Be a part of Our Telegram channel to remain updated on breaking information protection

The Bitcoin worth edged down 1.5% up to now 24 hours to commerce at $113,980 as of three:48 a.m. EST on buying and selling quantity that dropped 7% to $54.8 billion.

The autumn got here as S&P International Scores slapped a junk score on Michael Saylor’s Bitcoin treasury agency Technique due to its ”speculative” publicity to BTC.

The B- credit standing positioned the agency six notches beneath funding grade.

“We view Technique’s excessive bitcoin focus, slim enterprise focus, weak risk-adjusted capitalization, and low U.S. greenback liquidity as weaknesses,” the company stated.

However the score marks the primary time a Bitcoin-focused treasury firm has obtained an official S&P score, a big milestone for the crypto business’s rising overlap with conventional finance.

S&P Score ‘Hilarious’

Some analysts took subject with the score. Adam Livingston, an analyst with 56k followers on X, known as it “hilarious.”

All people, please learn this because it pertains to Technique’s credit standing.

It is hilarious

S&P International: “we’re more likely to proceed to view capital as a weak point, as a result of Technique’s bitcoin holdings are more likely to develop materially”

So mainly “the extra Bitcoin they purchase, the weaker… pic.twitter.com/vC4khB4sog

— Adam Livingston (@AdamBLiv) October 27, 2025

VanEck’s Matthew Sigel stated the B- score locations Technique in high-yield territory, implying a few 15% default threat over 5 years.

🚨Technique Inc Assigned ‘B-‘ Issuer Credit score Score; Outlook Steady at S&P

That’s high-yield territory. Capable of service debt for now, however susceptible to shocks.

S&P information: B issuers carry ~15% 5-yr default threat. https://t.co/ingZu6DRmH pic.twitter.com/RrHOWYmzVG

— matthew sigel, recovering CFA (@matthew_sigel) October 27, 2025

Regardless of the company’s score, Technique’s inventory (MSTR) rose virtually 2.3% yesterday to commerce at $295.63.

In the meantime, Technique added one other 390 BTC to its hoard at a price of about $43.4 million on Monday. The agency now holds 640,808 BTC.

