Synopsis- SIPs in Nifty 50 ETFs resembling Nippon India ETF Nifty 50 BeES presents a value efficient and disciplined strategy to create wealth over a time frame. On this article, An SIP of ₹5,000 has been considered, the place SIP XIRR is the important thing efficiency indicator. Classic evaluation paperwork the long-term compounding benefits of the technique, with longer horizons producing good returns and likewise providing safety in opposition to timing danger. The low price ratio ensures buyers achieve almost full market linked progress.

Nippon India ETF Nifty 50 BeES

Nippon India ETF Nifty 50 BeES is the primary and oldest exchange-traded fund in India which permits buyers to simply observe the efficiency of Nifty 50 index. It’s sometimes held up as a benchmark of passive investing due to its low price relative to different ETFs. The fund additionally trades in good volumes which provides excessive liquidity. As of twenty sixth August 2025, the ETF has traded at ₹279.05 with a 52W Excessive/Low of ₹231.30- ₹293.99. It has a big AUM of 48,923 crores and a low expense ratio of 0.04%

| Parameter | Particulars |

| Fund Title | Nippon India ETF Nifty 50 BeES |

| Market Worth (26-08-2025) | ₹279.05 |

| 52-Week Low / Excessive | ₹231.30 / ₹293.99 |

| Property Below Administration (AUM) | ₹48,923 Crores |

| Expense Ratio | 0.04% |

| Variety of Shares | 50 |

SIP Efficiency

| Period | SIP XIRR (%) | Invested Quantity (₹) | Present Worth (₹) |

| 1 12 months | 8.49% | 60,000 | 62,293 |

| 2 Years | 10.36% | 1,20,000 | 1,32,091 |

| 3 Years | 13.26% | 1,80,000 | 2,17,249 |

| 4 Years | 13.22% | 2,40,000 | 3,09,339 |

| 5 Years | 14.00% | 3,00,000 | 4,21,490 |

| 7 Years | 15.28% | 4,20,000 | 7,15,563 |

| 10 Years | 14.48% | 6,00,000 | 12,64,992 |

An SIP of ₹5,000 monthly is taken into account*

Additionally learn: 5 Worst Performing Flexi Cap Mutual Funds of 2025 – Is Your Cash at Danger?

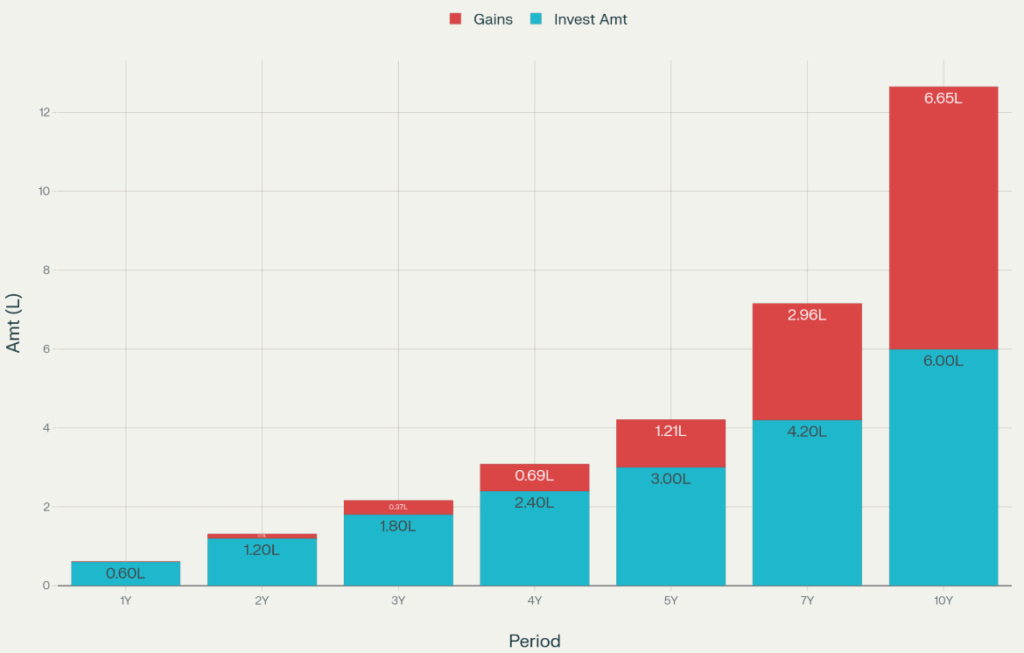

Graph exhibiting NiftyBees SIP Efficiency

Key Insights:

- Sturdy long-term compounding: Returns are higher through the years. The 1-year SIPs yielded barely above common returns, whereas the 10-year SIP returns doubled the quantity invested, owing to a compounding impact.

- Peak effectivity at medium-to-long phrases: The very best XIRR was famous after 7 years at 15.28% because the market skilled sturdy cycles. Though the 10-year returns fell a bit to 14.48%, absolutely the wealth generated was a lot better.

- Wealth scaling impact: In a 5-year interval, the beneficial properties have been ₹1.21 lakh however then in a interval of 10 years the beneficial properties magnified greater than 5 fold to ₹6.65 lakh. Absolute wealth will increase sooner than the linear progress in contributions.

- Volatility smoothing: SIPs get rid of timing danger by averaging over the market cycles. Because of this medium to lengthy horizons returns are in that vary of 13-15% regardless of market variations.

- Value effectivity: The expense ratio is 0.04% which is as little as zero, almost all the market returns could be transferred to buyers. The compounding good thing about such financial savings over a 10-year SIP beats larger price funds.

Last Ideas

SIP in Nifty 50 ETF has been a horny wealth creation technique in the long term offering a gentle return of 13-15% over time. The impact of compounding and its low price may be very efficient in attracting buyers who search passive publicity in India’s progress. Notably, when markets expertise a steep correction, buyers are suggested to buy extra items ( like lumpsum) together with SIP as this might tremendously multiply returns achieved within the long-term on account of price averaging. Make investments Properly.

Written by Prajwal Hegde