Be a part of Our Telegram channel to remain updated on breaking information protection

The US Commodity Futures Buying and selling Fee (CFTC) is going through a management vacuum after the Trump administration withdrew its nomination for Brian Quintenz after opposition from Gemini co-founders Cameron and Tyler Winklevoss.

The management vaccuum is compounded by a authorities shutdown after Congress did not cross a price range and the very fact Performing Chair Caroline Pham has additionally signaled plans to depart. Comissioner Kristin Johnson’s Sept. 3 departure left Pham because the CFTC’s sole commissioner.

That leaves the CFTC and not using a confirmed management simply because it begins coordinating with the Securities and Change Fee (SEC) on digital asset regulation and prepares for potential expanded authority underneath the pending CLARITY Act.

It’s a brand new day. Onwards 🇺🇸🫡 #ProjectCrypto @SECPaulSAtkins @SECGov @CFTC @A1Policy pic.twitter.com/kChRm036Mg

— Caroline D. Pham (@CarolineDPham) July 31, 2025

Professional-Crypto Quintenz Confronted Pushback From Gemini’s Co-Founders

Quintenz’s nomination started to unravel after strain from the Winklevoss twins, who publicly questioned his {qualifications} and objected to his stance on a CFTC enforcement motion in opposition to their agency.

In late July, Tyler Winklevoss mentioned that he didn’t consider that Quintenz’s views on builders and his expertise at Kalshi certified him for the function. The Winklevoss twins subsequently urged Trump to rethink Quintenz’s nomination.

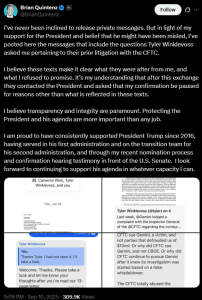

In September, Quintenz took to X and shared non-public messages that had been exchanged between himself and the Winklevoss twins.

Quintenz shares non-public messages from Gemini co-founders (Supply: X)

He recommended that the true cause the Gemini co-founders opposed his nomination was as a result of he wouldn’t decide to a public view on a CFTC enforcement motion in opposition to their agency.

“I consider these texts make it clear what they had been after from me, and what I refused to vow,” Quintenz wrote on X.

“It’s my understanding that after this trade they contacted the President and requested that my affirmation be paused for causes apart from what’s mirrored in these texts.”

Crypto lobbyist organizations and corporations had written a public letter supporting Quintenz’s nomination in direction of the top of August in an effort to get the previous commissioner’s nomination again on monitor.

That wasn’t sufficient, nonetheless, because the White Home requested the Senate Agriculture Committee to postpone a vote on Quintenz’s nomination. Final week, it was reported that the method to vet different candidates had already began.

CFTC Probably To Change into A Key Crypto Regulator

The challenges on the CFTC come as US lawmakers push to make the company a key regulator within the crypto area via the Digital Asset Market Readability Act, often called the CLARITY Act.

The invoice has made its method via Congress, and goals to make clear the roles of the CFTC, the SEC, and different businesses as regards to crypto regulation.

It additionally seeks to obviously outline which cryptos fall underneath the purview of every company, by dividing these digital belongings into three classes: digital commodities, funding contract belongings, and permitted fee stablecoins.

If signed into regulation, the CLARITY Act would give the company unique regulatory jurisdiction over transactions in digital commodities within the spot and money markets.

Quintenz mentioned it had been the “the consideration of my life” to be nominated to move the CFTC, including that he would return to the non-public sectors amid an “thrilling time for innovation” within the US.

Associated Articles:

Greatest Pockets – Diversify Your Crypto Portfolio

- Simple to Use, Function-Pushed Crypto Pockets

- Get Early Entry to Upcoming Token ICOs

- Multi-Chain, Multi-Pockets, Non-Custodial

- Now On App Retailer, Google Play

- Stake To Earn Native Token $BEST

- 250,000+ Month-to-month Energetic Customers

Be a part of Our Telegram channel to remain updated on breaking information protection