Be part of Our Telegram channel to remain updated on breaking information protection

The Bitcoin worth climbed a fraction of a % within the final 24 hours to commerce at $111,582 as of three:40 a.m. EST on a 25% improve in day by day buying and selling quantity to $29.05 billion.

Bitcoin is again within the information after two massive items of knowledge hit the market. First, Technique, Metaplanet and El Salvador all made recent Bitcoin purchases, displaying that institutional and state-level curiosity in BTC stays sturdy.

🟠 NEW: #Metaplanet purchased 136 $BTC, elevating its whole to twenty,136, whereas El Salvador additionally added extra Bitcoin. pic.twitter.com/OhrYCikH4Q

— Coinpaper (@coinpapercom) September 8, 2025

Second, stablecoin big Tether shortly moved to disclaim rumours a few large-scale Bitcoin sell-off, making an attempt to calm market fears. As these main headlines swirl, merchants and analysts are watching the Bitcoin worth intently to identify the following massive transfer.

El Salvador is already well-known because the world’s first nation to make Bitcoin authorized tender, and each further buy sends a robust message that its Bitcoin guess is long-term. In the meantime, Metaplanet is changing into recognized for copying Technique, stacking Bitcoin for long-term good points.

Every time these massive gamers purchase, it sends a optimistic sign to different traders that BTC stays the highest digital gold.

However not all of the information was bullish. A hearsay unfold throughout social media that Tether, one of many world’s largest stablecoin firms, was getting ready to dump a large quantity of Bitcoin. The hearsay claimed Tether wanted to promote to handle its reserves.

🚨 No, Tether didn’t dump its Bitcoin

👉 Q1: 92,650 BTC → Q2: 83,274 BTC (regarded like a promote)

👉 Actuality: ~19,800 BTC moved to XXI (Jack Mallers’ platform)

👉 Adjusted: Tether now holds 100,521 BTC = $11.17BExtra: https://t.co/RFSuEVD2qC pic.twitter.com/bkRtAWKUVF

— Fomos Information (@fomos_news) September 7, 2025

Tether responded quick, firmly denying the declare and saying its BTC holdings are safe and long-term.

Bitcoin Worth Faces Key Ranges After Latest Strikes

Turning to the day by day technicals, Bitcoin worth is hovering round $111,400. The chart reveals BTC lately bounced off a serious assist zone close to $101,800, which is the 200-day easy shifting common (SMA). This long-term trendline is a vital stage; every time BTC holds above the 200-day SMA, bulls are typically in management.

BTCUSD Evaluation Supply: Tradingview

The 50-day SMA now acts as short-term resistance at $114,860. To this point, repeated makes an attempt to push above this common have run into promoting strain. Bitcoin worth might want to reclaim this stage to ignite additional bullish momentum.

The present worth motion is caught between a Fibonacci assist at $101,800 and resistance close to $123,860, which traces up with the following key retracement stage. If bulls can drive BTC above $115,000, the following goal is $123,800, adopted by the $142,000 zone.

The final word upside goal, as marked by the chart, sits a lot larger close to $170,000, however it could take a robust rally to get there.

Technical indicators present a blended temper. MACD remains to be barely bearish, however a bullish crossover may very well be constructing if momentum continues. RSI is at 47, indicating Bitcoin is neither overbought nor oversold at this level. Which means there’s loads of room for a robust transfer in both path.

The ADX indicator sits at 15, a low studying, displaying this isn’t a robust pattern section. It may imply the present sideways vary is more likely to final just a little longer, except a brand new catalyst, like one other main purchase or a confirmed breakout, pushes the BTC worth out of this vary.

Help zones are clear: $101,800 is the principle ground, with deeper assist at $90,200 and $82,800 based mostly on Fibonacci traces. If the worth loses the 200-day SMA, bears may acquire management shortly.

For now, so long as Bitcoin worth holds above $101,800, the bias is impartial to barely bullish.

