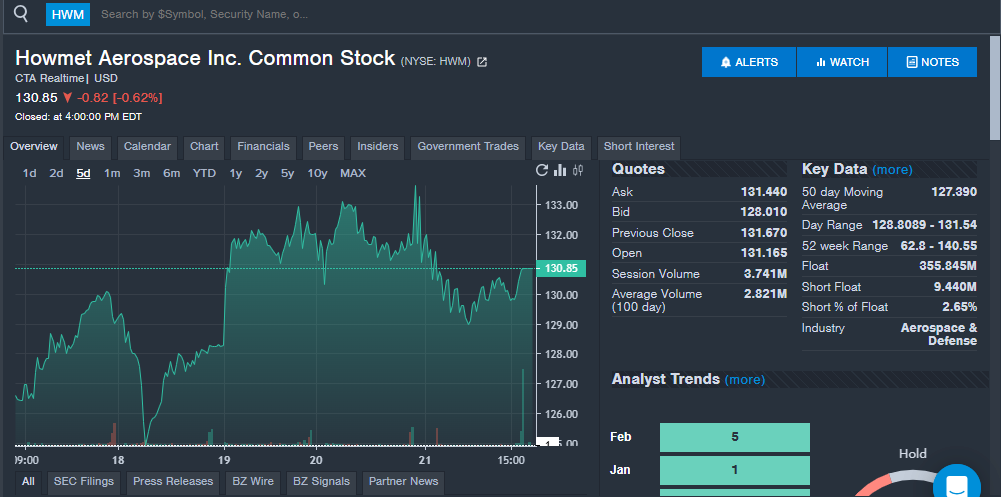

Howmet Aerospace HWM: The aerospace firm returns to the Inventory Whisper Index for the week. The corporate offered at a Financial institution of America convention the place the CEO mentioned they anticipate to see F-35 manufacturing static or growing within the second half of the last decade. The CEO additionally mentioned they anticipate to see service volumes enhance year-over-year over the subsequent 5 to eight years. Howmet reported fourth-quarter monetary outcomes that topped analyst estimates in February and noticed analysts elevate their worth targets on the inventory.

Keep tuned for subsequent week’s report, and comply with Benzinga Professional for all the newest headlines and high market-moving tales right here.

Learn the newest Inventory Whisper Index stories right here:

Learn Subsequent:

Momentum99.13

Progress26.80

High quality–

Worth9.18

Market Information and Information delivered to you by Benzinga APIs

© 2025 Benzinga.com. Benzinga doesn’t present funding recommendation. All rights reserved.