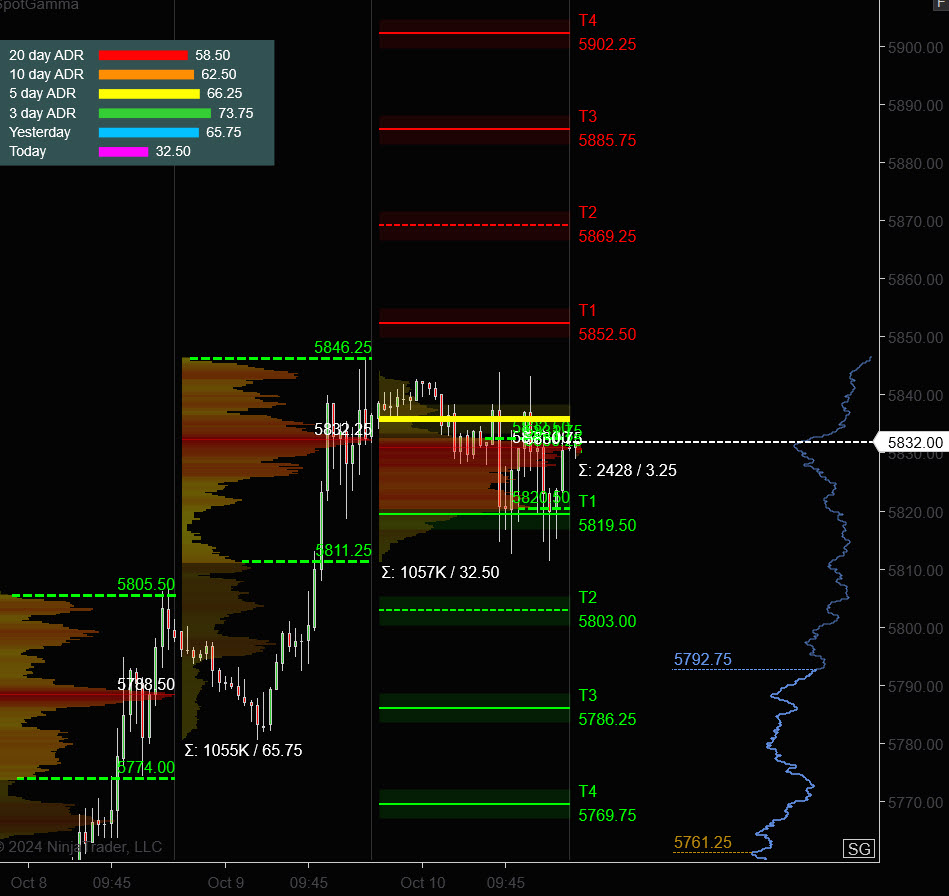

S&P 500

Prior Session was Cycle Day 1: Regular CD1 because the anticipated decline (90%) was fulfilled at 5814 with a remaining established low marked at 5811.50. This stage will probably be used to measure this cycle’s efficiency by Cycle Day 3. Right now’s session was primarily a consolidation of the earlier rally to all-time highs. Prior vary was 32 handles on 1.057M contracts exchanged.

For a extra detailed recap of the buying and selling session, click on on this hyperlink: Trading Room RECAP 10.10.24

Take a look at the hyperlink to study extra in regards to the Taylor Cycle and safe your FREE TRIAL.

…Transition from Cycle Day 1 to Cycle Day 2

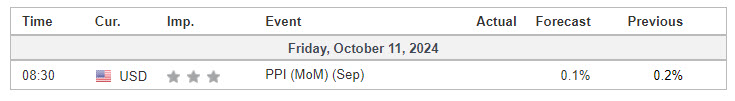

Transition into Cycle Day 2: Right now we’ve the follow-up Producer Value Index (PPI) to spherical out this week’s exercise. Value has notched a brand new all-time excessive and bulls would ideally like to shut the week out at or above the present highs.