Bitcoin Worth Rebounds Above Key Resistance Ranges Amid Bullish Restoration

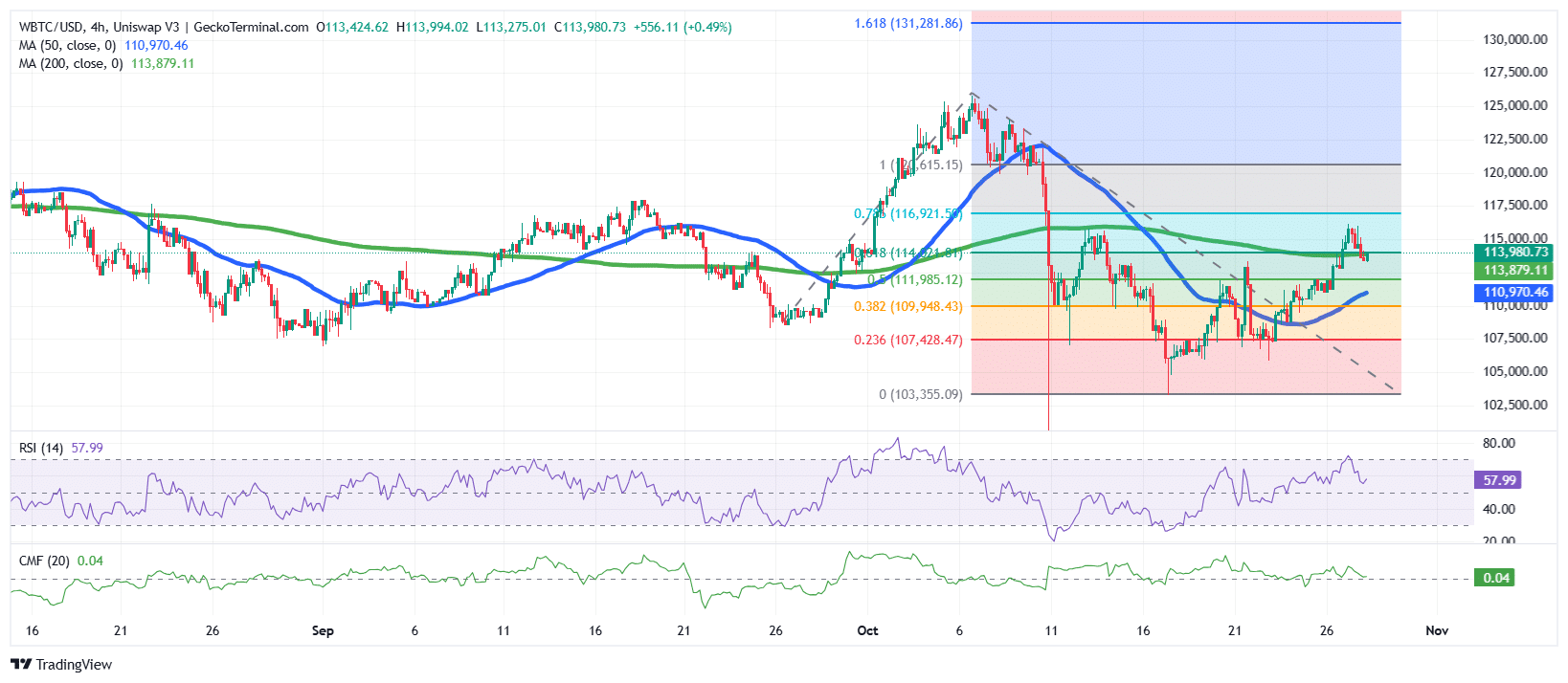

The BTC worth has staged a robust rebound over the previous week, indicating that the bulls are once more gaining momentum after a interval of consolidation and correction earlier in October.

Following the sharp decline from the native excessive close to $118,600, Bitcoin discovered assist round $103,350, signaling the beginning of a brand new restoration part.

Since then, the BTC worth has climbed steadily, breaking by means of a number of Fibonacci retracement ranges.

Presently, Bitcoin is buying and selling round $113,980, having moved above each the 50-day and 200-day Easy Shifting Averages (SMAs) on the 4-hour timeframe, a robust sign that patrons are regaining management of the market.

The Relative Energy Index (RSI) is at present above the 50-midline stage at 57.99. This studying alerts that bullish momentum stays dominant, however with sufficient room for additional upside earlier than approaching overbought circumstances.

Moreover, the Chaikin Cash Move (CMF) exhibits a mildly constructive studying of +0.04, which is a sign of regular capital influx and rising investor confidence. Sustained readings above +0.10 would verify stronger accumulation.

BTC is testing the 0.618 Fib stage ($114,324), which aligns with the 200-day SMA, a traditionally important confluence level. A profitable breakout above this space might speed up good points towards the $116,900–$118,600 vary.

BTC Worth Bulls Eye Costs Above $118,000

Primarily based on the continuing restoration try, the BTC worth seems poised to proceed towards the higher resistance band, offered it maintains momentum above the 50-day and 200-day SMAs.

If bullish stress persists, the following key resistance ranges lie at $116,900 (0.786 Fib) and $118,600 (current swing excessive). A breakout past this zone might open the trail to the Fibonacci extension goal at $131,280, representing a possible 15% upside from present ranges.

Ali Martinez, a preferred crypto analyst on X, says the value of BTC might nonetheless soar so long as it holds a sustained uptrend line.

Bitcoin $BTC: Every little thing is dependent upon this trendline! pic.twitter.com/n492Yjxi6b

— Ali (@ali_charts) October 28, 2025

Conversely, if the BTC worth fails to carry above $111,900 (Fib 0.5), a short-term pullback towards $110,000 and even $107,400 (Fib 0.236) might happen earlier than one other upward try.

Associated Information:

Finest Pockets – Diversify Your Crypto Portfolio

- Simple to Use, Function-Pushed Crypto Pockets

- Get Early Entry to Upcoming Token ICOs

- Multi-Chain, Multi-Pockets, Non-Custodial

- Now On App Retailer, Google Play

- Stake To Earn Native Token $BEST

- 250,000+ Month-to-month Energetic Customers

Be a part of Our Telegram channel to remain updated on breaking information protection