Be a part of Our Telegram channel to remain updated on breaking information protection

US crypto alternate Coinbase leads a $2.5 billion race with Mastercard to accumulate the stablecoin startup BVNK.

That’s in response to a report by Fortune, which cited sources acquainted with the matter as saying the 2 firms have held superior talks with BVNK on the acquisition.

The phrases and profitable bidder haven’t been finalized but with the sale worth anticipated to be between $1.5 and $2.5 billion. Three of the sources mentioned Coinbase seems to have an edge over Mastercard.

If a deal is reached, it could possibly be one of many largest acquisitions of a stablecoin agency thus far.

Citi Buys Stake In BVNK

BVNK’s core expertise is a blockchain-payments rail that facilitates stablecoin transactions globally. It additionally permits clients to seamlessly transfer funds between fiat and stablecoins.

The reported talks between Coinbase, Mastercard and BVNK comes laborious on the heels of stories that banking big Citi has acquired a stake within the stablecoin infrastructure agency.

Excited to announce a strategic funding from @Citi Ventures.

“Stablecoins are seeing elevated curiosity in use for settlement of on-chain and crypto asset transactions. We had been impressed by BVNK’s enterprise-grade infrastructure and their confirmed monitor file.” — Arvind… pic.twitter.com/xUKlw8IetT

— BVNK (@BVNKFinance) October 9, 2025

That funding was carried out via the financial institution’s enterprise capital arm, Citi Ventures. BVNK has not supplied particulars on how massive the funding was or at what valuation the deal was made.

Nevertheless, one among BVNK’s co-founders, Chris Harmse, mentioned the funding was made at a valuation increased than the $750 million that was publicly disclosed at its newest funding spherical.

Citi’s funding comes simply months after the establishment warned that stablecoins might drain conventional banks’ deposits.

In Could, BVNK revealed that it additionally secured a strategic funding from Visa via its enterprise capital arm, Visa Ventures.

Stablecoin Market Booms On GENIUS Act Signing

The latest strikes by fee and finance giants into BVNK comes amid a growth for the stablecoin market.

Previously couple of months, the capitalization for the stablecoin sector has been on a gradual rise. This uptick accelerated round mid-July, when US President Donald Trump signed the GENIUS Act into regulation, offering the primary regulatory framework for stablecoin companies that wish to difficulty their tokens within the US.

That invoice supplied the business with some long-awaited regulatory readability, and opened the best way for companies within the conventional finance (TradFi) house to enter the stablecoin market.

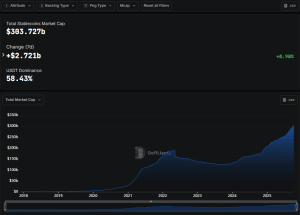

Following Trump’s July signing of the GENIUS Act, the stablecoin market cap went on to soar to above $300 billion for the primary time, information from DefiLlama reveals.

Stablecoin market cap (Supply: DefiLlama)

Within the final week alone, the stablecoin market cap has risen 0.9%, with round $2.721 billion flowing into the market, and Coinbase predicts that the house will attain $1.2 trillion by 2028.

In the meantime, Citi’s base case forecast is that the market will hit $1.6 trillion by 2030, including {that a} bullish state of affairs might see the sector’s capitalization attain “as much as $3.7 trillion.”

Analysts Involved That Stablecoin Development Comes At A Price For TradFi

The anticipated progress for the stablecoin market has, nonetheless, attracted warnings of a lower in deposits for banks within the conventional finance house.

Commonplace Chartered mentioned that US dollar-backed stablecoins “might pull as a lot as $1 trillion out of rising market banks over the subsequent three years.”

Banking lobbies have additionally warned lawmakers of a “loophole” within the GENIUS Act that might result in outflows as excessive as $6.6 trillion from the banking business. They argue that the GENIUS Act’s failure to increase its prohibition on stablecoin companies providing yields to token holders to 3rd events and associates offers the companies a method to circumvent the restriction.

Nevertheless, the crypto business has pushed again in opposition to the banking lobbies’ claims, and mentioned that their efforts stem from them making an attempt to forestall new competitors from getting into the market.

That’s as stablecoins, via exchanges and third social gathering platforms, supply token holders a lot increased yields than the common provided by financial savings accounts with banks. As such, many within the house have mentioned that banks must enhance the yields they provide clients or danger shedding enterprise as a result of greed.

Good publish on evolving stablecoin market construction. I might prolong it additional: sure, I believe that stablecoin issuers are going to need to share yield with others, however this is only one occasion. Everybody goes to need to share yield. As we speak, the common curiosity on US financial savings… https://t.co/yjjLOzxoOk

— Patrick Collison (@patrickc) October 3, 2025

Associated Articles:

Finest Pockets – Diversify Your Crypto Portfolio

- Simple to Use, Function-Pushed Crypto Pockets

- Get Early Entry to Upcoming Token ICOs

- Multi-Chain, Multi-Pockets, Non-Custodial

- Now On App Retailer, Google Play

- Stake To Earn Native Token $BEST

- 250,000+ Month-to-month Energetic Customers

Be a part of Our Telegram channel to remain updated on breaking information protection