Key for at the moment would be the 5810 – 5815 zone for assist whereas 5840 – 5845 zone marked as resistance. Clearance and Conversion of both of those ranges will decide whether or not bulls have a pattern continuation greater or a decline decrease again in to latest ranges.

Right now can be CAPITAL PRESERVATION FRYDAY…Proceed accordingly.

Our self-discipline of sustaining positioning that’s aligned with market forces continues to serve us effectively, so keep the course.

As such, situations to think about for at the moment’s buying and selling.

Bull Situation: Value sustains a bid above 5840, initially targets 5855 – 5860 zone.

Bear Situation: Value sustains a proposal under 5815, initially targets 5800 – 5795 zone.

PVA Excessive Edge = 5832 PVA Low Edge = 5820 Prior POC = 5831

ES Chart Profile)

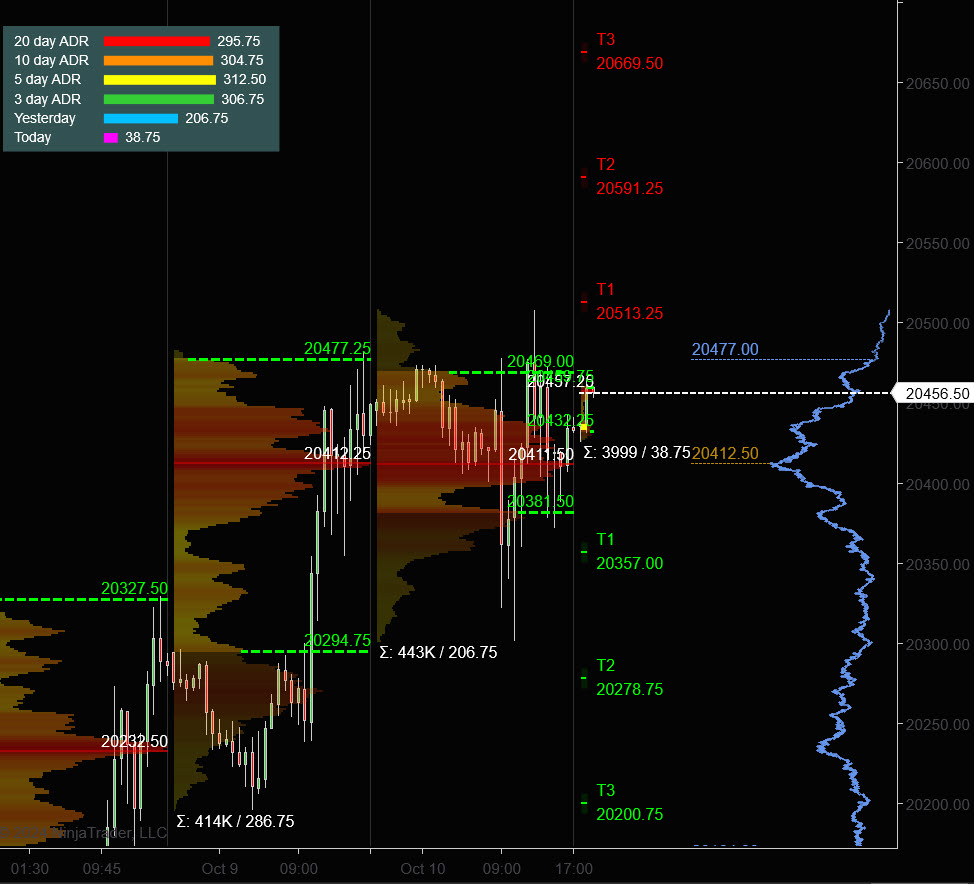

Nasdaq 100 (NQ)

Prior Session was Cycle Day 1: Regular CD1 because the anticipated decline (90%) was fulfilled at 20372 with a remaining established low marked at 20301.50. This stage will probably be used to measure this cycle’s efficiency by Cycle Day 3. Right now’s session was primarily a consolidation of the earlier rally. Prior vary was 206 handles on 443k contracts exchanged.