Bitcoin Worth: On-Chain Information Flashes Blended Alerts

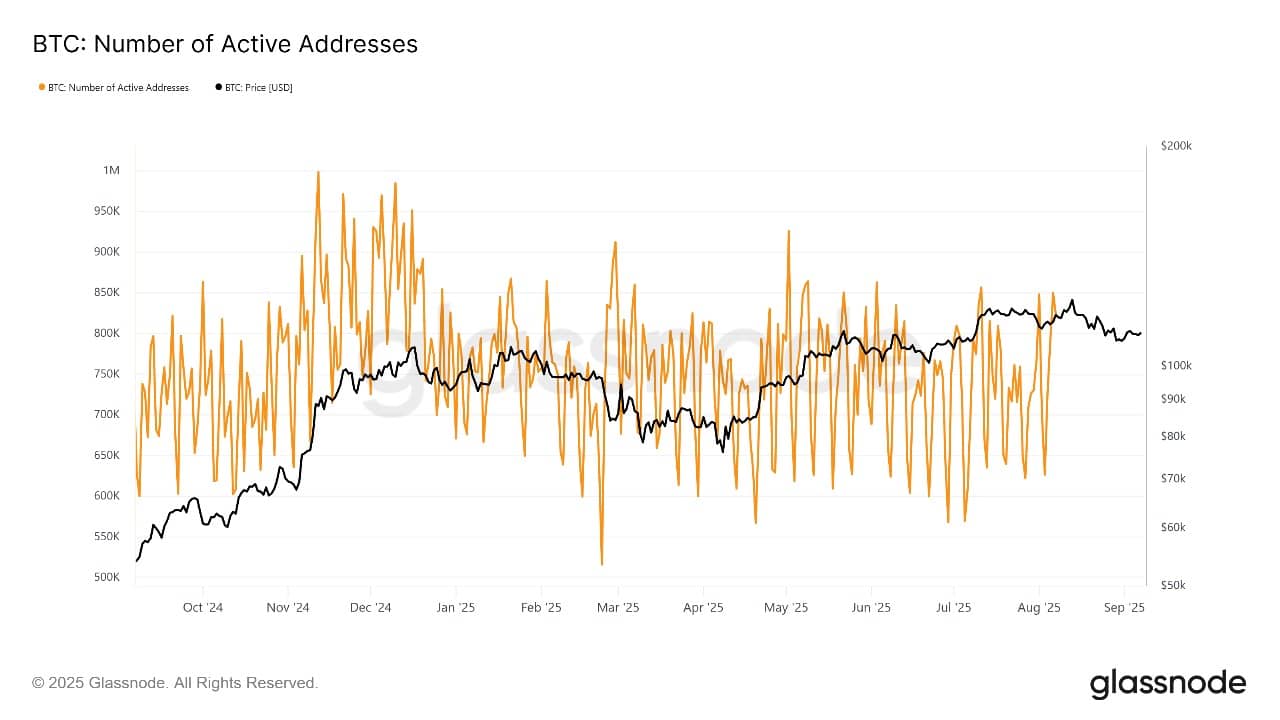

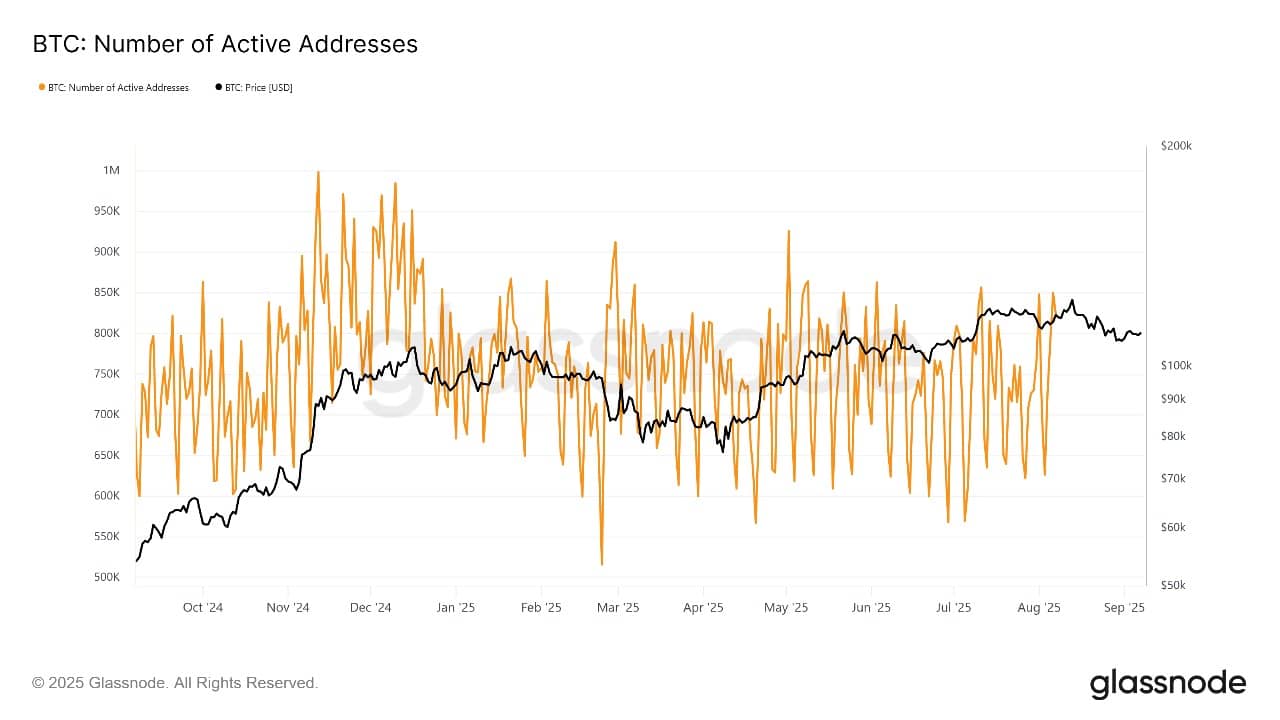

Wanting on the on-chain evaluation, the Bitcoin community is displaying each power and indicators of warning. The entire variety of energetic pockets addresses is rising, an vital bullish sign. This implies extra individuals are utilizing and shifting BTC, which often comes earlier than an enormous worth transfer.

Bitcoin Variety of Lively Addresses Supply: Glassnode

In the meantime, information from blockchain explorers reveals that “outflows” from exchanges are growing. This implies extra Bitcoin is being taken off buying and selling platforms, usually a bullish signal, as long-term holders are sending cash to chilly storage.

When Bitcoin provide on exchanges goes down, worth tends to seek out assist and even rally, since there’s much less obtainable for fast promoting.

Nevertheless, some short-term merchants seem nervous. Proper after the Tether hearsay, there was a fast spike in “inflows,” or cash despatched to exchanges, as some customers ready to promote or hedge.

However this slip didn’t final lengthy; quickly after Tether’s denial, inflows cooled down, and the stability of BTC on exchanges started to fall once more.

Additionally, miner flows stay secure, suggesting massive mining firms aren’t speeding to dump new cash. All in all, on-chain fundamentals for Bitcoin stay impartial to bullish, particularly with assist from information about main institutional shopping for.

Associated Articles:

Finest Pockets – Diversify Your Crypto Portfolio

- Simple to Use, Function-Pushed Crypto Pockets

- Get Early Entry to Upcoming Token ICOs

- Multi-Chain, Multi-Pockets, Non-Custodial

- Now On App Retailer, Google Play

- Stake To Earn Native Token $BEST

- 250,000+ Month-to-month Lively Customers

Be part of Our Telegram channel to remain updated on breaking information protection