Be part of Our Telegram channel to remain updated on breaking information protection

The Bitcoin value climbed 1.4% within the final 24 hours to commerce at $103,132 as of 4.15 a.m. on a 48% plunge in each day buying and selling quantity to $59.47 billion.

That’s as crypto bull Samson Mow advised his virtually 357k followers on X that the true BTC bull run “hasn’t even began but.”

Regardless of weeks of heavy promoting, Mow, CEO of JAN3, believes the market is just within the early phases of a generational uptrend. He means that long-term holders and rising institutional curiosity imply the muse for a rally is in place, however that the explosive beneficial properties many anticipate are nonetheless a way off.

SAMSON MOW: “The #Bitcoin bull run hasn’t began but. We’re simply marginally outperforming inflation at this value vary.” pic.twitter.com/mcdqalUbik

— JAN3 (@JAN3com) November 5, 2025

However he says the situations for a “decade-long bitcoin rally” are mounting as central banks increase liquidity. However, for now, he warns merchants to not anticipate a sudden surge, saying Bitcoin’s bull run is “delayed” and forecasting a potential uptrend in 2026.

Bitcoin Worth Holds Robust After Market Shakeout

The sudden drop in BTC value to beneath $100,000 in early November led to panic amongst short-term merchants. Many rushed to promote, fueling fears that the uptrend could be over. Nevertheless, technical alerts recommend that BTC value is holding essential ranges, helped by long-term patrons stepping in.

The market’s crying. Bitcoiners? Nonetheless stacking. 💰

Concern and Greed Index sits at 23 which is the Excessive Greed space.

As a result of Bitcoiners concern lacking sats, not #Bitcoin value drops. 📈 pic.twitter.com/lRLhe2liKI

— JAN3 Monetary (@JAN3Financial) November 5, 2025

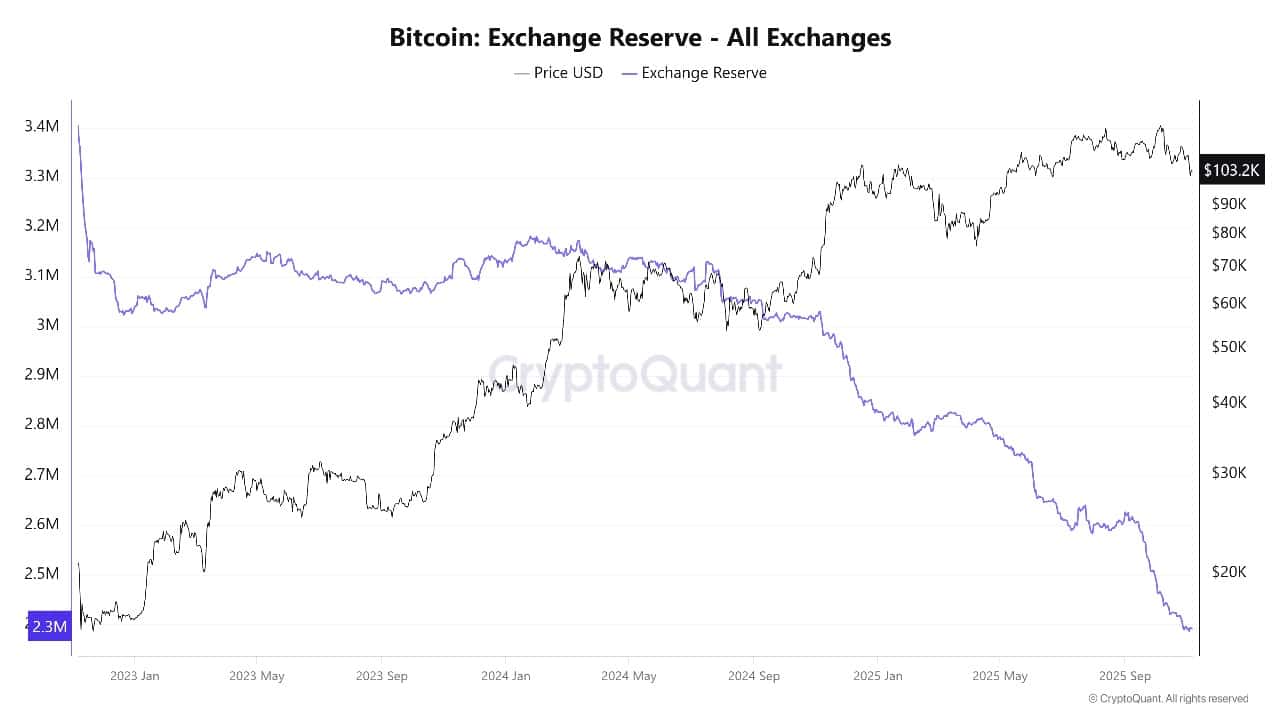

On-chain information reveals that the majority Bitcoin holders didn’t panic throughout the dip. Trade withdrawals really rose, indicating that traders are transferring cash into self-custody, exhibiting religion in BTC’s long-term potential.