For a extra detailed recap of the buying and selling session, click on on this hyperlink: Trading Room RECAP 10.10.24

Take a look at the hyperlink to study extra in regards to the Taylor Cycle and safe your FREE TRIAL.

…Transition from Cycle Day 1 to Cycle Day 2

Transition into Cycle Day 2: Right now we’ve the follow-up Producer Value Index (PPI) to spherical out this week’s exercise. Bulls would ideally like to shut the week out at or above the present highs.

Key for at the moment would be the 20300 for assist whereas 20500 marked as resistance. Clearance and Conversion of both of those ranges will decide whether or not bulls have a pattern continuation greater or a decline decrease again in to latest ranges.

Right now can be CAPITAL PRESERVATION FRYDAY…Proceed accordingly.

Our self-discipline of sustaining positioning that’s aligned with market forces continues to serve us effectively, so keep the course.

As such, situations to think about for at the moment’s buying and selling.

Bull Situation: Value sustains a bid above 20415, initially targets 20513– 20557 zone.

Bear Situation: Value sustains a proposal under 20415, initially targets 20381 – 20357 zone.

PVA Excessive Edge = 20469 PVA Low Edge = 20381 Prior POC = 20412

NQ Chart (Profile)

Financial Calendar

Commerce Technique: Our tactical commerce technique will merely stay unaltered…We’ll be versatile to commerce each lengthy and quick facet from Determination Pivot Ranges. Proceed to concentrate on Bull/Bear Stackers and Premium/Reductions. As all the time, remaining in alignment with dominant intra-day pressure will increase possibilities of manufacturing successful trades.

Keep Targeted…Non-Biased…Disciplined ALWAYS USE STOPS!

Good Buying and selling…David

“Realizing will not be sufficient, We should APPLY. Prepared will not be sufficient, We should DO.” –BR

*****This commerce technique report is disseminated for “schooling solely” and shouldn’t be considered in any method as a suggestion to purchase or promote futures merchandise.”

PAST PERFORMANCE IS NOT NECESSARILY INDICATIVE OF FUTURE RESULTS

IMPORTANT NOTICE! No illustration is being made that using this technique or any system or buying and selling methodology will generate income. Previous efficiency will not be essentially indicative of future outcomes. There’s substantial threat of loss related to buying and selling securities and choices on equities. Solely threat capital needs to be used to commerce. Buying and selling securities will not be appropriate for everybody.

Disclaimer: Futures, Choices, and Forex buying and selling all have massive potential rewards, however additionally they have massive potential threat. You could concentrate on the dangers and be prepared to simply accept them with a view to put money into these markets. Don’t commerce with cash you possibly can’t afford to lose.

This web site is neither a solicitation nor a proposal to Purchase/Promote futures, choices, or currencies. No illustration is being made that any account will or is prone to obtain income or losses much like these mentioned on this web page. The previous efficiency of any buying and selling system or methodology will not be essentially indicative of future outcomes.

CFTC RULE 4.41 –HYPOTHETICAL OR SIMULATED PERFORMANCE RESULTS HAVE CERTAIN LIMITATIONS. UNLIKE AN ACTUAL PERFORMANCE RECORD, SIMULATED RESULTS DO NOT REPRESENT ACTUAL TRADING. ALSO, SINCE THE TRADES HAVE NOT BEEN EXECUTED, THE RESULTS MAY HAVE UNDER-OR-OVER COMPENSATED FOR THE IMPACT, IF ANY, OF CERTAIN MARKET FACTORS, SUCH AS LACK OF LIQUIDITY. SIMULATED TRADING PROGRAMS IN GENERAL ARE ALSO SUBJECT TO THE FACT THAT THEY ARE DESIGNED WITH THE BENEFIT OF HINDSIGHT. NO REPRESENTATION IS BEING MADE THAT ANY ACCOUNT WILL OR IS LIKELY TO ACHIEVE PROFIT OR LOSSES SIMILAR TO THOSE SHOWN