S&P 500

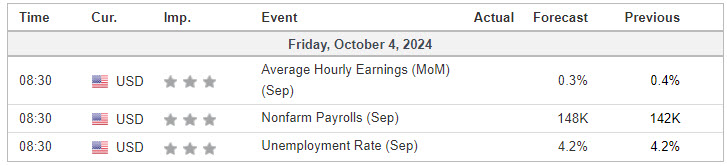

Listed here are three potential market context eventualities, factoring within the impression of the Non-Farm Payrolls (NFP) report and the way it might affect the broader buying and selling dynamics round as we speak’s key ranges:

1. Stronger-than-Anticipated NFP Report (Bullish Context)

Market Context: A stronger-than-expected NFP report signifies a strong labor market and helps the outlook for continued financial development. This may be seen as bullish for equities, particularly if merchants consider it implies a secure or managed inflation outlook.

- Value Motion: On this situation, the market is more likely to react positively, with consumers stepping in. Anticipate a break above your LIS (5760-5770) as bulls try to convert that zone into assist.

- Bull Situation: Sustained value above the 5760-5770 zone targets 5785-5790, with the potential for additional upside if the market shifts into risk-on mode. If shopping for momentum persists, we might see makes an attempt at new highs, so long as quantity helps the transfer.

- Bear Danger: A stronger NFP might initially trigger volatility, but when consumers battle to carry above the LIS zone, and the value falls again under 5760, it might result in a “false breakout.” Look ahead to indicators of exhaustion if this occurs.

2. Weaker-than-Anticipated NFP Report (Bearish Context)

Market Context: A weaker-than-expected NFP report would sign a slowing labor market, probably rising issues over financial development. This may weigh on equities, pushing costs decrease, particularly if it sparks fears of recession.

- Value Motion: If the NFP report disappoints, anticipate sellers to take management, urgent costs under 5730-5740. The market might break down additional as risk-off sentiment dominates, with merchants shifting in direction of safer property.

- Bear Situation: Sustained value under the 5730 zone might result in elevated promoting strain, concentrating on 5717-5710. If liquidation continues, you may see additional draw back momentum, particularly if world components like rising geopolitical dangers exacerbate the scenario.

- Bull Danger: Even in a weak NFP situation, look ahead to any sharp intraday reversal. Typically, a weak report can result in hypothesis of future coverage easing (like charge cuts), which might entice consumers. If value rapidly reverses after testing 5730-5740, it may very well be a lure for aggressive shorts.

3. In-Line NFP Report (Impartial-to-Barely Bullish)

Market Context: An in-line report that meets market expectations is more likely to trigger much less volatility in comparison with an excessive shock. Merchants could interpret it as affirmation of a “regular as she goes” financial system.

- Value Motion: Initially, we might even see a continuation of consolidation across the LIS (5760-5770) as merchants assess the impression of the report. The battle between bulls and bears might intensify, with no clear course within the rapid aftermath of the info.

- Bull Situation: If consumers handle to interrupt the LIS (5760-5770), sustained commerce above this zone targets 5785-5790, however the transfer may very well be extra gradual in comparison with a stronger report. Quantity affirmation is vital right here.

- Bear Situation: Ought to value fall under the 5730-5740 assist, sellers might goal 5717-5710. Nevertheless, with out an excessive catalyst, the draw back is perhaps restricted except different components come into play (e.g., geopolitical tensions, sudden Fed feedback).

- Impartial Situation: Costs might oscillate throughout the 5760-5730 zone if there isn’t a clear directional driver post-NFP. This may possible imply one other day of consolidation with two-way commerce and potential fading of key ranges because the market waits for extra readability within the days forward.

Key Concerns for At present:

- Quantity: Look ahead to sharp spikes in quantity that affirm breakouts or breakdowns, particularly after the NFP launch.

- Geopolitical Tensions: Any escalation in abroad conflicts, significantly within the Center East, might amplify the impression of the NFP report.

- Market Sentiment: Sentiment could shift rapidly after the preliminary response to the report, so being adaptable to modifications in value motion is vital.

These eventualities will make it easier to keep ready for a way the market may reply post-NFP and information your subsequent steps based mostly on the important thing zones.

*****Our self-discipline of sustaining positioning that’s aligned with market forces continues to serve us nicely, so keep the course.

