Be part of Our Telegram channel to remain updated on breaking information protection

The Bitcoin worth plunged 5.6% over the previous 24 hours to commerce at $90,108 as of two:48 a.m. EST on buying and selling quantity that soared 43% to $114.6 billion.

This comes after BTC dropped beneath $90k for the primary time since April up to now 24 hours, deepening a stoop that’s seen it lose 13.5% up to now week and erasing features for the yr, based on CoinGecko.

BTC has slid from an all-time excessive of greater than $126k, a reversal that comes amid rising financial headwinds, together with renewed issues over interest-rate coverage and stretched valuations throughout markets.

Regardless of the continued drop, Michael Saylor’s Technique revealed it purchased $835.6 million in Bitcoin within the seven days ending Sunday, the biggest buy by the agency since July.

That introduced its complete holdings to 649,870 tokens price roughly $61.7 billion.

Technique has acquired 8,178 BTC for ~$835.6 million at ~$102,171 per bitcoin and has achieved BTC Yield of 27.8% YTD 2025. As of 11/16/2025, we hodl 649,870 $BTC acquired for ~$48.37 billion at ~$74,433 per bitcoin. $MSTR $STRC $STRD $STRE $STRF $STRK https://t.co/HI1TeYOvQ9

— Michael Saylor (@saylor) November 17, 2025

In the meantime, El Salvador added 1,090 BTC to its hoard on Monday night, which is the biggest single-day acquisition the nation has ever made. The acquisition introduced its complete holdings to 7,474 BTC price round $676 million.

Hooah! pic.twitter.com/KxMVbUrcGE

— Nayib Bukele (@nayibbukele) November 18, 2025

Cameron Winklevoss Sees Final Likelihood To Purchase Bitcoin Low-cost

With the value of Bitcoin buying and selling beneath $90k, Gemini co-founder Cameron Winklevoss informed his 753K followers on X that he believes it’s the ”final time” they’ll have the ability to purchase Bitcoin underneath $90,000.

That is the final time you may ever have the ability to purchase bitcoin beneath $90k!

— Cameron Winklevoss (@cameron) November 18, 2025

Bitcoin Value Drops Under The Falling Channel Sample – Continued Bearish Strain?

