Synopsis- Gold costs in India have hit a brand new lifetime excessive with 24-carat gold approaching ₹1,17,500 per 10 grams pushed by a mixed affect of home and international financial components.

Gold has all the time been a dependable funding worldwide, particularly in India, the place cultural and monetary components preserve demand sturdy. As of September 2025, gold costs in India have hit document highs, with 24-carat gold close to ₹117,500 per 10 grams. This surge is pushed by sturdy native shopping for and international financial tendencies, creating momentum that appears set to proceed within the close to future.

Components Driving the Gold Worth Rally

- One large issue behind the latest leap in gold costs is all of the speak concerning the US Federal Reserve easing up on its tight financial coverage. They’re prone to minimize rates of interest fairly quickly. That ought to weaken the greenback a contact. A softer greenback makes gold seem like a steal for patrons abroad. It attracts in additional demand from in all places. Thus, rising costs.

- In India, this strains up completely with the festive season kicking into excessive gear. Individuals seize gold prefer it’s the final likelihood they’ll get.The seasonal shopping for spree pushes costs up much more. It doesn’t finish there.

- The nation’s import patterns and the Reserve Financial institution of India’s push to stockpile reserves add further gasoline to the hearth.

- Central banks world wide have ramped up their gold stashes too. Particularly after geopolitical flare-ups just like the Russia-Ukraine mess.

Funding and Demand Patterns

Individuals nonetheless flock to gold when the financial system begins trying shaky. It’s that dependable fallback, like an outdated pal you belief in robust occasions. Fact is, with all the thrill a few international slowdown and geopolitical complications, buyers preserve searching for refuge in gold and put their cash into gold ETFs and futures. That regular demand simply gained’t give up. India’s native shopping for habits again up this upbeat view fairly solidly. Authorities coverage just like the GST adjustments is boosting gold gross sales fairly a bit. They’re additionally clearing up the market, making it extra easy and smoother.

Additionally learn: Prime 5 Indian States That Recorded the Highest Digital Transactions in August 2025

Potential Challenges and Worth Corrections

- Even with these upbeat indicators, we must always nonetheless tread fastidiously. Gold costs climbing greater may squeeze affordability for India’s middle-class of us. That would simply cool off demand in the event that they shoot up an excessive amount of from right here.

- Right here’s the factor with surging gold imports into India. They might throw off the present account stability in a foul approach. That may carry in additional regulatory eyes or tweaks to import duties. And yeah, these adjustments may shake up costs a bit.

- Quick-term corrections may pop up every now and then. However specialists say they’ll keep fairly contained. Robust demand beneath and stable financial vibes ought to preserve issues in examine. Forecasts level to stabilisation round ₹114,500 to ₹115,300 per 10 grams on MCX futures. Globally, costs hover close to $3,820 to $3,850 per ounce. General, it’s nonetheless heading up.

Subsequent 5 years

- Issues pushing gold costs up embody inflation, shaky geopolitics, what central banks are as much as, and even new tech making mining smoother.

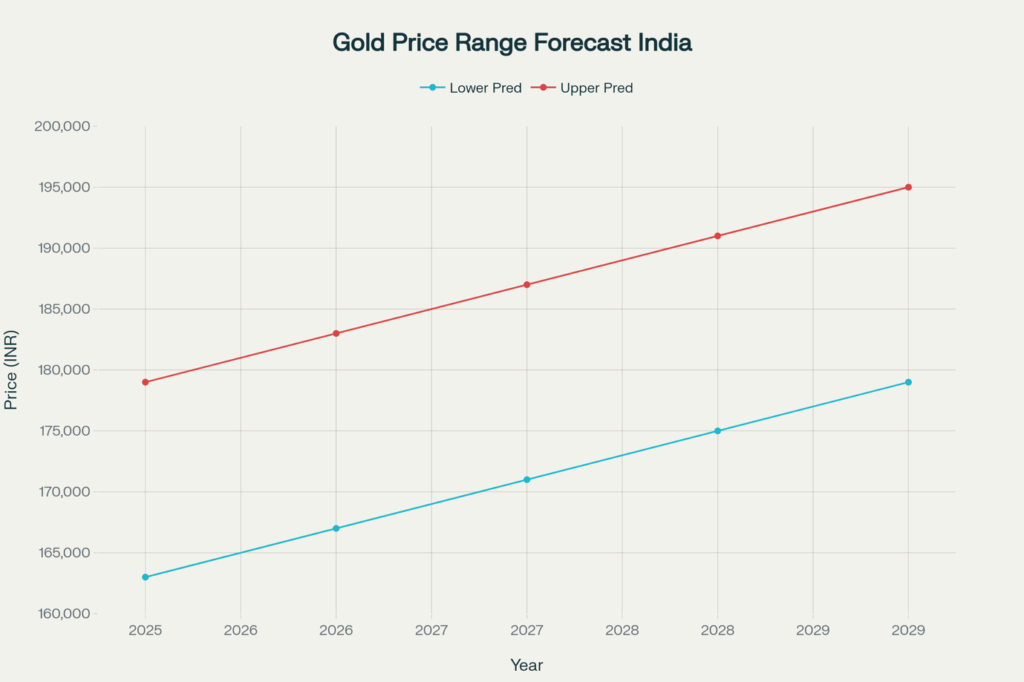

- Costs ought to creep greater yr by yr. By 2029, they could hit wherever from Rs. 1,63,000 to Rs. 1,95,000 per ounce.

- If you’re planning on investing in gold here’s a prediction that will help you attain a call.

| Yr | Predicted worth vary (per ounce) |

| 2025 | ₹1,63,000 – ₹1,79,000 |

| 2026 | ₹1,67,000 – ₹1,83,000 |

| 2027 | ₹1,71,000 – ₹ 1,87,000 |

| 2028 | ₹1,75,000 – ₹ 1,91,000 |

| 2029 | ₹1,79,000 – ₹1,95,000 |

**The predictions given above are primarily based on present components just like the financial system, insurance policies and different components.**

Conclusion

Gold costs in India look fairly good for the close to time period. Issues like adjustments in financial coverage, that regular cultural demand everyone knows about, ongoing geopolitical tensions, and a few stable funding tendencies are backing it up. Positive, there is likely to be just a few small dips alongside the way in which. Nonetheless, with sturdy shopping for from of us at residence and large international establishments leaping in, costs ought to preserve heading up. In these unsure occasions, gold actually stands out as a sensible funding selection.

Written by Jayanth R Pai

Doporucte web ostatni a hledejte bonusy nebo mozna pausalni platby. v nezavislych kasina hraci, obvykle, maji vice [url=https://omov.alumniits.com/mezinarodni-casino-vstupte-do-svta-globalnich-her/]https://omov.alumniits.com/mezinarodni-casino-vstupte-do-svta-globalnich-her/[/url] bonusove funkce.