Be a part of Our Telegram channel to remain updated on breaking information protection

Bitcoin plunged under $90K for the primary time since April and Ethereum and XRP slid as “excessive concern” gripped the crypto market.

BTC is buying and selling at $89,730.57 as of three:12 a.m. EST after sliding greater than 5% prior to now 24 hours. It has now dropped greater than 14% prior to now week.

Different main cryptos additionally tumbled, with altcoin king ETH slumping 6%, inflicting it to slip under the psychological $3K degree. XRP shed over 5%, edging it nearer to the $2 mark.

Crypto Market Cap Nears $3 Trillion As High 10 Bleed

Many of the remainder of the highest ten largest cryptos by market cap additionally buckled below the wave of promoting stress. Cardano (ADA) misplaced 6%, BNB and Solana (SOL) tumbled greater than 3%, whereas Tron (TRX) and meme coin chief Dogecoin (DOGE) fell 1% and 4%, respectively.

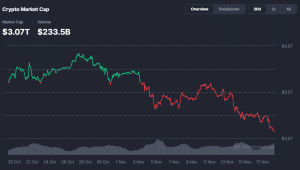

Crypto’s total market capitalization plunged 5% to $3.07 trillion, in accordance to CoinMarketCap knowledge.

Crypto market cap continues to drop (Supply: CoinMarketCap)

“Excessive Concern” Reigns As Liquidations High $1 Billion

Amid the market-wide pullback, investor sentiment turned much more bearish, with the Crypto Concern & Greed Index, a well-liked instrument to gauge market sentiment, falling three factors to an “excessive concern” degree of 11. It’s additionally misplaced 18 factors prior to now month.

CoinGlass knowledge exhibits liquidations topped $1.02 billion prior to now day, with lengthy positions accounting for $724.2 million.

The ratio of brief to lengthy liquidations spiked prior to now 4 hours, with $100.74 million worn out from lengthy positions and solely $17.90 million liquidated from shorts throughout this era.

Previous to the newest selloff, The Kobeissi Letter instructed its greater than 1.1 million followers on X that the crypto market had suffered three days of greater than $1 billion liquidations in simply the previous 16 days.

Over the past 16 days alone, we now have seen 3 days with liquidations exceeding $1 billion.

Every day liquidations of $500+ million have turn out to be a standard incidence.

Significantly in durations of skinny quantity, this ends in violent crypto swings.

And, it goes in each instructions. pic.twitter.com/yGMQG4VEMC

— The Kobeissi Letter (@KobeissiLetter) November 16, 2025

It added that $500+ million liquidations had additionally turn out to be a “regular incidence,” and blamed extreme ranges of leverage. It mentioned high leverage mixed with skinny volumes have been the rationale for “violent crypto swings.”

Bitwise And BitMine Execs See A Backside This Week

Bitwise CIO Matt Hougan and BitMine Chairman Tom Lee say that the market might backside this week.

Talking in an interview with CNBC yesterday, Lee mentioned that crypto has been struggling because the Oct. 10 liquidation occasion, and added that merchants are nonetheless uncertain if there will probably be an rate of interest lower in December.

Associated Articles:

Finest Pockets – Diversify Your Crypto Portfolio

- Simple to Use, Characteristic-Pushed Crypto Pockets

- Get Early Entry to Upcoming Token ICOs

- Multi-Chain, Multi-Pockets, Non-Custodial

- Now On App Retailer, Google Play

- Stake To Earn Native Token $BEST

- 250,000+ Month-to-month Energetic Customers

Be a part of Our Telegram channel to remain updated on breaking information protection