Be a part of Our Telegram channel to remain updated on breaking information protection

Nakamoto CEO and crypto advisor to the Donald Trump administration David Bailey says that Bitcoin (BTC) would already be at $150K if it weren’t for 2 whales that he believes are actively promoting the crypto.

“The one cause we’re not at $150k proper now could be two large whales,” Bailey mentioned on X. “As soon as they’re slain” BTC will go “up solely,” he added.

He mentioned that one whale has already been taken care of, leaving the market to soak up gross sales solely from the opposite.

Bailey’s submit comes after a whale offered 24K BTC price roughly $2.7 billion on Aug. 24, resulting in a flash crash within the crypto market. This liquidated round $500 million in leveraged positions over the course of minutes.

Whales Seem To Be Pivoting From Bitcoin To Ethereum

The selloff by Bitcoin whales seems to be a part of a pivot from the main crypto to the biggest altcoin by market cap, Ethereum (ETH).

One explicit whale, which on-chain analytics platform Lookonchain refers to as “the Bitcoin OG,” has offered a complete of 35,991 BTC valued at over $4 billion since Aug. 20. Regardless of this excessive promoting exercise, the whale nonetheless holds 49,634 BTC valued at $5.34 billion throughout 4 wallets, the agency mentioned.

Since Aug 20, the Bitcoin OG has offered 35,991 $BTC($4.04B) and acquired 886,371 $ETH($4.07B) at a 0.0406 fee on #Hyperliquid.

He nonetheless holds 49,634 $BTC($5.43B) in 4 wallets. pic.twitter.com/ns7T1zMtAO

— Lookonchain (@lookonchain) September 1, 2025

In an X submit earlier as we speak, Lookonchain mentioned {that a} whale with the deal with “0xFf15” has offered 425 BTC price $46.5 million over the previous 4 days as effectively. Much like the “Bitcoin OG,” this huge investor used the entire funds from the sale to purchase ETH.

Analysts Share Combined Views On BTC’s Subsequent Transfer

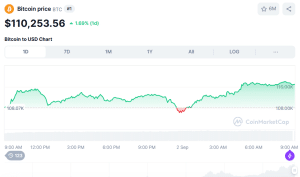

Bitcoin’s worth has managed to print a acquire within the final 24 hours regardless of the promoting strain from whales. Knowledge from CoinMarketCap reveals that the crypto rose over 1% to commerce at $110,223.05 as of three:28 a.m. EST.

BTC worth chart (Supply: CoinMarketCap)

That 24-hour acquire was sufficient to push the crypto’s weekly efficiency again into the inexperienced by a fraction of a proportion as effectively. That is as BTC enters what has traditionally been a bearish month for the crypto.

Since 2013, there have solely been 4 situations the place BTC has closed September within the inexperienced, in accordance to Coinglass information.

Nevertheless, there are analysts that keep a bullish outlook for BTC’s worth.

Amongst them is pseudonymous crypto dealer and analyst “Captain Faibik,” who mentioned on X as we speak that BTC has damaged out of a falling wedge sample. That is typically thought of a bullish chart sample, and reveals weakening promote strain. With the breakout now “confirmed,” the analyst informed his over 106.2K followers that BTC will soar to $116K quickly.

That bullish outlook is shared by one other dealer and analyst that goes by the X username “Mister Crypto.” In a Sept. 1 X submit to his greater than 142.7K followers, he famous that three consecutive purchase indicators have emerged on BTC’s chart not too long ago.

The final time that occurred, Bitcoin “went parabolic,” he mentioned, earlier than speculating that historical past will repeat itself.

However not everyone seems to be satisfied. This contains famend dealer and analyst Michael van de Poppe. Following the August month-to-month candle shut, which he says was “not the most effective candle on $BTC,” van de Poppe informed his 805.3K followers that he could be shocked “if we’re going to be working again in the direction of the ATH.”

He warned his followers that he anticipates a brand new low can be recorded this month. If this occurs, it’s going to “finalize the correction” earlier than BTC begins to rise within the fourth quarter, he added.

Bitcoin ETPs Maintain 7% Of BTC’s Provide

Whereas merchants and traders brace for a probably bearish September, Bitcoin ETPs (exchange-traded merchandise) are quietly increase their BTC reserves.

In line with information shared by the X account HODL15Capital, BTC ETPs maintain over 1.47 million Bitcoin as of Aug. 31. This quantities to 7% of the crypto’s provide.

🌎 AUGUST World Bitcoin ETF replace 👇 pic.twitter.com/6VkRsTmOU2

— HODL15Capital 🇺🇸 (@HODL15Capital) September 2, 2025

US BTC ETFs (exchange-traded funds) maintain nearly all of that Bitcoin, with their collective holdings of greater than 1.29 million cash. Of this quantity, BlackRock’s IBIT holds 746,810 BTC, the information confirmed.

Associated Articles:

Finest Pockets – Diversify Your Crypto Portfolio

- Straightforward to Use, Characteristic-Pushed Crypto Pockets

- Get Early Entry to Upcoming Token ICOs

- Multi-Chain, Multi-Pockets, Non-Custodial

- Now On App Retailer, Google Play

- Stake To Earn Native Token $BEST

- 250,000+ Month-to-month Lively Customers

Be a part of Our Telegram channel to remain updated on breaking information protection