Bitcoin Trade Reserve Supply: CryptoQuant

Brief-term losses now have an effect on round 12% of all UTXOs (unspent cash), which exhibits discomfort however remains to be removed from the true capitulation seen in earlier cycles. In the meantime, whale exercise has dropped, decreasing sell-side stress and hinting that giant holders anticipate extra beneficial properties forward.

Coin value demand additionally appears to be like wholesome from the on-chain facet. Greater than $10 billion in stablecoins just lately entered Binance, giving merchants contemporary shopping for energy if the worth begins to show up. BTC’s community safety stays robust, with hashrate close to all-time highs, retaining miners assured regardless of value swings.

Accumulation by long-term holders is rising. As cash transfer off exchanges and into chilly storage, short-term promoting stress is diminished, serving to the coin value to stabilise after such deep corrections. These elements recommend that, regardless of volatility, the underlying demand supporting the BTC value stays agency.

Bitcoin Worth Technical Evaluation: Bottoming Out And Eyeing A Rebound

Trying on the present value chart, Bitcoin sits simply above $103,000 after bouncing again from latest lows. The weekly chart exhibits BTC is testing key help ranges, particularly close to its 50-week Easy Transferring Common (SMA) at $102,994. This stage is supported by long-term patrons.

The coin value stays far above the 200-week SMA at $55,051, signalling that the general pattern remains to be optimistic in the long term.

Technical indicators proper now are blended. The Relative Energy Index (RSI) is at 45.46, which means that the market is just not but oversold and will get better if patrons step in. The MACD has turned barely detrimental, exhibiting bears are nonetheless in management for now, however momentum might shift if value stabilises at key ranges.

A essential help zone lies between $100,000 and $104,200. So long as the BTC value stays above these ranges, a rebound stays potential. If BTC falls beneath $100,000, the decline might speed up towards $94,000, the following Fibonacci retracement stage.

On the upside, resistance sits at $105,500 after which $110,000. Clearing these might spark a rally to $120,000 or larger.

BTCUSD Evaluation Supply: TradingView

The worth sample additionally suggests the market is forming a backside. A number of technical setups, just like the channel and upward pattern traces within the chart, level to a potential reversal as patrons collect power, particularly if short-term promote stress fades.

The forecast on the chart exhibits a potential bounce earlier than resuming the uptrend into the brand new yr. Regardless of latest dips, the Bitcoin value is holding key help and will resume its uptrend if macro situations enhance and extra patrons return.

If present momentum builds and inflows stay optimistic, BTC might climb towards earlier highs and start a brand new bullish section. For merchants, watching the $102,994–$104,200 area is important. Holding right here might set off a powerful bounce and make sure the market’s resilience. Failing to carry might invite additional correction earlier than new patrons step in.

With long-term fundamentals robust and on-chain information supporting additional demand, Bitcoin’s sharp swings have shaken out weak palms, however the story is way from over.

Associated Articles:

Greatest Pockets – Diversify Your Crypto Portfolio

- Straightforward to Use, Function-Pushed Crypto Pockets

- Get Early Entry to Upcoming Token ICOs

- Multi-Chain, Multi-Pockets, Non-Custodial

- Now On App Retailer, Google Play

- Stake To Earn Native Token $BEST

- 250,000+ Month-to-month Energetic Customers

Be part of Our Telegram channel to remain updated on breaking information protection

Clarte Nexive Review

Clarte Nexive se distingue comme une plateforme d’investissement crypto revolutionnaire, qui utilise la puissance de l’intelligence artificielle pour proposer a ses membres des avantages decisifs sur le marche.

Son IA etudie les marches financiers en temps reel, detecte les occasions interessantes et met en ?uvre des strategies complexes avec une finesse et une celerite inatteignables pour les traders humains, augmentant de ce fait les potentiels de profit.