Be part of Our Telegram channel to remain updated on breaking information protection

The Bitcoin value has risen over 1% within the final 24 hours, buying and selling at $111,331 as of 4:00 a.m. EST, on a 31% lower in day by day buying and selling quantity to $50.47 billion.

That BTC value enhance occurred at the same time as Tom Lee, BitMine’s well-known chairman, says that at the same time as Bitcoin turns into extra in style with massive funding corporations, sharp drops of fifty% or extra are nonetheless potential.

“Simply holding crypto on a stability sheet doesn’t assure long-term efficiency,” he defined, reminding everybody of Bitcoin’s turbulent previous.

⚡️TOM LEE: BITCOIN NOT IMMUNE TO A 50% CRASH

He warns that even with Wall Avenue backing, $BTC may nonetheless face deep drawdowns, similar to the inventory market. pic.twitter.com/xOgzIb6YY0

— Coin Bureau (@coinbureau) October 24, 2025

In the previous few weeks, Bitcoin has confronted tough swings. First capturing as much as almost $126,000 after which tumbling beneath $110,000 earlier than bouncing again. Regardless of the pullbacks, Bitcoin’s place above $110,000 reveals the market nonetheless has religion, for now.

Nonetheless, massive traders have pumped greater than $1.2 trillion into Bitcoin by means of main exchanges prior to now 12 months, making it the largest crypto entry level on the planet. Whilst different cryptocurrencies achieve floor, Bitcoin stays the primary alternative for conventional traders, particularly within the US.

Bitcoin On-Chain Information: Exercise Stays Excessive Regardless of Warnings

On-chain alerts give a clearer image of what’s taking place behind the value. Bitcoin stays the chief when it comes to community exercise and total demand.

Buying and selling quantity for on-chain perpetuals (crypto derivatives traded immediately on the blockchain) hit all-time highs in October, with greater than $1 trillion price of notional worth exchanged this month alone. This implies robust curiosity from institutional and retail merchants alike, at the same time as costs swing up and down.

Nonetheless, some pink flags are exhibiting. The variety of Bitcoin transfers between wallets and exchanges has elevated throughout value drops, sometimes an indication that some holders wish to take earnings or restrict their losses.

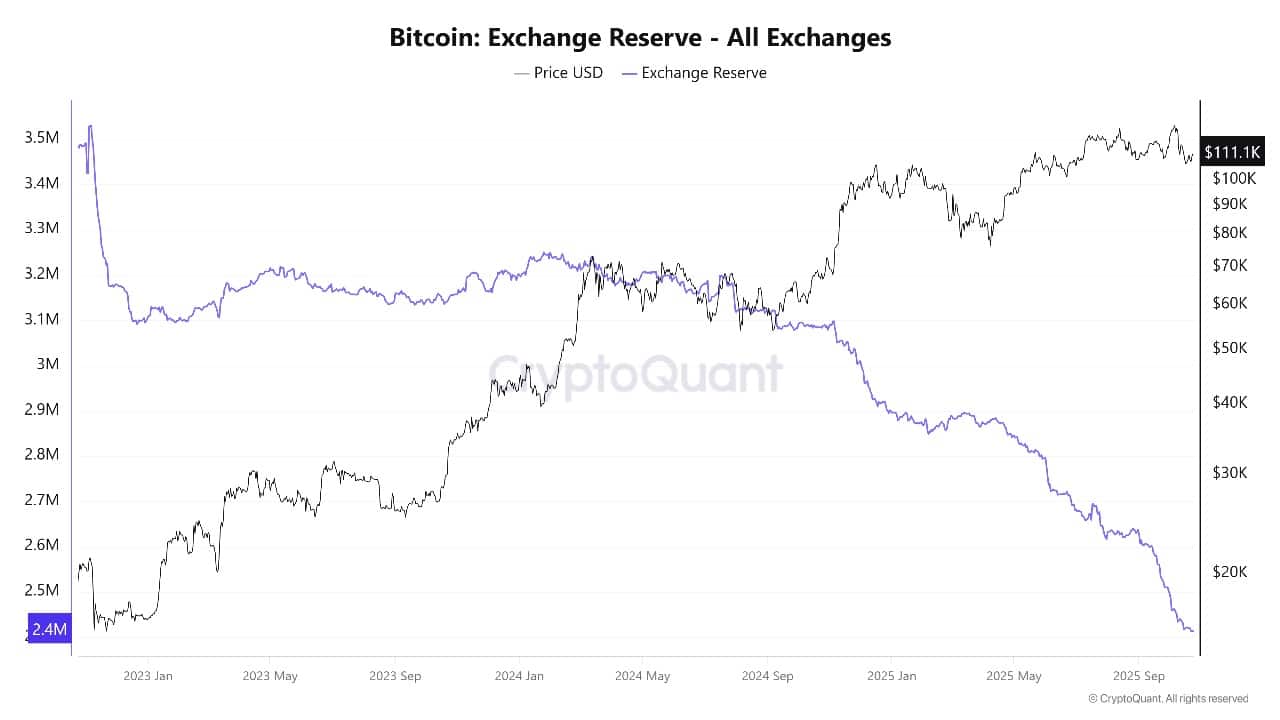

Bitcoin Trade Reserve Supply: CryptoQuant

Whereas many long-term holders are staying put, new patrons are stepping in each time Bitcoin dips beneath main assist ranges. This implies that the market stays energetic, with patrons and sellers rapidly reacting to strikes in value.

Bitcoin Technical Evaluation: BTC Exhibiting A Bearish Tilt

Trying on the charts, Bitcoin is at the moment in a consolidation zone after a pointy drop from its current highs close to $126,000. The worth is holding above the 200-day Easy Shifting Common (SMA) at $108,445.78, which acts as a key assist degree. The 50-day SMA is at $114,194.62, now simply above the most recent value, making a “zone of resistance” overhead.

BTCUSD Evaluation Supply: Tradingview

Technical indicators present combined alerts. The Relative Power Index (RSI) is at 47.34, exhibiting the market is impartial, that means patrons and sellers are evenly matched for now.

The Shifting Common Convergence Divergence (MACD) stays beneath the sign line, an indication that bearish momentum may proceed if patrons fail to step in.

In the meantime, the Common Directional Index (ADX) is at 25.47, indicating the development is current however not overwhelming, and the market may simply tip in both course.

The chart additionally reveals clear horizontal assist and resistance zones. Sellers have repeatedly pushed Bitcoin down from the $125,000–$126,000 space, as marked by pink arrows. On the draw back, robust assist will be discovered simply above $108,000 and round $105,000, near the 200-day SMA.

A fall beneath these ranges can be a warning of deeper corrections, and as Lee says, robust corrections ought to by no means be dominated out, even in bullish cycles.

Conversely, if the value strikes above resistance at $114,200 after which $118,000, Bitcoin may attempt to retest current highs. However with out a robust catalyst, the trail to increased ranges appears to be like difficult..

For now, technical and on-chain information present Bitcoin is holding, however bulls face a troublesome highway. Because the market waits for its subsequent massive catalyst, staying above $108,000 is vital. If not, even Wall Avenue’s favourite crypto may see a pointy drop earlier than bouncing again.

Associated Articles:

Greatest Pockets – Diversify Your Crypto Portfolio

- Simple to Use, Characteristic-Pushed Crypto Pockets

- Get Early Entry to Upcoming Token ICOs

- Multi-Chain, Multi-Pockets, Non-Custodial

- Now On App Retailer, Google Play

- Stake To Earn Native Token $BEST

- 250,000+ Month-to-month Energetic Customers

Be part of Our Telegram channel to remain updated on breaking information protection