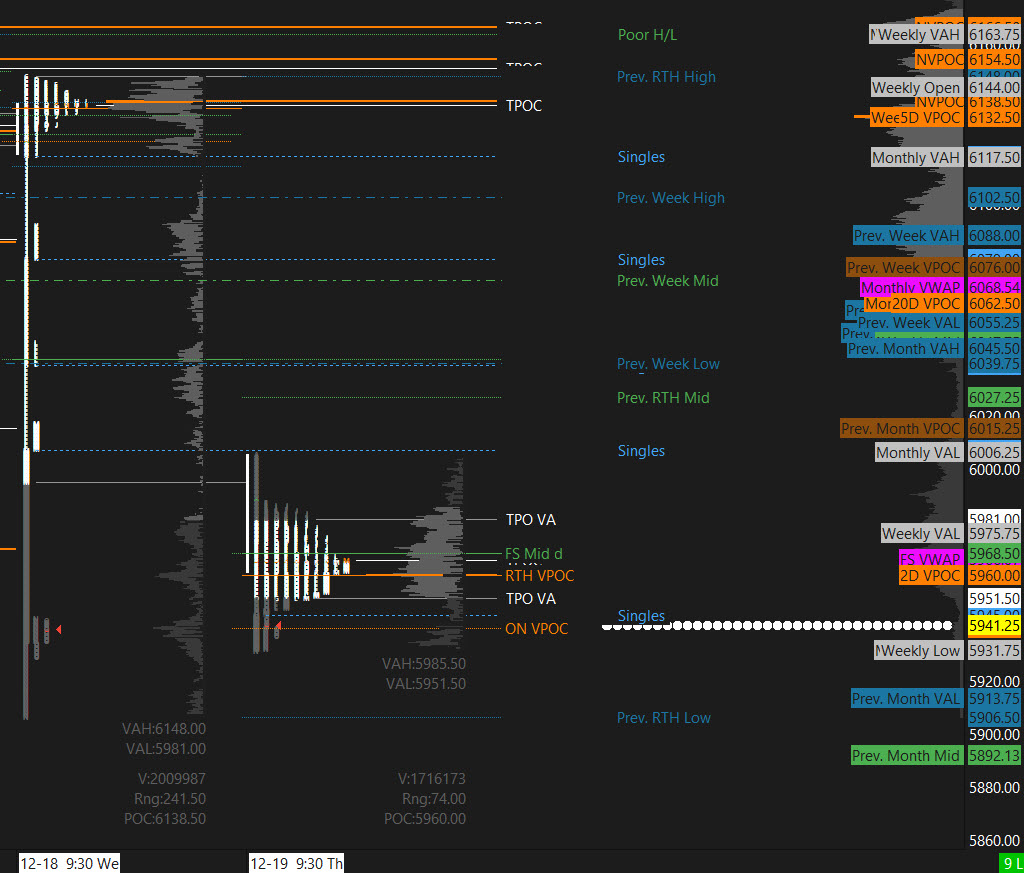

S&P 500 (ES)

Prior Session was Cycle Day 3: As anticipated, the restoration hill was simply to excessive to climb, as a uncommon (7.25%) “failed-cycle” was secured. Definition of Failed 3-Day Cycle: Failure of Worth to commerce above the Cycle Day 1 Low throughout Cycle Day 3. Luckily for future periods historic cycle odds (92.75%) favor Constructive 3 Day Cycles. Vary for this session was 74 handles on 2.081M contracts exchanged.

FREE TRIAL hyperlink to PTG/Taylor Three Day Cycle

For a extra detailed recap of the buying and selling session, click on on this hyperlink: Buying and selling Room RECAP 12.19.24

…Transition from Cycle Day 3 to Cycle Day 1

Transition into Cycle Day 1: This session begins a brand new cycle with the value already satisfying the typical decline.

Bulls might be seeking to cleanup any overflow promoting and restore the draw back FED induced momentum promote down.

Bears in fact might be seeking to press for decrease to power further long-liquidation and shut out the week.

PTG’s Major Directive (PD) is to ALWAYS STAY IN ALIGNMENT with the DOMINANT FORCE.

As such, eventualities to contemplate for at present’s buying and selling.

Bull Situation: Worth sustains a bid above 5930, initially targets 5950 – 5965 zone.

Bear Situation: Worth sustains a proposal beneath 5930, initially targets 5890 – 5875 zone.

PVA Excessive Edge = 5986 PVA Low Edge = 5951 Prior POC = 5962

ES (Profile)