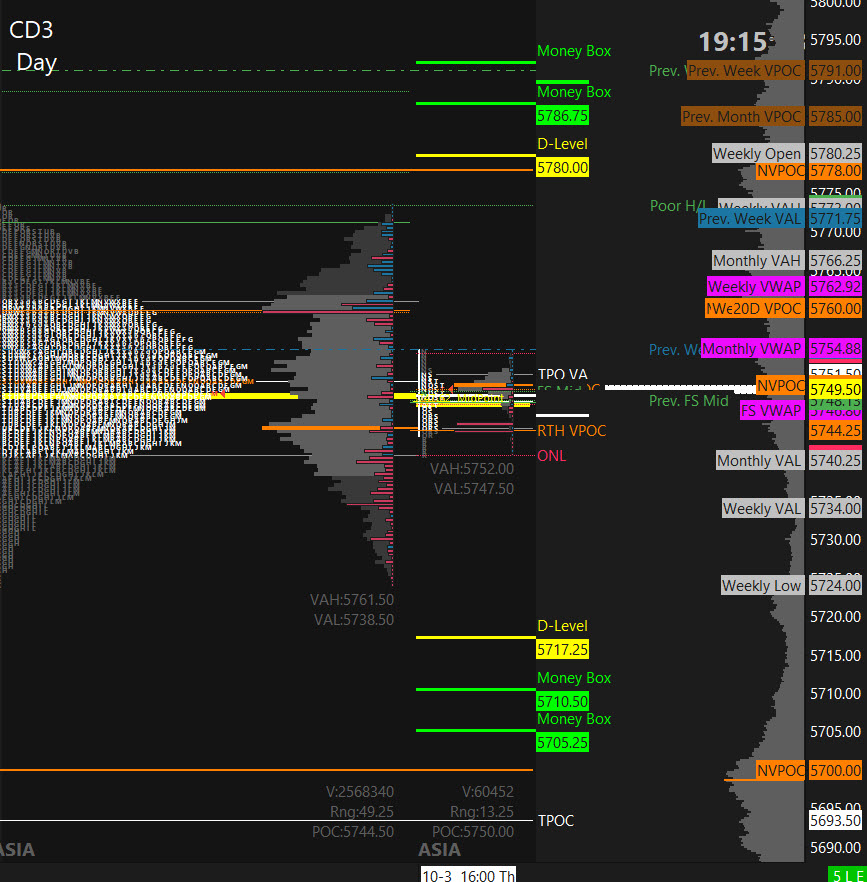

PVA Excessive Edge = 5754 PVA Low Edge = 5736 Prior POC = 5741

ES Chart (Profile + D-Stage Cash Field)

Nasdaq 100 (NQ)

Prior Session was Cycle Day 2: Regular CD2 as value continued with “balancing” two-way commerce supported on the 19875 – 19900 decrease zone and resisted at 20050 – 20090 Line within the Sand (LIS) as outlined in prior DTS Briefing 10.3.24. Vary was 261 handles on 521k contracts exchanged.

For a extra detailed recap of the buying and selling session, click on on this hyperlink: Trading Room RECAP 10.3.24

…Transition from Cycle Day 2 to Cycle Day 3

The transition to Cycle Day 3 Constructive Three-Day Cycle Statistic (92%) will likely be crammed so long as value trades above the 19833.50 CD1 Low throughout RTH Session. Markets have been tightly consolidating in-advance of as we speak’s BIG Non-Farm Payrolls (Jobs) Report which might act as a catalyst to interrupt the present ever-tightening consolidation.

Our self-discipline of sustaining positioning that’s aligned with market forces continues to serve us nicely, so keep the course.

As such, eventualities to think about for as we speak’s buying and selling.

Bull Situation: Value sustains a bid above 20050, initially targets 20149– 20185 zone.

Bear Situation: Value sustains a suggestion under 19875, initially targets 19817 – 19780 zone.

PVA Excessive Edge = 20004 PVA Low Edge = 19910 Prior POC = 19958

NQ Chart (Profile)

Financial Calendar

Commerce Technique: Our tactical commerce technique will merely stay unaltered…We’ll be versatile to commerce each lengthy and quick aspect from Determination Pivot Ranges. Proceed to concentrate on Bull/Bear Stackers and Premium/Reductions. As at all times, remaining in alignment with dominant intra-day power will increase possibilities of manufacturing successful trades.

Keep Centered…Non-Biased…Disciplined ALWAYS USE STOPS!

Good Buying and selling…David

“Understanding isn’t sufficient, We should APPLY. Keen isn’t sufficient, We should DO.” –BR

*****This commerce technique report is disseminated for “training solely” and shouldn’t be seen in any approach as a advice to purchase or promote futures merchandise.”

PAST PERFORMANCE IS NOT NECESSARILY INDICATIVE OF FUTURE RESULTS

IMPORTANT NOTICE! No illustration is being made that using this technique or any system or buying and selling methodology will generate earnings. Previous efficiency isn’t essentially indicative of future outcomes. There may be substantial threat of loss related to buying and selling securities and choices on equities. Solely threat capital needs to be used to commerce. Buying and selling securities isn’t appropriate for everybody.

Disclaimer: Futures, Choices, and Foreign money buying and selling all have massive potential rewards, however additionally they have massive potential threat. You have to concentrate on the dangers and be keen to simply accept them with the intention to put money into these markets. Don’t commerce with cash you possibly can’t afford to lose.

This web site is neither a solicitation nor a suggestion to Purchase/Promote futures, choices, or currencies. No illustration is being made that any account will or is more likely to obtain earnings or losses just like these mentioned on this website online. The previous efficiency of any buying and selling system or methodology isn’t essentially indicative of future outcomes.

CFTC RULE 4.41 –HYPOTHETICAL OR SIMULATED PERFORMANCE RESULTS HAVE CERTAIN LIMITATIONS. UNLIKE AN ACTUAL PERFORMANCE RECORD, SIMULATED RESULTS DO NOT REPRESENT ACTUAL TRADING. ALSO, SINCE THE TRADES HAVE NOT BEEN EXECUTED, THE RESULTS MAY HAVE UNDER-OR-OVER COMPENSATED FOR THE IMPACT, IF ANY, OF CERTAIN MARKET FACTORS, SUCH AS LACK OF LIQUIDITY. SIMULATED TRADING PROGRAMS IN GENERAL ARE ALSO SUBJECT TO THE FACT THAT THEY ARE DESIGNED WITH THE BENEFIT OF HINDSIGHT. NO REPRESENTATION IS BEING MADE THAT ANY ACCOUNT WILL OR IS LIKELY TO ACHIEVE PROFIT OR LOSSES SIMILAR TO THOSE SHOWN