Be a part of Our Telegram channel to remain updated on breaking information protection

Bitcoin (BTC), Ethereum (ETH), and XRP prolonged their slide Tuesday as renewed US–China tensions deepened market jitters, sending silver surging to a document excessive.

Beijing introduced sanctions on the US items of South Korean shipbuilder Hanwha Ocean and warned of additional motion in opposition to the maritime sector, escalating tensions between the world’s two largest economies and damping hopes of a near-term thaw.

International equities fell, and the fallout rippled by means of digital property, triggering one other wave of liquidations that pushed main tokens to multi-week lows.

( @realDonaldTrump – Reality Social Publish )

( Donald J. Trump – Oct 12, 2025, 12:43 PM ET )Don’t fear about China, it is going to all be advantageous! Extremely revered President Xi simply had a nasty second. He doesn’t need Despair for his nation, and neither do I. The united statesA. desires to assist… pic.twitter.com/30ot0cICw4

— Fan Donald J. Trump 🇺🇸 TRUTH POSTS (@TruthTrumpPosts) October 12, 2025

Crypto Costs Tumble With No Decision In Sight

US Treasury Secretary Scott Bessent mentioned that talks with China are nonetheless on, however the uncertainty has left a darkish cloud hanging over the crypto market.

After taking a breather from the current downtrend, crypto costs have continued to fall up to now 24 hours.

BTC and ETH have dropped over 3% and 4%, respectively, in accordance with information from CoinMarketCap. Ethereum is now down greater than 15% up to now seven days and BTC over 10%.

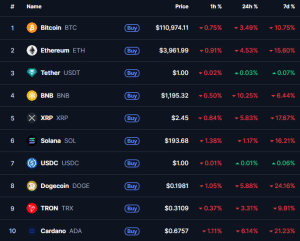

Prime 10 cryptos by market cap (Supply:CoinMarketCap)

The remainder of the highest ten largest cryptos by market cap all fell, too. BNB, which not too long ago set a brand new all-time excessive (ATH), has plunged 10%, marking the largest loss within the high ten listing.

XRP and Solana (SOL) fell 6% and 1%, respectively, whereas Dogecoin (DOGE), Tron (TRX) and Cardano (ADA) dropped 5%, 3%, and 6%, respectively. Overall, the crypto market cap dropped over 3%.

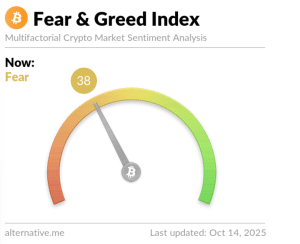

The Crypto Worry & Greed Index, a well-liked instrument used to gauge investor sentiment, slumped to a “concern” studying of 38 from a “greed” degree of 70 only a week in the past.

Crypto Worry & Greed Index (Supply: Various.me)

CoinGlass information exhibits liquidations within the crypto market surpassed $694.81 million up to now 24 hours, with lengthy positions accounting for $511.80 million of the entire. Some brief merchants additionally obtained hit, with $195.31 million liquidated from trades that have been in opposition to the market.

Silver Worth Hits Document Excessive, Alongside With Gold

The seek for safe-haven investments despatched to the silver worth to a document excessive of $53 per ounce, taking its positive aspects for the 12 months to greater than 85%.

Silver is commonly seen as a proxy for gold, which additionally soared to a different all-time excessive earlier at this time.

Commenting on the efficiency of gold, silver and the crypto market, Bitcoin critic Peter Schiff warned that “crypto patrons are in for a impolite awakening.” He additionally mentioned that crypto buyers will study “a really priceless however costly lesson.”

Gold and silver proceed to soften up as Bitcoin and Ether proceed to soften down. Crypto patrons are in for a impolite awakening and can quickly study a really priceless however costly lesson. Fortuitously, most crypto house owners are younger with a number of time to earn again what they’re about to lose.

— Peter Schiff (@PeterSchiff) October 14, 2025

That’s after he mentioned that Bitcoin’s flash crash this previous Friday “wasn’t a shopping for alternative however a warning.” He added that gold’s continued surge is “exposing the fiction that Bitcoin is digital gold.”

In the meantime, famend analyst Michael van de Poppe mentioned that BTC’s current correction is “nothing particular,” and predicted that “volatility will stay excessive earlier than there’s a transparent new pattern.”

Associated Articles:

Finest Pockets – Diversify Your Crypto Portfolio

- Straightforward to Use, Function-Pushed Crypto Pockets

- Get Early Entry to Upcoming Token ICOs

- Multi-Chain, Multi-Pockets, Non-Custodial

- Now On App Retailer, Google Play

- Stake To Earn Native Token $BEST

- 250,000+ Month-to-month Lively Customers

Be a part of Our Telegram channel to remain updated on breaking information protection