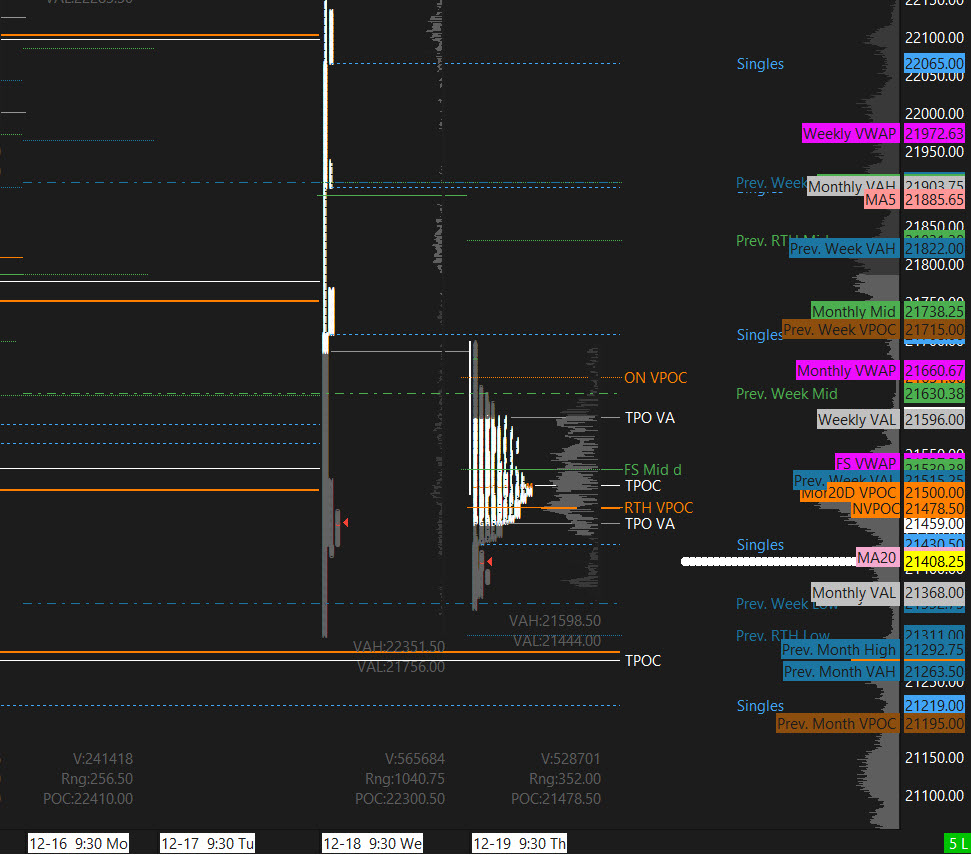

Nasdaq (NQ)

Prior Session was Cycle Day 3: MATD dominated this session as anticipated as balancing/consolidation rhythms stemmed any additional decline. Vary for this session was 352 handles on 689k contracts exchanged.

…Transition from Cycle Day 3 to Cycle Day 1

Transition into Cycle Day 1: This session begins a brand new cycle with the value already satisfying the typical decline.

Bulls might be seeking to cleanup any overflow promoting and restore the draw back FED induced momentum promote down.

Bears in fact might be seeking to press for decrease to power further long-liquidation and shut out the week.

PTG’s Major Directive (PD) is to ALWAYS STAY IN ALIGNMENT with the DOMINANT FORCE.

As such, eventualities to contemplate for at present’s buying and selling.

Bull Situation: Worth sustains a bid above 21310, initially targets 21435 – 21460 zone.

Bear Situation: Worth sustains a proposal beneath 21310, initially targets 21134 – 21091 zone.

PVA Excessive Edge = 21607 PVA Low Edge = 21459 Prior POC = 21482

NQ (Profile)

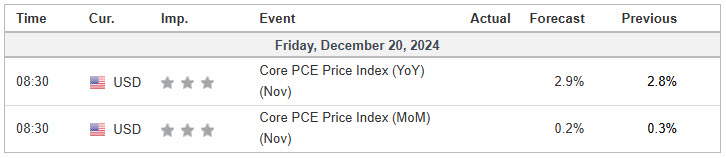

Financial Calendar

Commerce Technique: Our tactical commerce technique will merely stay unaltered…We’ll be versatile to commerce each lengthy and quick facet from Choice Pivot Ranges. Proceed to concentrate on Bull/Bear Stackers and Premium/Reductions. As all the time, remaining in alignment with dominant intra-day power will increase chances of manufacturing profitable trades.

Keep Centered…Non-Biased…Disciplined ALWAYS USE STOPS!

Good Buying and selling…David

“Realizing just isn’t sufficient, We should APPLY. Prepared just isn’t sufficient, We should DO.” –BR

*****This commerce technique report is disseminated for “training solely” and shouldn’t be seen in any approach as a advice to purchase or promote futures merchandise.”

PAST PERFORMANCE IS NOT NECESSARILY INDICATIVE OF FUTURE RESULTS

IMPORTANT NOTICE! No illustration is being made that using this technique or any system or buying and selling methodology will generate income. Previous efficiency just isn’t essentially indicative of future outcomes. There may be substantial danger of loss related to buying and selling securities and choices on equities. Solely danger capital needs to be used to commerce. Buying and selling securities just isn’t appropriate for everybody.

Disclaimer: Futures, Choices, and Forex buying and selling all have giant potential rewards, however in addition they have giant potential danger. You could concentrate on the dangers and be keen to just accept them in an effort to spend money on these markets. Don’t commerce with cash you possibly can’t afford to lose.

This web site is neither a solicitation nor a proposal to Purchase/Promote futures, choices, or currencies. No illustration is being made that any account will or is more likely to obtain income or losses just like these mentioned on this web page. The previous efficiency of any buying and selling system or methodology just isn’t essentially indicative of future outcomes.

CFTC RULE 4.41 –HYPOTHETICAL OR SIMULATED PERFORMANCE RESULTS HAVE CERTAIN LIMITATIONS. UNLIKE AN ACTUAL PERFORMANCE RECORD, SIMULATED RESULTS DO NOT REPRESENT ACTUAL TRADING. ALSO, SINCE THE TRADES HAVE NOT BEEN EXECUTED, THE RESULTS MAY HAVE UNDER-OR-OVER COMPENSATED FOR THE IMPACT, IF ANY, OF CERTAIN MARKET FACTORS, SUCH AS LACK OF LIQUIDITY. SIMULATED TRADING PROGRAMS IN GENERAL ARE ALSO SUBJECT TO THE FACT THAT THEY ARE DESIGNED WITH THE BENEFIT OF HINDSIGHT. NO REPRESENTATION IS BEING MADE THAT ANY ACCOUNT WILL OR IS LIKELY TO ACHIEVE PROFIT OR LOSSES SIMILAR TO THOSE SHOWN