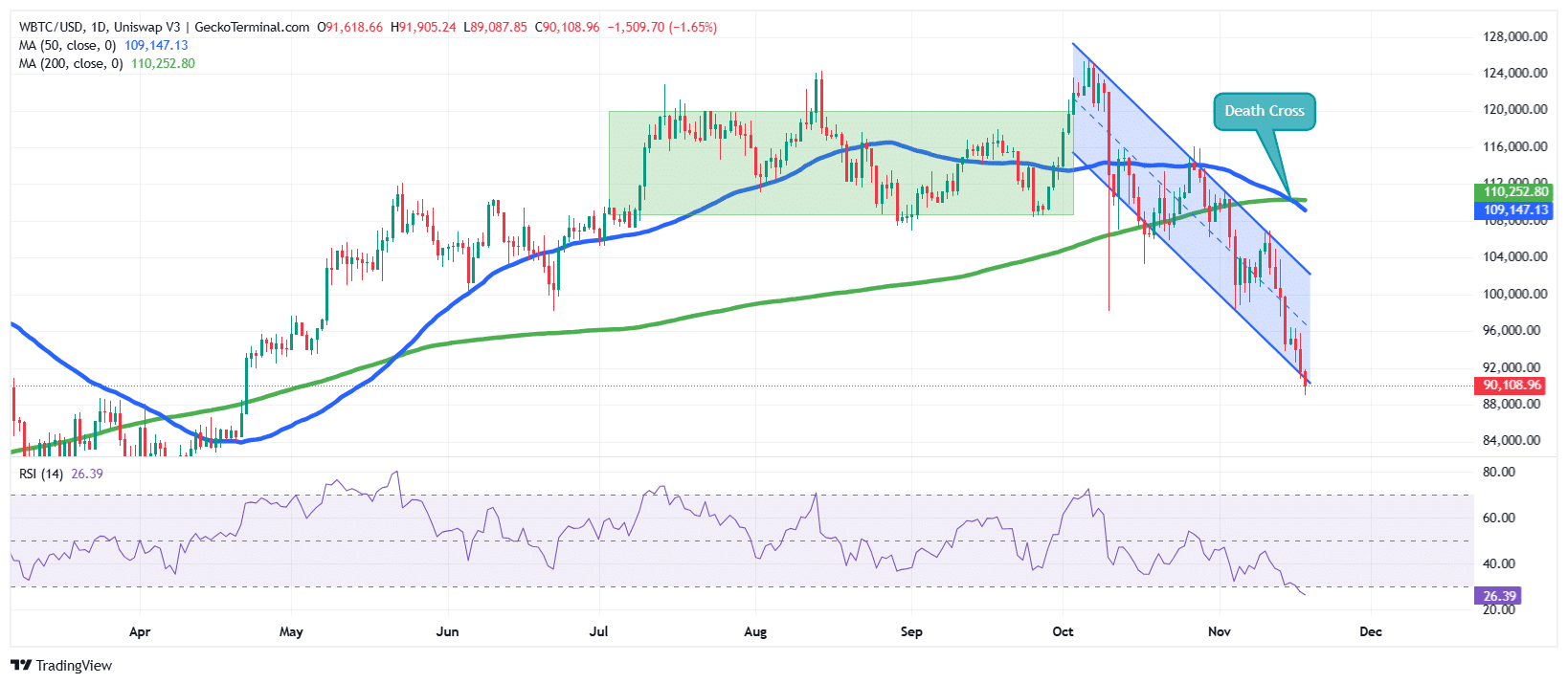

After a surge from the $85,300 zone in April, the BTC worth encountered resistance across the $120,000 zone, which drove it by means of a consolidation section, buying and selling inside a sideways sample from July to the tip of September.

The bulls then took cost of the value, breaching the resistance to push the Bitcoin worth to its ATH round $126,000.

Nevertheless, this acted as the highest for BTC, with the bears taking cost of the value to push it down throughout the confines of a falling channel sample.

This bearish stress has been constant, as within the final day, BTC dropped beneath the decrease boundary of the falling channel, which cements the downtrend narrative.

The general bearish stance has been pushed even additional, because the 50-day Easy Transferring Common (SMA) has dropped beneath the 200-day SMA, forming a dying cross round $110,159. BTC nonetheless trades beneath each SMAs, which helps the bears.

Furthermore, the Relative Energy Index (RSI has slipped beneath the 30-oversold degree, at present trending at 26, which locations the value of BTC underneath intense promoting stress.

BTC Value Prediction

Based mostly on the BTC/USD chart evaluation, the Bitcoin worth is displaying clear bearish momentum because it trades inside a falling channel and stays beneath each the 50-day and 200-day SMAs.

The current dying cross reinforces draw back stress, whereas the RSI close to 26 signifies deep oversold situations that usually precede short-term aid bounces.

If the downtrend continues, the subsequent seemingly help zone sits round $87,000, the place consumers might try and stabilize the BTC worth. A breakdown beneath this vary may expose a deeper transfer towards $84,000.

Nevertheless, if oversold situations set off a corrective rally, preliminary resistance lies close to the descending channel’s higher boundary round $97,000–$100,000.

A stronger restoration would require reclaiming the 50-day SMA close to $109,000, which might sign weakening bearish momentum.

Ali Martinez, an influential analyst on X, says that each time BTC has shaped a dying cross on the every day chart, it has signaled an area backside for the asset.

Over the previous yr, each dying cross has marked an area backside for Bitcoin $BTC, however in 2022, it kicked off a full bear market.

A brand new dying cross is forming now… So which one is it this time: native backside or bear market? pic.twitter.com/tBnKNngunN

— Ali (@ali_charts) November 18, 2025

Nevertheless, till the value of BTC breaks the channel and reclaims each SMAs, downward stress stays the dominant drive.

Associated Information:

Finest Pockets – Diversify Your Crypto Portfolio

- Straightforward to Use, Characteristic-Pushed Crypto Pockets

- Get Early Entry to Upcoming Token ICOs

- Multi-Chain, Multi-Pockets, Non-Custodial

- Now On App Retailer, Google Play

- Stake To Earn Native Token $BEST

- 250,000+ Month-to-month Lively Customers

Be part of Our Telegram channel to remain updated on breaking information protection